Any time you desire to fill out OMB, you don't have to download and install any kind of programs - simply give a try to our online tool. To make our tool better and simpler to utilize, we continuously develop new features, bearing in mind suggestions from our users. To get the process started, go through these simple steps:

Step 1: Simply click on the "Get Form Button" in the top section of this webpage to get into our pdf editor. There you'll find all that is required to fill out your file.

Step 2: With this handy PDF editor, you can actually accomplish more than just complete blank form fields. Edit away and make your documents appear sublime with custom textual content added, or tweak the file's original input to excellence - all accompanied by the capability to add any type of pictures and sign it off.

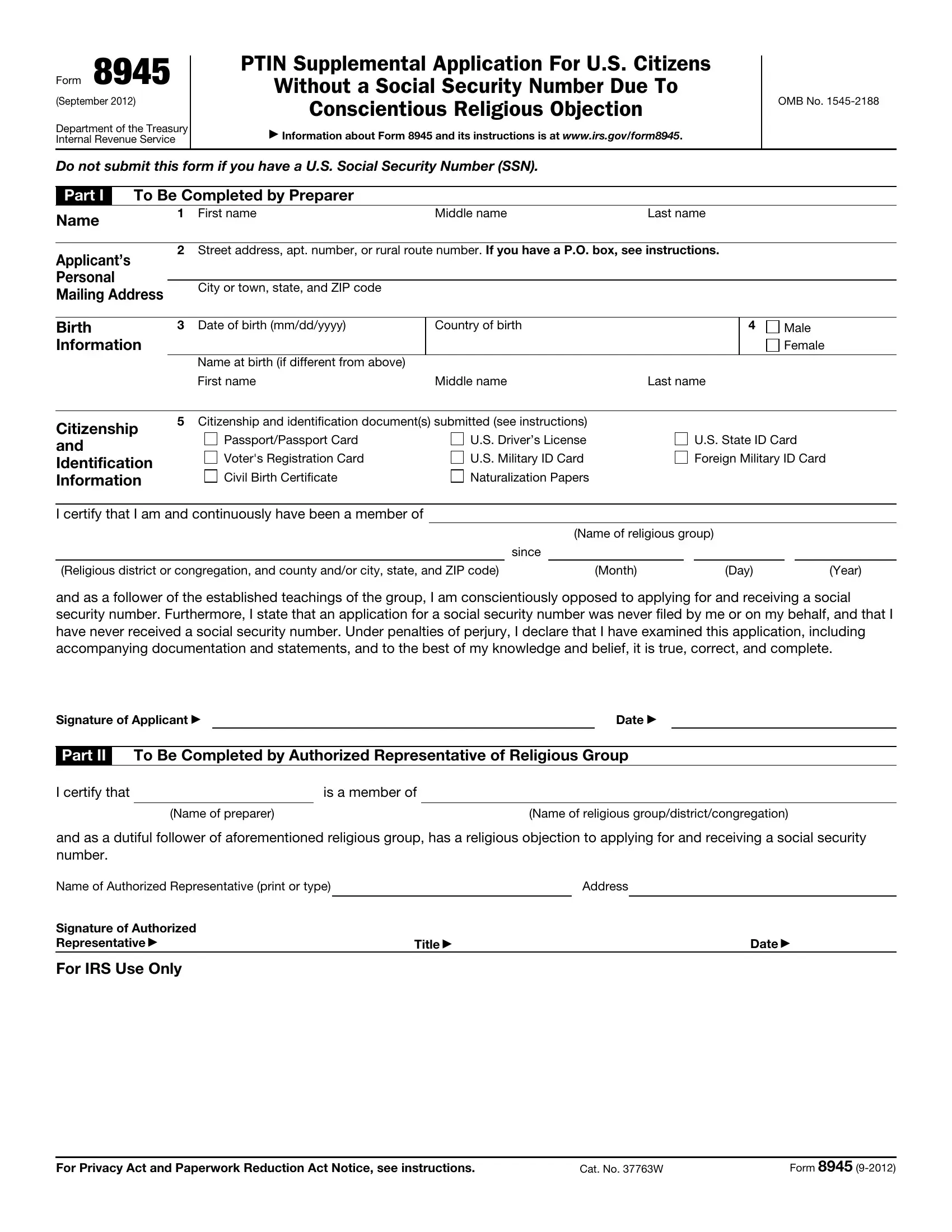

This PDF requires specific information to be filled in, thus ensure that you take the time to type in what's asked:

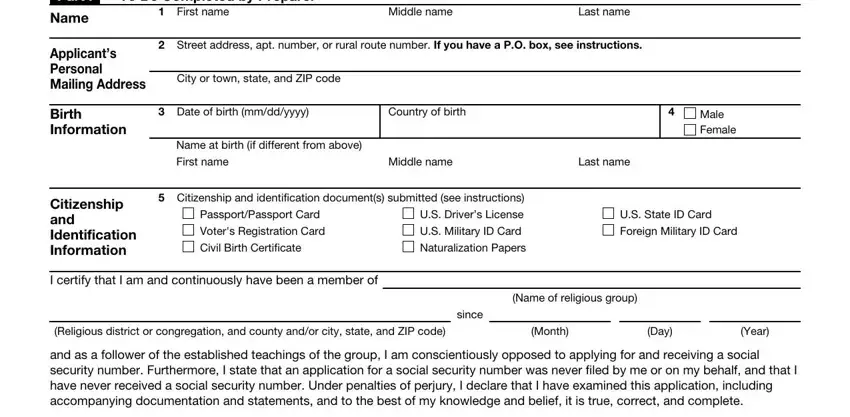

1. The OMB involves specific details to be typed in. Be sure the following blanks are completed:

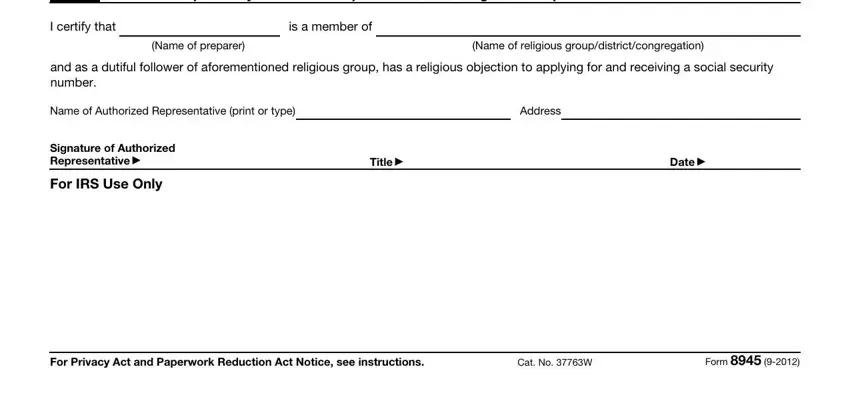

2. After the last part is finished, you'll want to add the necessary particulars in Part II, To Be Completed by Authorized, I certify that, is a member of, Name of preparer, Name of religious, and as a dutiful follower of, Name of Authorized Representative, Address, Signature of Authorized, For IRS Use Only, Title, Date, For Privacy Act and Paperwork, and Cat No W in order to progress further.

You can easily make a mistake when filling out the For Privacy Act and Paperwork, so be sure to reread it prior to when you submit it.

Step 3: After you have looked once more at the information in the blanks, click on "Done" to finalize your document creation. Create a 7-day free trial subscription at FormsPal and get instant access to OMB - download or modify from your FormsPal account page. FormsPal guarantees your information privacy with a secure system that never saves or shares any sort of personal information used. Be confident knowing your paperwork are kept safe each time you work with our services!