Form 8554 Ep can be completed without any problem. Just make use of FormsPal PDF editing tool to complete the job right away. FormsPal is devoted to providing you the perfect experience with our tool by consistently releasing new functions and improvements. With these improvements, using our tool becomes easier than ever! To begin your journey, consider these easy steps:

Step 1: Just hit the "Get Form Button" at the top of this page to start up our form editing tool. Here you'll find everything that is needed to work with your document.

Step 2: With our state-of-the-art PDF editor, you'll be able to do more than just fill in forms. Express yourself and make your documents seem professional with customized text added, or adjust the file's original content to perfection - all that supported by an ability to add your personal images and sign the PDF off.

This document will need some specific details; to guarantee accuracy and reliability, please be sure to take note of the guidelines listed below:

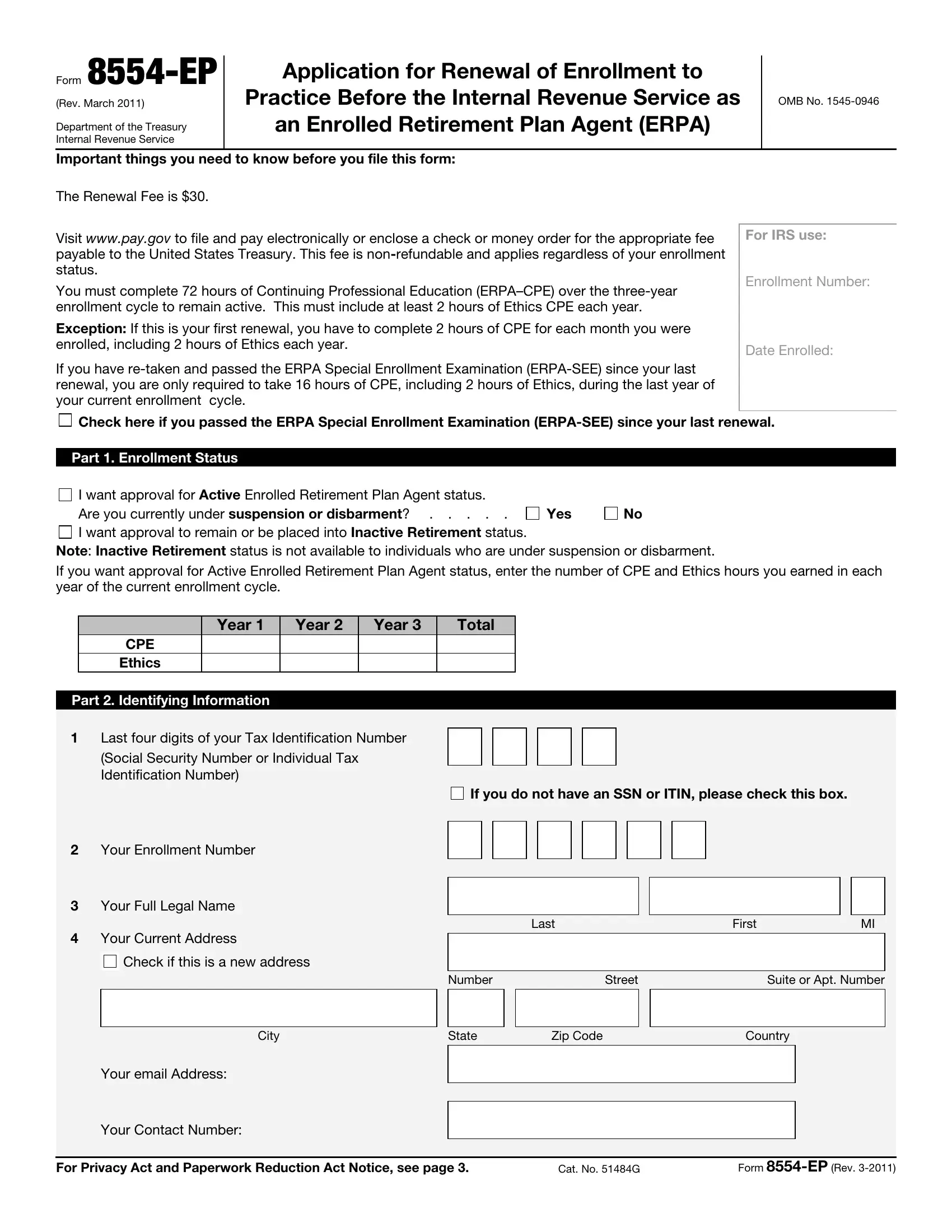

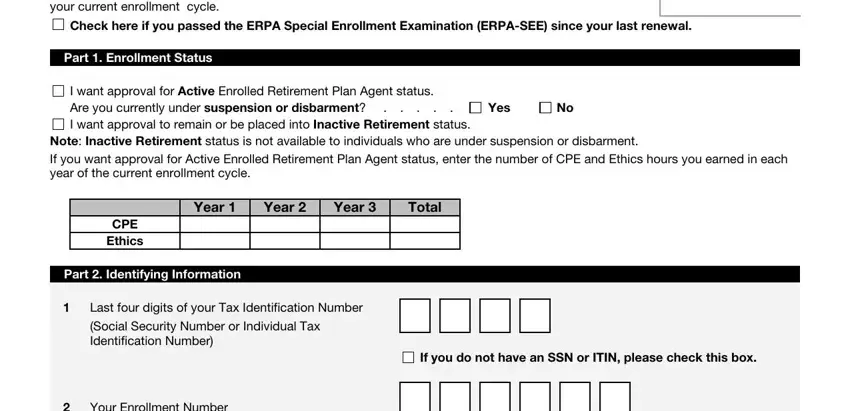

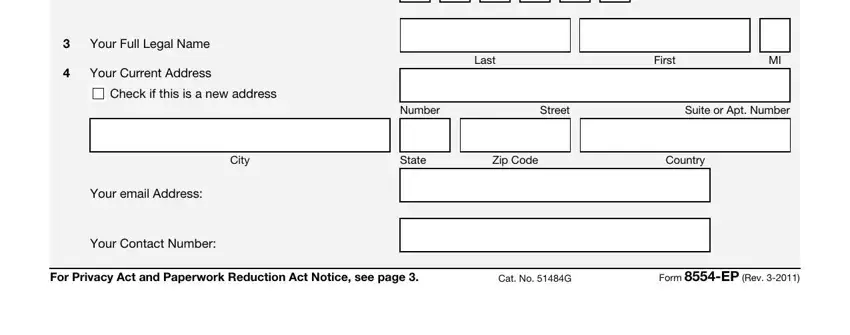

1. Fill out your Form 8554 Ep with a number of major blank fields. Gather all the required information and ensure nothing is left out!

2. Once your current task is complete, take the next step – fill out all of these fields - Your Enrollment Number, Your Full Legal Name, Your Current Address, Check if this is a new address, Last, First, Number, Street, Suite or Apt Number, City, State, Zip Code, Country, Your email Address, and Your Contact Number with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

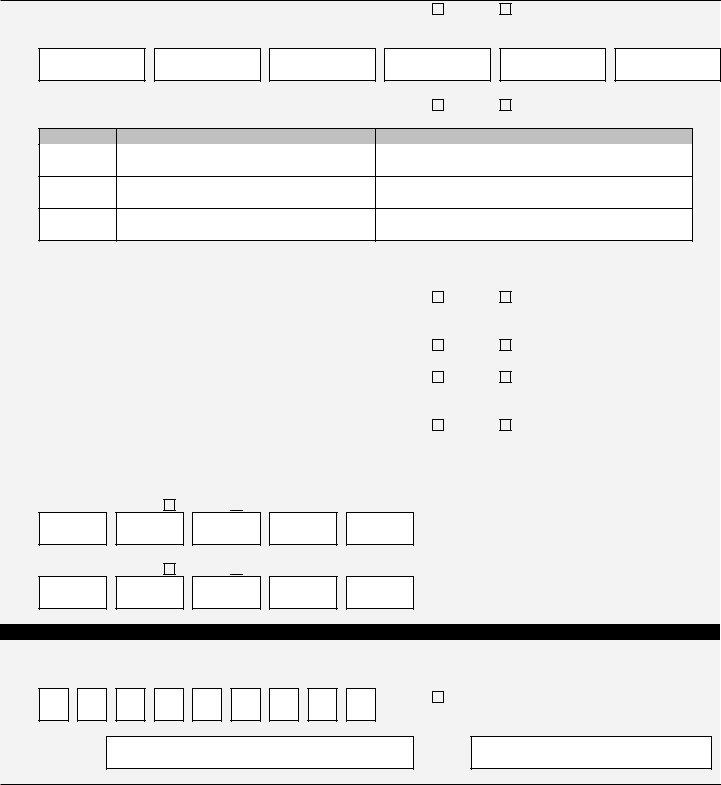

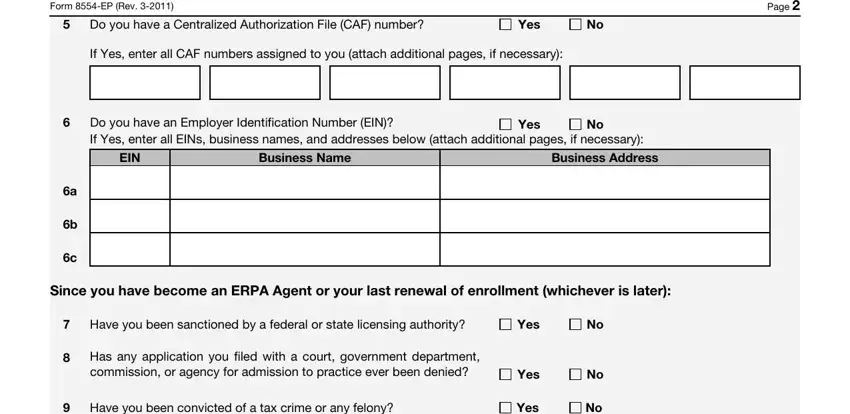

3. The third step is usually hassle-free - complete all of the empty fields in Form EP Rev, Page, Do you have a Centralized, Yes, If Yes enter all CAF numbers, Do you have an Employer, Yes, EIN, Business Name, Business Address, Since you have become an ERPA, Have you been sanctioned by a, Yes, Has any application you filed with, and Have you been convicted of a tax in order to complete this process.

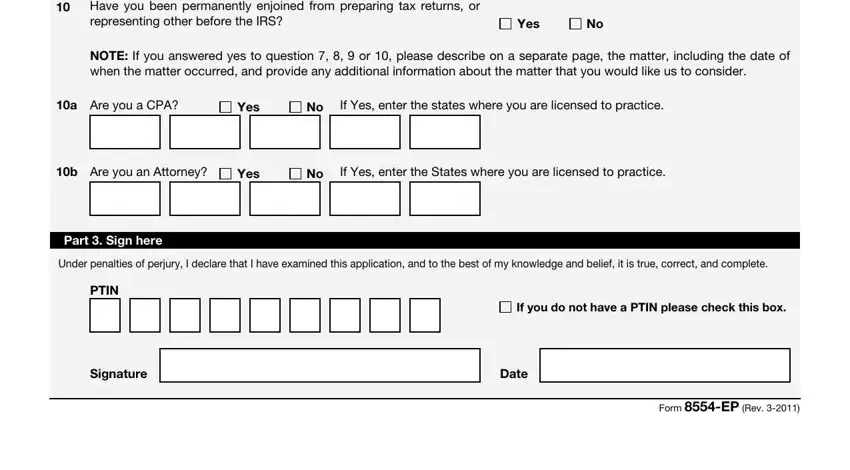

4. This next section requires some additional information. Ensure you complete all the necessary fields - Have you been permanently enjoined, Yes, NOTE If you answered yes to, a Are you a CPA, Yes, If Yes enter the states where you, b Are you an Attorney, Yes, If Yes enter the States where you, Part Sign here, Under penalties of perjury I, PTIN, If you do not have a PTIN please, Signature, and Date - to proceed further in your process!

When it comes to Date and If Yes enter the states where you, be certain you don't make any mistakes here. The two of these are definitely the most important ones in this file.

Step 3: Look through the details you've typed into the blank fields and then click on the "Done" button. Obtain the Form 8554 Ep the instant you register here for a free trial. Instantly view the form inside your personal cabinet, together with any edits and adjustments all kept! Here at FormsPal.com, we do our utmost to make sure all of your information is stored private.