When working in the online editor for PDFs by FormsPal, you can easily complete or modify Form 8939 right here. In order to make our tool better and less complicated to utilize, we constantly develop new features, with our users' suggestions in mind. To get the ball rolling, take these easy steps:

Step 1: Just hit the "Get Form Button" at the top of this page to start up our pdf file editing tool. This way, you will find all that is required to work with your file.

Step 2: The editor offers the capability to change your PDF document in many different ways. Modify it by including any text, correct what's originally in the file, and add a signature - all at your disposal!

This PDF form requires specific details; in order to guarantee accuracy and reliability, make sure you pay attention to the guidelines further down:

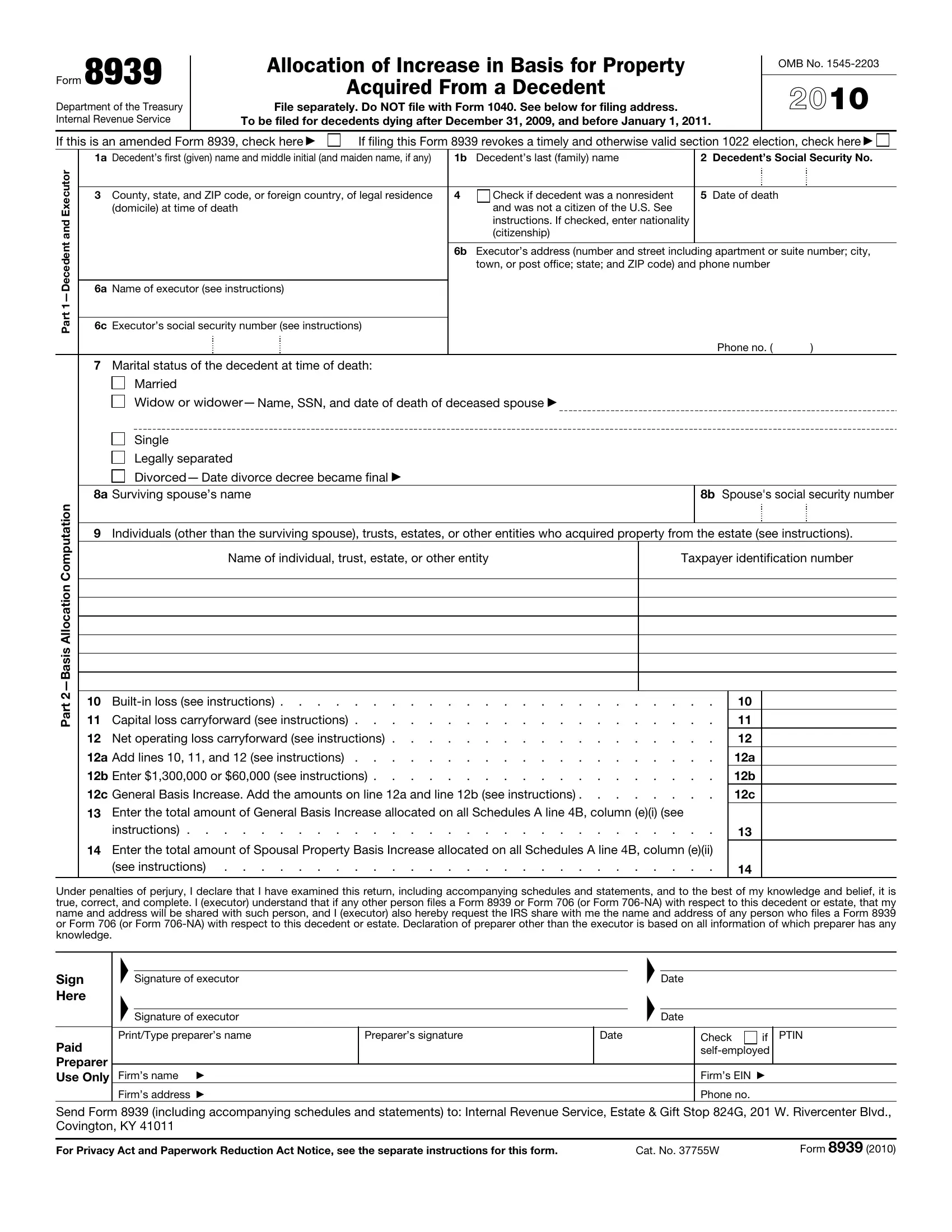

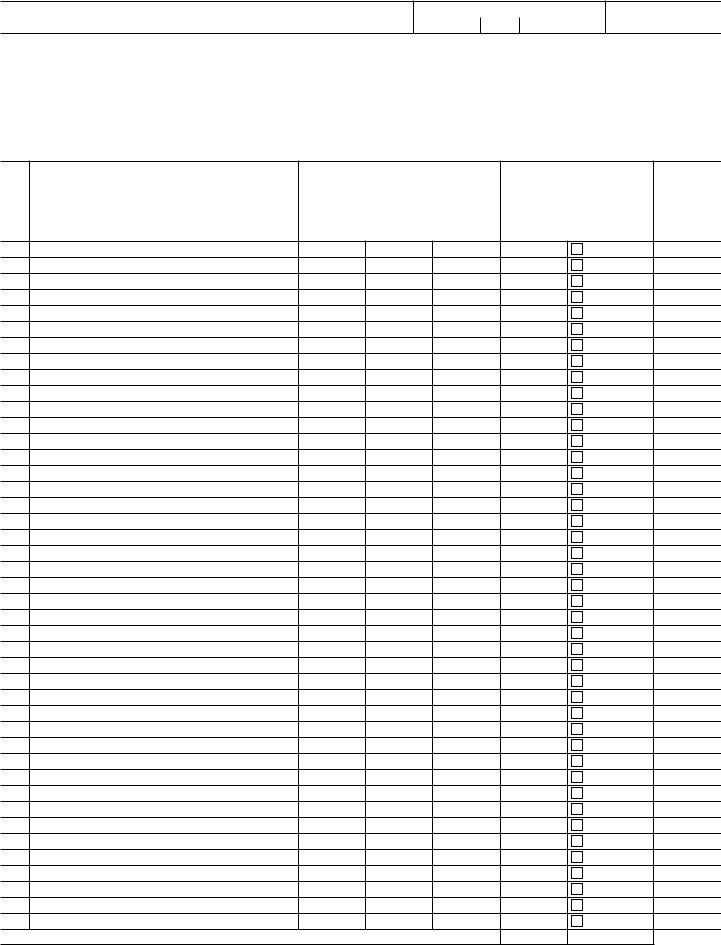

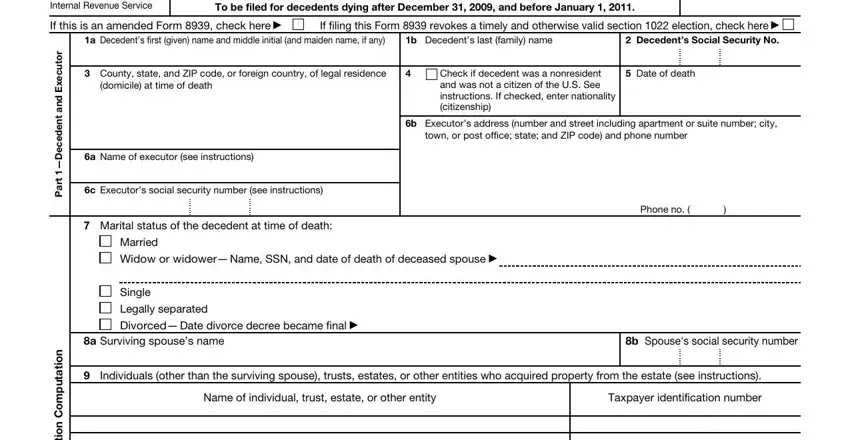

1. Firstly, when completing the Form 8939, beging with the page that includes the following blank fields:

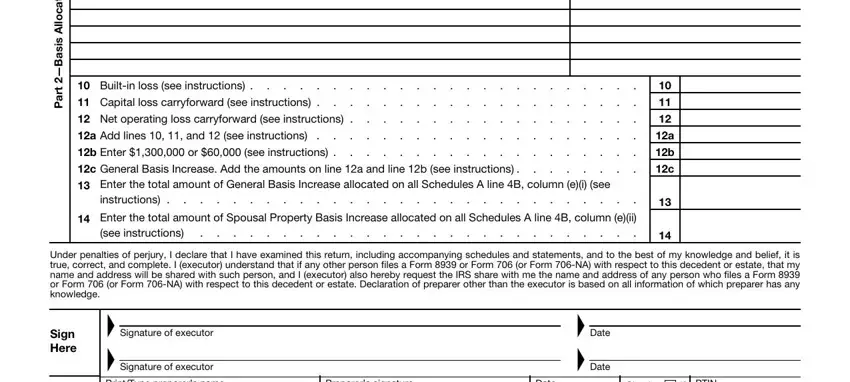

2. When this array of fields is completed, go on to enter the applicable information in all these - n o i t a t u p m o C n o i t a c o, l l, A s s a B, t r a P, Builtin loss see instructions, instructions, Enter the total amount of Spousal, see instructions, Under penalties of perjury I, Sign Here, Signature of executor Signature, PrintType preparers name, Preparers signature, Date, and Date Date.

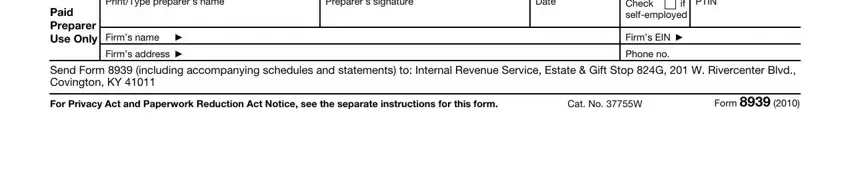

3. In this part, take a look at Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, Check if selfemployed, PTIN, Firms EIN, Phone no, Send Form including accompanying, For Privacy Act and Paperwork, Cat No W, and Form. Each of these are required to be completed with utmost accuracy.

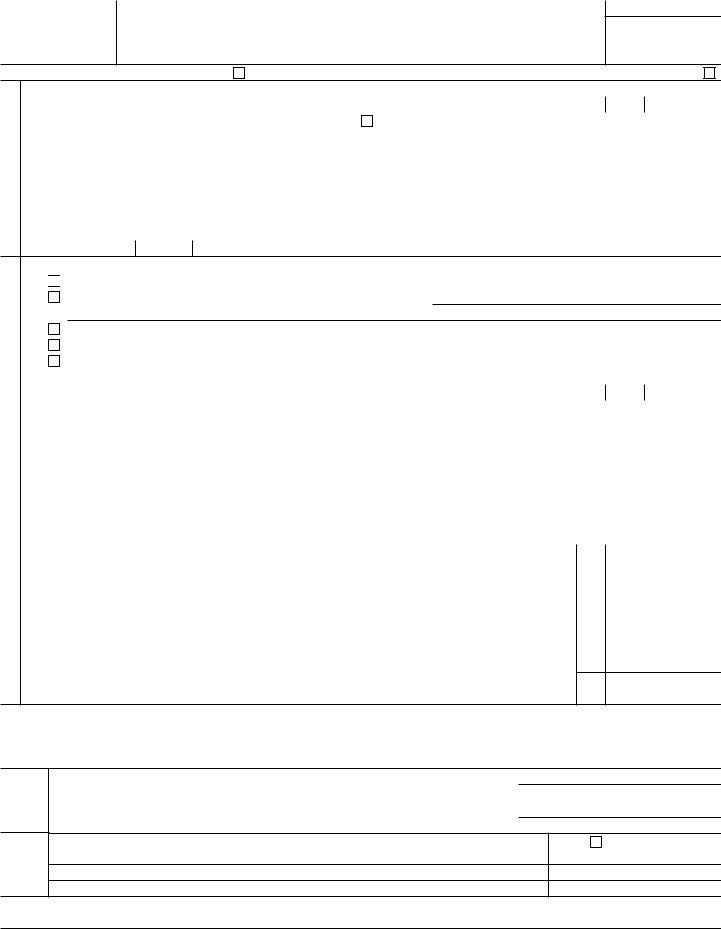

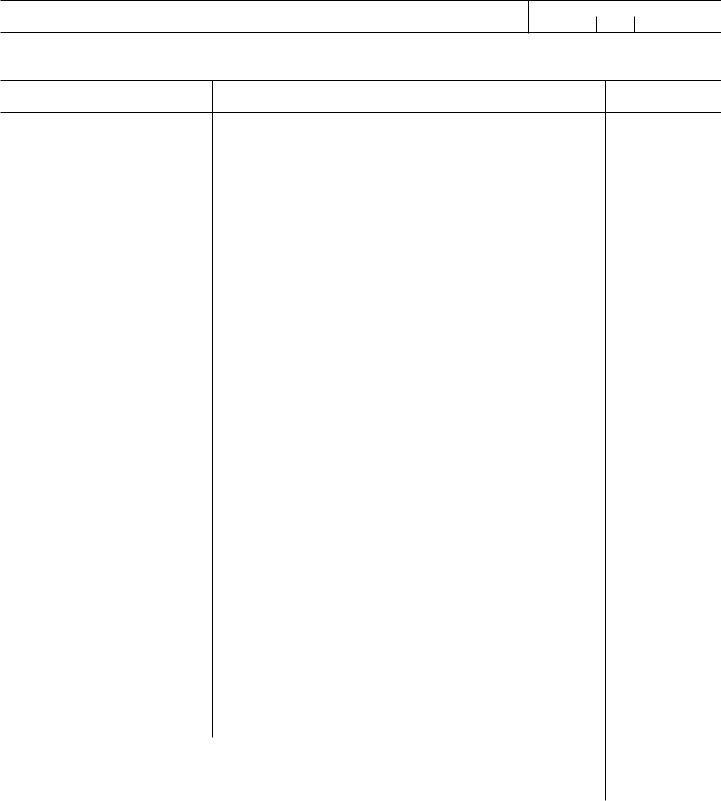

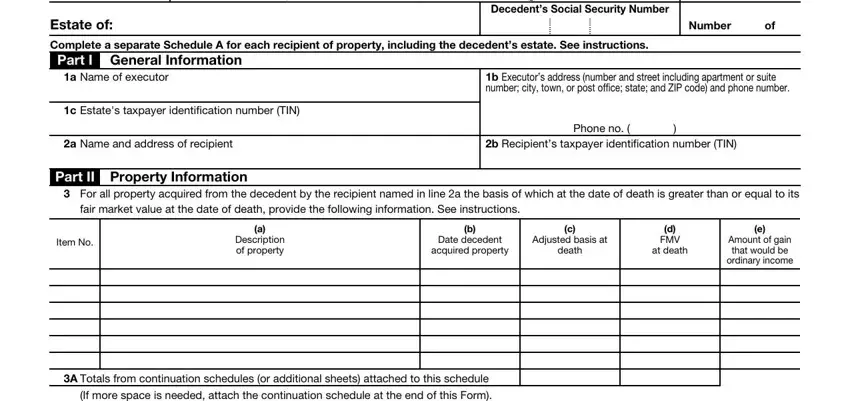

4. Filling in Department of the Treasury, Recipients of Schedule A For more, Estate of, Decedents Social Security Number, Number, Complete a separate Schedule A for, Part I General Information, a Name of executor, c Estates taxpayer identification, a Name and address of recipient, Part II Property Information, b Executors address number and, Phone no, b Recipients taxpayer, and For all property acquired from is crucial in this section - be certain to invest some time and fill in every field!

When it comes to Decedents Social Security Number and Complete a separate Schedule A for, ensure that you double-check them here. The two of these are thought to be the most important fields in the file.

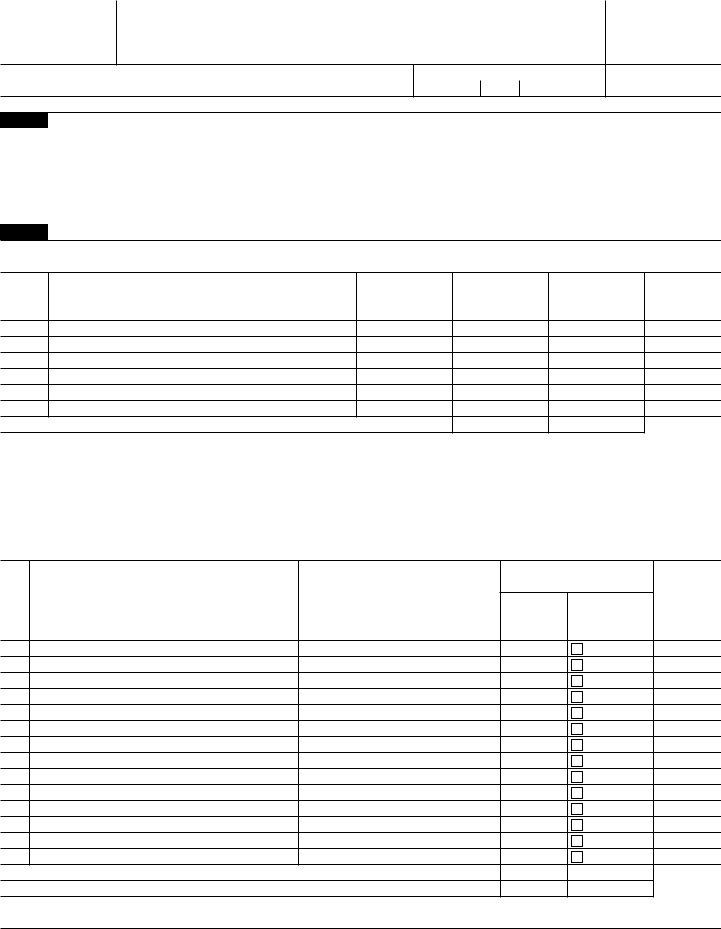

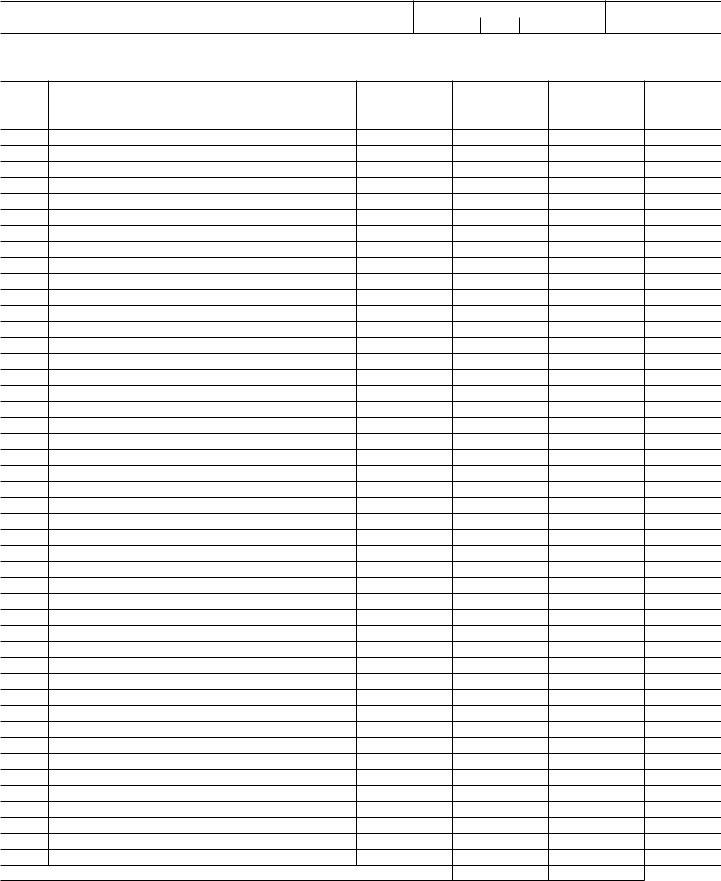

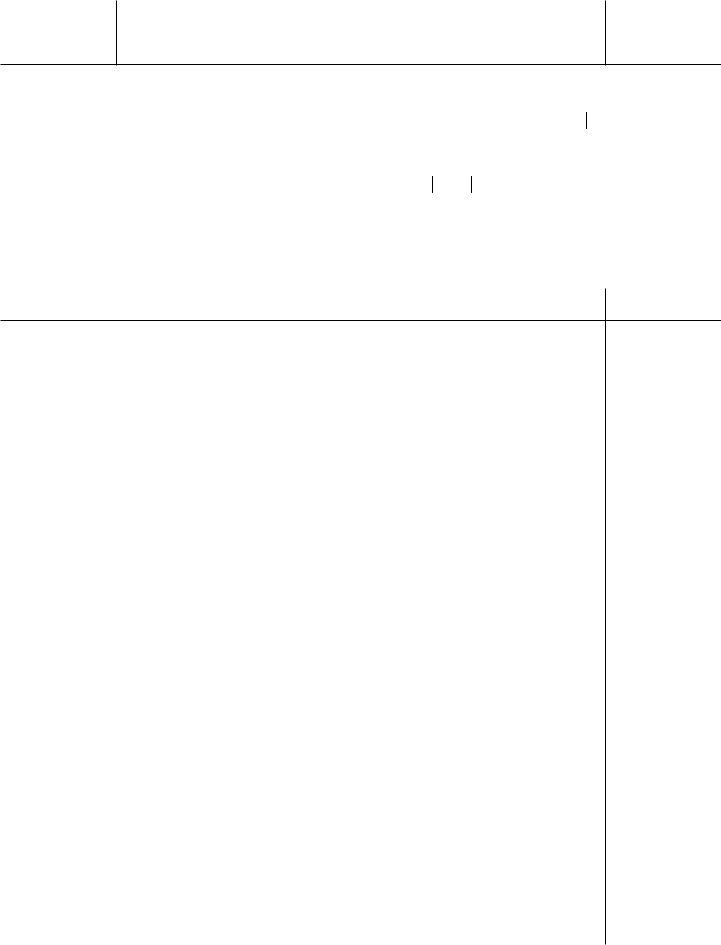

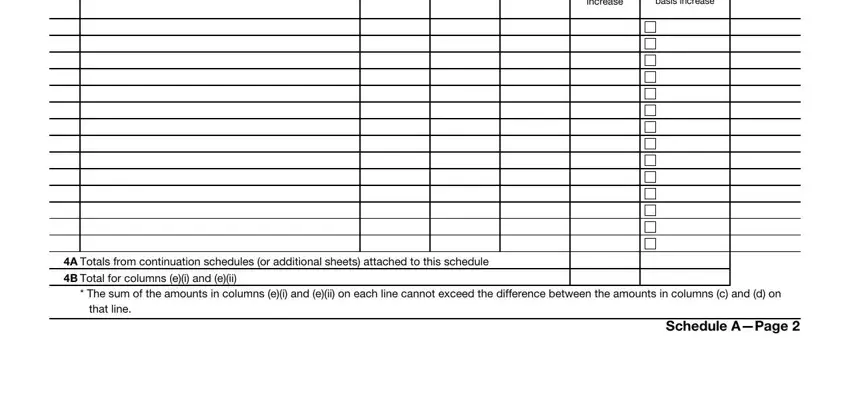

5. When you come close to the conclusion of the form, you will find a couple more things to undertake. Particularly, increase, basis increase, A Totals from continuation, The sum of the amounts in columns, that line, and Schedule APage must all be filled out.

Step 3: Prior to moving on, make sure that blanks have been filled in the proper way. When you establish that it is fine, press “Done." Get hold of your Form 8939 the instant you register online for a free trial. Readily view the pdf within your FormsPal account page, along with any modifications and adjustments automatically kept! FormsPal is focused on the personal privacy of all our users; we always make sure that all information entered into our system remains protected.