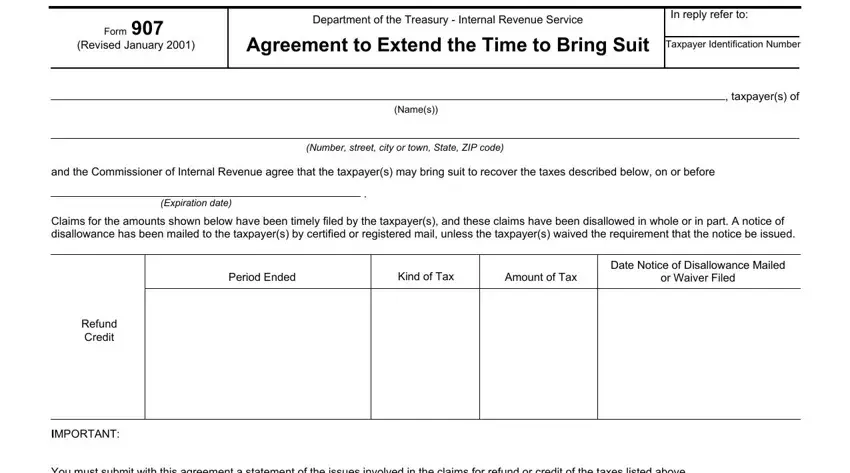

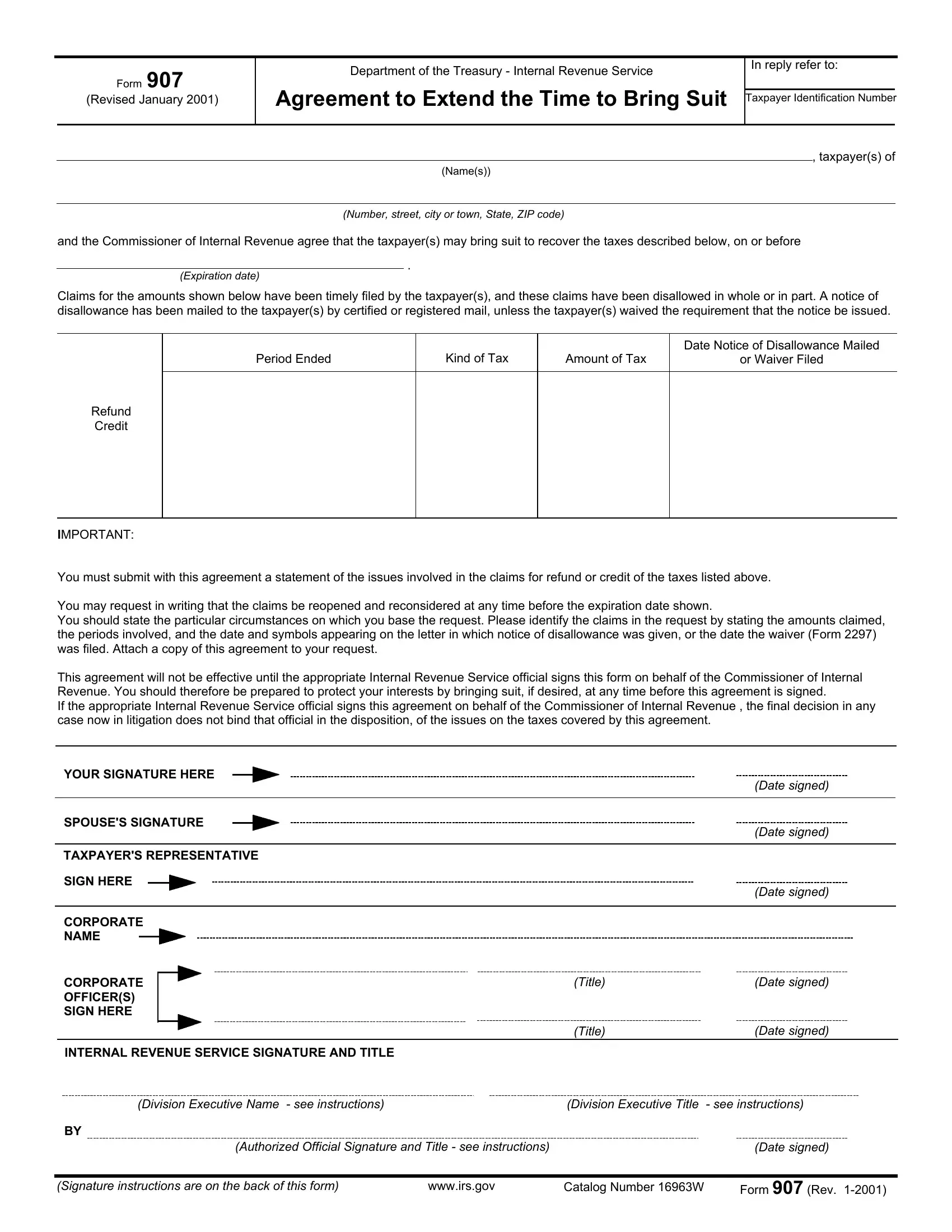

Form 907

(Revised January 2001)

Department of the Treasury - Internal Revenue Service |

In reply refer to: |

|

Agreement to Extend the Time to Bring Suit |

|

Taxpayer Identification Number |

|

|

|

, taxpayer(s) of |

(Name(s))

(Number, street, city or town, State, ZIP code)

and the Commissioner of Internal Revenue agree that the taxpayer(s) may bring suit to recover the taxes described below, on or before

.

(Expiration date)

Claims for the amounts shown below have been timely filed by the taxpayer(s), and these claims have been disallowed in whole or in part. A notice of disallowance has been mailed to the taxpayer(s) by certified or registered mail, unless the taxpayer(s) waived the requirement that the notice be issued.

Date Notice of Disallowance Mailed

or Waiver Filed

IMPORTANT:

You must submit with this agreement a statement of the issues involved in the claims for refund or credit of the taxes listed above.

You may request in writing that the claims be reopened and reconsidered at any time before the expiration date shown.

You should state the particular circumstances on which you base the request. Please identify the claims in the request by stating the amounts claimed, the periods involved, and the date and symbols appearing on the letter in which notice of disallowance was given, or the date the waiver (Form 2297) was filed. Attach a copy of this agreement to your request.

This agreement will not be effective until the appropriate Internal Revenue Service official signs this form on behalf of the Commissioner of Internal Revenue. You should therefore be prepared to protect your interests by bringing suit, if desired, at any time before this agreement is signed.

If the appropriate Internal Revenue Service official signs this agreement on behalf of the Commissioner of Internal Revenue , the final decision in any case now in litigation does not bind that official in the disposition, of the issues on the taxes covered by this agreement.

YOUR SIGNATURE HERE

(Date signed)

SPOUSE'S SIGNATURE

(Date signed)

TAXPAYER'S REPRESENTATIVE

SIGN HERE

(Date signed)

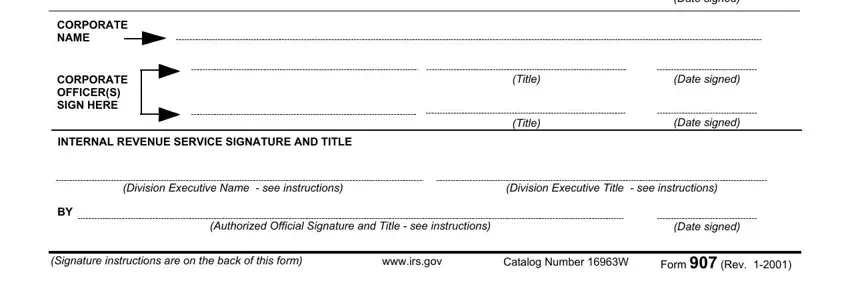

CORPORATE

NAME

CORPORATE OFFICER(S)

SIGN HERE

|

|

|

(Title) |

(Date signed) |

|

|

INTERNAL REVENUE SERVICE SIGNATURE AND TITLE |

|

|

|

|

|

(Division Executive Name - see instructions) |

|

(Division Executive Title |

- see instructions) |

|

|

BY |

|

|

|

|

|

(Authorized Official Signature and Title - see instructions) |

|

(Date signed) |

|

|

|

|

|

|

|

(Signature instructions are on the back of this form) |

www.irs.gov |

Catalog Number 16963W |

Form 907 (Rev. 1-2001) |

|

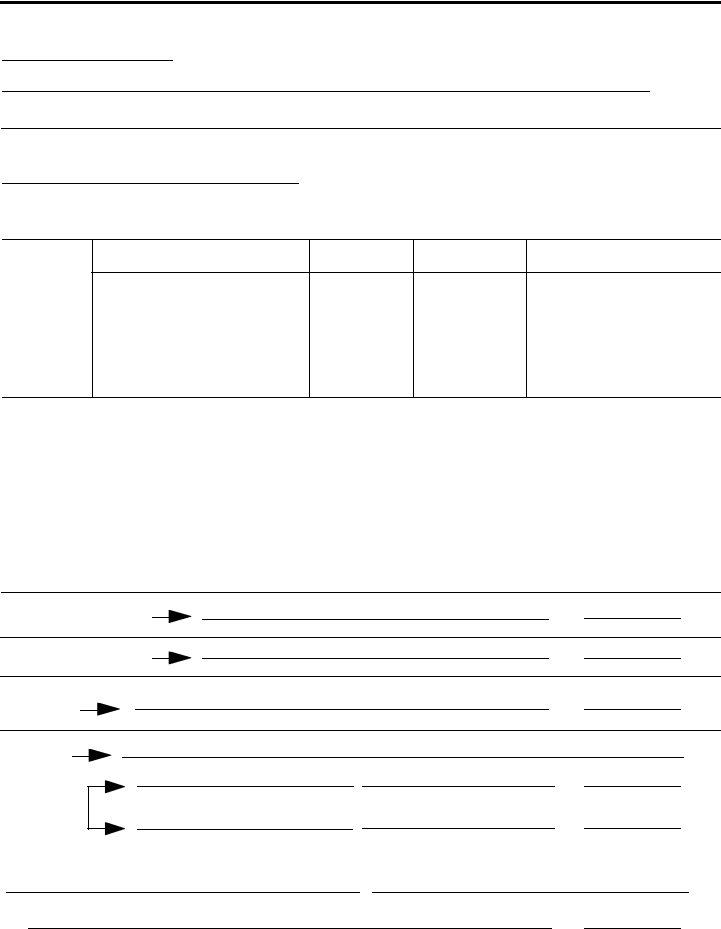

Instructions

If this agreement is for any year(s) you filed a joint return, both husband and wife must sign the original and copy of this form unless one, acting under a power of attorney, signs as agent for the other. The signatures must match the names as they appear on this form.

If you are an attorney or agent of the taxpayer(s), you may sign this agreement provided the action is specifically authorized by a power of attorney. If you didn't previously file the power of attorney, please include it with this form.

If you are acting as a fiduciary (such as executor, administrator, trustee, etc.) and you sign this agreement, also attach a completed Form 56, Notice Concerning Fiduciary Relationship, if you haven't already filed one.

If the taxpayer is a corporation, sign this agreement with the corporate name followed by the signature and title of the officer(s) authorized to sign.

Instructions for Internal Revenue Service Employees

Complete the Division Executive's name and title depending upon your division.

If you are in the Small Business /Self-Employed Division, enter the name and title for the appropriate division executive for your business unit (e.g., Area Director for your area; Director, Compliance Policy; Director, Compliance Services).

If you are in the Wage and Investment Division, enter the name and title for the appropriate division executive for your business unit (e.g., Area Director for your area; Director, Field Compliance Services).

If you are in the Large and Mid-Size Business Division, enter the name and title of the Director, Field Operations for your industry.

If you are in the Tax Exempt and Government Entities Division, enter the name and title for the appropriate division executive for your business unit (e.g., Director, Exempt Organizations; Director, Employee Plans; Director, Federal, State and Local Governments; Director, Indian Tribal Governments; Director, Tax Exempt Bonds).

If you are in Appeals, enter the name and title of the appropriate Director, Appeals Operating Unit.

The signature and title line will be signed and dated by the appropriate authorized official within your division.

Catalog Number 16963W |

Form 907 (Rev. 1-2001) |