The PDF editor was developed with the goal of making it as effortless and easy-to-use as it can be. These steps can make managing the state of alabama 1099 transmittal form fast and simple.

Step 1: Select the button "Get Form Here".

Step 2: Right now, you are able to modify your state of alabama 1099 transmittal form. Our multifunctional toolbar makes it possible to add, erase, adjust, highlight, and undertake similar commands to the text and fields inside the form.

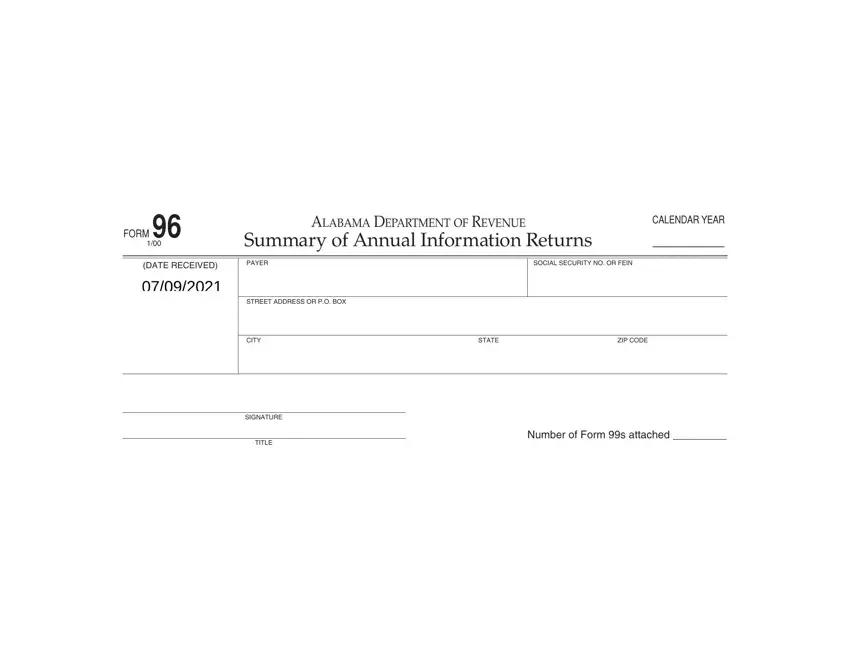

In order to prepare the template, type in the content the platform will ask you to for each of the appropriate sections:

Step 3: After you have hit the Done button, your file will be accessible for transfer to any kind of electronic device or email you identify.

Step 4: Get no less than several copies of the form to avoid different possible challenges.