You can work with Form 8874 A without difficulty by using our PDF editor online. The editor is consistently upgraded by us, getting useful features and becoming more versatile. To get the process started, consider these simple steps:

Step 1: Simply press the "Get Form Button" in the top section of this site to launch our form editor. Here you'll find everything that is required to work with your document.

Step 2: The tool enables you to modify the majority of PDF files in various ways. Change it by writing personalized text, adjust what is already in the document, and place in a signature - all manageable in no time!

This document will require you to enter specific information; in order to ensure consistency, please make sure to take heed of the next tips:

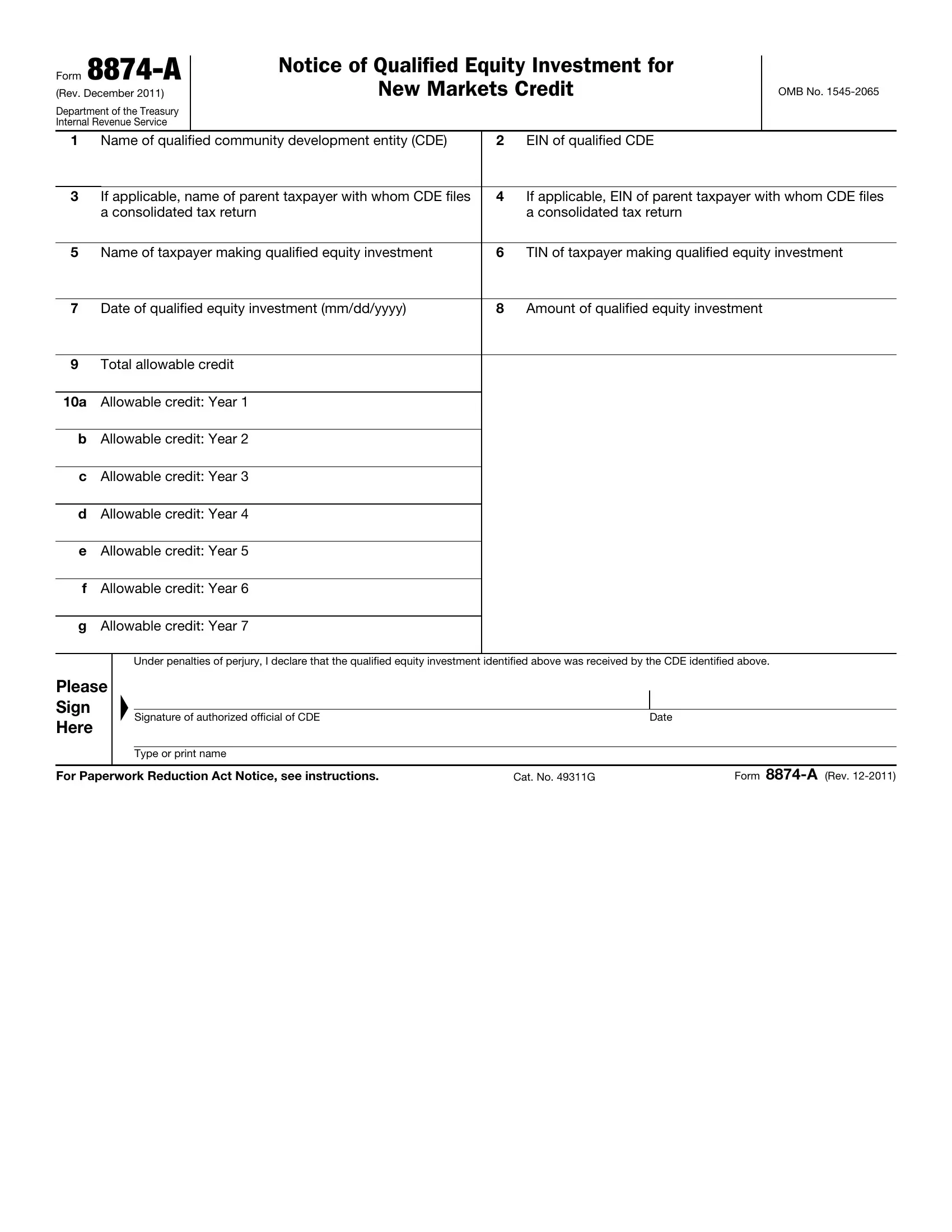

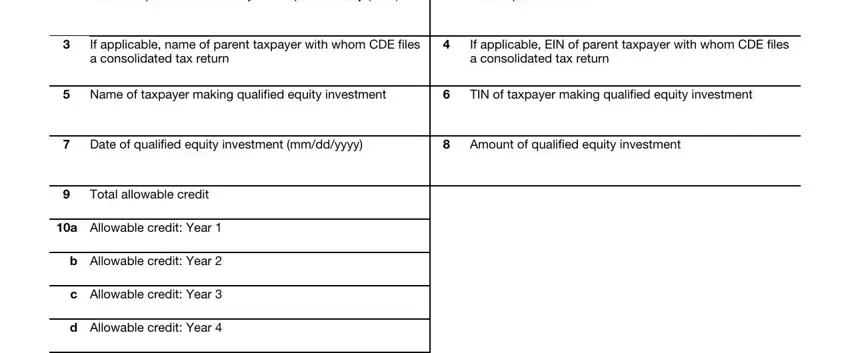

1. You have to complete the Form 8874 A correctly, so pay close attention when filling in the parts including all these fields:

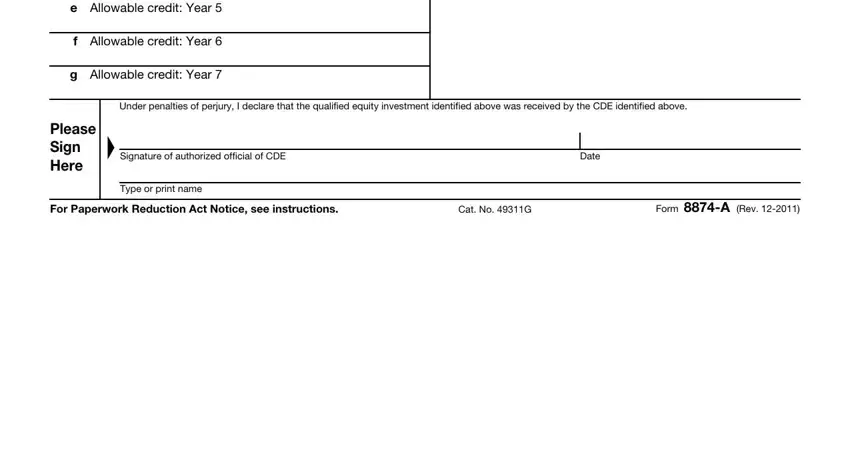

2. Once the last array of fields is done, you need to add the essential particulars in e Allowable credit Year, f Allowable credit Year, g Allowable credit Year, Under penalties of perjury I, Please Sign Here, Signature of authorized official, Type or print name, Date, For Paperwork Reduction Act Notice, Cat No G, and Form A Rev allowing you to proceed further.

Always be very careful when completing g Allowable credit Year and Cat No G, since this is the part in which a lot of people make a few mistakes.

Step 3: Be certain that your details are right and simply click "Done" to continue further. After registering afree trial account at FormsPal, you will be able to download Form 8874 A or email it without delay. The form will also be readily accessible in your personal account menu with your changes. FormsPal provides risk-free document tools without personal data record-keeping or sharing. Rest assured that your data is in good hands with us!