Form 8824 can be filled out online without any problem. Simply try FormsPal PDF editing tool to perform the job in a timely fashion. FormsPal team is devoted to providing you the perfect experience with our editor by constantly presenting new functions and enhancements. With all of these updates, using our tool gets better than ever! To get the ball rolling, take these simple steps:

Step 1: Press the orange "Get Form" button above. It'll open up our pdf tool so that you can start completing your form.

Step 2: As you start the PDF editor, you'll see the form made ready to be filled in. Other than filling in different blank fields, you could also do some other actions with the form, particularly putting on your own text, editing the initial text, inserting illustrations or photos, affixing your signature to the PDF, and a lot more.

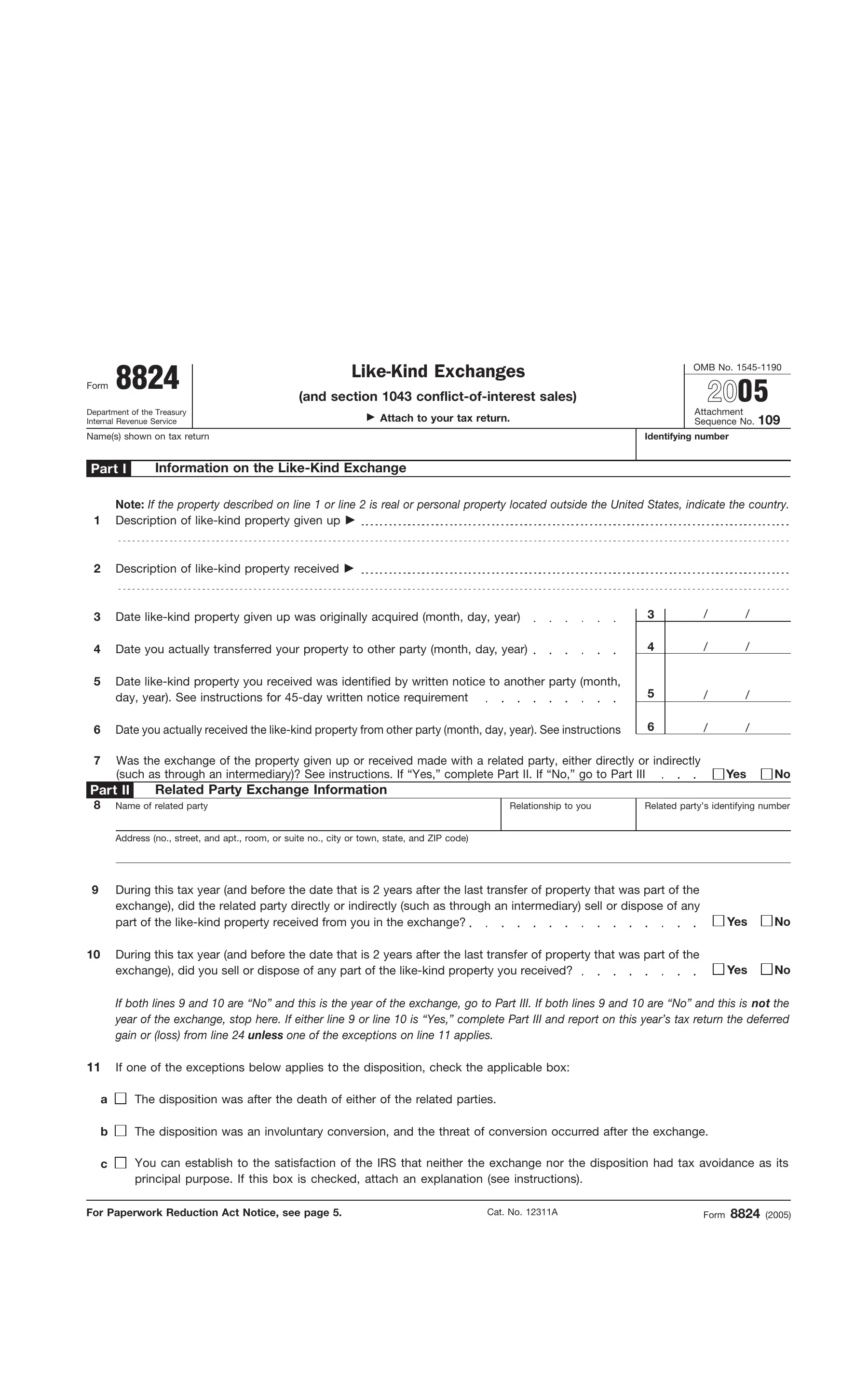

This document will require specific details to be typed in, hence you need to take your time to enter precisely what is expected:

1. It is very important complete the Form 8824 properly, so be mindful when filling out the sections containing all these fields:

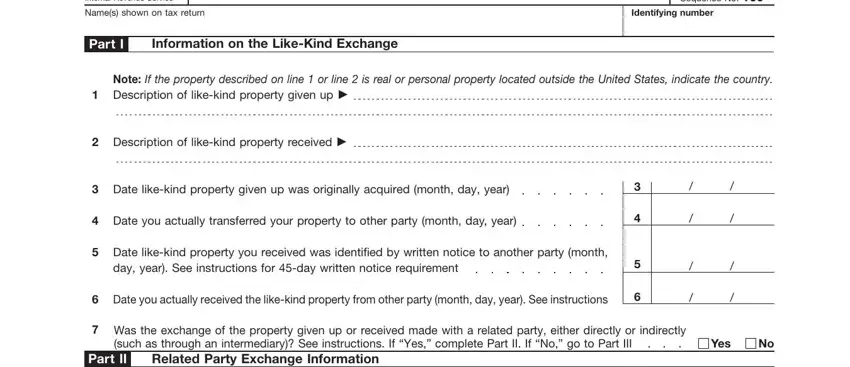

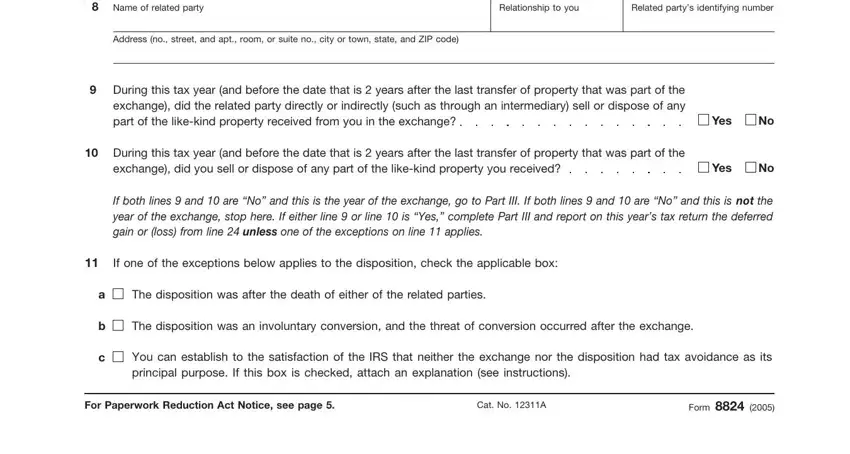

2. Immediately after this part is completed, go to enter the applicable details in these - Part II, Name of related party, Relationship to you, Related partys identifying number, Address no street and apt room or, During this tax year and before, Yes, During this tax year and before, Yes, If both lines and are No and, If one of the exceptions below, The disposition was after the, The disposition was an involuntary, You can establish to the, and For Paperwork Reduction Act Notice.

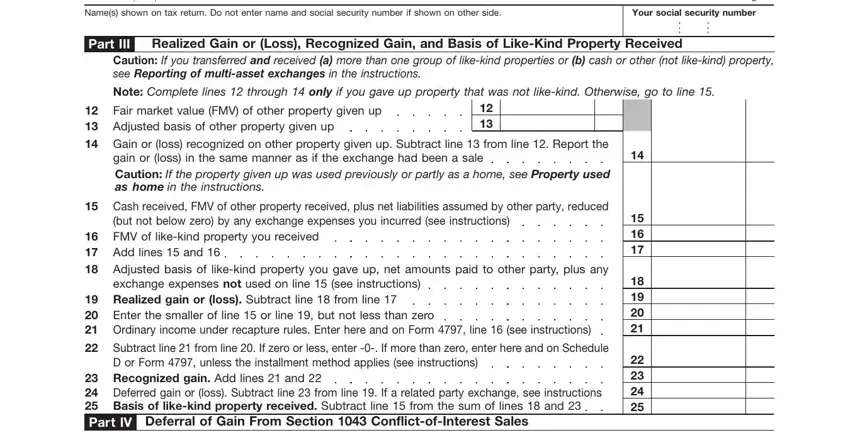

3. Completing Form, Page, Names shown on tax return Do not, Your social security number, Part III, Realized Gain or Loss Recognized, Caution If you transferred and, Note Complete lines through only, Fair market value FMV of other, Adjusted basis of other property, Gain or loss recognized on other, Cash received FMV of other, but not below zero by any exchange, Ordinary income under recapture, and Subtract line from line If zero is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

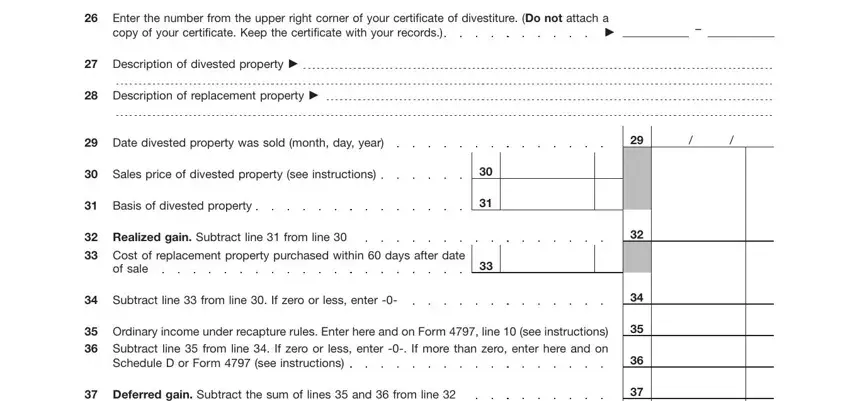

4. To move onward, this next form section requires completing several form blanks. Examples include Enter the number from the upper, Description of divested property, Description of replacement, Date divested property was sold, Sales price of divested property, Basis of divested property, Realized gain Subtract line from, Cost of replacement property, Subtract line from line If zero, Ordinary income under recapture, and Deferred gain Subtract the sum of, which you'll find vital to going forward with this particular process.

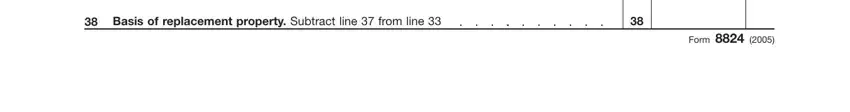

5. Last of all, this last portion is what you'll want to finish before finalizing the form. The blank fields in this instance are the next: Deferred gain Subtract the sum of, Basis of replacement property, and Form.

People frequently get some points incorrect while filling in Basis of replacement property in this area. Ensure you double-check what you type in right here.

Step 3: Before moving forward, ensure that all blanks were filled out properly. The moment you believe it is all good, press “Done." Sign up with FormsPal right now and immediately access Form 8824, all set for download. Each edit made is conveniently kept , allowing you to change the file at a later time as needed. We do not share or sell the information that you provide whenever filling out documents at FormsPal.