You may work with Form 8879 Pe instantly with the help of our PDFinity® online PDF tool. Our team is focused on making sure you have the perfect experience with our tool by regularly adding new functions and upgrades. With these improvements, working with our editor gets better than ever! This is what you'll need to do to begin:

Step 1: Click the "Get Form" button above on this page to open our editor.

Step 2: This tool offers the ability to change PDF forms in a range of ways. Improve it by writing customized text, adjust original content, and put in a signature - all within the reach of a few clicks!

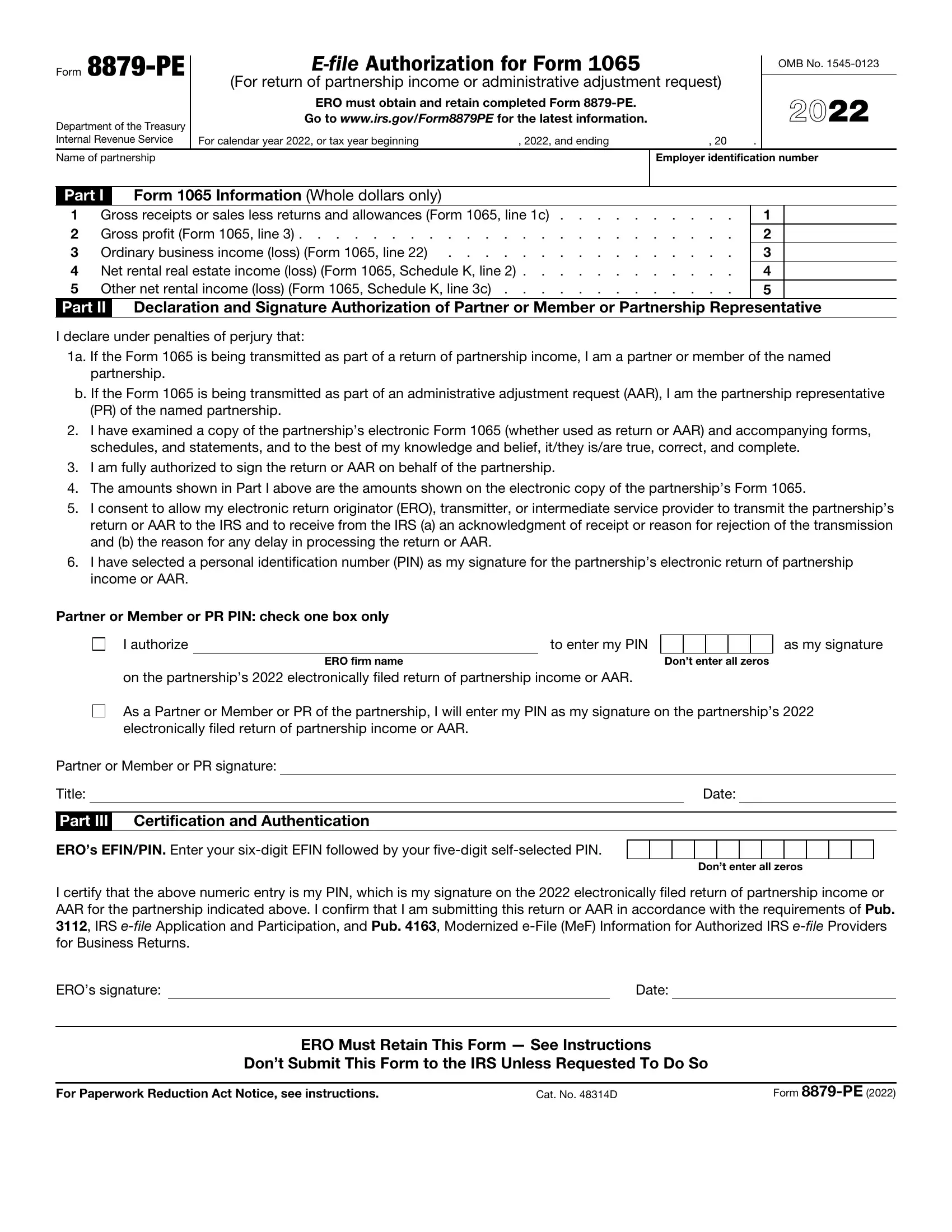

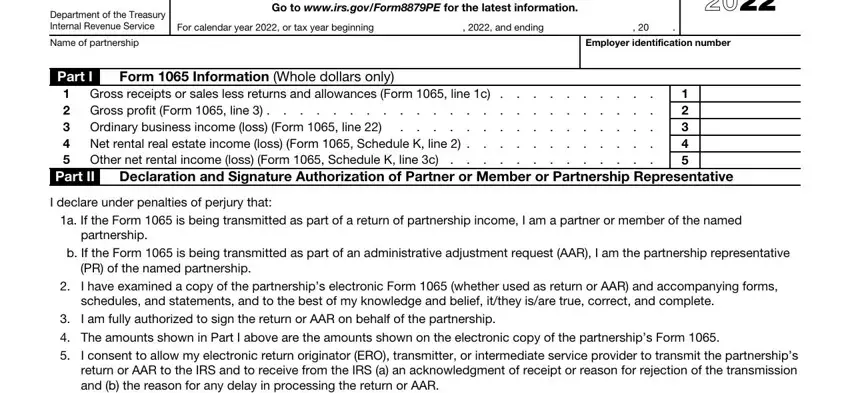

To be able to complete this PDF document, be sure you provide the required information in each and every blank field:

1. Complete the Form 8879 Pe with a selection of major blank fields. Collect all of the required information and make sure nothing is neglected!

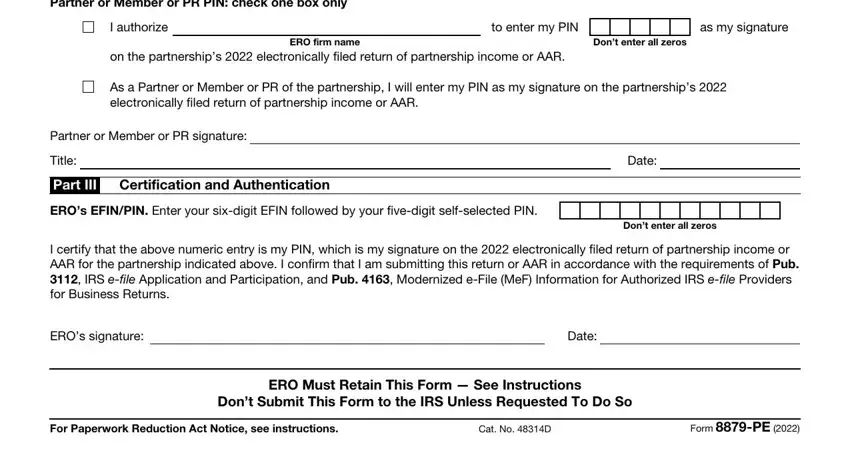

2. The third part would be to submit all of the following fields: Partner or Member or PR PIN check, I authorize, to enter my PIN, as my signature, ERO firm name, Dont enter all zeros, on the partnerships, As a Partner or Member or PR of, Partner or Member or PR signature, Title, Part III, Certification and Authentication, EROs EFINPIN Enter your sixdigit, Date, and Dont enter all zeros.

Those who use this form frequently get some things incorrect when completing Title in this area. Be certain to re-examine everything you type in here.

Step 3: Immediately after double-checking your form fields, click "Done" and you're done and dusted! After setting up a7-day free trial account here, you'll be able to download Form 8879 Pe or send it through email immediately. The document will also be readily available in your personal account page with all your adjustments. FormsPal provides protected document editor devoid of personal data record-keeping or sharing. Feel at ease knowing that your data is secure with us!