When working in the online PDF editor by FormsPal, you'll be able to fill in or alter Form 8858 here and now. To maintain our editor on the cutting edge of practicality, we strive to integrate user-oriented capabilities and enhancements regularly. We're routinely looking for suggestions - assist us with revolutionizing PDF editing. With some simple steps, you are able to begin your PDF journey:

Step 1: Access the PDF doc inside our editor by hitting the "Get Form Button" above on this page.

Step 2: This editor enables you to modify your PDF form in many different ways. Transform it by writing customized text, correct original content, and put in a signature - all when it's needed!

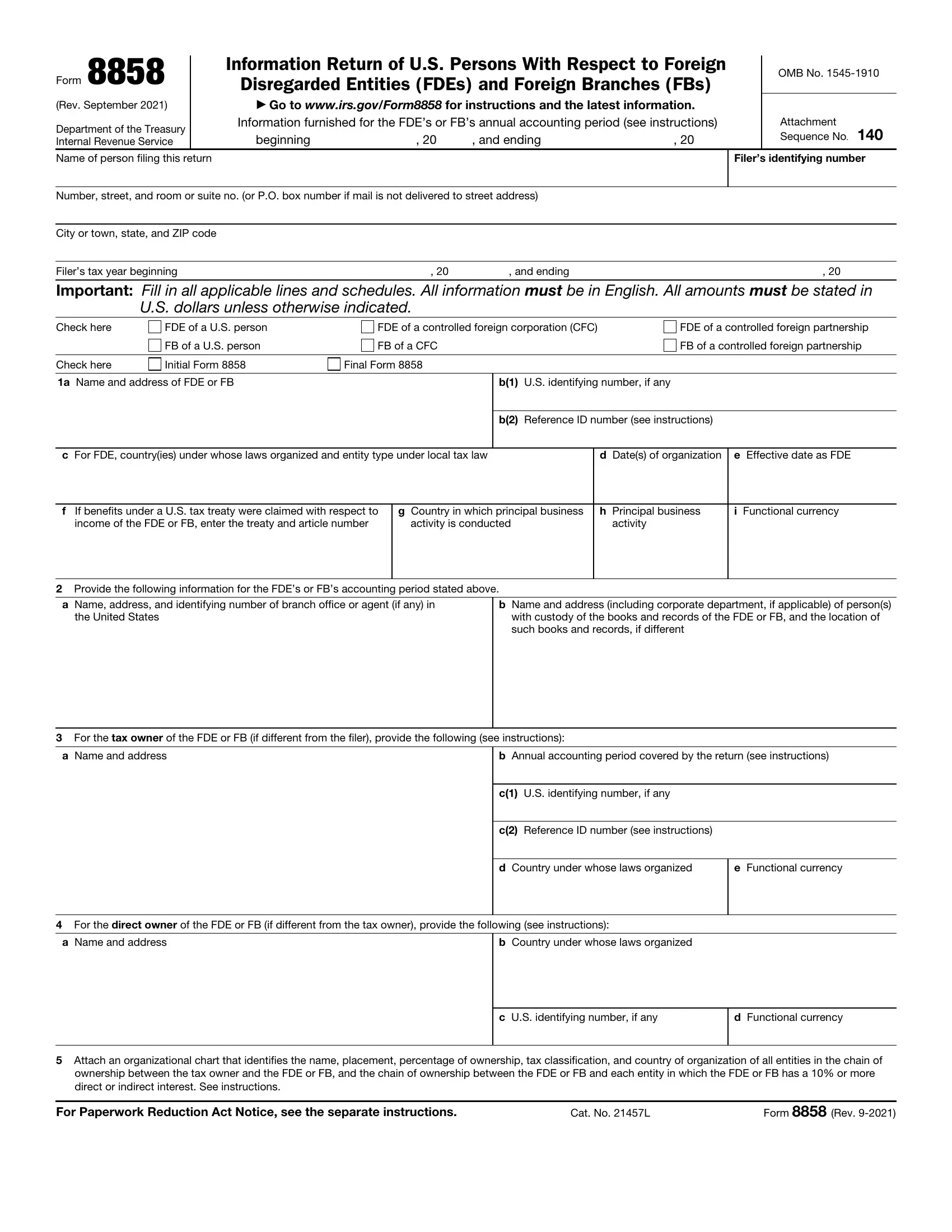

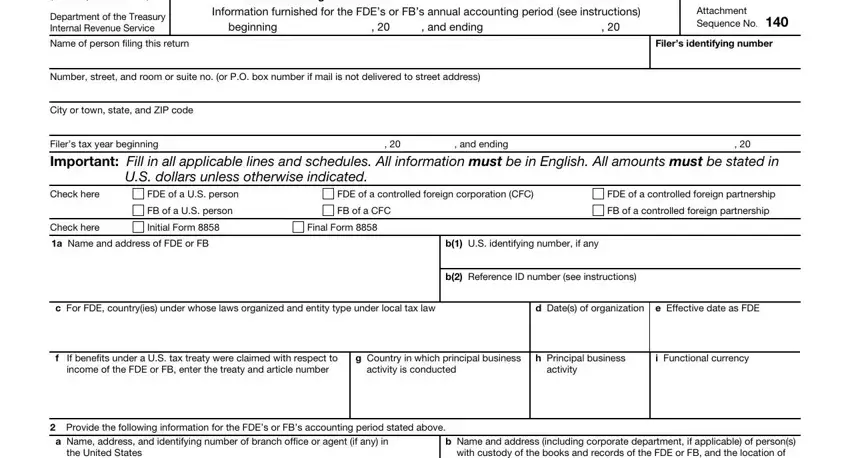

To be able to complete this document, be certain to type in the right details in every field:

1. The Form 8858 requires certain details to be typed in. Be sure that the next blanks are completed:

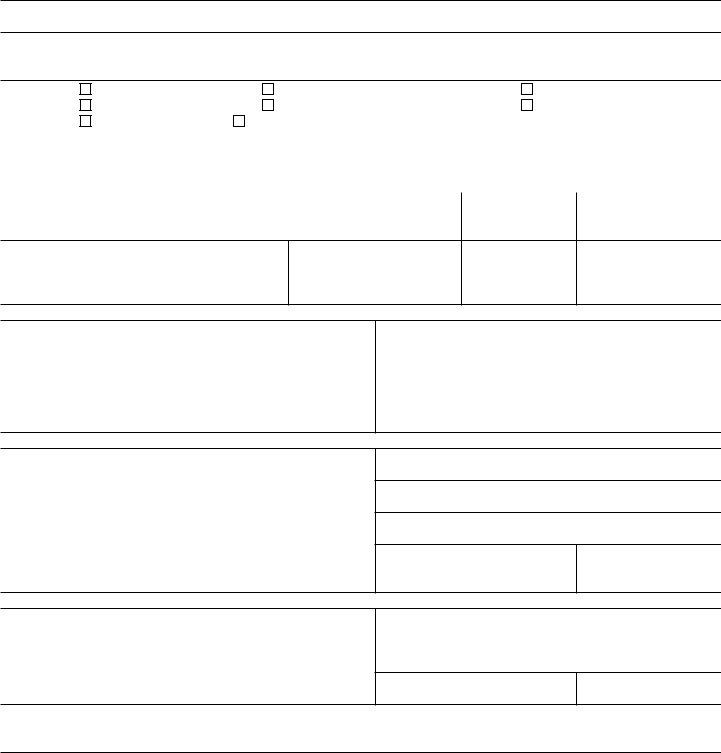

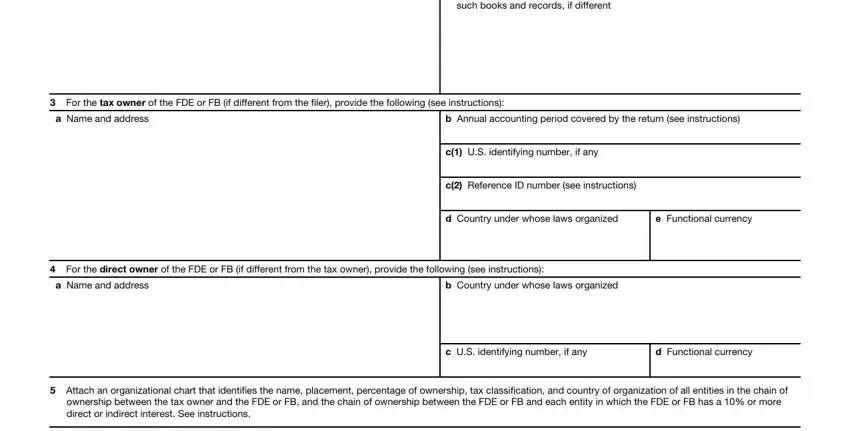

2. Now that the previous segment is completed, it is time to include the essential particulars in the United States, with custody of the books and, For the tax owner of the FDE or, a Name and address, b Annual accounting period covered, c US identifying number if any, c Reference ID number see, d Country under whose laws, e Functional currency, For the direct owner of the FDE, a Name and address, b Country under whose laws, Attach an organizational chart, ownership between the tax owner, and c US identifying number if any allowing you to go to the 3rd step.

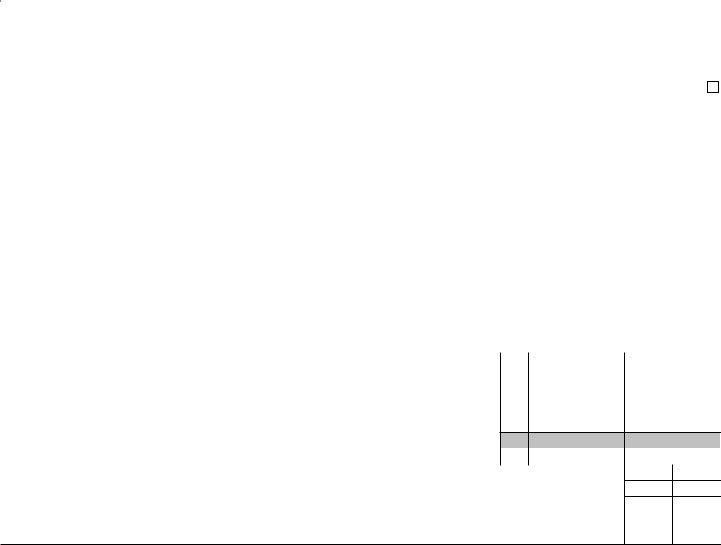

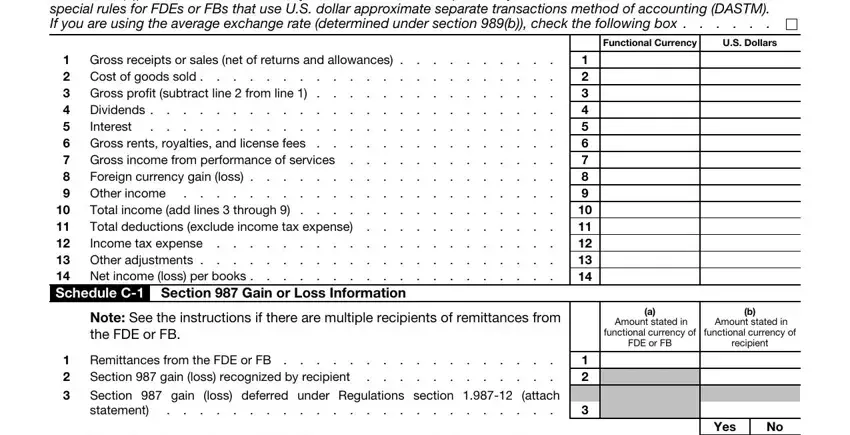

3. Completing Important Report all information, Gross receipts or sales net of, Note See the instructions if there, Remittances from the FDE or FB, Functional Currency, US Dollars, Amount stated in, Amount stated in, functional currency of, functional currency of, FDE or FB, recipient, and Yes is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

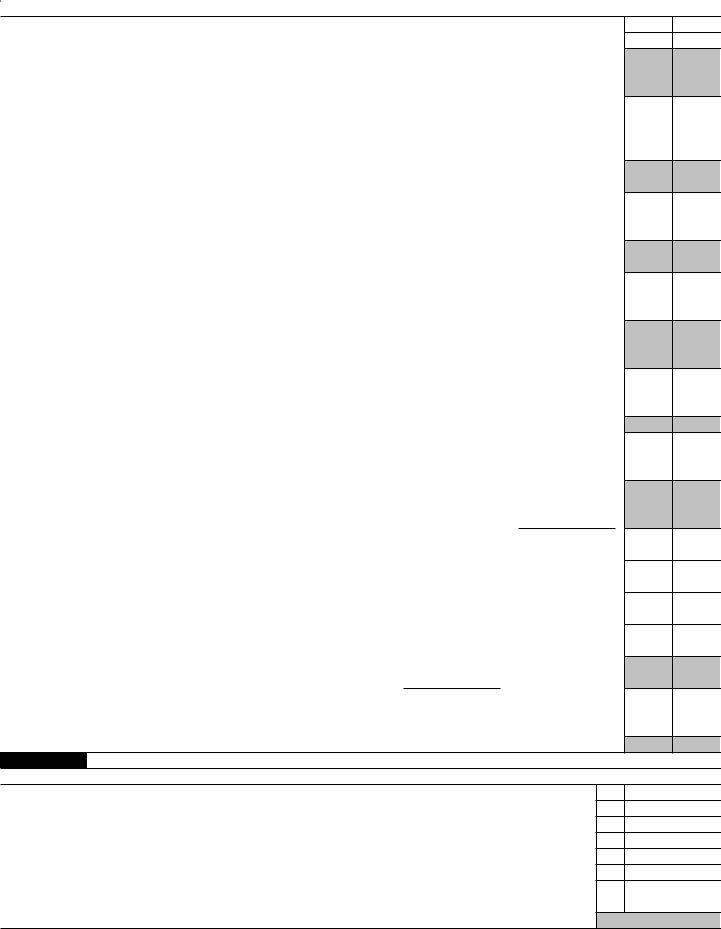

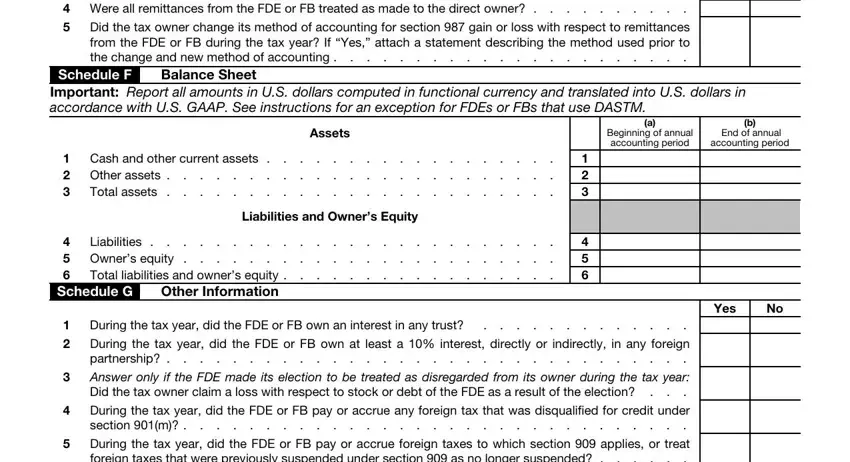

4. Filling in Were all remittances from the FDE, Did the tax owner change its, Schedule F, Balance Sheet, Important Report all amounts in US, Cash and other current assets, Assets, Liabilities and Owners Equity, Beginning of annual accounting, End of annual, accounting period, Liabilities Owners equity, Schedule G, Other Information, and Yes is essential in this next form section - ensure to don't rush and take a close look at every single field!

Many people generally get some points incorrect while filling in Yes in this area. Be certain to double-check everything you enter right here.

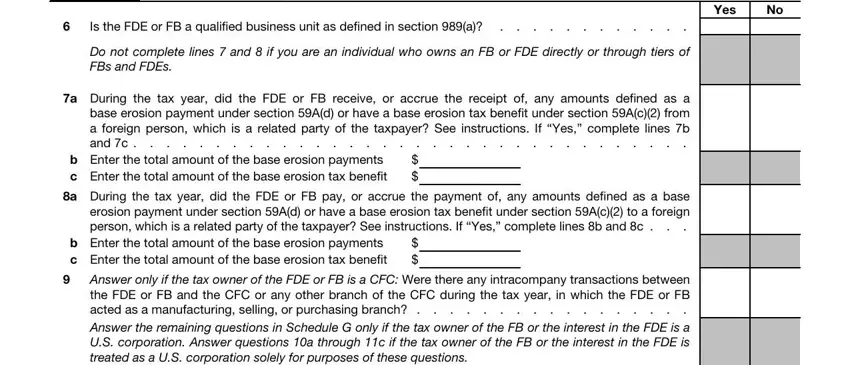

5. To wrap up your form, the final part incorporates some extra blank fields. Filling in Other Information continued, Yes, Is the FDE or FB a qualified, Do not complete lines and if you, During the tax year did the FDE or, a b Enter the total amount of, During the tax year did the FDE or, a b Enter the total amount of the, and Answer only if the tax owner of will conclude everything and you will be done very quickly!

Step 3: Immediately after looking through your completed blanks, press "Done" and you are good to go! Create a free trial option with us and acquire instant access to Form 8858 - download or modify in your FormsPal account page. With FormsPal, you'll be able to fill out documents without having to get worried about personal information breaches or entries getting distributed. Our secure software makes sure that your private details are kept safe.