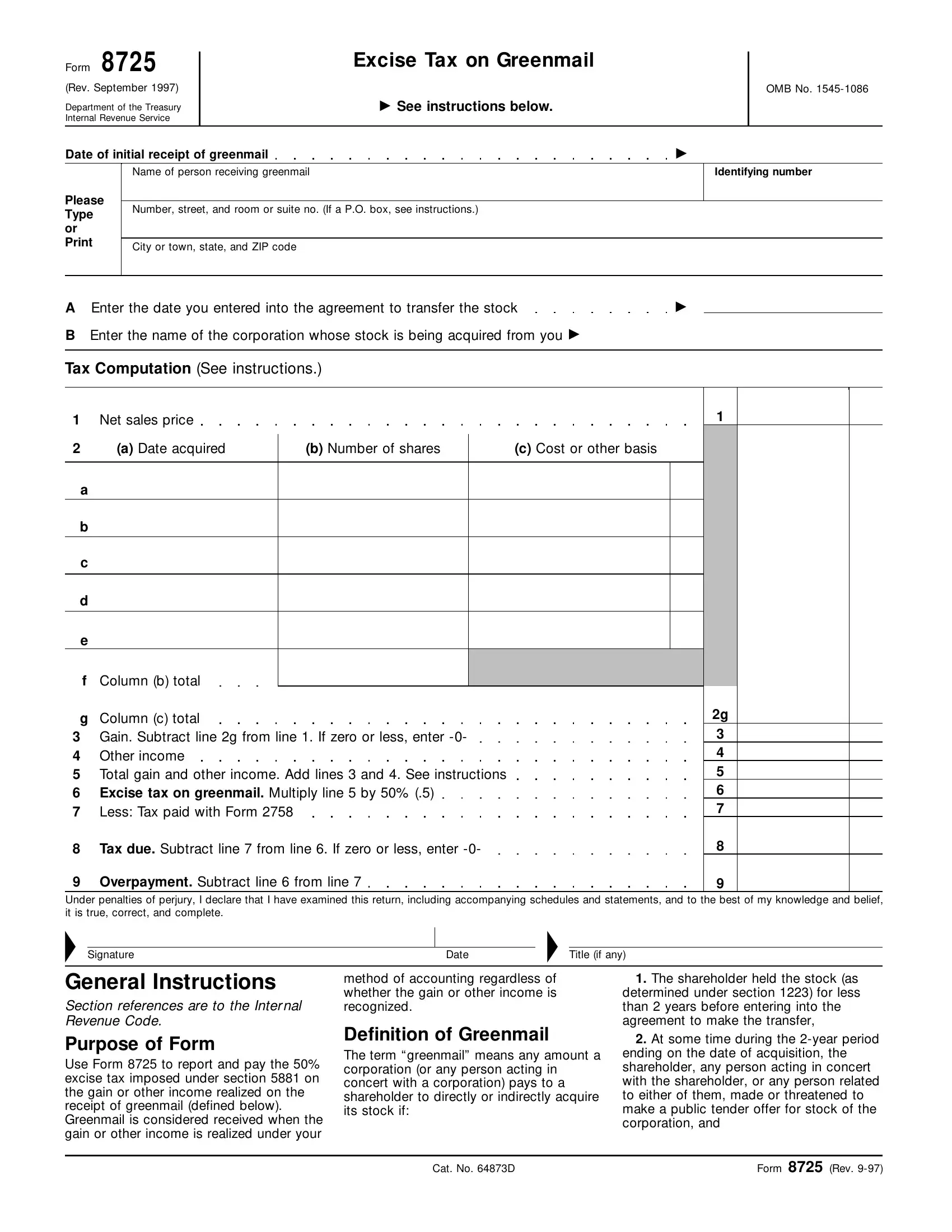

3.The acquisition was made under an offer that was not made on the same terms to all shareholders.

Note: Payments made in connection with (or in transactions related to) an acquisition are treated as payments made for the acquisition of the stock.

Indirect acquisition of stock.—Stock is deemed to have been acquired indirectly by the issuing corporation if such stock is sold to an entity related to the issuing corporation (e.g., a controlled subsidiary).

Public tender offer.—The term “public tender offer” means any offer to purchase or otherwise acquire stock or assets in a corporation if the offer was required to be filed or registered with any Federal or state agency regulating securities.

Related person.—A person is considered related to another person if the relationship between such persons would result in the disallowance of losses under section 267 or 707(b).

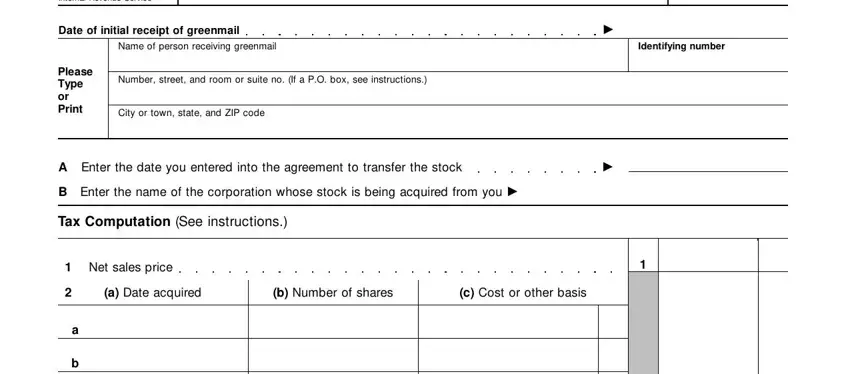

Who Must File

You must file Form 8725 if you are liable for the excise tax on greenmail under section 5881. File a separate Form 8725 for each agreement made to transfer stock.

When To File

File Form 8725 by the 90th day following receipt of any portion of the greenmail. If you need more time to file, use Form 2758, Application for Extension of Time To File Certain Excise, Income, Information, and Other Returns, by the due date of Form 8725. Form 2758 does not extend the time for payment of tax.

Where To File

File Form 8725 with the Internal Revenue Service Center where you file your income tax return. If you have no legal residence, principal place of business, or office or agency in the United States, file the form with the Internal Revenue Service Center, Philadelphia, PA 19255.

Rounding Off to Whole Dollars

You may show money items on the return as whole dollars. To do so, drop any amount less than 50 cents and increase any amount from 50 cents through 99 cents to the next higher dollar.

Amended Return

To amend a previously filed Form 8725, file a corrected Form 8725 and write “Amended” at the top of the form.

Attachments and Signature

If more space is needed, attach separate sheets to Form 8725. Be sure to put your name and identifying number on each sheet.

See the instructions for the Signature

section of your Federal income tax return.

Interest and Penalties

Interest.—Interest is charged on taxes not paid by the due date at a rate determined under section 6621.

Late filing of return.—A penalty of 5% a month or part of a month, up to a maximum of 25% , is imposed on the net amount due if Form 8725 is not filed when due.

Late payment of tax.—Generally, the penalty for not paying tax when due is 1⁄2 of 1% of the unpaid amount, up to a maximum of 25% , for each month or part of a month the tax remains unpaid. The penalty is imposed on the net amount due.

Specific Instructions

Name and Address

Enter the name shown on your most recently filed Federal income tax return. Include the suite, room, apartment, or other unit number after the street address. If the Post Office does not deliver mail to the street address and the taxpayer has a P.O. box, show the box number instead of the street address.

Identifying Number

If you are an individual, enter your social security number. Other filers should enter their employer identification number.

Tax Computation

Line 1—Net sales price.—Enter the net proceeds received from the sale of the stock subject to the excise tax.

Column 2(a)—Date acquired.—For each separate acquisition of stock subject to the excise tax, enter the date acquired (e.g., the trade date for stock traded on an exchange or over the counter). See section 1223 for special rules on determining the holding period of stock received in an exchange, for stock that has the same basis in whole or in part as it would have in the hands of another person, for stock subject to the “wash sale” rules of section 1091, etc.

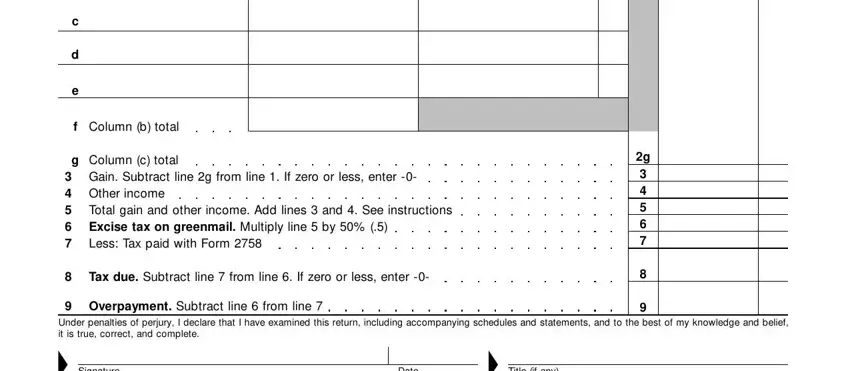

Column 2(c)—Cost or other basis.—The cost or other basis of stock is generally the cost of the stock plus purchase commissions. If you inherited the stock, received it as a gift, received it in a

tax-free exchange, or re-acquired stock in a “wash sale” transaction subject to the rules of section 1091, you may not be able to use the actual cash cost as the basis. If you do not use cash cost, attach an explanation of your basis. Be sure to adjust your basis by subtracting all the nontaxable distributions you received before the sale. Also adjust your basis for any stock splits. For more information, see Pub. 551, Basis of Assets.

Line 4—Other income.—If you realized any other income that is subject to the excise tax, enter the amount of the income on line 4.

Line 5—Total gain and other income.—

You must include the recognized portion of the amount on line 5 as income on your Federal income tax return.

Line 6—Excise tax on greenmail.—You may not claim a deduction on your Federal income tax return for the amount shown on line 6.

Line 7—Tax paid with Form 2758.—If you filed Form 2758, enter the amount of tax paid, if any, when you filed that form.

Line 8—Tax due.—You must pay the tax due in full when you file Form 8725. Make your check or money order payable to the “Internal Revenue Service.” Write your name, address, identifying number, and “Form 8725” on the check or money order.

Line 9—Overpayment.—The IRS will refund the amount on line 9 if you owe no other taxes.

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file

this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

5 hr., 30 min. |

Learning about the law |

|

or the form |

42 min. |

Preparing and sending |

|

the form to the IRS |

49 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. DO NOT send the tax form to this address. Instead, see Where To File above.