Once you open the online tool for PDF editing by FormsPal, you are able to fill in or modify oregon elderly rental assistance program right here. Our tool is constantly developing to grant the best user experience possible, and that's because of our dedication to constant improvement and listening closely to customer opinions. Starting is easy! All that you should do is follow the next simple steps down below:

Step 1: Just hit the "Get Form Button" in the top section of this site to get into our pdf file editing tool. Here you will find all that is required to fill out your file.

Step 2: With this handy PDF editor, you could do more than merely fill out blanks. Express yourself and make your docs appear faultless with custom text added in, or modify the file's original input to excellence - all that comes with the capability to incorporate almost any pictures and sign the document off.

This PDF doc will require some specific details; to ensure consistency, be sure to pay attention to the following recommendations:

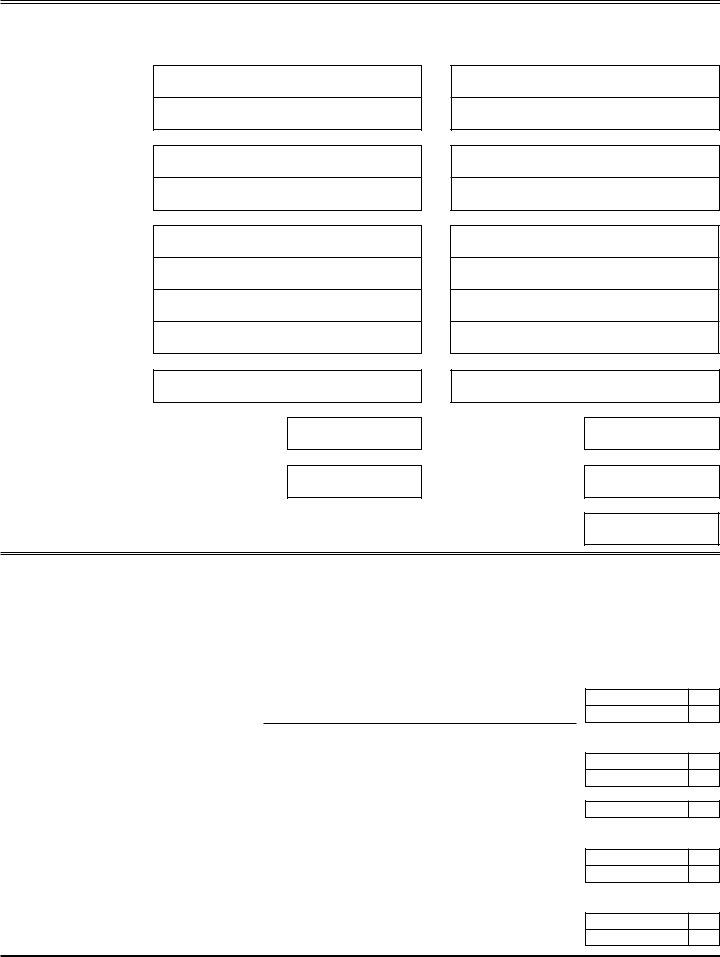

1. For starters, when filling in the oregon elderly rental assistance program, start with the section containing next fields:

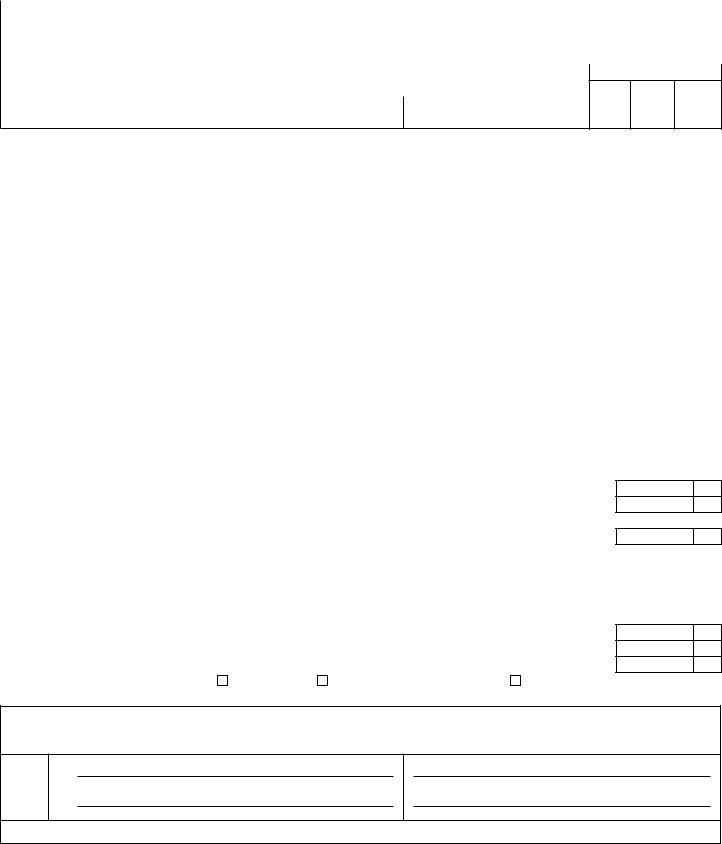

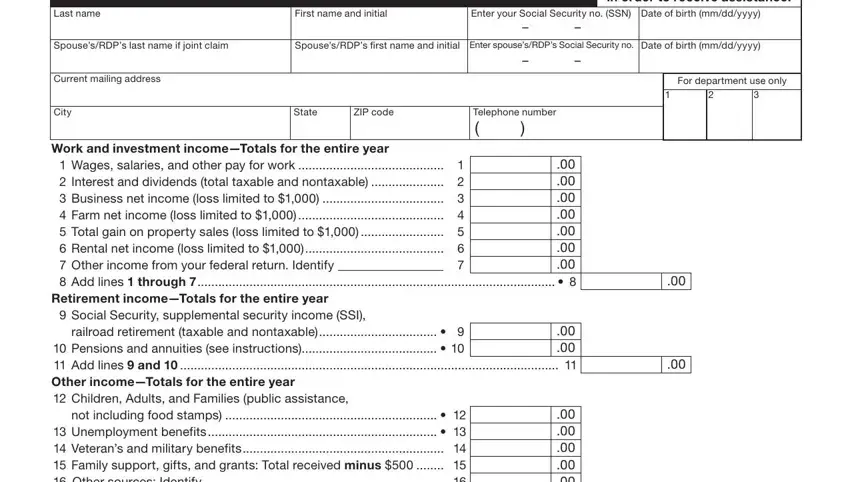

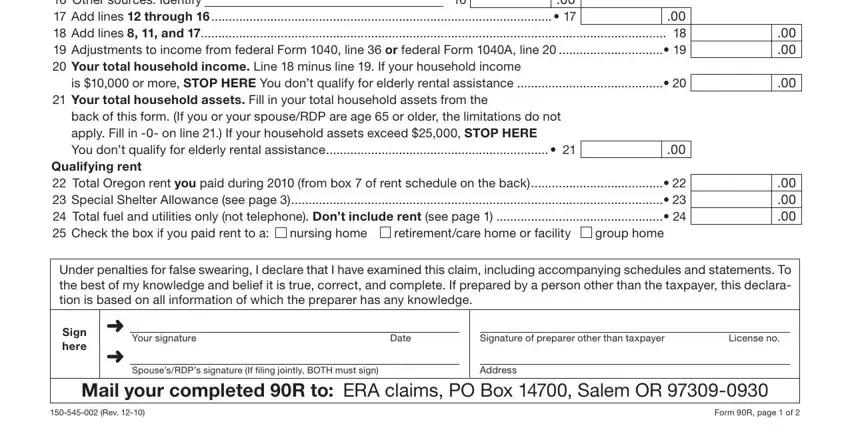

2. Soon after this section is done, go on to type in the relevant information in these - Work and investment incomeTotals, is or more STOP HERE You dont, back of this form If you or your, Qualifying rent Total Oregon rent, retirementcare home or facility, nursing home, group home, Under penalties for false swearing, Sign here, Your signature, Date, Signature of preparer other than, License no, SpousesRDPs signature If iling, and Address.

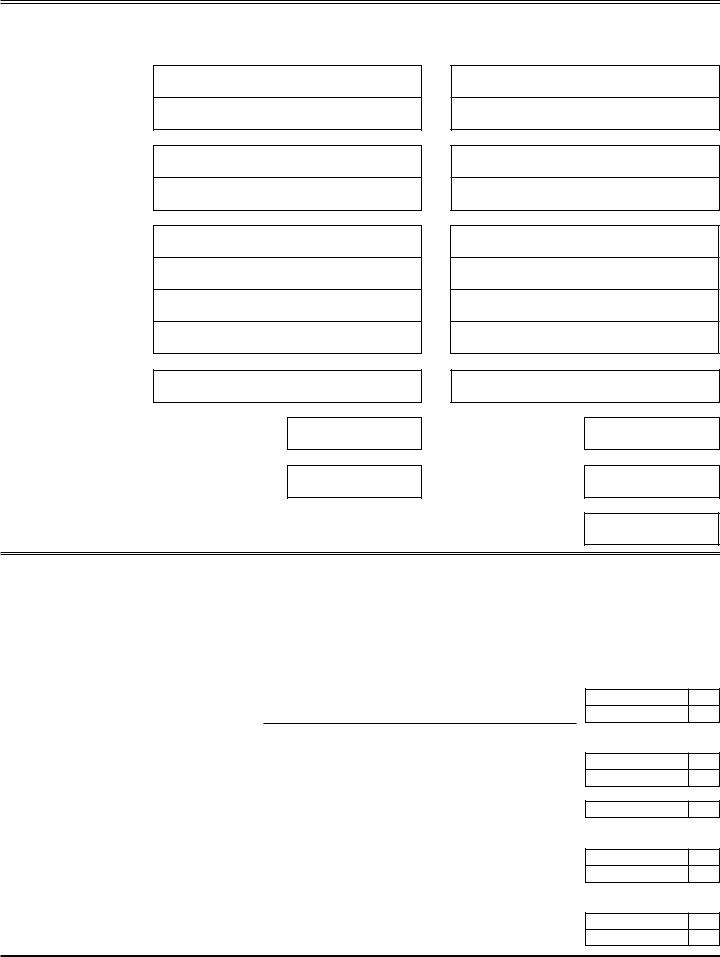

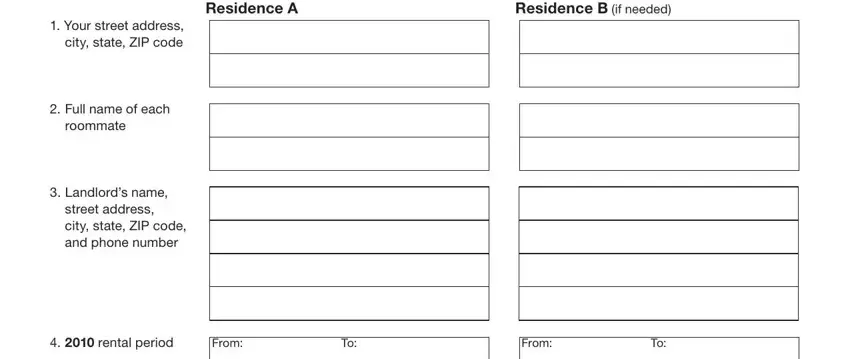

3. Within this part, examine Residence A, Residence B if needed, Your street address city state, Full name of each, roommate, Landlords name, street address city state ZIP code, rental period, From, and From. Each of these need to be taken care of with utmost precision.

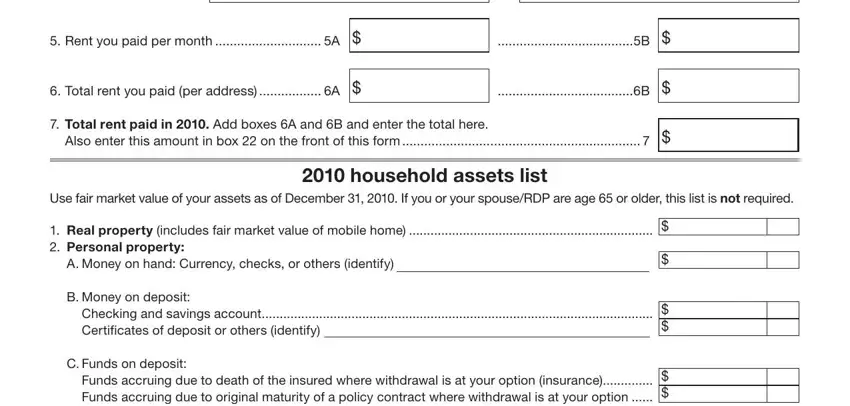

4. This next section requires some additional information. Ensure you complete all the necessary fields - Rent you paid per month A, Total rent you paid per address A, Total rent paid in Add boxes A, Use fair market value of your, household assets list, Real property includes fair, B Money on deposit, Checking and savings account, C Funds on deposit, and Funds accruing due to death of the - to proceed further in your process!

Those who use this PDF frequently make errors while filling out Real property includes fair in this part. Be certain to reread whatever you enter here.

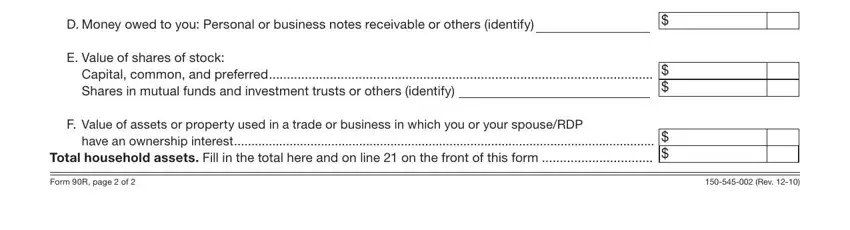

5. The pdf has to be completed by filling out this section. Here one can find a comprehensive set of blanks that require appropriate details to allow your document usage to be complete: D Money owed to you Personal or, E Value of shares of stock, Capital common and preferred, F Value of assets or property used, Form R page of, and Rev.

Step 3: Make sure that the details are accurate and click "Done" to complete the project. Right after setting up a7-day free trial account here, you'll be able to download oregon elderly rental assistance program or send it through email directly. The document will also be readily accessible in your personal account page with your modifications. We do not sell or share any information you enter when dealing with forms at our site.