We chose the top computer programmers to implement our PDF editor. Our application will let you create the Mississippi file simply and won't take too much of your time and effort. This easy-to-follow procedure may help you begin.

Step 1: To begin the process, choose the orange button "Get Form Now".

Step 2: You're now able to alter Mississippi. You possess plenty of options thanks to our multifunctional toolbar - it's possible to add, delete, or alter the content material, highlight its selected sections, and undertake other commands.

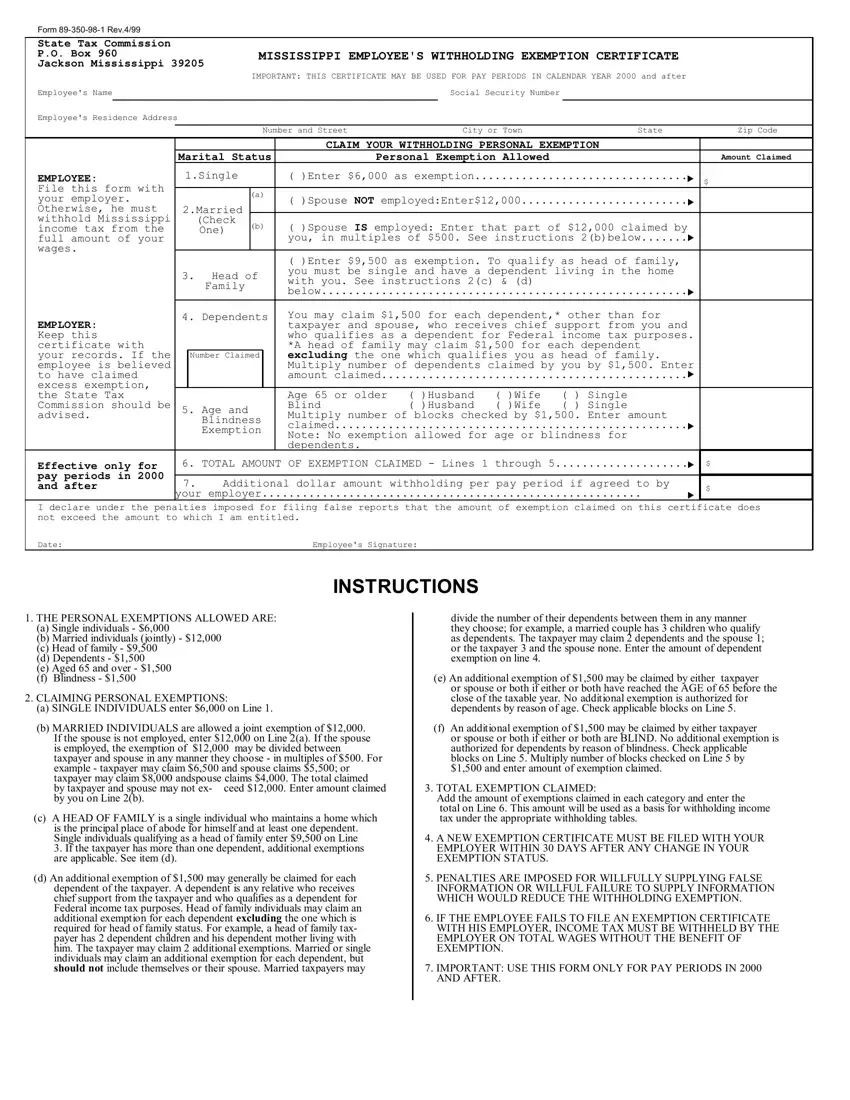

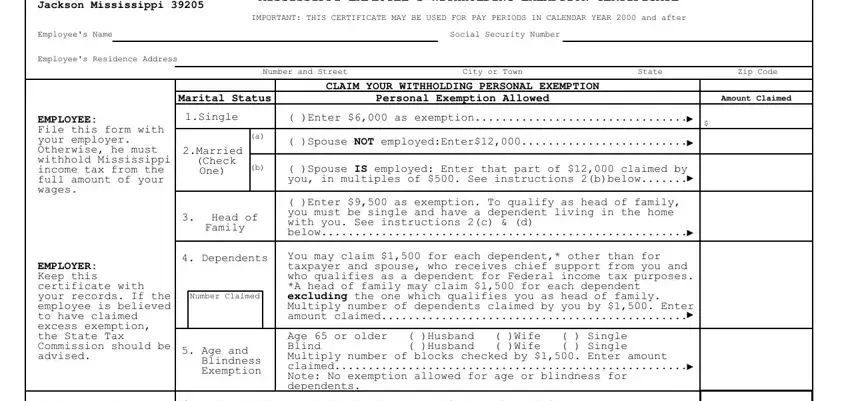

Make sure you type in the following information to create the Mississippi PDF:

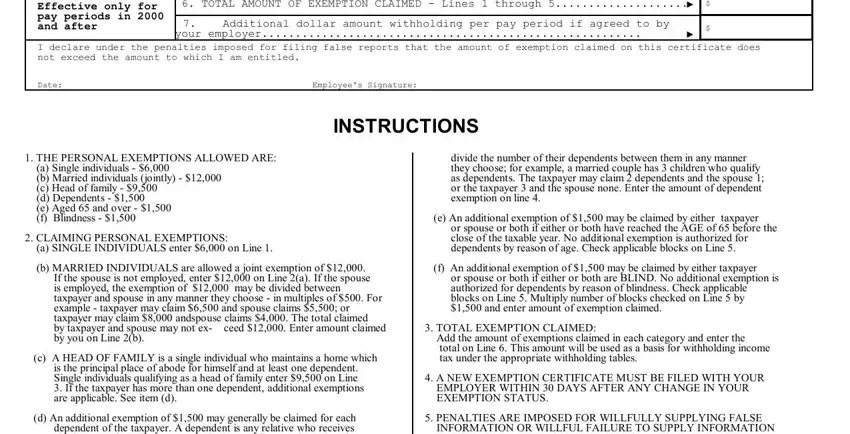

You need to fill out the Effective only for pay periods in, TOTAL AMOUNT OF EXEMPTION CLAIMED, Additional dollar amount, your employer, I declare under the penalties, Date, Employees Signature, INSTRUCTIONS, THE PERSONAL EXEMPTIONS ALLOWED, a Single individuals b Married, CLAIMING PERSONAL EXEMPTIONS, a SINGLE INDIVIDUALS enter on, b MARRIED INDIVIDUALS are allowed, ceed Enter amount claimed, and c A HEAD OF FAMILY is a single space with the demanded particulars.

Put together the important information in the part.

Step 3: Press the button "Done". Your PDF form is available to be transferred. You may download it to your device or email it.

Step 4: Ensure that you prevent future troubles by getting around a pair of copies of the file.