Through the online PDF tool by FormsPal, it is possible to fill out or edit section for thirdparty affidavit here and now. To maintain our tool on the leading edge of practicality, we aim to integrate user-oriented features and enhancements regularly. We are at all times glad to receive feedback - play a pivotal part in revampimg the way you work with PDF forms. It merely requires just a few easy steps:

Step 1: Firstly, access the tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: The tool will give you the ability to customize your PDF in a range of ways. Change it with personalized text, correct original content, and place in a signature - all within a few clicks!

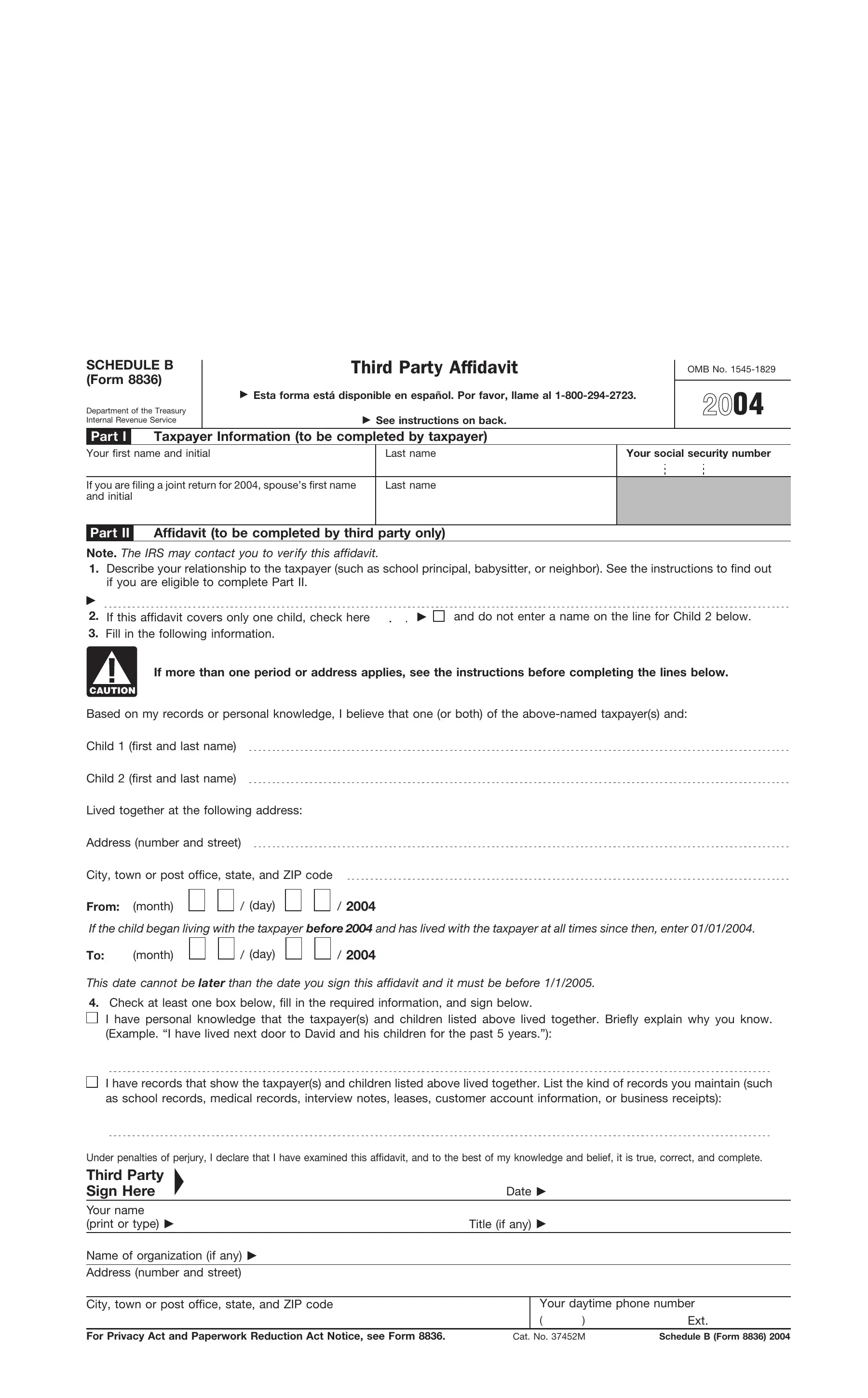

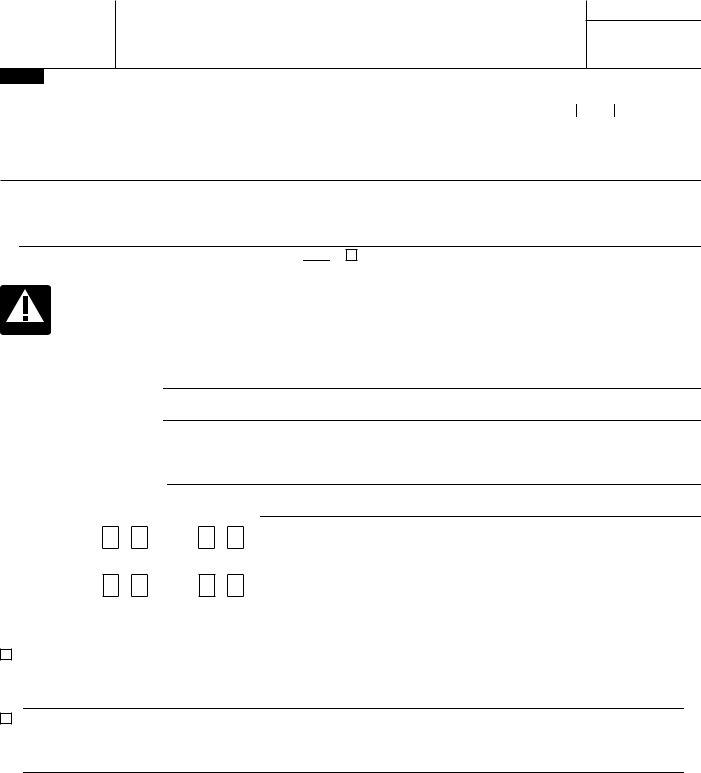

This PDF form requires specific data to be filled in, therefore you need to take the time to enter what is requested:

1. The section for thirdparty affidavit will require certain details to be inserted. Ensure the following fields are complete:

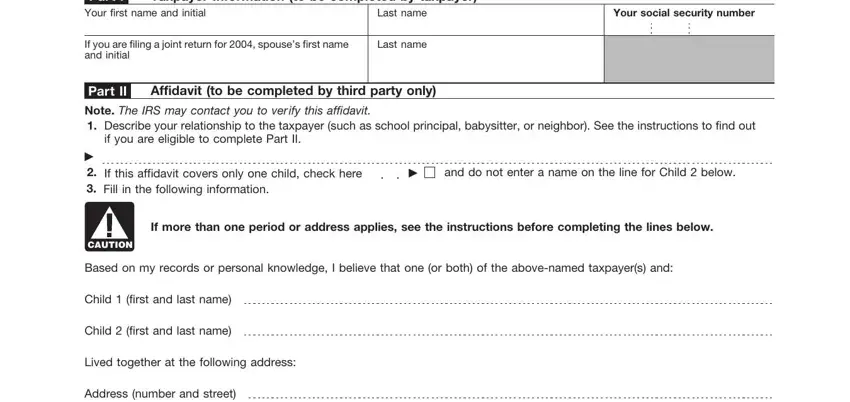

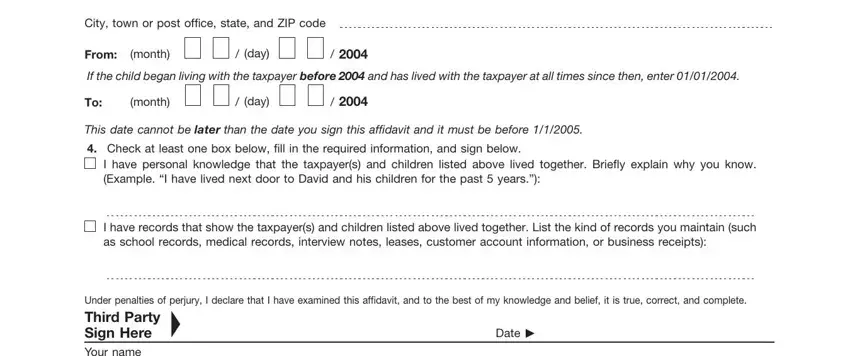

2. Once this part is finished, it is time to add the essential specifics in City town or post office state and, From, month, day, If the child began living with the, month, day, This date cannot be later than the, Check at least one box below fill, I have records that show the, Under penalties of perjury I, Date, and Your name print or type so you're able to proceed further.

People who use this document often get some points wrong when filling in day in this section. Don't forget to re-examine everything you type in right here.

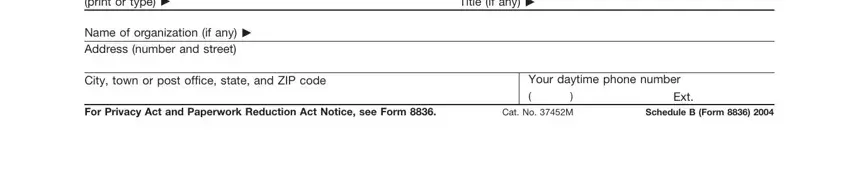

3. The third part is generally simple - complete every one of the fields in Your name print or type, Name of organization if any, Title if any, City town or post office state and, Your daytime phone number, Ext, For Privacy Act and Paperwork, Cat No M, and Schedule B Form in order to complete this segment.

Step 3: Spell-check all the information you have inserted in the blank fields and then press the "Done" button. After registering a7-day free trial account here, it will be possible to download section for thirdparty affidavit or send it through email directly. The PDF form will also be easily accessible through your personal cabinet with your changes. FormsPal guarantees protected form editor devoid of personal data record-keeping or any sort of sharing. Rest assured that your details are safe with us!