when will form 8958 be available can be filled in effortlessly. Simply open FormsPal PDF tool to get it done without delay. In order to make our tool better and more convenient to use, we continuously come up with new features, taking into account suggestions from our users. With just a few simple steps, you may start your PDF editing:

Step 1: Access the PDF doc in our tool by clicking on the "Get Form Button" in the top section of this page.

Step 2: With this online PDF editing tool, you can accomplish more than merely fill out forms. Edit away and make your forms appear faultless with customized text added in, or modify the original content to perfection - all comes with an ability to insert stunning graphics and sign the PDF off.

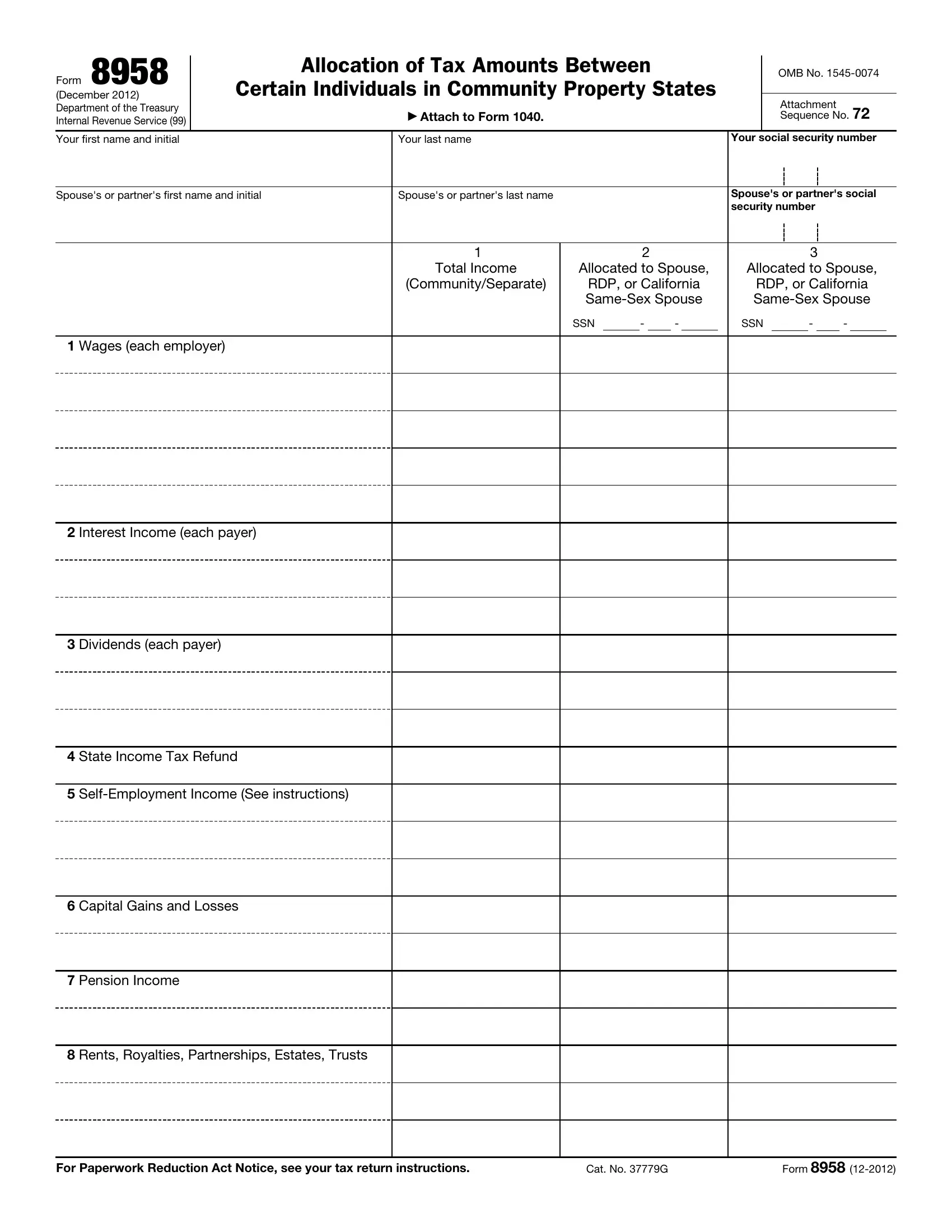

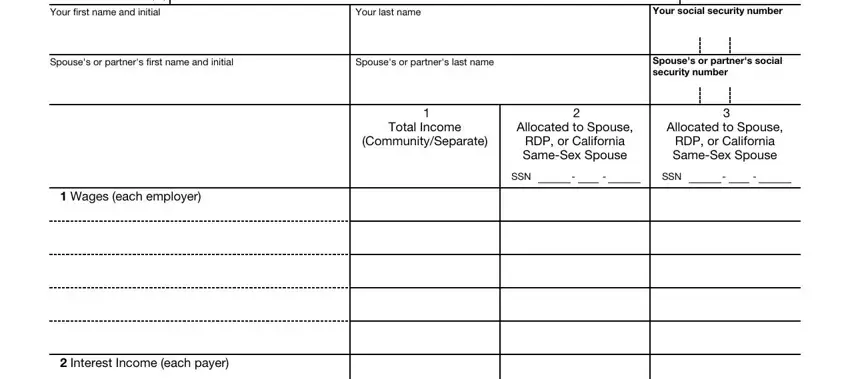

This PDF form will need particular details to be filled out, so you should definitely take whatever time to fill in precisely what is expected:

1. To start off, when completing the when will form 8958 be available, start in the area that contains the next blank fields:

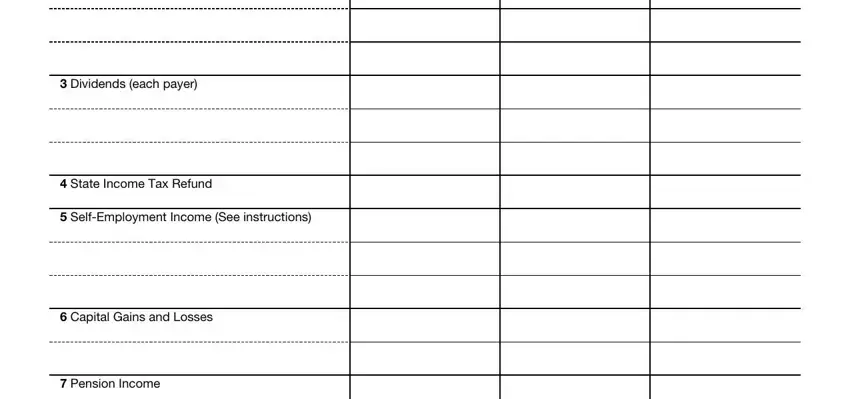

2. After completing the previous section, head on to the subsequent part and fill in the essential details in these blank fields - Dividends each payer, State Income Tax Refund, SelfEmployment Income See, Capital Gains and Losses, and Pension Income.

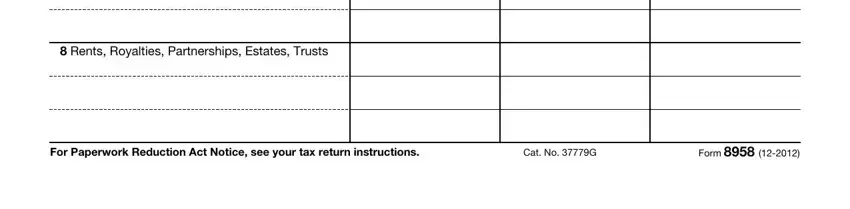

3. Completing Rents Royalties Partnerships, For Paperwork Reduction Act Notice, Cat No G, and Form is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

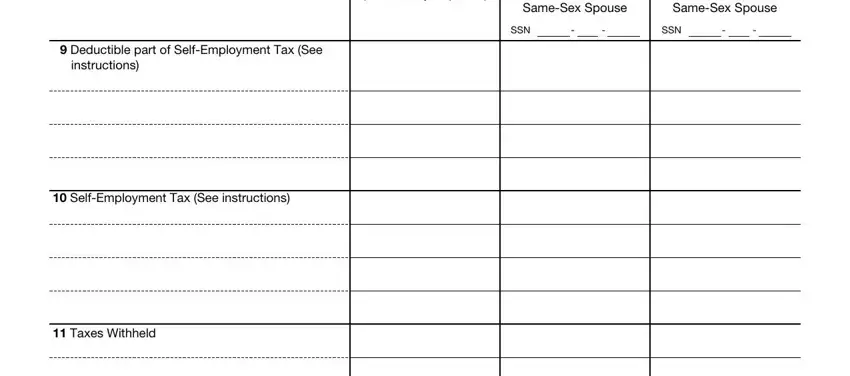

4. You're ready to complete the next part! Here you'll have these Deductible part of SelfEmployment, instructions, CommunitySeparate, Allocated to Spouse RDP or, Allocated to Spouse RDP or, SSN, SSN, SelfEmployment Tax See, and Taxes Withheld blanks to complete.

Concerning Allocated to Spouse RDP or and Deductible part of SelfEmployment, ensure you don't make any errors here. Both of these could be the most important ones in this form.

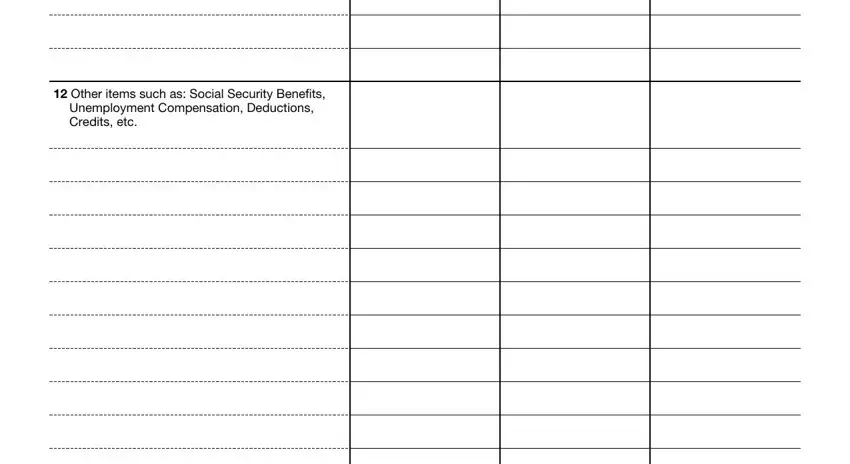

5. To finish your document, the last area involves a few extra blank fields. Filling out Other items such as Social, and Unemployment Compensation is going to wrap up everything and you're going to be done in a tick!

Step 3: Ensure the details are correct and then just click "Done" to progress further. Create a free trial subscription at FormsPal and gain direct access to when will form 8958 be available - accessible from your personal cabinet. FormsPal guarantees your data confidentiality by having a secure method that never saves or shares any personal information used. Be assured knowing your paperwork are kept protected any time you use our tools!