orderseforms can be completed with ease. Simply try FormsPal PDF editor to get the job done promptly. The tool is continually updated by our team, acquiring cool features and turning out to be greater. All it takes is a few simple steps:

Step 1: Simply press the "Get Form Button" above on this webpage to access our pdf form editing tool. Here you will find all that is necessary to work with your file.

Step 2: With our handy PDF editing tool, it is easy to accomplish more than merely complete blanks. Edit away and make your forms look great with custom text added in, or modify the file's original input to excellence - all comes with an ability to add stunning pictures and sign the PDF off.

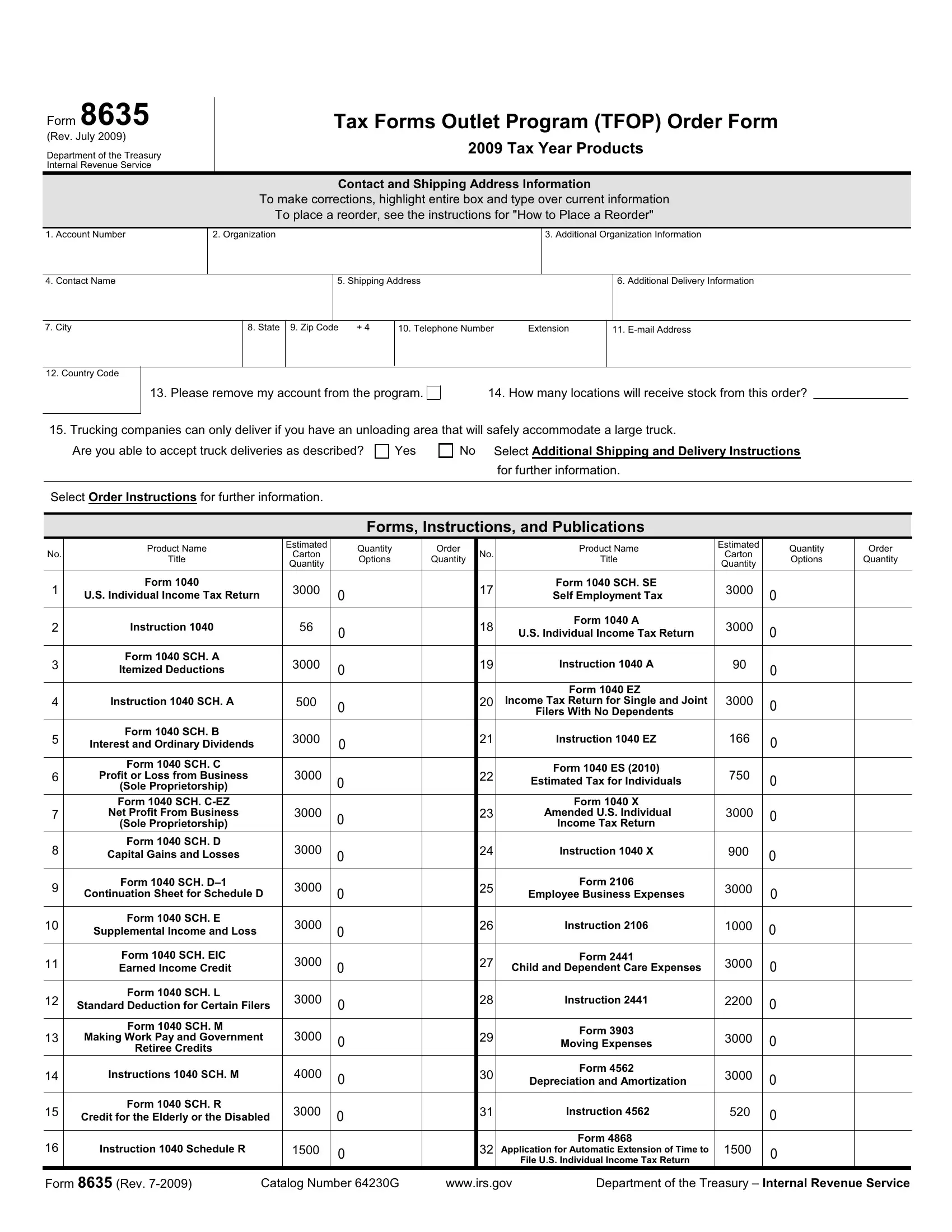

This PDF doc will require some specific information; in order to guarantee accuracy and reliability, be sure to take heed of the following guidelines:

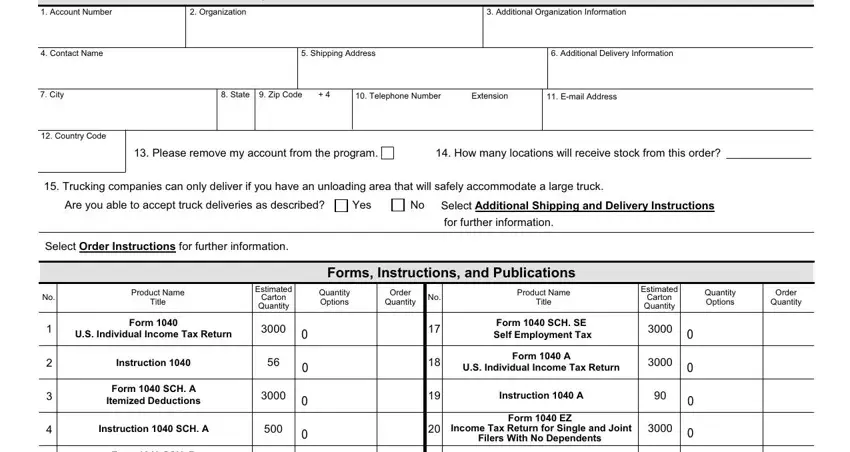

1. The orderseforms necessitates certain information to be entered. Be sure the next blanks are completed:

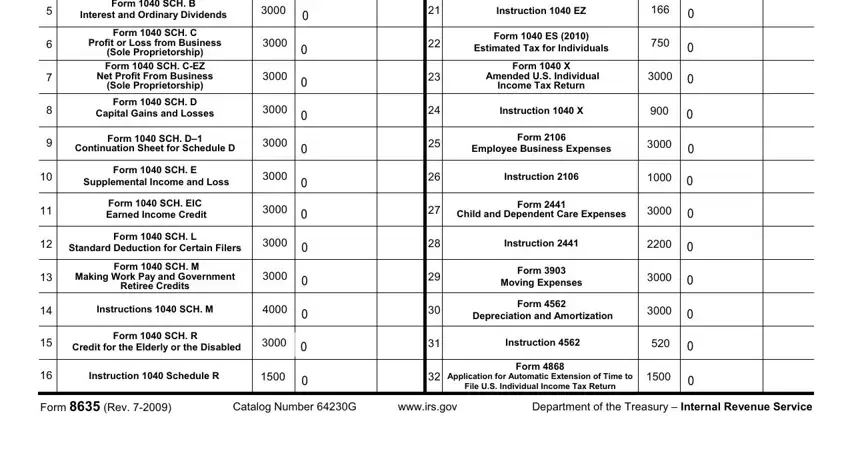

2. Given that the previous array of fields is done, you're ready put in the required specifics in Form SCH B, Interest and Ordinary Dividends, Form SCH C, Profit or Loss from Business, Sole Proprietorship, Form SCH CEZ, Net Profit From Business, Sole Proprietorship, Form SCH D, Capital Gains and Losses, Form SCH D, Continuation Sheet for Schedule D, Form SCH E, Supplemental Income and Loss, and Form SCH EIC Earned Income Credit so you're able to progress further.

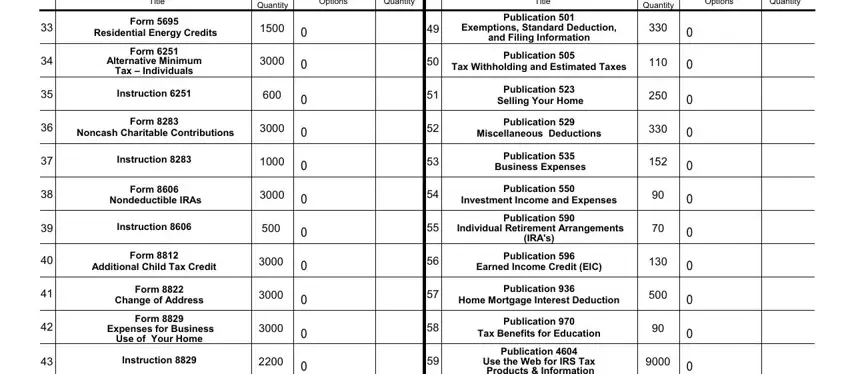

3. The following step is about Title, Form, Residential Energy Credits, Form, Alternative Minimum, Tax Individuals, Instruction, Form, Noncash Charitable Contributions, Instruction, Form, Nondeductible IRAs, Instruction, Form, and Additional Child Tax Credit - fill out every one of these empty form fields.

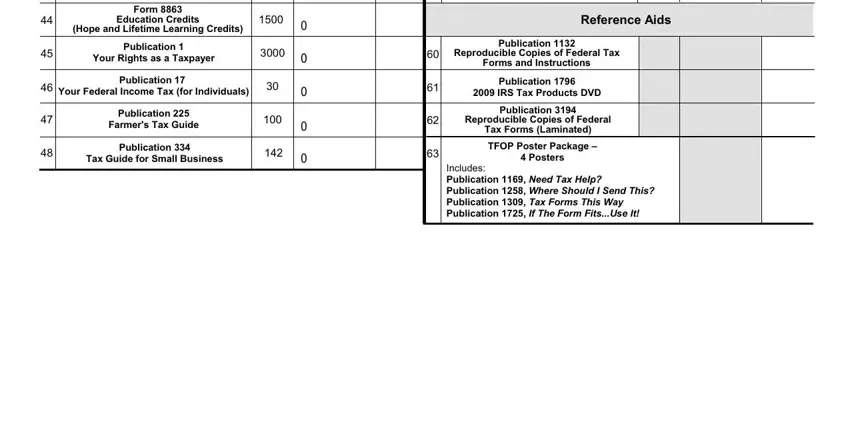

4. This fourth section arrives with these blank fields to complete: Form, Education Credits, Hope and Lifetime Learning Credits, Publication, Your Rights as a Taxpayer, Publication, Your Federal Income Tax for, Publication, Farmers Tax Guide, Publication, Tax Guide for Small Business, Use the Web for IRS Tax Products, Reference Aids, Publication, and Reproducible Copies of Federal Tax.

5. This form must be finalized with this particular segment. Further there's a full list of blank fields that require correct information to allow your document submission to be faultless: Form Rev, Catalog Number G, wwwirsgov, and Department of the Treasury.

Always be very careful when filling out wwwirsgov and Department of the Treasury, as this is where most users make some mistakes.

Step 3: Ensure that your information is correct and then click "Done" to proceed further. After creating afree trial account with us, it will be possible to download orderseforms or email it right off. The PDF document will also be readily available through your personal account menu with your every single change. FormsPal provides protected form completion devoid of personal data recording or distributing. Be assured that your details are safe with us!