With the online PDF editor by FormsPal, you may fill out or change mississippi state tax withholding form here and now. Our editor is consistently developing to provide the very best user experience possible, and that's because of our dedication to constant development and listening closely to customer feedback. If you are seeking to get started, here is what it takes:

Step 1: Press the "Get Form" button at the top of this webpage to open our PDF tool.

Step 2: After you launch the editor, you will find the form prepared to be filled out. Aside from filling out different blank fields, you could also do several other actions with the file, specifically writing your own words, modifying the initial text, adding graphics, signing the form, and more.

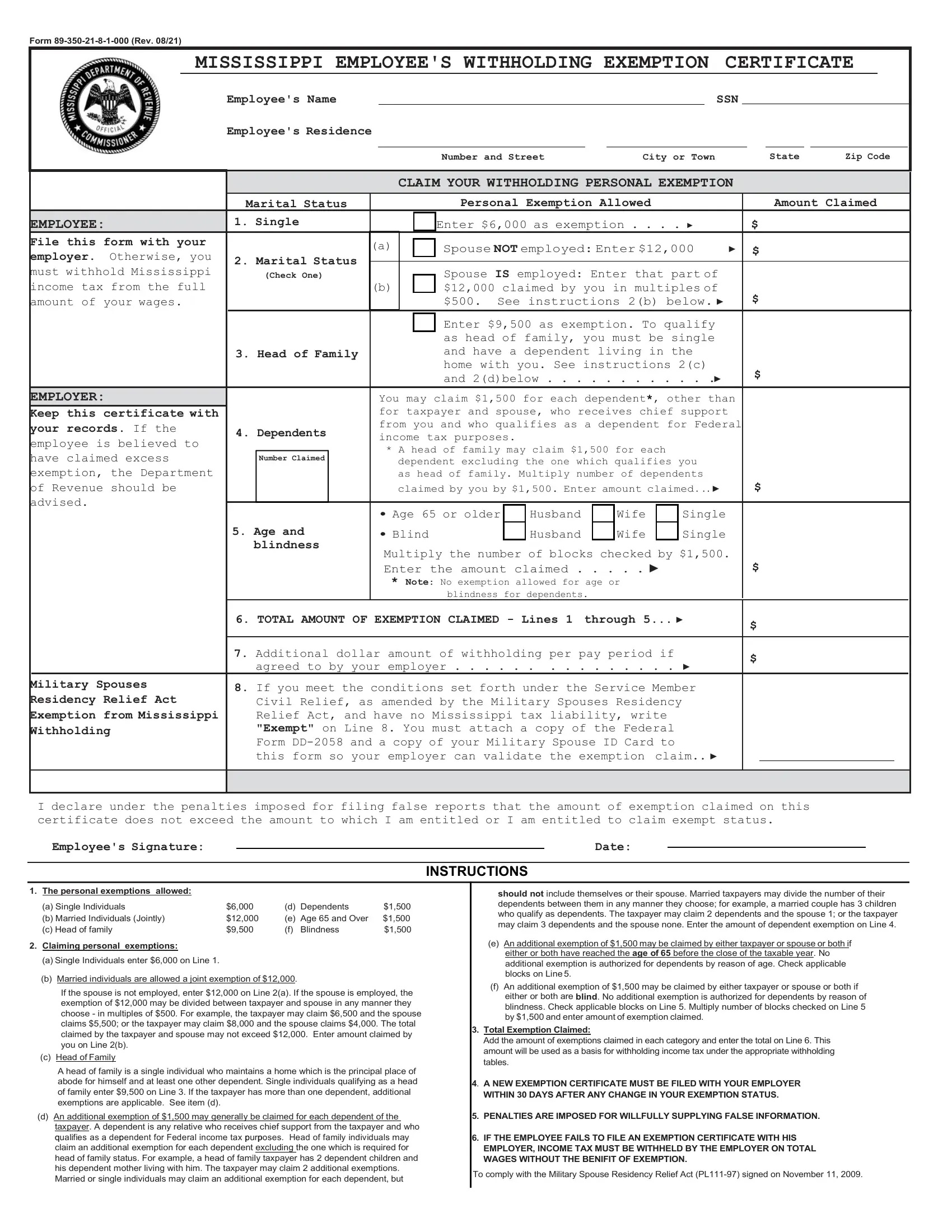

When it comes to blank fields of this specific PDF, here's what you should do:

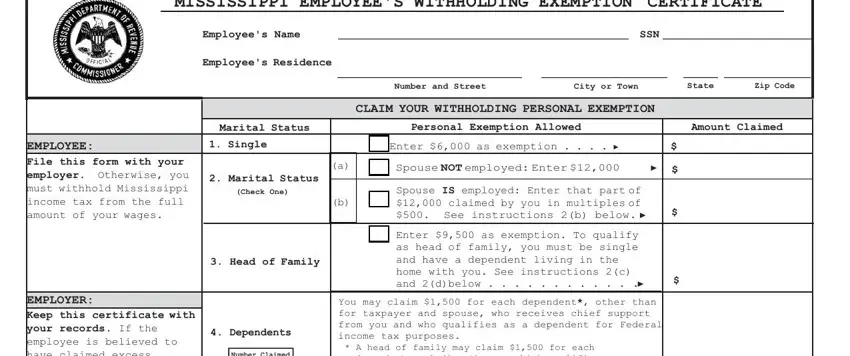

1. It is important to complete the mississippi state tax withholding form correctly, thus be mindful while working with the areas comprising these particular blank fields:

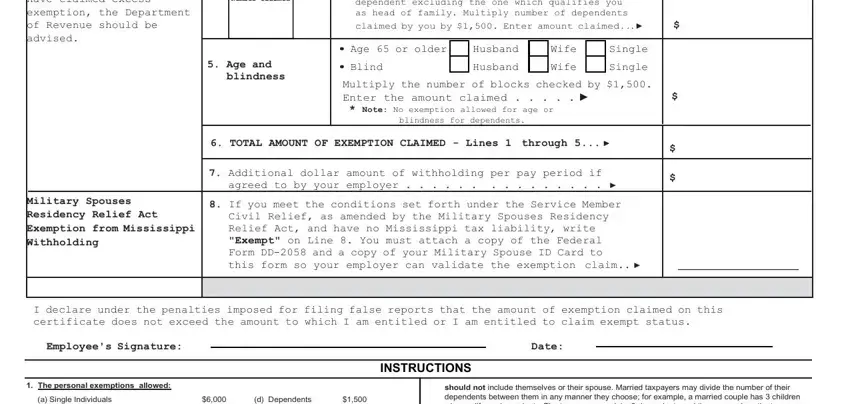

2. Once your current task is complete, take the next step – fill out all of these fields - employee is believed to have, Dependents Number Claimed, Age and, blindness, dependent excluding the one which, Age or older, Husband, Wife, Single, Blind, Husband, Wife, Single, Multiply the number of blocks, and blindness for dependents with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

In terms of Wife and Blind, be certain you don't make any mistakes in this section. Both these could be the most important ones in the document.

Step 3: Before finishing this document, make sure that blanks have been filled in the proper way. As soon as you’re satisfied with it, press “Done." Get your mississippi state tax withholding form as soon as you sign up at FormsPal for a 7-day free trial. Easily access the pdf inside your FormsPal account page, together with any modifications and adjustments conveniently kept! FormsPal is dedicated to the confidentiality of our users; we ensure that all information processed by our tool is kept secure.