form 8865 can be filled out effortlessly. Simply try FormsPal PDF tool to finish the job right away. To maintain our tool on the cutting edge of efficiency, we aim to put into practice user-oriented features and enhancements regularly. We are at all times pleased to receive suggestions - play a vital role in remolding the way you work with PDF docs. For anyone who is seeking to start, here's what it takes:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: With the help of this advanced PDF editing tool, you'll be able to do more than simply fill in blank form fields. Edit away and make your forms seem perfect with customized text added, or modify the original content to perfection - all that comes with an ability to incorporate stunning graphics and sign the document off.

Pay attention while filling in this pdf. Make sure every field is filled in accurately.

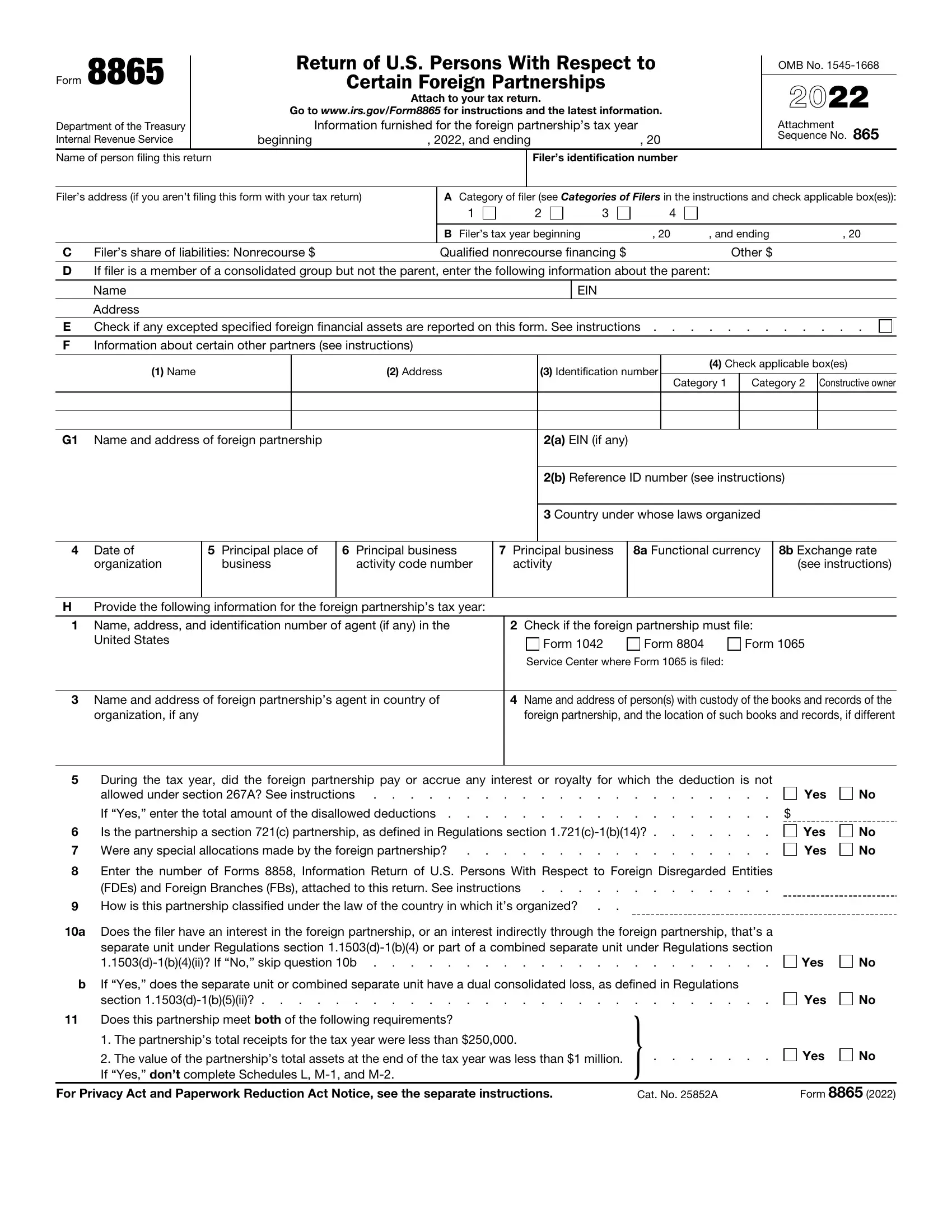

1. The form 8865 needs specific details to be typed in. Make certain the next blanks are filled out:

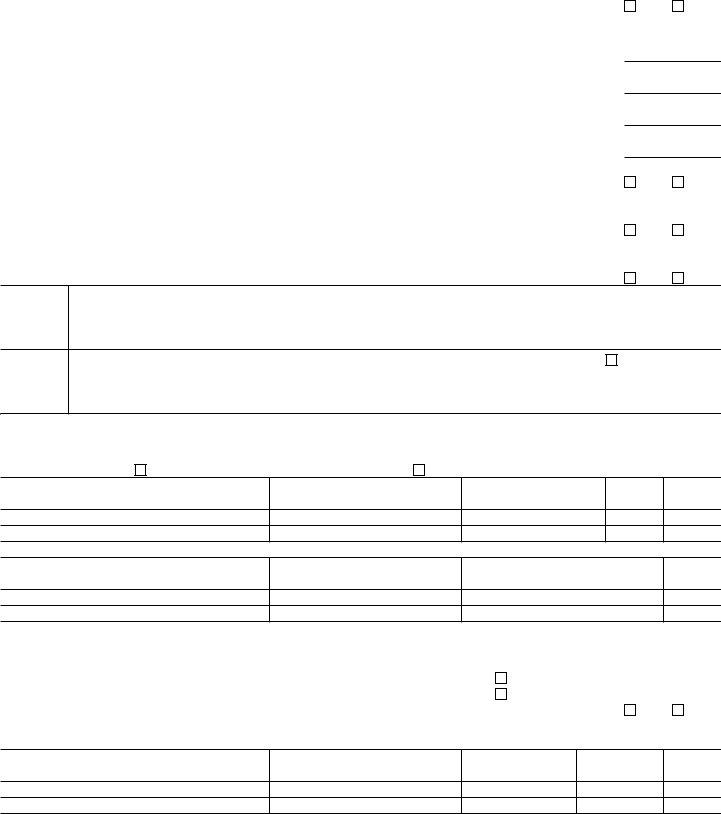

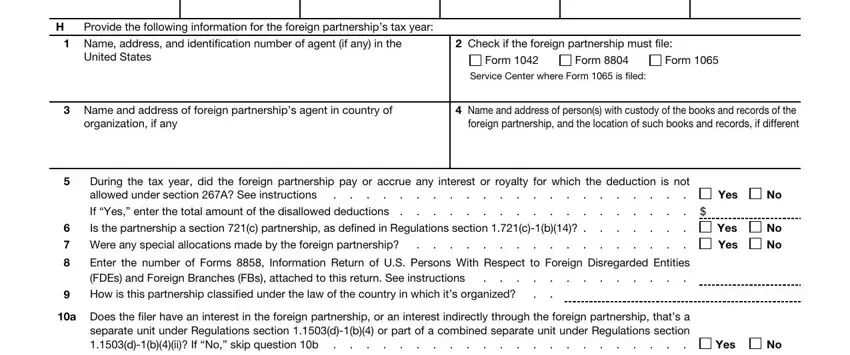

2. Once your current task is complete, take the next step – fill out all of these fields - Provide the following information, Name address and identification, Check if the foreign partnership, United States, Form, Form, Form, Service Center where Form is filed, Name and address of foreign, organization if any, Name and address of persons with, During the tax year did the, Were any special allocations made, Enter the number of Forms, and Does the filer have an interest in with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People generally make errors while completing Service Center where Form is filed in this part. Don't forget to read twice whatever you enter right here.

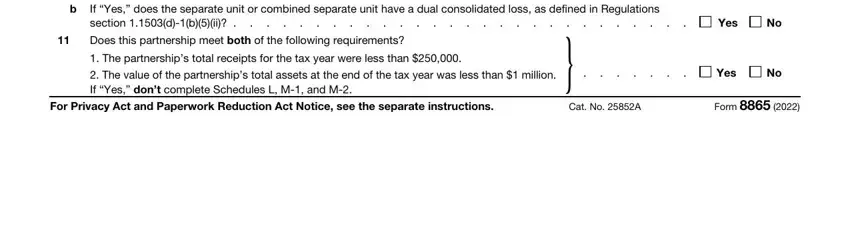

3. Your next stage is generally simple - complete every one of the form fields in If Yes does the separate unit or, Does this partnership meet both of, The partnerships total receipts, Yes, Yes, For Privacy Act and Paperwork, Cat No A, and Form to complete the current step.

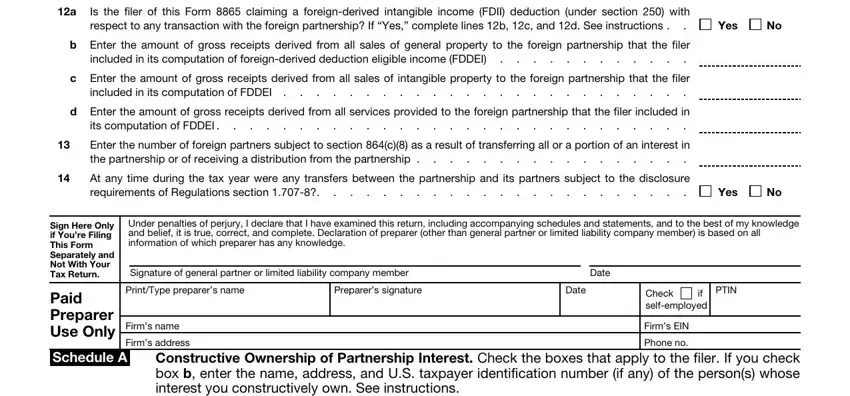

4. Now start working on this next segment! In this case you'll get all these Is the filer of this Form, Yes, b Enter the amount of gross, included in its computation of, c Enter the amount of gross, included in its computation of, d Enter the amount of gross, its computation of FDDEI, Enter the number of foreign, At any time during the tax year, Yes, Sign Here Only if Youre Filing, Paid Preparer Use Only, Under penalties of perjury I, and Signature of general partner or blanks to fill out.

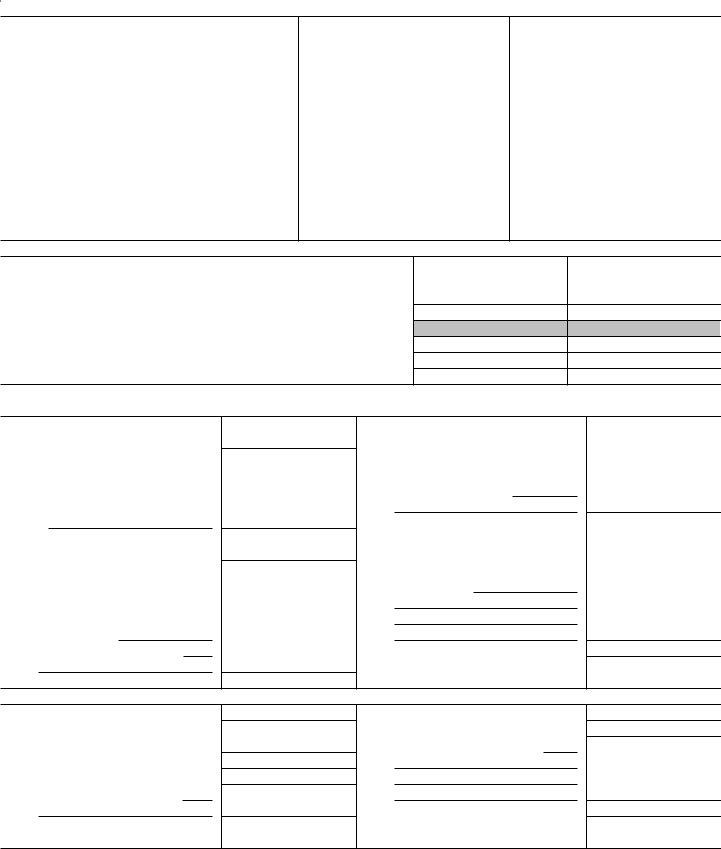

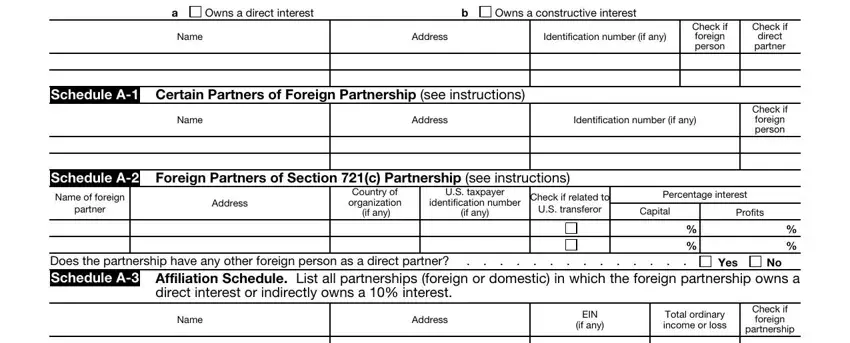

5. This very last stage to finalize this form is critical. Ensure to fill in the necessary form fields, for instance Constructive Ownership of, Owns a direct interest, Owns a constructive interest, Name, Address, Identification number if any, Check if foreign person, Check if, direct partner, Schedule A Certain Partners of, Name, Address, Identification number if any, Check if foreign person, and Schedule A Foreign Partners of, before submitting. In any other case, it could result in an unfinished and probably nonvalid document!

Step 3: Just after looking through your entries, hit "Done" and you are good to go! Go for a 7-day free trial account at FormsPal and obtain instant access to form 8865 - downloadable, emailable, and editable inside your personal account page. FormsPal is committed to the personal privacy of all our users; we make sure all personal data handled by our system is protected.