8952 form can be completed online in no time. Just make use of FormsPal PDF tool to accomplish the job in a timely fashion. To keep our tool on the forefront of practicality, we work to put into operation user-oriented capabilities and enhancements on a regular basis. We're always looking for feedback - play a vital part in remolding how we work with PDF forms. Should you be seeking to get started, this is what it takes:

Step 1: Access the PDF inside our editor by pressing the "Get Form Button" at the top of this page.

Step 2: With our state-of-the-art PDF file editor, it is easy to do more than merely fill out blank form fields. Express yourself and make your forms look perfect with custom text put in, or tweak the original input to excellence - all that comes along with the capability to insert your own images and sign the document off.

This PDF doc will require you to enter specific information; in order to ensure accuracy and reliability, please make sure to take heed of the next steps:

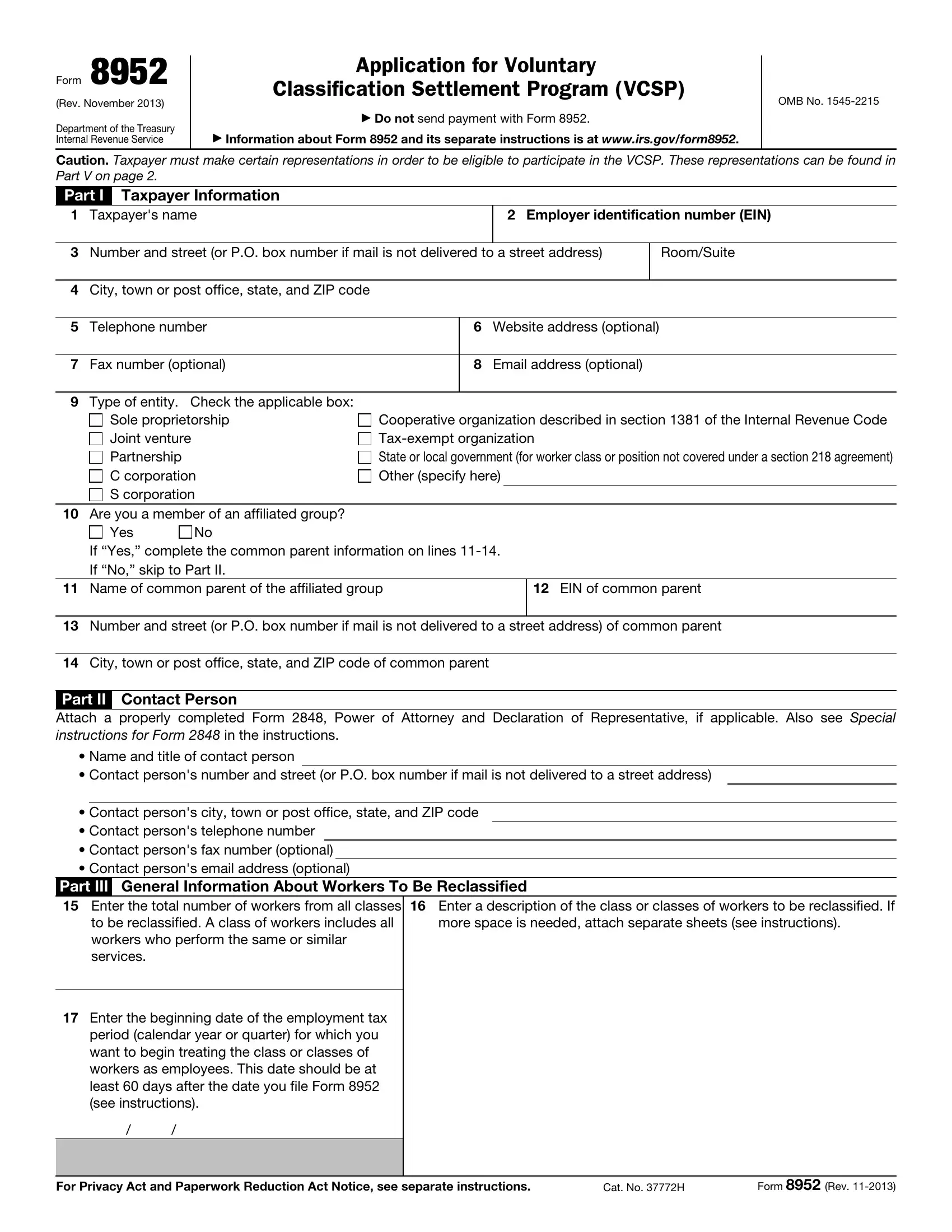

1. When filling out the 8952 form, make sure to complete all needed blanks within the corresponding part. It will help hasten the work, enabling your information to be processed quickly and accurately.

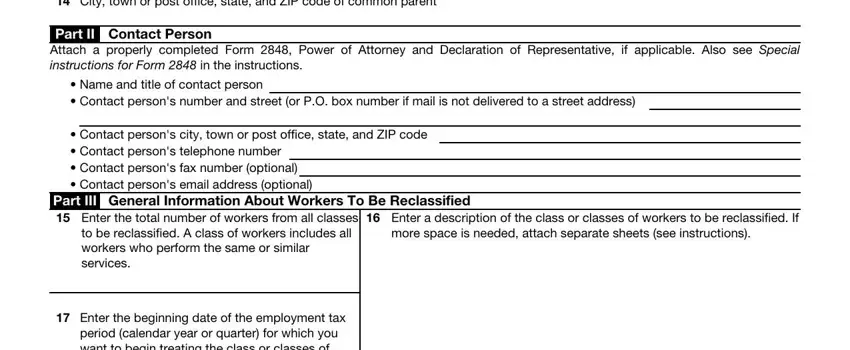

2. After filling out the last section, go to the next part and fill in the necessary details in all these fields - City town or post office state, Part II Contact Person Attach a, Name and title of contact person, Contact persons city town or post, Part III General Information About, Enter a description of the class, to be reclassified A class of, more space is needed attach, Enter the beginning date of the, and period calendar year or quarter.

It's easy to get it wrong when filling out the Name and title of contact person, hence make sure that you go through it again prior to deciding to send it in.

3. This subsequent section should also be rather easy, period calendar year or quarter, For Privacy Act and Paperwork, Cat No H, and Form Rev - these fields must be filled out here.

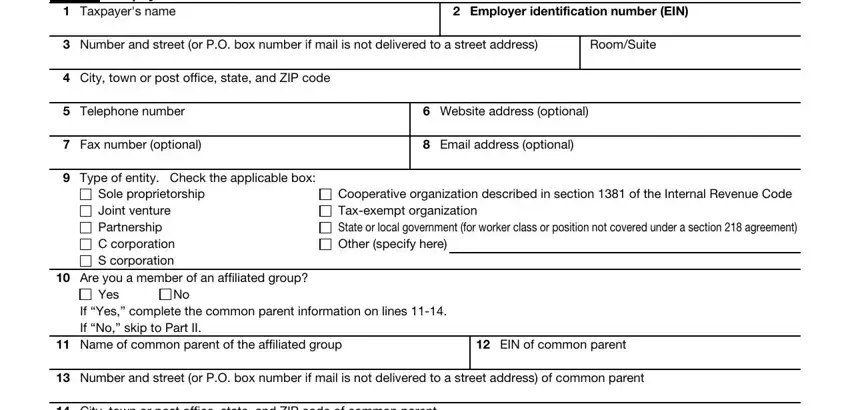

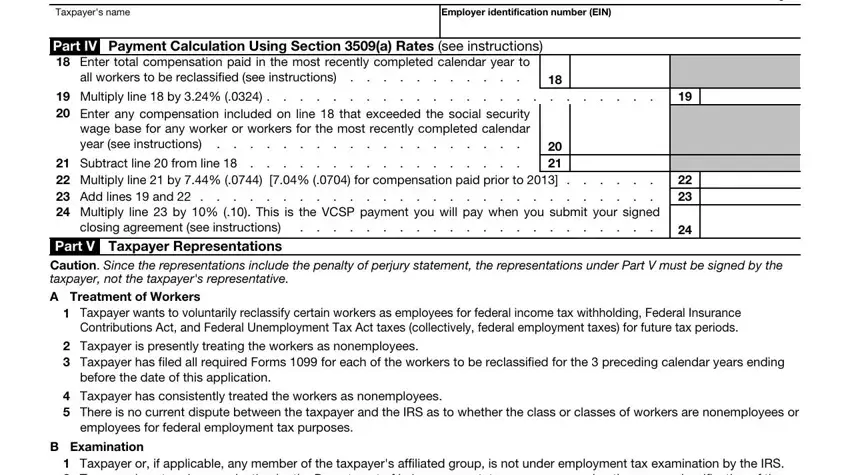

4. To move forward, the following part involves completing several form blanks. These comprise of Form Rev, Taxpayers name, Employer identification number EIN, Page, Part IV Payment Calculation Using, all workers to be reclassified see, Multiply line by Enter any, Subtract line from line, closing agreement see instructions, Caution Since the representations, A Treatment of Workers, Taxpayer wants to voluntarily, Taxpayer is presently treating, before the date of this application, and Taxpayer has consistently treated, which are crucial to moving forward with this particular PDF.

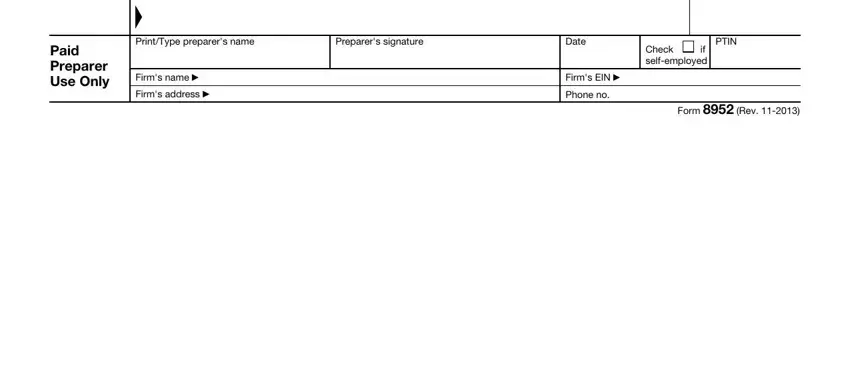

5. When you draw near to the end of the form, you'll notice a couple extra things to do. Particularly, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, PTIN, Check if selfemployed, Firms name, Firms address, Firms EIN, Phone no, and Form Rev must be done.

Step 3: Make certain the information is correct and simply click "Done" to continue further. Right after setting up a7-day free trial account with us, it will be possible to download 8952 form or email it directly. The file will also be accessible from your personal account menu with your every edit. At FormsPal, we strive to be certain that your information is maintained private.