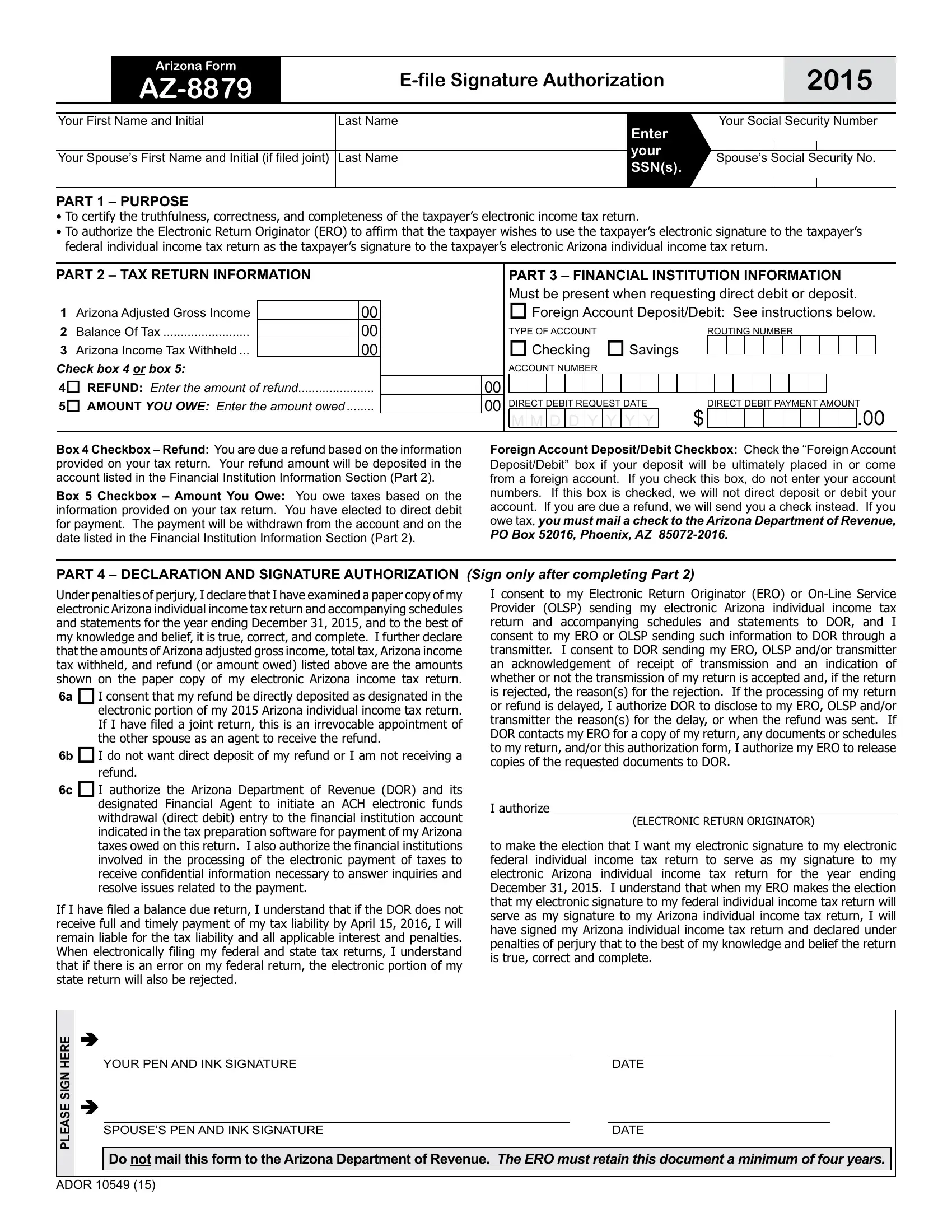

Should you want to fill out arizona tax form az 8879, you don't have to install any sort of programs - just make use of our PDF tool. We at FormsPal are dedicated to making sure you have the perfect experience with our tool by constantly introducing new capabilities and upgrades. With all of these updates, using our editor becomes better than ever before! All it requires is just a few basic steps:

Step 1: Press the "Get Form" button at the top of this webpage to access our tool.

Step 2: Once you start the tool, you will find the form all set to be completed. Aside from filling out different fields, you may also perform other sorts of actions with the form, such as putting on custom words, editing the original text, inserting graphics, placing your signature to the form, and much more.

Be attentive when filling out this document. Ensure that all mandatory blank fields are completed properly.

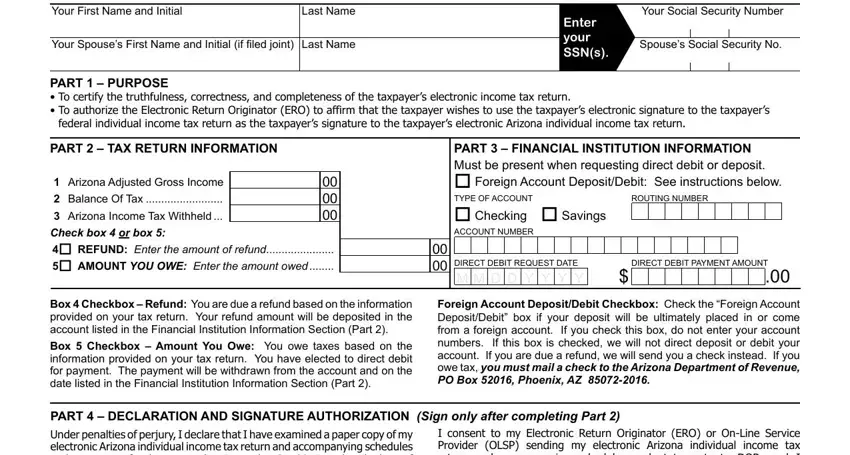

1. When submitting the arizona tax form az 8879, ensure to complete all of the necessary blanks in their associated area. This will help to facilitate the work, allowing for your information to be processed quickly and properly.

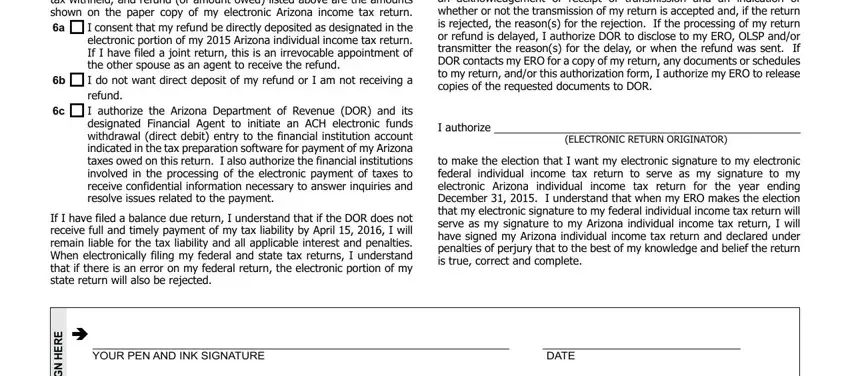

2. After completing the last step, go on to the subsequent part and fill in the essential details in all these fields - Under penalties of perjury I, b I do not want direct deposit of, refund, If I have filed a balance due, I consent to my Electronic Return, I authorize, ELECTRONIC RETURN ORIGINATOR, to make the election that I want, YOUR PEN AND INK SIGNATURE, DATE, and E R E H N G S E S A E L P.

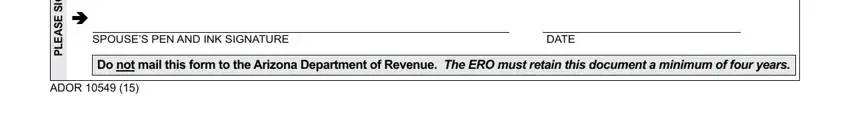

3. This step is easy - fill out every one of the blanks in SPOUSES PEN AND INK SIGNATURE, DATE, E R E H N G S E S A E L P, Do not mail this form to the, and ADOR in order to complete the current step.

It is easy to make a mistake while filling in the ADOR , so you'll want to take another look prior to deciding to finalize the form.

Step 3: When you've reread the details you given, just click "Done" to complete your form at FormsPal. Try a free trial plan with us and acquire instant access to arizona tax form az 8879 - with all transformations saved and accessible in your personal account. At FormsPal.com, we strive to ensure that all your information is maintained private.