When you would like to fill out form 8023, you don't need to download any kind of applications - simply make use of our online PDF editor. FormsPal expert team is ceaselessly endeavoring to improve the tool and make it even faster for clients with its extensive functions. Make use of the current progressive possibilities, and find a heap of emerging experiences! Getting underway is easy! All you have to do is take the following simple steps down below:

Step 1: Hit the "Get Form" button above. It is going to open our tool so you can start completing your form.

Step 2: When you access the online editor, there'll be the document prepared to be completed. Aside from filling out different blank fields, you may as well perform some other actions with the form, namely putting on custom text, modifying the initial text, adding graphics, placing your signature to the form, and much more.

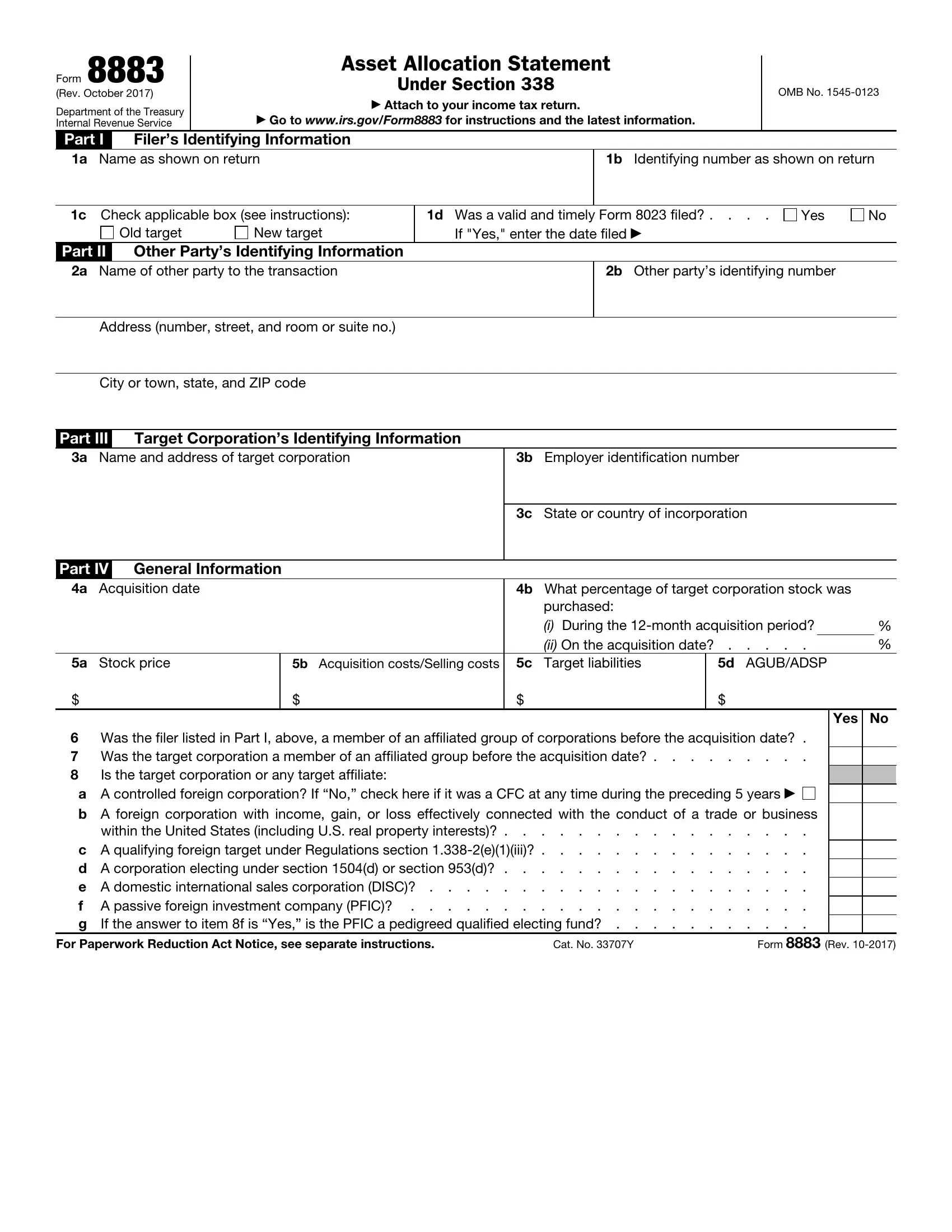

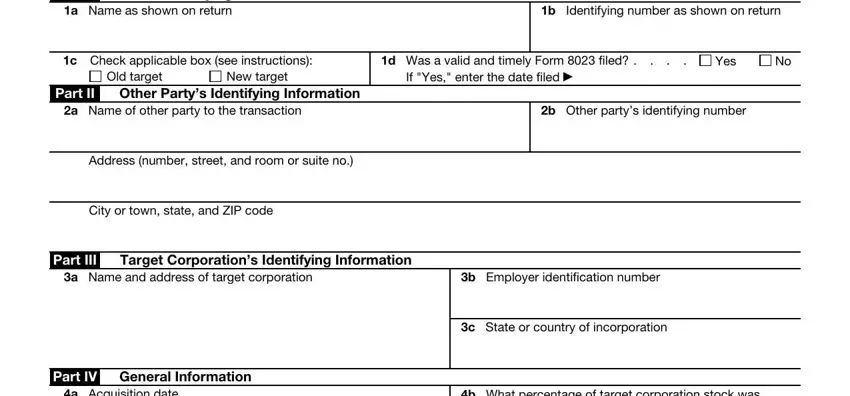

As a way to complete this form, make certain you enter the necessary details in each and every blank:

1. While completing the form 8023, be sure to complete all needed blank fields in its corresponding section. This will help speed up the process, which allows your information to be handled efficiently and appropriately.

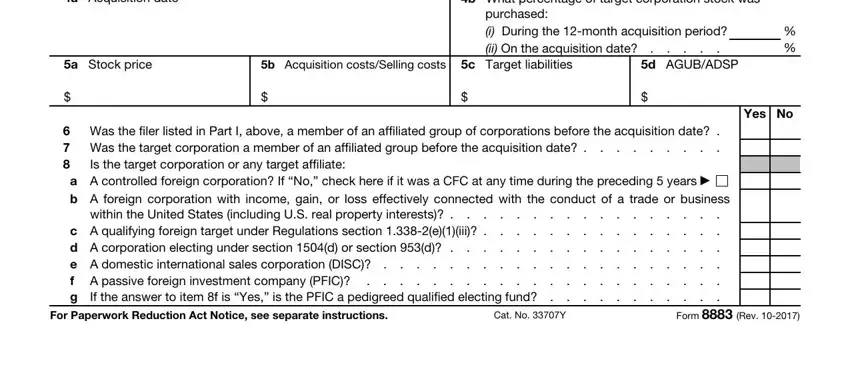

2. Your next part would be to fill in the following blanks: a Acquisition date, b What percentage of target, a Stock price, b Acquisition costsSelling costs, c Target liabilities, d AGUBADSP, purchased i During the month, Yes No, Was the filer listed in Part I, Is the target corporation or any, a A controlled foreign corporation, A foreign corporation with income, b c A qualifying foreign target, For Paperwork Reduction Act Notice, and Cat No Y.

Be extremely careful while filling out b What percentage of target and For Paperwork Reduction Act Notice, as this is the section in which a lot of people make some mistakes.

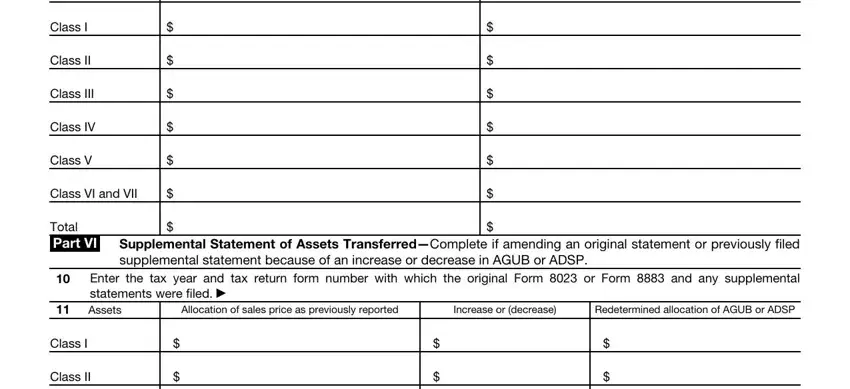

3. Your next part will be simple - fill out all the blanks in Assets, Aggregate fair market value actual, Allocation of AGUB or ADSP, Supplemental Statement of Assets, Enter the tax year and tax return, Allocation of sales price as, Increase or decrease, Redetermined allocation of AGUB or, Class I, Class II, Class III, Class IV, Class V, Class VI and VII, and Total Part VI in order to finish this process.

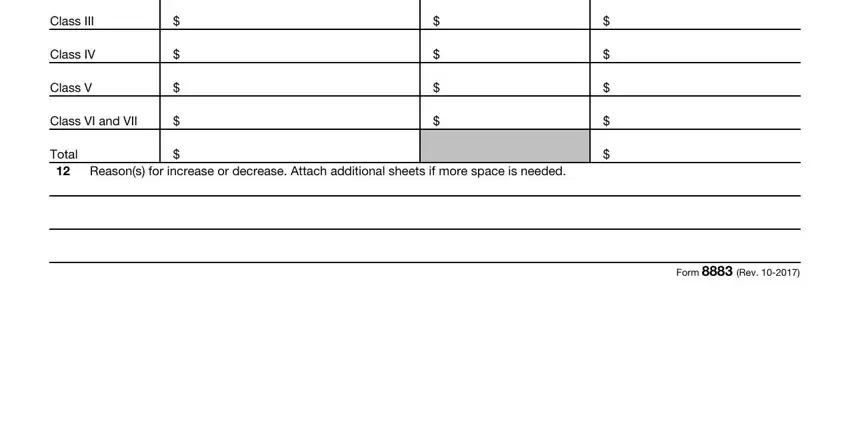

4. Filling in Class III, Class IV, Class V, Class VI and VII, Total, Reasons for increase or decrease, and Form Rev is vital in this part - always invest some time and be attentive with each field!

Step 3: Once you've looked once more at the information you filled in, just click "Done" to complete your form. After registering a7-day free trial account here, it will be possible to download form 8023 or send it via email right away. The PDF form will also be easily accessible in your personal account menu with all your changes. At FormsPal, we aim to ensure that all your information is kept secure.