Whenever you desire to fill out irs form 8926, it's not necessary to install any kind of applications - simply make use of our online PDF editor. Our team is committed to giving you the absolute best experience with our tool by constantly presenting new features and improvements. Our editor is now even more helpful thanks to the most recent updates! Now, filling out PDF forms is simpler and faster than before. Here is what you would want to do to start:

Step 1: Just click the "Get Form Button" in the top section of this webpage to see our pdf editor. This way, you'll find everything that is required to fill out your file.

Step 2: Once you start the tool, you will see the document all set to be completed. Apart from filling in different blank fields, you may as well do other sorts of things with the form, that is writing any textual content, changing the original textual content, inserting graphics, placing your signature to the form, and more.

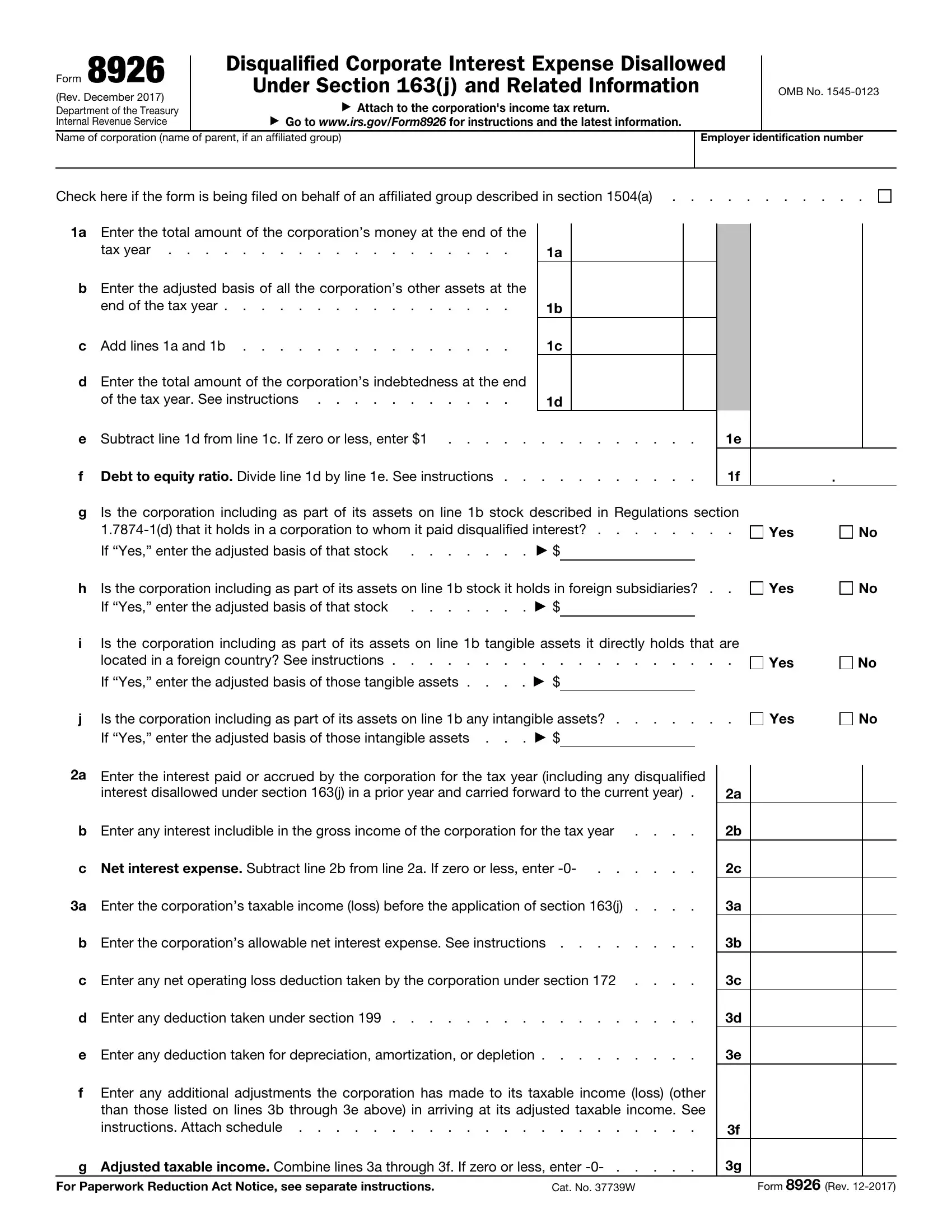

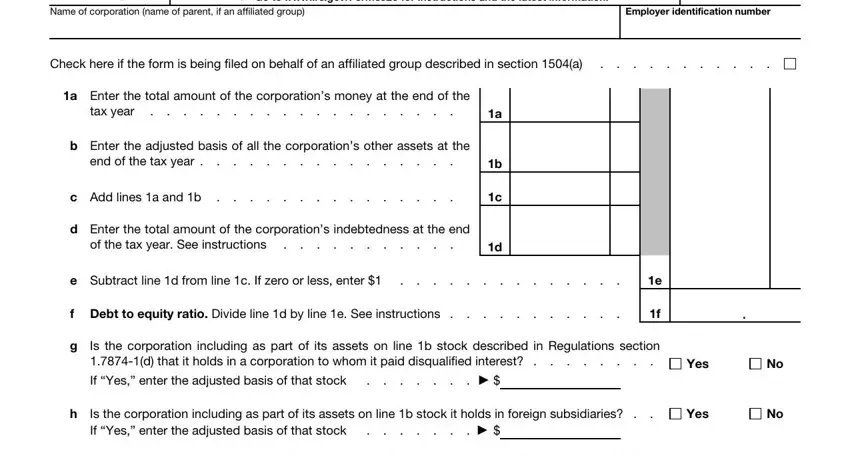

As a way to fill out this document, make sure that you enter the necessary details in each and every blank field:

1. It's important to fill out the irs form 8926 properly, so pay close attention when filling out the sections containing these fields:

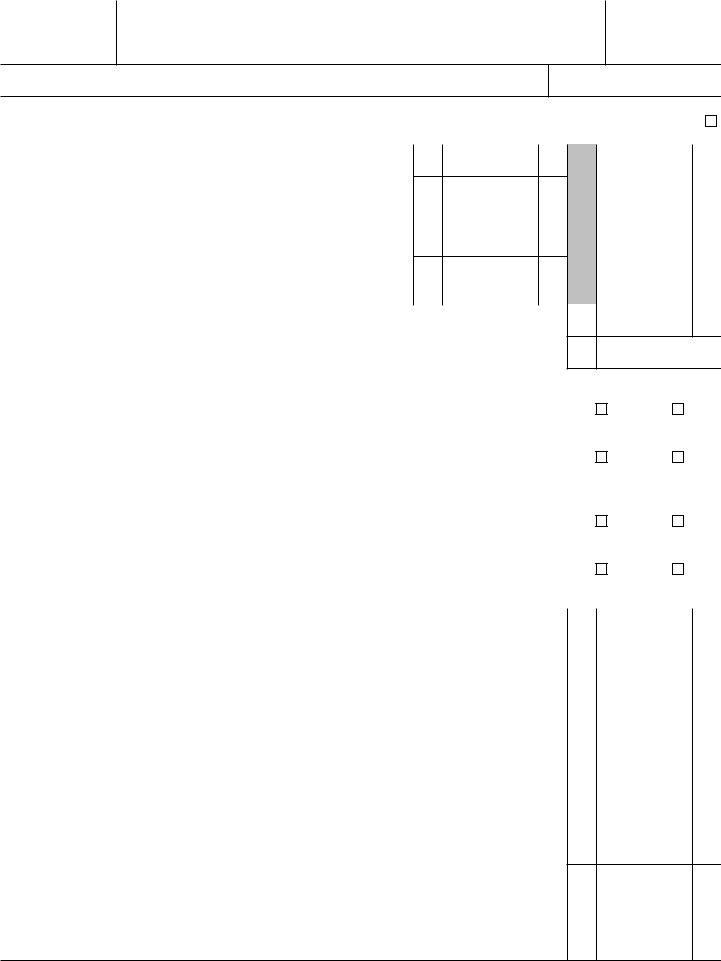

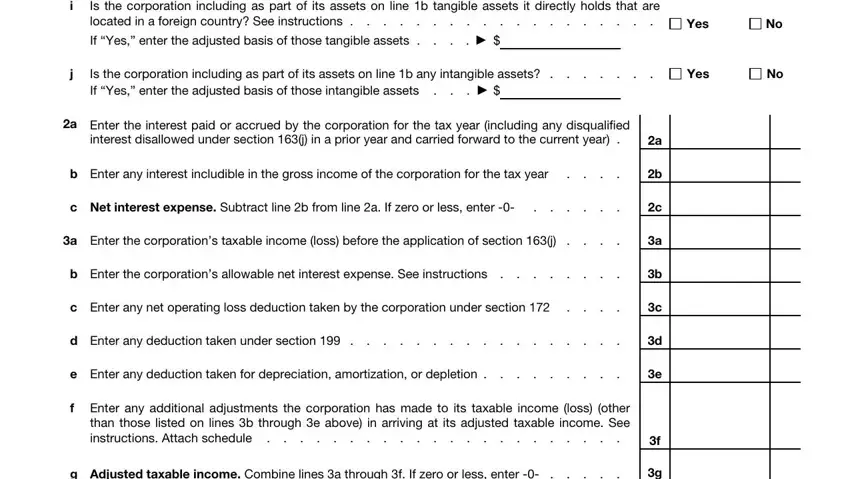

2. Just after completing the last part, go on to the next part and enter the necessary particulars in all these blanks - Is the corporation including as, Yes, If Yes enter the adjusted basis of, Is the corporation including as, Yes, a Enter the interest paid or, interest disallowed under section, b Enter any interest includible in, c Net interest expense Subtract, a Enter the corporations taxable, b Enter the corporations allowable, c Enter any net operating loss, d Enter any deduction taken under, e Enter any deduction taken for, and Enter any additional adjustments.

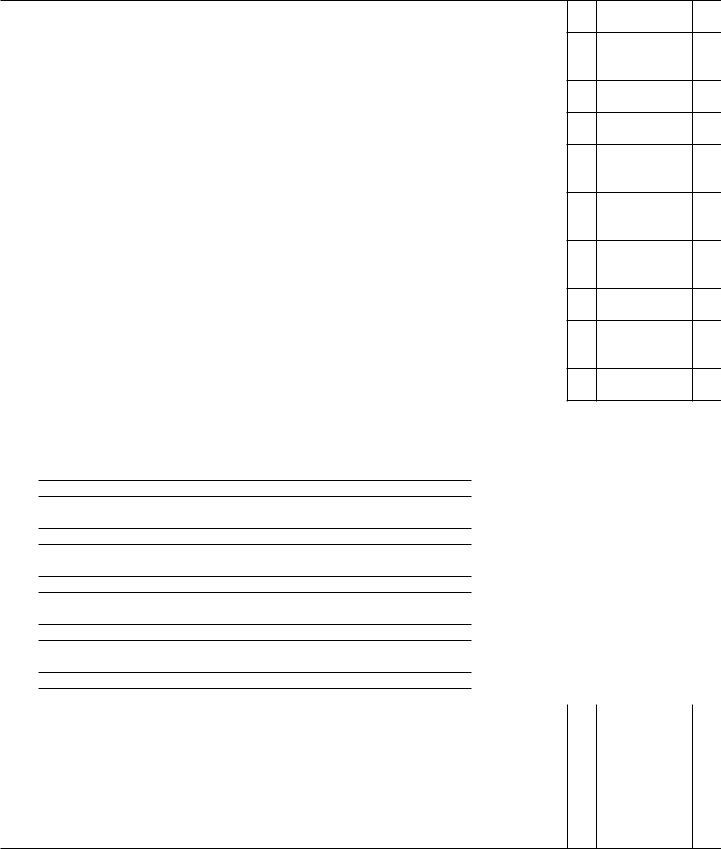

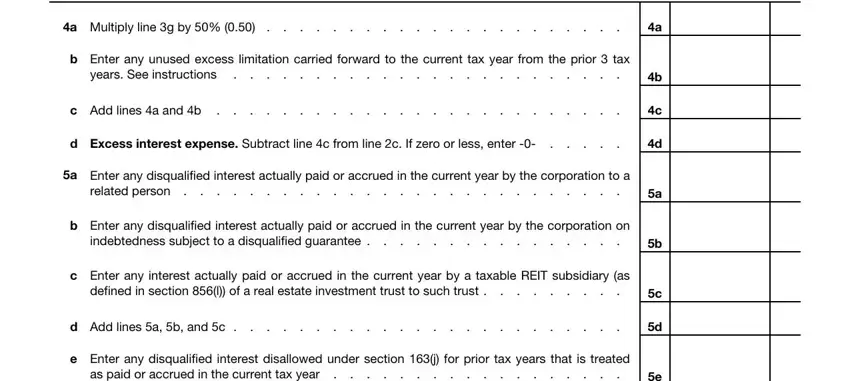

3. In this particular stage, examine a Multiply line g by, b Enter any unused excess, years See instructions, c Add lines a and b, d Excess interest expense Subtract, a Enter any disqualified interest, related person, b Enter any disqualified interest, indebtedness subject to a, c Enter any interest actually paid, defined in section l of a real, d Add lines a b and c, e Enter any disqualified interest, and as paid or accrued in the current. These will need to be filled in with highest accuracy.

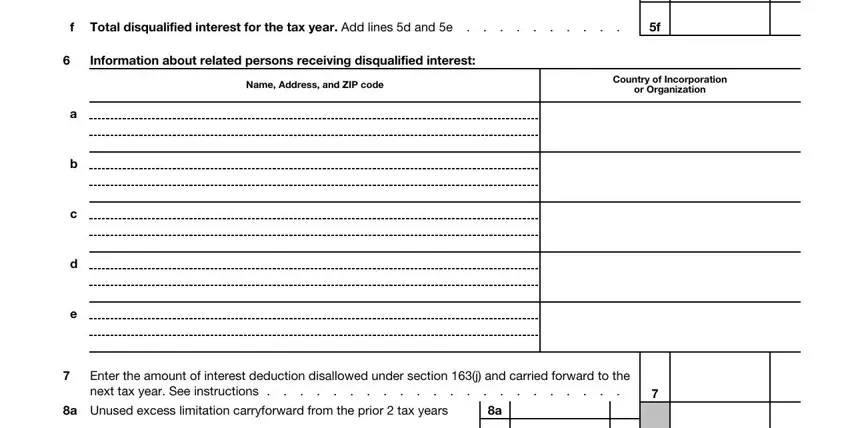

4. The form's fourth paragraph arrives with these particular form blanks to fill out: f Total disqualified interest for, Information about related persons, Name Address and ZIP code, Country of Incorporation, or Organization, Enter the amount of interest, and a Unused excess limitation.

Be really mindful when filling out Enter the amount of interest and a Unused excess limitation, since this is the section where many people make mistakes.

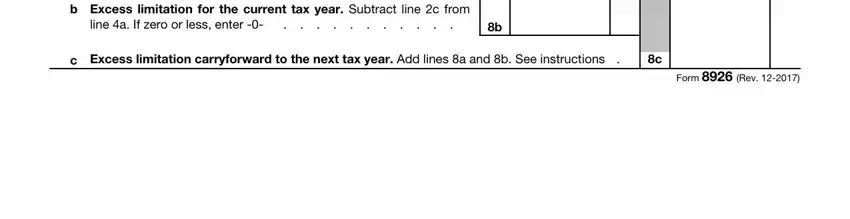

5. The final point to submit this form is crucial. You must fill in the necessary form fields, particularly b Excess limitation for the, line a If zero or less enter, c Excess limitation carryforward, and Form Rev, before finalizing. Failing to do it can give you an unfinished and probably nonvalid form!

Step 3: Immediately after looking through your form fields you've filled in, click "Done" and you are done and dusted! Grab your irs form 8926 once you join for a 7-day free trial. Easily use the pdf document within your FormsPal account page, together with any edits and adjustments all saved! FormsPal guarantees secure document completion devoid of personal data recording or any type of sharing. Rest assured that your data is secure here!