Any time you desire to fill out irc sec 7216, there's no need to download any sort of applications - just make use of our PDF tool. In order to make our editor better and less complicated to utilize, we consistently work on new features, with our users' suggestions in mind. It just takes a couple of simple steps:

Step 1: Open the PDF form in our tool by pressing the "Get Form Button" above on this page.

Step 2: The tool enables you to change most PDF forms in a range of ways. Enhance it by writing personalized text, adjust what's originally in the PDF, and put in a signature - all within a couple of mouse clicks!

Pay close attention while filling in this document. Make sure each and every field is done correctly.

1. The irc sec 7216 requires certain details to be typed in. Ensure that the following blanks are completed:

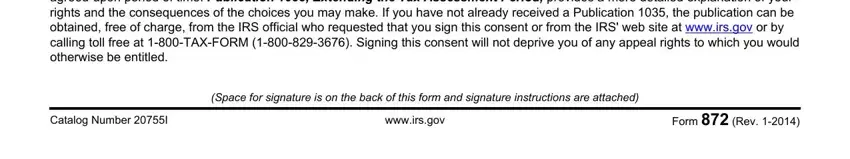

2. Once your current task is complete, take the next step – fill out all of these fields - You have the right to refuse to, Catalog Number I, wwwirsgov, Form Rev, and Space for signature is on the back with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make a mistake when completing your You have the right to refuse to, consequently make sure you go through it again prior to when you submit it.

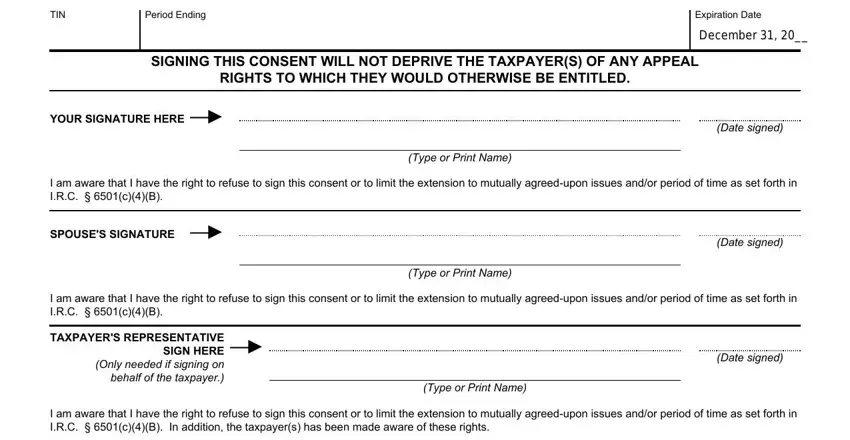

3. Your next part is going to be hassle-free - fill out all of the form fields in TIN, Period Ending, Expiration Date, SIGNING THIS CONSENT WILL NOT, RIGHTS TO WHICH THEY WOULD, YOUR SIGNATURE HERE, Type or Print Name, Date signed, I am aware that I have the right, SPOUSES SIGNATURE, Type or Print Name, Date signed, I am aware that I have the right, TAXPAYERS REPRESENTATIVE SIGN HERE, and Type or Print Name to complete this segment.

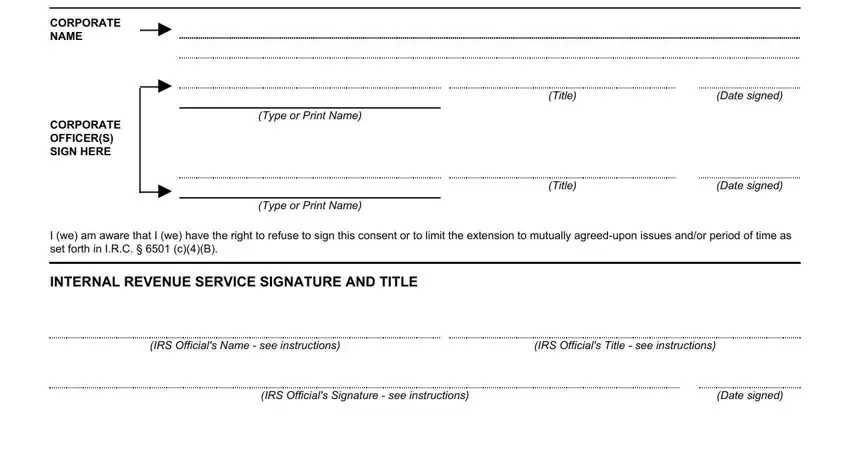

4. Now fill in the next portion! In this case you have all these CORPORATE NAME, CORPORATE OFFICERS SIGN HERE, Type or Print Name, Type or Print Name, Title, Date signed, Title, Date signed, I we am aware that I we have the, INTERNAL REVENUE SERVICE SIGNATURE, IRS Officials Name see, IRS Officials Title see, IRS Officials Signature see, and Date signed blank fields to fill in.

Step 3: Before moving forward, check that all blank fields are filled in as intended. When you’re satisfied with it, click “Done." After registering a7-day free trial account at FormsPal, it will be possible to download irc sec 7216 or send it via email directly. The file will also be accessible from your personal cabinet with your every change. We don't share any information you enter when dealing with forms at our website.