Working with PDF forms online is certainly surprisingly easy with this PDF editor. Anyone can fill in Form 85 105 10 8 1 000 here and try out many other functions we offer. In order to make our tool better and less complicated to work with, we continuously design new features, bearing in mind suggestions from our users. To get the ball rolling, go through these easy steps:

Step 1: Access the PDF form inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: When you open the tool, you will see the document made ready to be completed. Other than filling out different blank fields, you may also do other sorts of things with the file, that is writing any text, editing the original text, adding illustrations or photos, signing the form, and much more.

This PDF form will involve some specific details; in order to guarantee accuracy and reliability, remember to pay attention to the recommendations below:

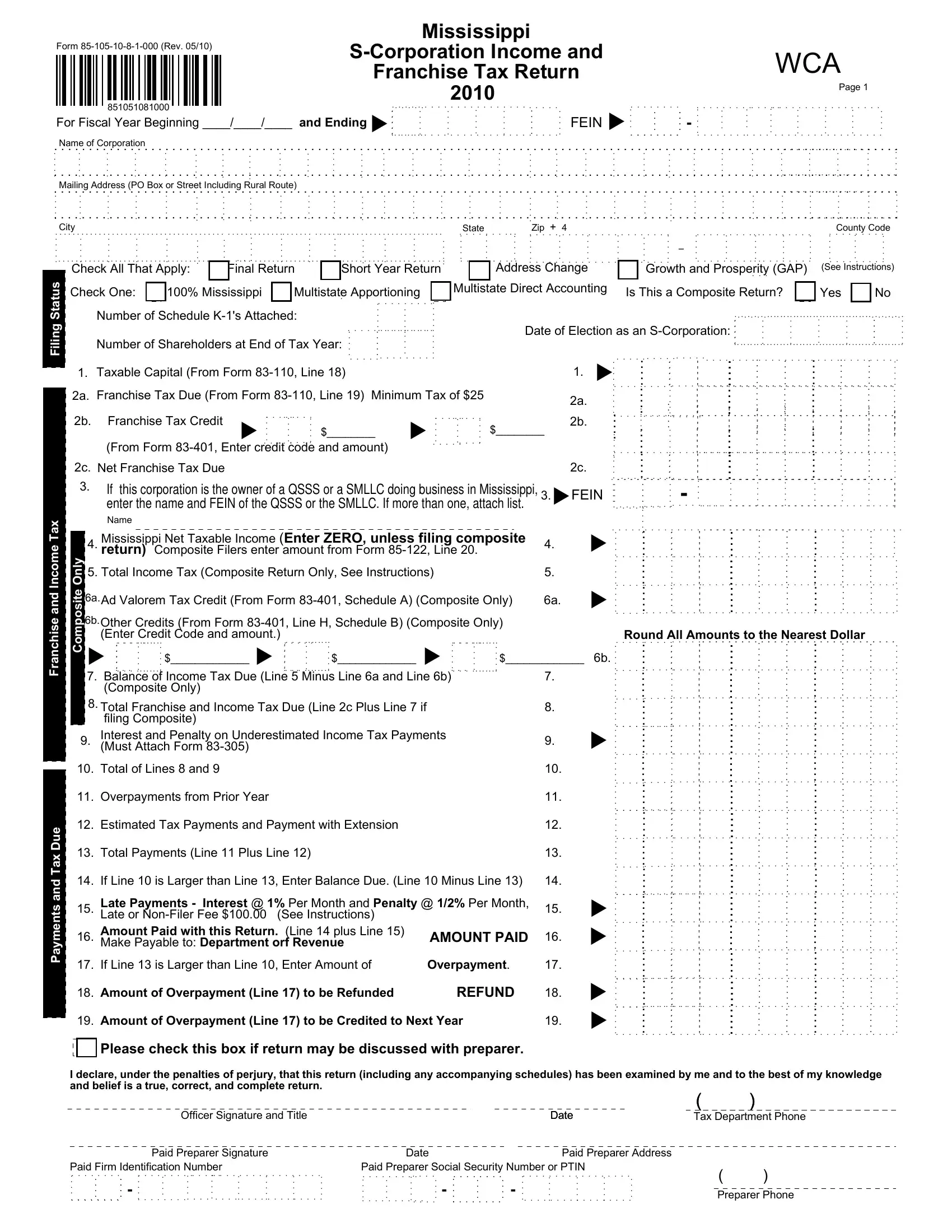

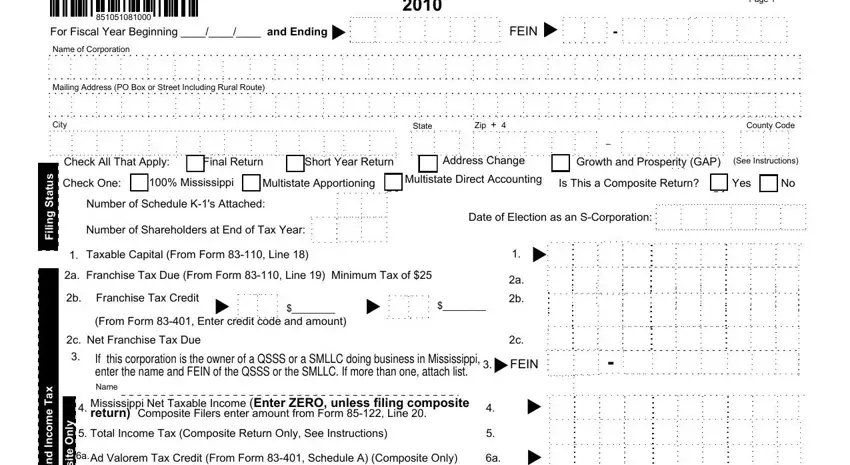

1. You will need to complete the Form 85 105 10 8 1 000 properly, thus be mindful while filling out the areas including these blanks:

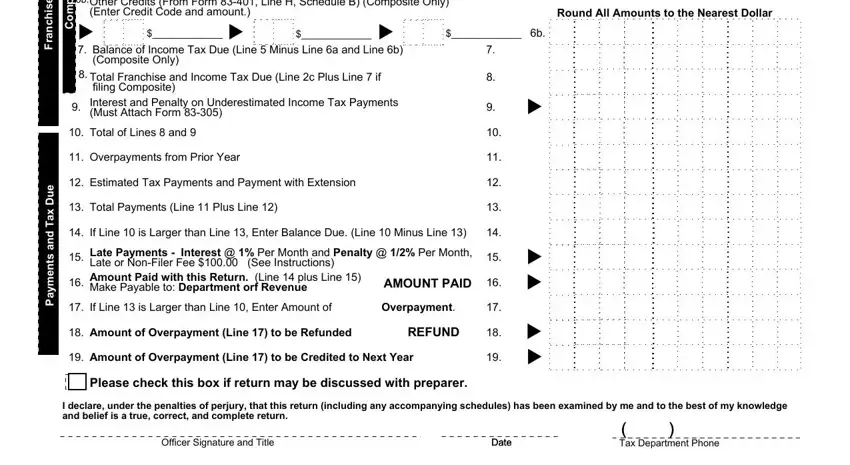

2. The next step is to submit these fields: Round All Amounts to the Nearest, e s h c n a r F, e u D x a T d n a s t n e m y a P, y n O e t i s o p m o C, Other Credits From Form Line H, Balance of Income Tax Due, Total Franchise and Income Tax Due, Total of Lines and, Overpayments from Prior Year, Estimated Tax Payments and Payment, Total Payments Line Plus Line, If Line is Larger than Line, Late Payments Interest Per, AMOUNT PAID, and If Line is Larger than Line.

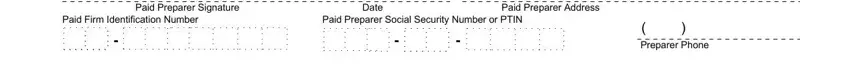

3. The third stage is generally straightforward - complete every one of the form fields in Paid Preparer Signature, Date, Paid Preparer Address, Paid Firm Identification Number, Paid Preparer Social Security, and Preparer Phone to conclude this segment.

It is easy to get it wrong when filling in your Preparer Phone, hence be sure you take a second look before you decide to submit it.

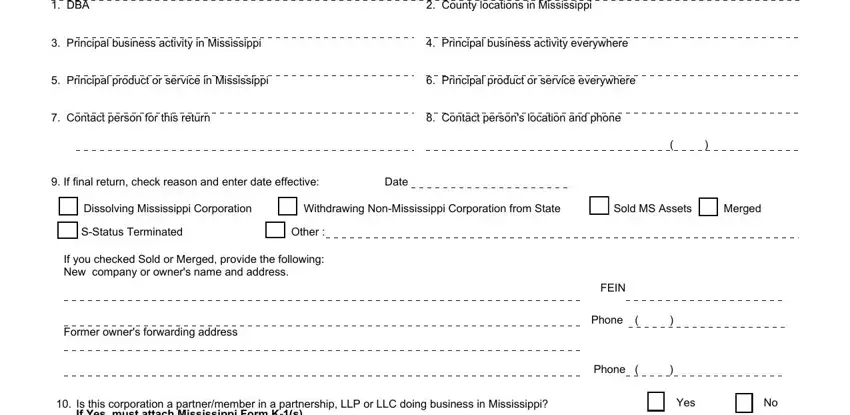

4. Completing DBA, County locations in Mississippi, Principal business activity in, Principal business activity, Principal product or service in, Principal product or service, Contact person for this return, Contact persons location and phone, If final return check reason and, Date, Dissolving Mississippi Corporation, SStatus Terminated, Withdrawing NonMississippi, Sold MS Assets, and Merged is key in this fourth part - you should definitely don't rush and fill out every single blank!

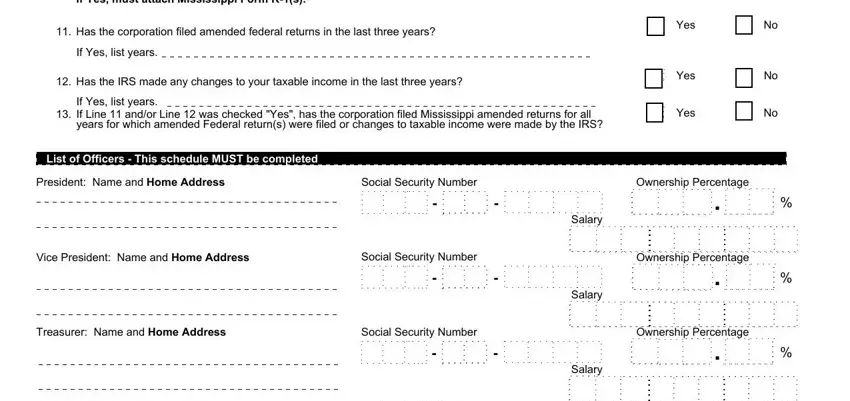

5. To wrap up your document, this last segment has several additional blanks. Completing Is this corporation a, Has the corporation filed amended, If Yes list years, Has the IRS made any changes to, If Yes list years If Line andor, Yes, Yes, Yes, List of Officers This schedule, President Name and Home Address, Vice President Name and Home, Treasurer Name and Home Address, Social Security Number, Social Security Number, and Social Security Number should wrap up the process and you're going to be done in a tick!

Step 3: Prior to moving on, it's a good idea to ensure that blanks have been filled out the proper way. The moment you believe it is all fine, click on “Done." Try a 7-day free trial plan at FormsPal and get direct access to Form 85 105 10 8 1 000 - download or modify in your FormsPal account page. FormsPal guarantees your information confidentiality by having a protected system that in no way records or distributes any kind of personal information provided. Be assured knowing your docs are kept protected any time you use our services!