The Form 8830, Enhanced Oil Recovery Credit, issued by the Department of the Treasury and the Internal Revenue Service (IRS), plays a critical role for taxpayers involved in specific oil recovery projects. It enables both individuals and entities to claim a credit of 15% on qualified enhanced oil recovery costs, a significant incentive designed to encourage the deployment of tertiary recovery methods to increase crude oil production within the United States. These methods are pivotal for extracting additional oil that conventional primary and secondary recovery phases cannot. The form details a range of costs that qualify for the credit, including tangible property investments integral to recovery projects and certain intangible drilling and development costs. Additionally, the form outlines tax liability limitations and the process for calculating the credit, which includes adjustments based on oil reference prices and inflation. Moreover, partnerships and S corporations can allocate the calculated credit among partners and shareholders, underscoring the form's broader applicability. It is essential for filers to adhere to specific instructions regarding the qualification of projects and costs, alongside ensuring accurate tax reporting by considering various tax credits and their impact on overall tax liability. With comprehensive instructions and criteria outlined for the credit’s application, the Form 8830 facilitates a structured approach to claiming tax incentives for enhanced oil recovery projects, echoing the government's support for energy production initiatives.

| Question | Answer |

|---|---|

| Form Name | Form 8830 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Recordkeeping, TX, form 8830, 12e |

Form 8 8 3 0 |

Enhanced Oil Recovery Credit |

|

OMB No. |

|

|

||

Department of the Treasury |

▶ Attach to your return. |

|

Attachment |

Internal Revenue Service |

|

|

Sequence No. 78 |

Name(s) shown on return |

|

Identifying number |

|

|

|

|

|

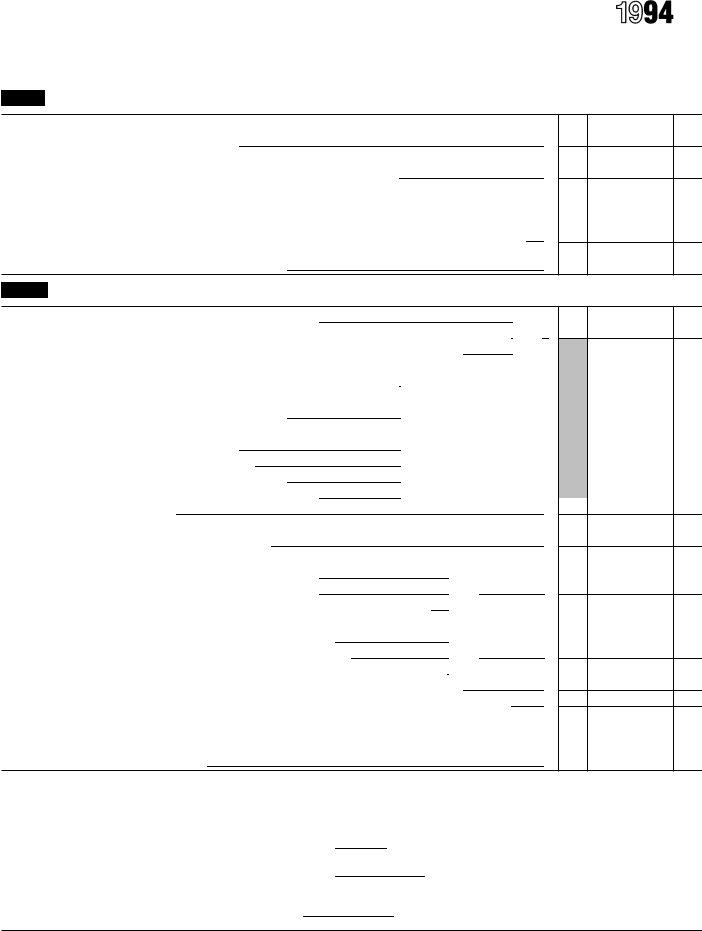

Part I Current Year Enhanced Oil Recovery Credit (See instructions.)

1Qualified enhanced oil recovery costs

2Current year credit. Multiply line 1 by 15% (.15) (see instructions)

3 Enhanced oil recovery credits |

|

If you are a— |

Then enter total of current year credit(s) from— |

|

|

||

from |

|

|

|

|

|

|

|

a |

Shareholder |

Schedule |

(Form 1120S), lines 12d, 12e, or 13 |

% |

|||

|

|||||||

|

b |

Partner |

Schedule |

(Form 1065), lines 13d, 13e, or 14 |

|||

4 Total current year credit. Add lines 2 and 3

1

2

3

4

Part II Tax Liability Limitation (See Who Must File Form 3800 to see if you complete Part II or file Form 3800.)

5a |

Individuals. Enter amount from Form 1040, line 40 |

|

|

% |

|

b Corporations. Enter am ount from Form 1120, Schedule J, line 3 (or Form 1120- A, Part I, line 1) |

|

||||

c |

Other filers. Enter regular tax before credits from your return (see instructions) |

|

|||

6 |

Credits that reduce regular tax before the general business credit: |

|

|

|

|

a |

Credit for child and dependent care expenses (Form 2441, line 10) |

6a |

|

|

|

b |

Credit for the elderly or the disabled (Schedule R (Form 1040), line 21) |

6b |

|

|

|

c |

Mortgage interest credit (Form 8396, line 11) |

6c |

|

|

|

d |

Foreign tax credit (Form 1116, line 32, or Form 1118, Sch. B, line 12) |

6d |

|

|

|

e |

Possessions tax credit (Form 5735) |

6e |

|

|

|

f |

Orphan drug credit (Form 6765, line 10) |

6f |

|

|

|

g |

Credit for fuel from a nonconventional source |

6g |

|

|

|

h |

Qualified electric vehicle credit (Form 8834, line 19) |

6h |

|

|

|

iAdd lines 6a through 6h

7 |

Net regular tax. Subtract line 6i from line 5 |

|

8 |

Tentative minimum tax (see instructions): |

|

a |

Individuals. Enter amount from Form 6251, line 26 |

% |

b |

Corporations. Enter amount from Form 4626, line 13 |

|

c |

Estates and trusts. Enter amount from Form 1041, Schedule H, line 37 |

|

9 |

Net income tax: |

|

a |

Individuals. Add line 7 above and line 28 of Form 6251 |

% |

b |

Corporations. Add line 7 above and line 15 of Form 4626 |

|

c |

Estates and trusts. Add line 7 above and line 39 of Form 1041, Schedule H |

|

10 |

If line 7 is more than $25,000, enter 25% (.25) of the excess (see instructions) |

|

11 |

Subtract line 8 or line 10, whichever is greater, from line 9. If less than zero, enter |

|

12 |

Enhanced oil recovery credit allowed for the current year. Enter the smaller of line 4 or line 11. |

|

|

This is your General Business Credit for 1994. Enter here and on Form 1040, line 44; Form 1120, |

|

|

Schedule J, line 4e; Form |

|

|

line of other income tax returns |

|

5

6i

7

8

9

10

11

12

Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

5 hr., 16 |

min. |

Learning about the |

|

|

law or the form |

53 min. |

|

Preparing and |

|

|

sending the form |

|

|

to the IRS |

1 hr., 1 |

min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to both the IRS and the Office of Management and Budget at the addresses listed in the instructions for the tax return with which this form is filed.

Cat. No. 13059B |

Form 8830 (1994) |

Form 8830 (1994) |

Page 2 |

|

|

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Use Form 8830 to claim the enhanced oil recovery credit. Partnerships and S corporations use the form to figure the credit to pass through to partners and shareholders. The credit is 15% of certain costs paid or incurred in connection with an enhanced oil recovery project.

An owner of an operating mineral interest may claim or elect not to claim this credit on either an original or amended return at any time within 3 years from the due date of the return (determined without regard to extensions).

Amount of Credit

The tentative credit is 15% (.15) of qualified costs for the year. The credit is reduced when the reference price, determined under section 29(d)(2)(C), exceeds $28 per barrel. The $28 value is adjusted for inflation for years after 1991. If the reference price exceeds the base value of $28 (as adjusted by inflation) by more than $6, the credit is zero. For 1994, there is no reduction of the credit.

Definitions

Qualified enhanced oil recovery costs

means:

1.Any amount paid or incurred during the tax year for tangible property—

a. That is an integral part of a qualified enhanced oil recovery project, and

b. For which depreciation (or amortization in lieu of depreciation) is allowable.

2.Any intangible drilling and development costs—

a. That are paid or incurred in connection with a qualified enhanced oil recovery project, and

b. For which the taxpayer may make an election under section 263(c). For an integrated oil company, this includes intangible drilling costs required to be amortized under section 291(b).

3.Any qualified tertiary injectant expenses paid or incurred in connection with a qualified enhanced oil recovery project, and for which a deduction under section 193 is allowable.

Qualified enhanced oil recovery

project means any project involving the application of one or more tertiary recovery methods defined in section 193(b)(3) (and listed below) that can reasonably be expected to result in more than an insignificant increase in the amount of crude oil that will ultimately be recovered. The project must be located within the United States, which includes the seabed and subsoil adjacent to the territorial waters of the United States and over which the United States has exclusive rights by international law for exploration and

exploitation of natural resources (see section 638(1)). The first injection of liquids, gases, or other matter must begin after 1990. However, any significant expansion after 1990 of a project begun before 1991 is treated as a project where the first injection begins after 1990.

Additionally, the operator (or designated owner) must submit a certification from a petroleum engineer that the project meets the above requirements. File this certification with the Internal Revenue Service Center, Austin, TX 73301, by the due date of the operator’s (or designated owner’s) Federal income tax return. The petroleum engineer certifying a project must be duly registered or certified by any state.

The operator (or designated owner) must certify each following year that the project continues to be implemented substantially in accordance with the petroleum engineer’s certification. This continued certification must be filed with the Internal Revenue Service Center, Austin, TX 73301, by the due date for filing the operator’s (or designated owner’s) Federal income tax return.

If the application of a tertiary recovery method is terminated, the operator (or designated owner) must notify the Internal Revenue Service Center, Austin, TX 73301, of the termination by the due date of the operator’s (or designated owner’s) Federal income tax return for the tax year in which the project terminates.

See Regulations section

Tertiary recovery methods qualifying for the credit include:

●Miscible fluid displacement,

●Steam drive injection,

●Microemulsion flooding,

●In situ combustion,

●

●

●Alkaline (or caustic) flooding,

●Carbonated water flooding,

●Immiscible nonhydrocarbon gas displacement, or

●Any other method approved by the Secretary of the Treasury.

Specific Instructions

Part I

Use lines 1 and 2 to figure any enhanced oil recovery credit from your own trade or business. Skip lines 1 and 2 if you are claiming only a credit that was allocated to you from an S corporation or a partnership.

S Corporations and Partnerships

Figure the total credit on lines 1 through 4. Then allocate the line 4 credit among the individual shareholders or partners in the same way that income and loss are shared.

Printed on recycled paper

Line

Line

You must reduce the otherwise allowable deduction(s) for line 1 costs by the line 2 credit attributable to these costs. Also, if any part of the line 1 costs are for expenditures that increase the basis of property, reduce the otherwise allowable basis increase by the line 2 credit attributable to these costs.

Who Must File Form 3800

If for this year you have more than one of the credits included in the general business credit listed below, or have a carryback or carryforward of any of the credits, or have an investment credit from a passive activity, you must complete Form 3800, General Business Credit, instead of completing Part II of Form 8830 to figure the tax liability limitation.

The general business credit consists of the following credits: Investment (Form 3468), Jobs (Form 5884), Alcohol used as fuel (Form 6478), Research (Form 6765),

The empowerment zone employment credit (Form 8844), while a component of the general business credit, is figured separately on Form 8844 and is never carried to Form 3800.

Part II

Line

Line

Line

Line

Note: If you cannot use all of your credit because of the tax liability limitations (line 12 is smaller than line 4), carry any excess back 3 years and then forward to each of the 15 years after the year of the credit. Any unused credit from 1994 cannot be carried back to a tax year beginning before January 1, 1991. See the separate Instructions for Form 3800 for details.