With the help of the online PDF editor by FormsPal, it is possible to complete or change refigure right here. Our tool is constantly evolving to deliver the very best user experience possible, and that's due to our commitment to continual development and listening closely to user feedback. Starting is easy! All you have to do is follow these basic steps below:

Step 1: Click on the "Get Form" button at the top of this page to access our PDF tool.

Step 2: As soon as you launch the tool, you'll see the form prepared to be filled in. Other than filling out various blank fields, it's also possible to do some other things with the file, such as writing your own textual content, changing the initial text, adding illustrations or photos, signing the PDF, and a lot more.

This form needs some specific information; in order to guarantee consistency, please make sure to take into account the recommendations down below:

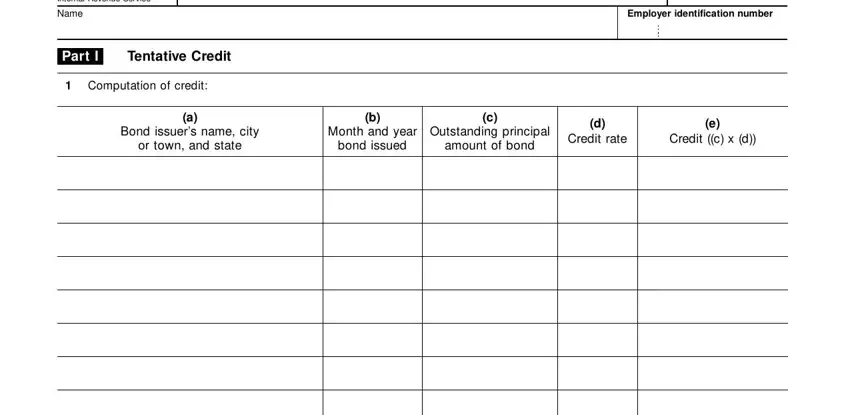

1. When filling in the refigure, ensure to complete all needed blank fields within its corresponding section. It will help expedite the work, allowing your details to be processed efficiently and appropriately.

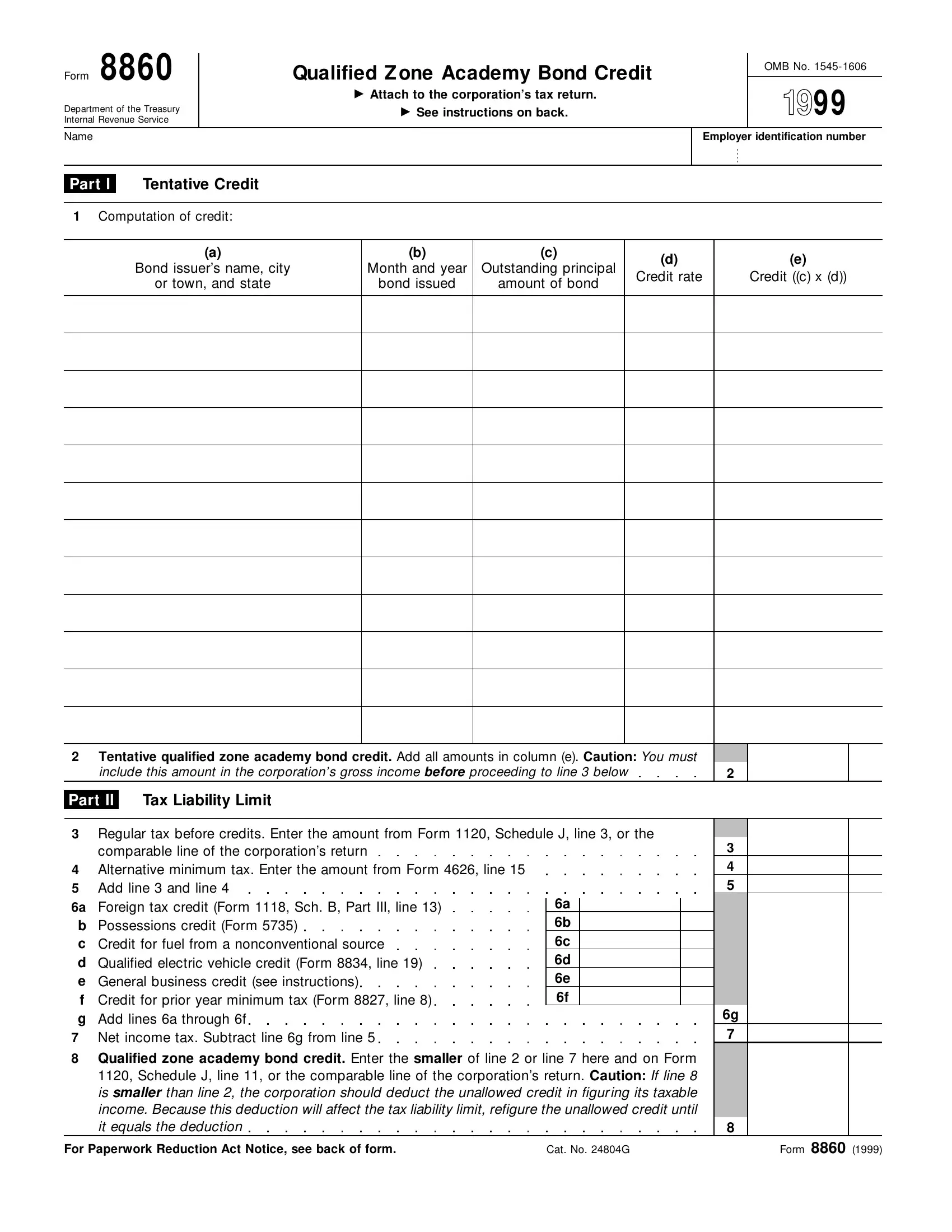

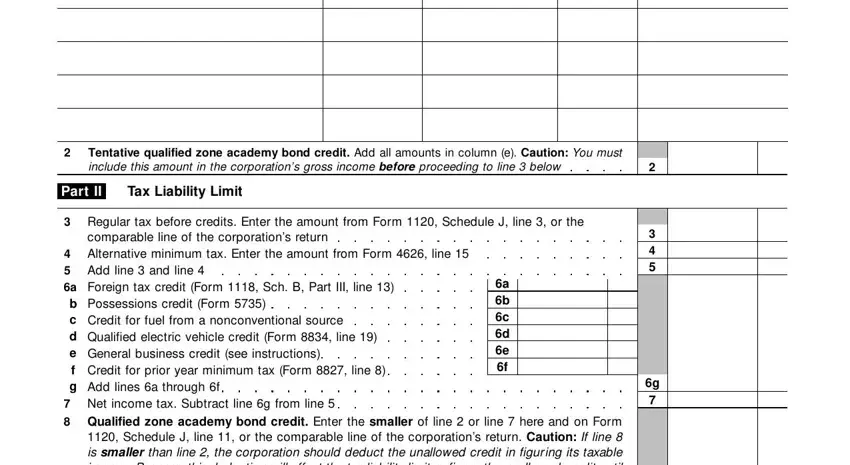

2. Just after the prior part is completed, go to enter the suitable details in all these: Tentative qualified zone academy, Part II, Tax Liability Limit, a b c d e f g, Regular tax before credits Enter, a b c d e f, and Qualified zone academy bond credit.

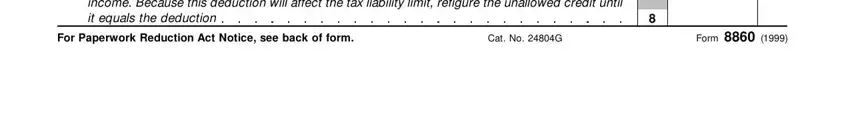

3. Completing Qualified zone academy bond credit, For Paperwork Reduction Act Notice, Cat No G, and Form is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

You can potentially make an error when completing your Form, therefore you'll want to look again before you decide to send it in.

Step 3: Prior to moving forward, make sure that blanks were filled in the correct way. As soon as you are satisfied with it, click “Done." Create a 7-day free trial plan with us and gain direct access to refigure - available from your personal account page. FormsPal ensures your data privacy by using a secure system that never saves or distributes any kind of personal information used. You can relax knowing your documents are kept safe whenever you work with our service!