Branded prescription drug sales. Branded prescription drug sales are sales of branded prescription drugs made to specified government programs (or sales due to coverage under the programs). A branded prescription drug is any prescription drug for which an application was submitted under section 505(b) of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. 355(b)), or any biological product the license for which was submitted under section 351(a) of the Public Health Service Act (42 U.S.C. 262(a)). A prescription drug is any drug that is subject to section 503(b) of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. 353(b)).

Branded prescription drug sales do not include sales of section 45C orphan drugs (defined below).

Specified government programs. Specified government programs under the Act are:

•The Medicare Part D program under part D of title XVIII of the Social Security Act;

•The Medicare Part B program under part B of title XVIII of the Social Security Act;

•The Medicaid program under title XIX of the Social Security Act;

•Any program under which branded prescription drugs are procured by the Department of Veterans Affairs;

•Any program under which branded prescription drugs are procured by the Department of Defense; and

•The TRICARE retail pharmacy program under section 1074g of title 10, United States Code.

Section 45C orphan drugs. Generally, branded prescription drug sales do not include sales of an orphan drug if any person claimed (and was allowed) a section 45C tax credit for the orphan drug on a return or claim for refund for any taxable year, and there has not been a final assessment or a court disallowance of the full section 45C credit taken for the drug.

Non-orphan drug marketing. However, a branded prescription drug is not treated as an orphan drug after December 31 of the year in which the drug or biological product was approved by the Food and Drug Administration (FDA) for non-orphan drug marketing, regardless of whether a section 45C credit was allowed for an orphan drug either before or after the non-orphan drug designation. Non-orphan drug marketing is marketing for any indication other than the treatment of the rare disease or condition for which the section 45C tax credit was allowed.

Specific Instructions

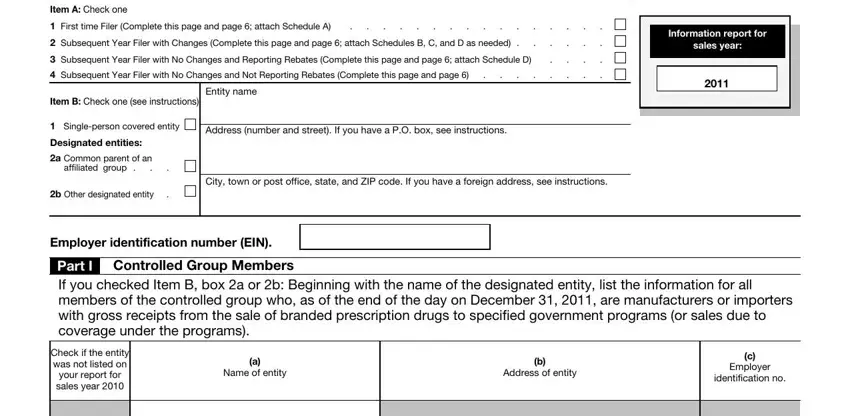

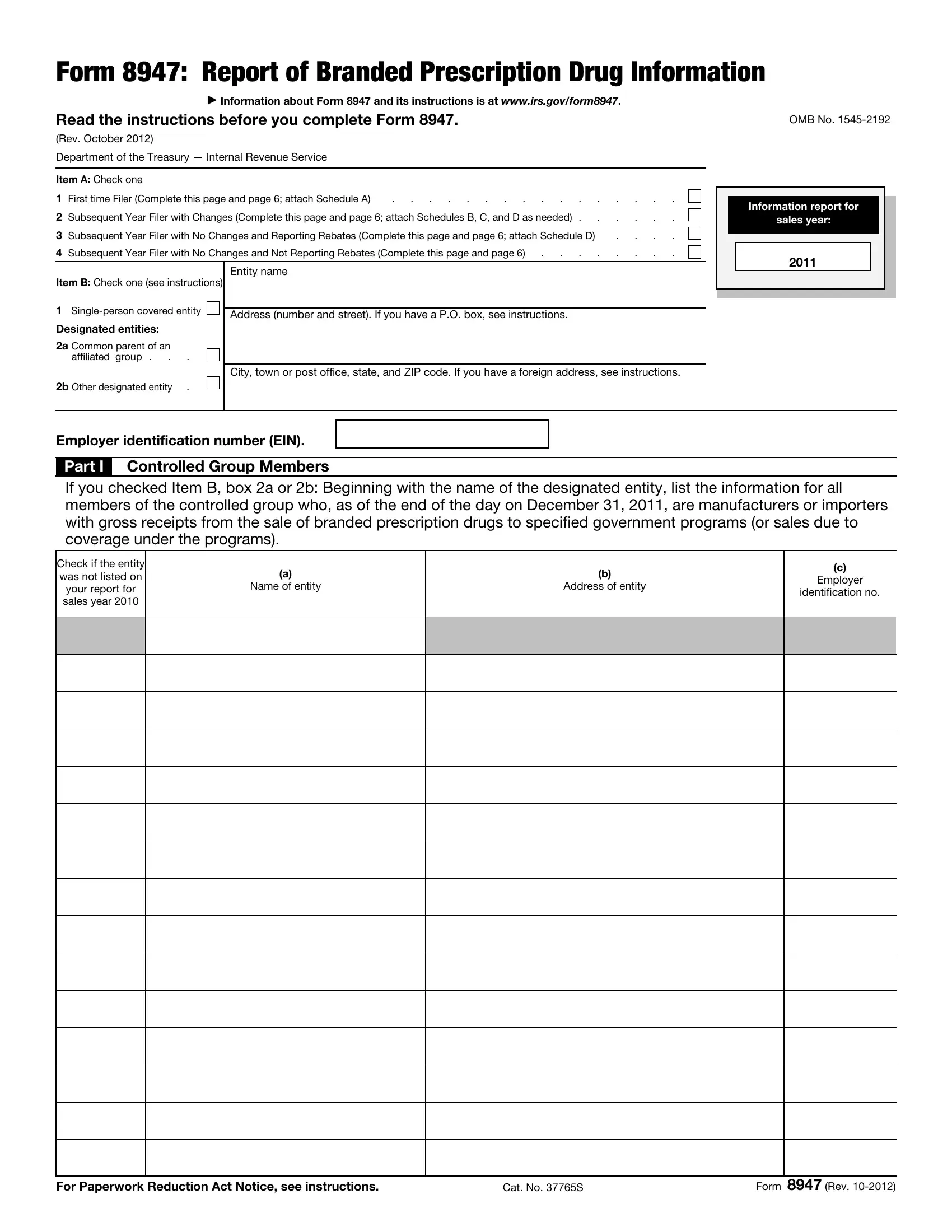

Item B. Covered Entity Information

Covered entity. A covered entity is any manufacturer or importer with gross receipts from branded prescription drug sales. A manufacturer or importer is the person identified in the Labeler Code of the NDC for the branded prescription drug. The NDC is an identifier assigned by the FDA to a branded prescription drug, as well as other drugs. The Labeler Code is the first five numeric characters of the NDC, or the first six numeric characters when the available five-character code combinations are exhausted.

For purposes of the Act, all persons treated as a single employer under sections 52(a), 52(b), 414(m), or 414(o) will be treated as one covered entity (an Act section 9008(d)(2) controlled group). A covered entity is either a single-person covered entity or a member of a controlled group. In applying the single employer rules, a foreign entity subject to tax under section 881 is included within a controlled group under section 52(a) or 52(b). A covered entity is treated as being a member of a controlled group if it is a member of the group at the end of the day on December 31, 2011. Also, a controlled group that is an affiliated group that filed a consolidated federal tax return for tax year 2011 (“affiliated group”) will be treated as one covered entity.

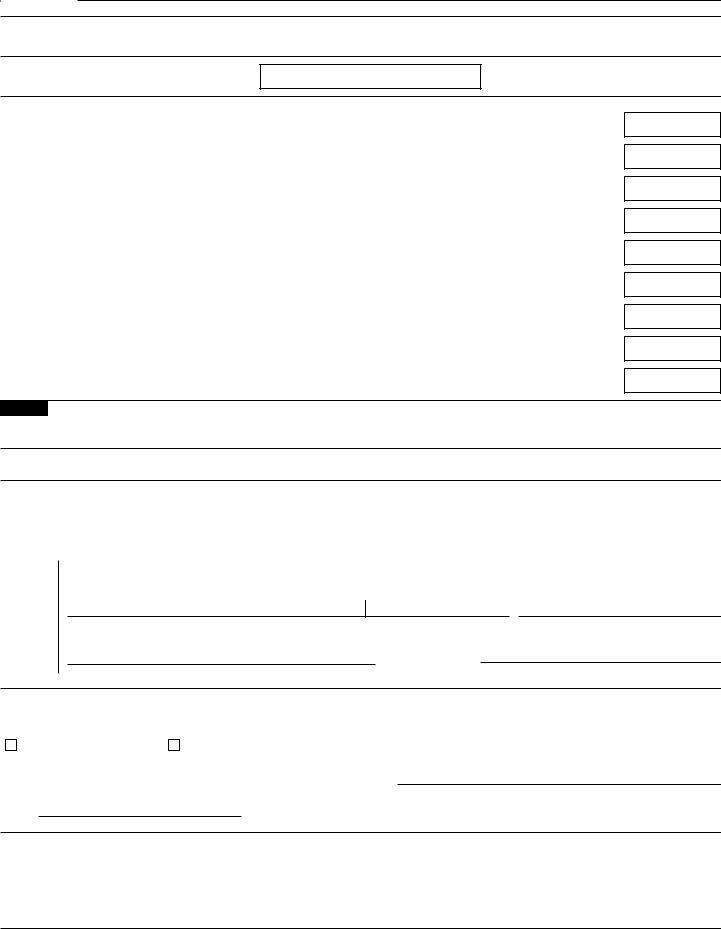

Box 1. Check box 1 if you are a single-person covered entity. You must sign Part II on page 6.

Designated entity. Generally, the designated entity is one of the following.

•The common parent of an affiliated group.

•The member chosen to be the designated entity by the members of a controlled group that is not an affiliated group. If a controlled group does not select a designated entity, the IRS will select a member of the controlled group as the designated entity for the controlled group.

The designated entity is responsible for the following for the group.

•Filing Form 8947,

•Receiving IRS communications about the fee,

•Filing any necessary error report (as described in Temporary Regulations section 51.7T), and

•Paying the fee to the IRS.

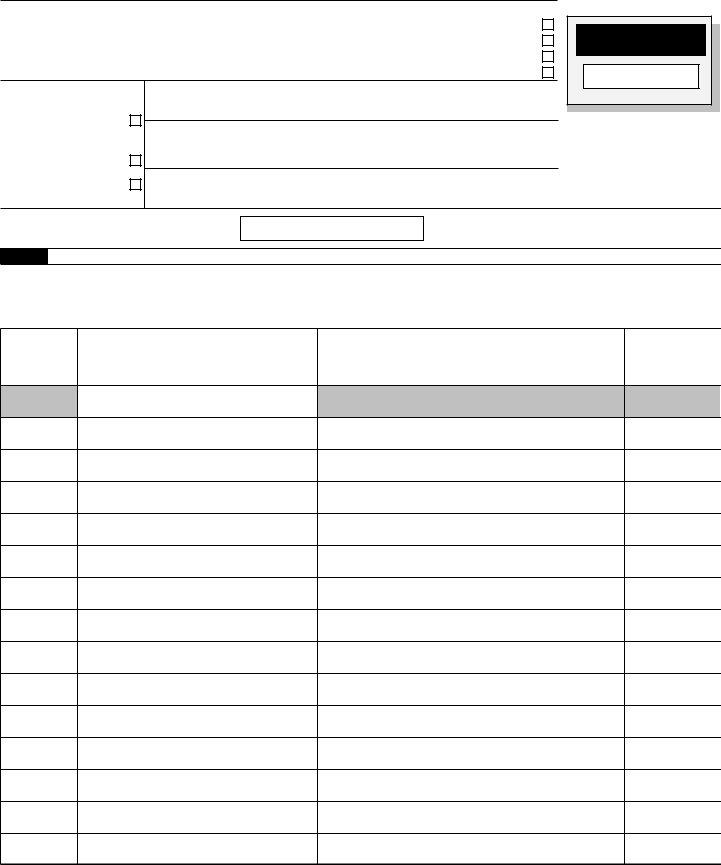

Box 2a. Check box 2a if you are a common parent of an affiliated group. Also complete Part I, Controlled Group Members, giving the name, address, and EIN of only those members of the controlled group who, as of the end of the day on December 31, 2011, are manufacturers or importers with gross receipts from the sale of branded prescription drugs to specified government programs (or sales due to coverage under the program), listing the designated entity's name first. You must also sign Part II on page 6.

Box 2b. Check box 2b if you are the designated entity for a covered entity that is not an affiliated group. Also complete Part I, Controlled Group Members, giving the name, address, and EIN of only those members of the controlled group who, as of the end of the day on December 31, 2011, are manufacturers or importers with gross receipts from the sale of branded prescription drugs to specified government programs (or sales due to coverage under the program), listing the designated entity's name first. You must also sign Part II on page 6.

Name and Address

Entity name. If you checked box 1, enter the name of the single-person covered entity. If you checked box 2a or 2b, enter the name of the designated entity.

P.O. box. Enter your box number only if your post office does not deliver mail to your street address.

Foreign Address. Enter the information in the following order: city, province or state, and country. Follow the country's practice for entering the postal code. In some countries the postal code may come before the city or town name. Enter the full name of the country using uppercase letters in English.

Third Party. If you receive your mail in care of a third party (such as an accountant or an attorney), enter on the street address line “C/O” followed by the third party's name and street address or P.O. box.

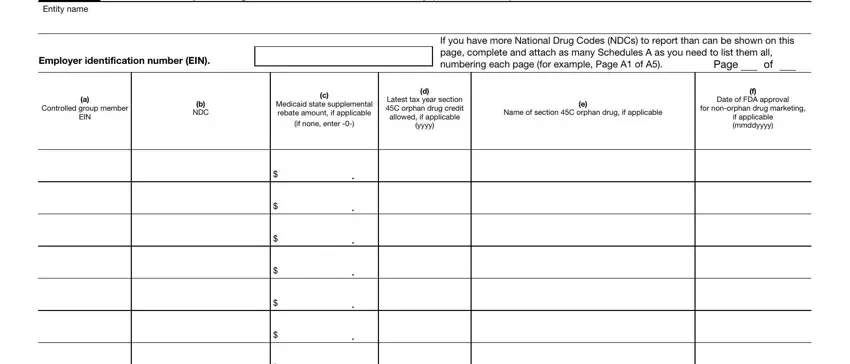

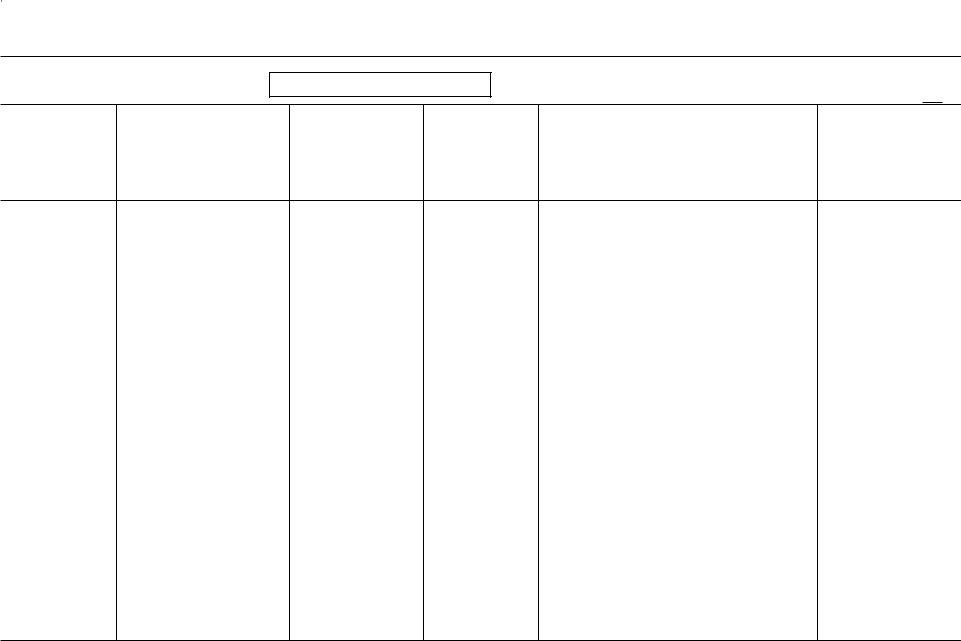

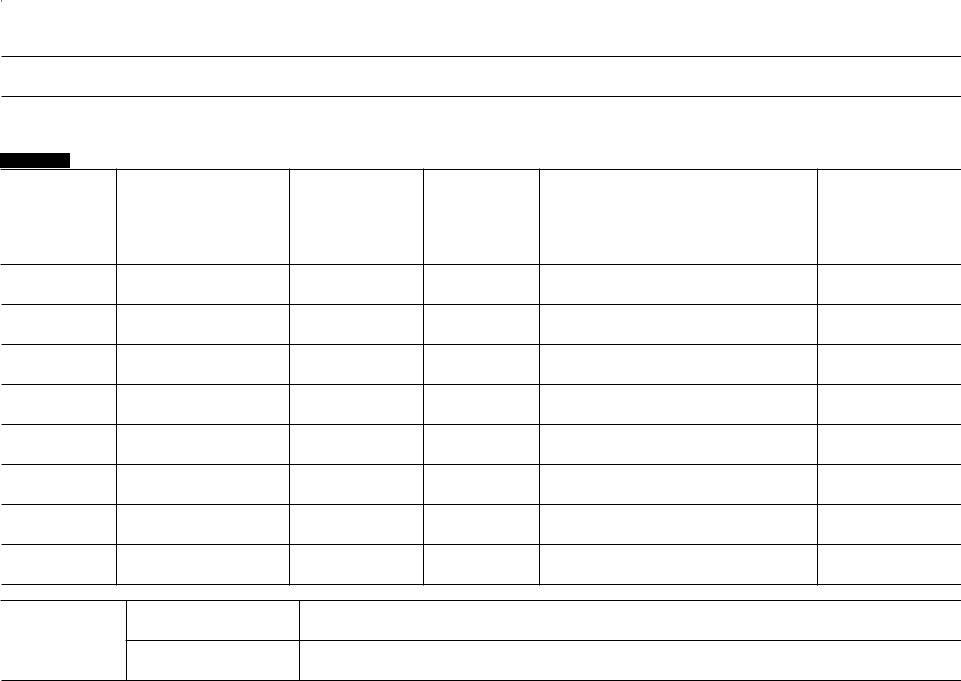

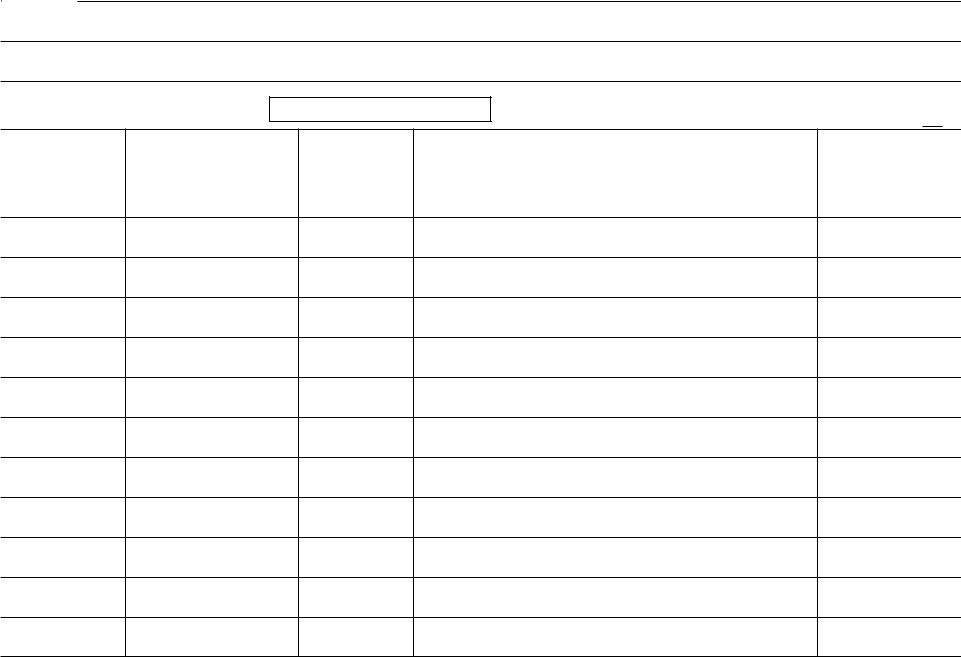

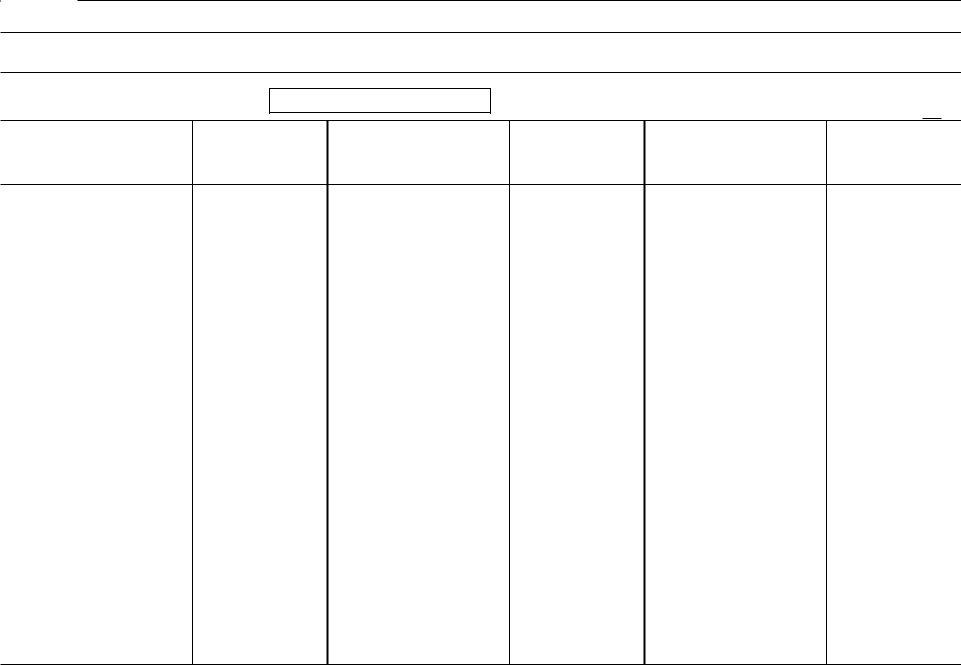

Schedule A. Branded Prescription Drug Information – First Time Filers Only

If you filed Form 8947 for sales year 2010, do not use Schedule A for the 2011 sales year. If you checked Item A, box 1, use Schedule A to report the following.

Controlled group member EIN. Enter the same EIN for each member that was shown in Part I, column (c).

NDC. Enter the 11-digit NDC (omitting hyphens) for any branded prescription drug sold to any specified government program (or sold due to coverage under the programs) during 2011.

Medicaid state supplemental rebate amount. Enter the Medicaid state supplemental rebates for each NDC paid by the covered entity for sales under Medicaid in sales year 2011. For this purpose, enter Medicaid state supplemental rebates invoiced by states and paid by the covered entity for drugs in sales year 2011 and paid before you file Form 8947.