Form 8820 can be filled out effortlessly. Simply try FormsPal PDF editing tool to complete the job quickly. FormsPal is committed to providing you with the ideal experience with our editor by consistently introducing new features and improvements. With all of these improvements, using our editor gets easier than ever before! Here is what you'll need to do to begin:

Step 1: Just click on the "Get Form Button" at the top of this page to get into our pdf editor. This way, you'll find everything that is needed to fill out your document.

Step 2: Using our advanced PDF file editor, it's possible to do more than just fill in forms. Try each of the features and make your documents look great with custom text added, or tweak the file's original content to excellence - all comes with the capability to incorporate stunning pictures and sign it off.

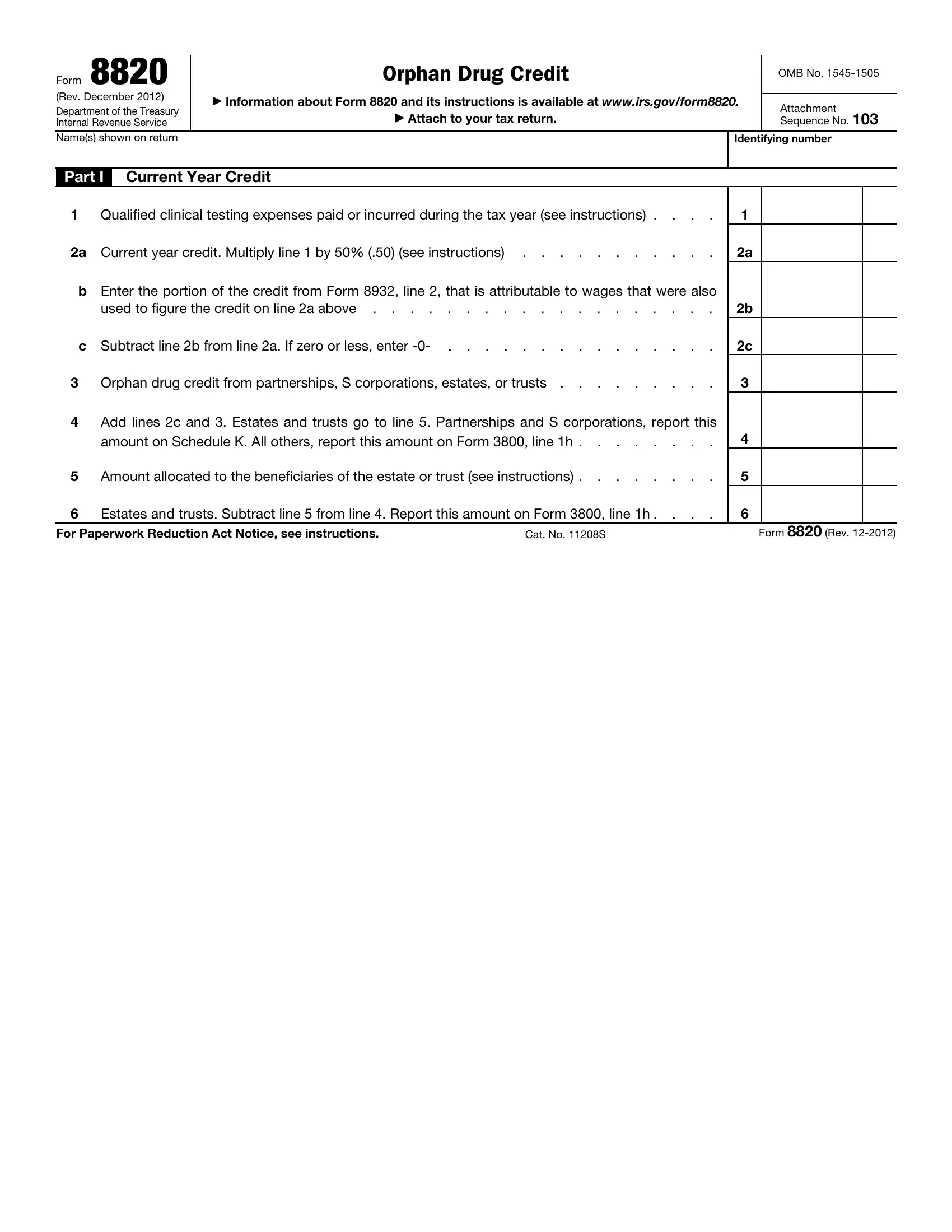

To be able to complete this PDF document, make sure you enter the right information in every blank:

1. It is crucial to complete the Form 8820 accurately, therefore take care while filling in the parts including all of these fields:

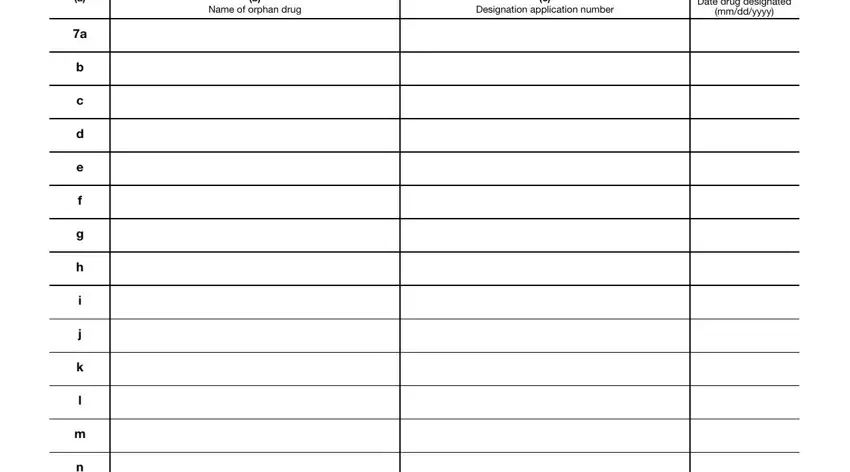

2. After this part is complete, you should add the necessary details in Name of orphan drug, Designation application number, Date drug designated, and mmddyyyy so you're able to move on to the third stage.

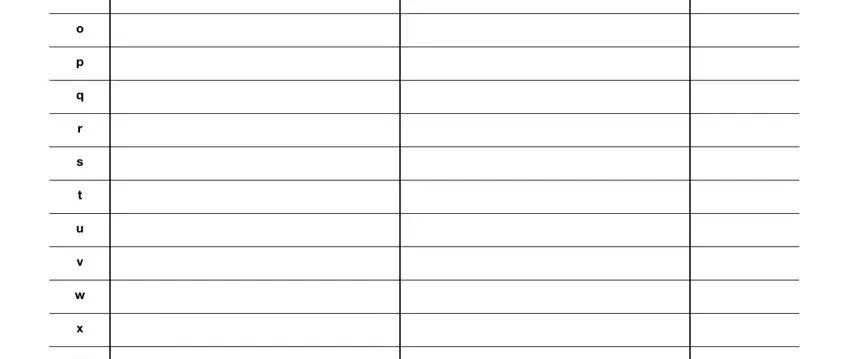

3. Completing is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It is easy to make errors while filling out your this field, hence make sure you look again before you'll finalize the form.

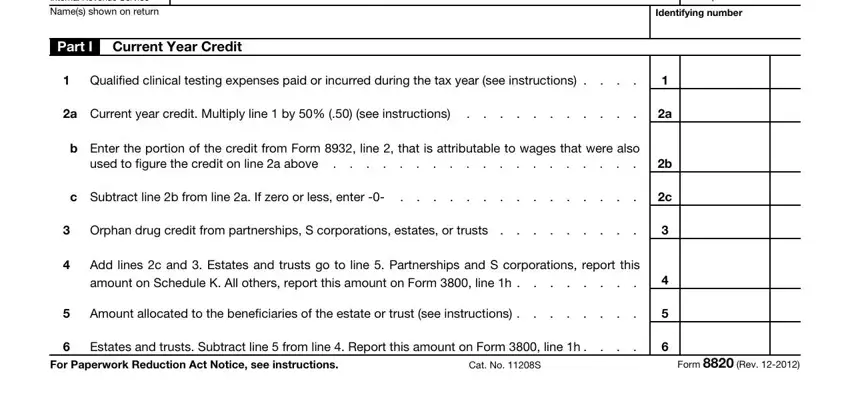

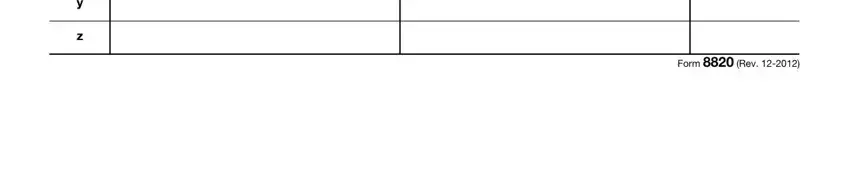

4. This subsection arrives with the next few empty form fields to fill out: Form Rev.

Step 3: After you have glanced through the information you filled in, just click "Done" to complete your document creation. Find your Form 8820 once you register at FormsPal for a free trial. Instantly access the pdf form from your FormsPal cabinet, together with any modifications and adjustments automatically preserved! FormsPal offers protected form completion with no personal data record-keeping or distributing. Feel safe knowing that your information is in good hands with us!