You are able to fill out OMB instantly by using our online PDF tool. Our development team is continuously working to enhance the tool and help it become even faster for people with its cutting-edge functions. Enjoy an ever-evolving experience now! Getting underway is simple! All you have to do is follow the following simple steps directly below:

Step 1: Open the PDF doc in our tool by pressing the "Get Form Button" above on this webpage.

Step 2: This tool provides the opportunity to work with PDF files in a variety of ways. Transform it with customized text, adjust what is already in the PDF, and place in a signature - all at your fingertips!

This form will require you to type in specific information; in order to ensure accuracy and reliability, remember to adhere to the subsequent suggestions:

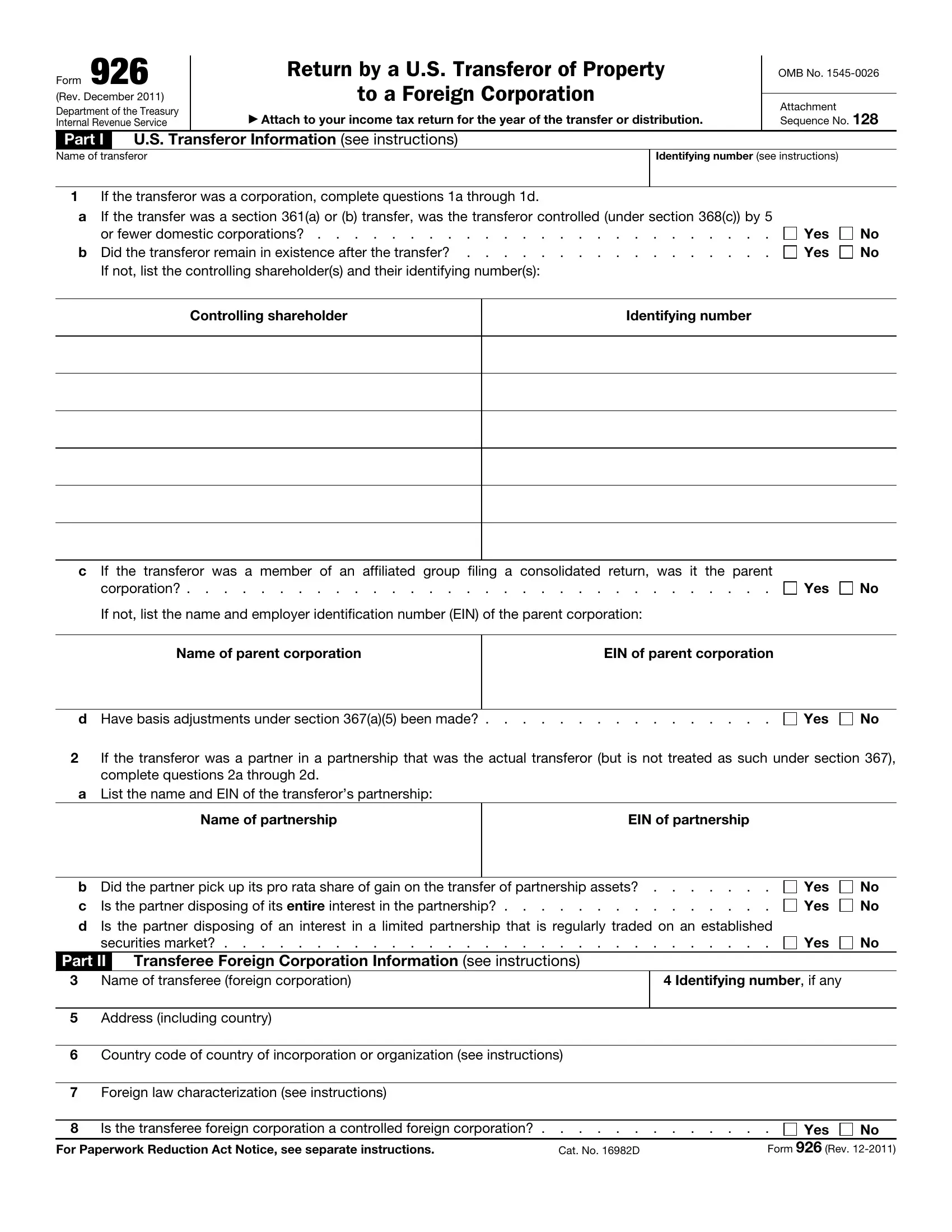

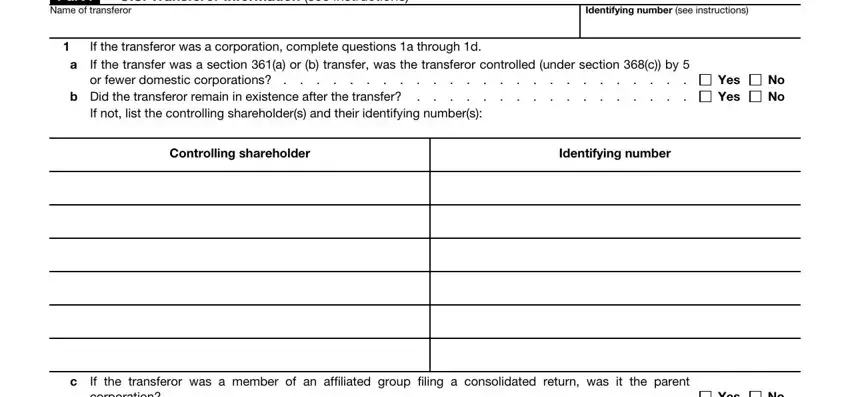

1. The OMB needs particular information to be entered. Be sure the next blank fields are filled out:

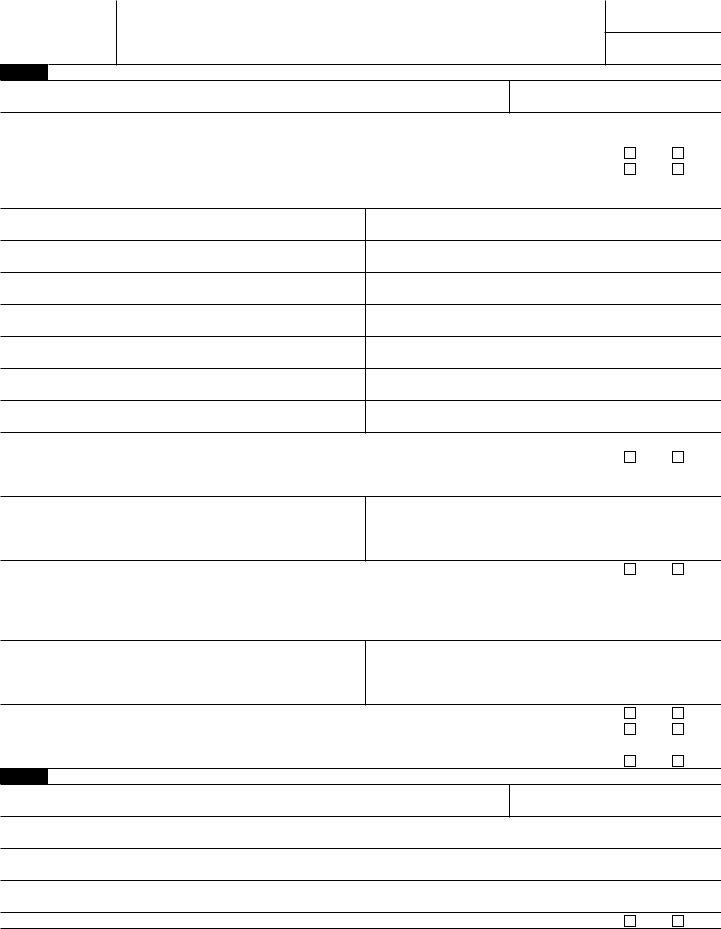

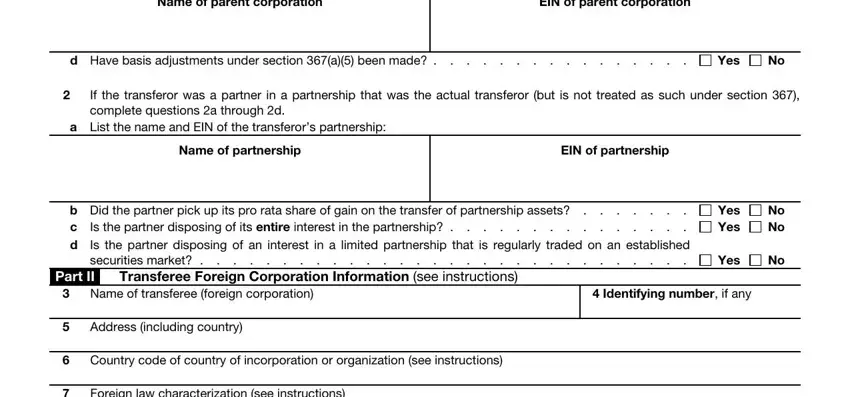

2. When this array of fields is complete, it is time to include the needed particulars in Name of parent corporation, EIN of parent corporation, d Have basis adjustments under, Yes, If the transferor was a partner in, a List the name and EIN of the, Name of partnership, EIN of partnership, b Did the partner pick up its pro, Yes Yes, No No, Is the partner disposing of an, Transferee Foreign Corporation, Part II, and Yes so that you can go further.

3. This subsequent segment is relatively simple, Foreign law characterization see, Is the transferee foreign, For Paperwork Reduction Act Notice, Cat No D, Yes, and Form Rev - all these empty fields is required to be completed here.

It is easy to make errors when filling out the Is the transferee foreign, therefore be sure to go through it again before you finalize the form.

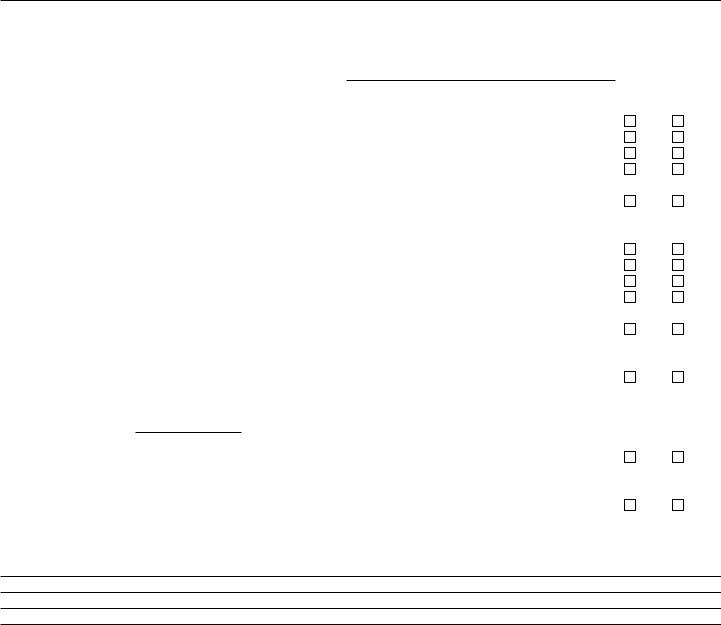

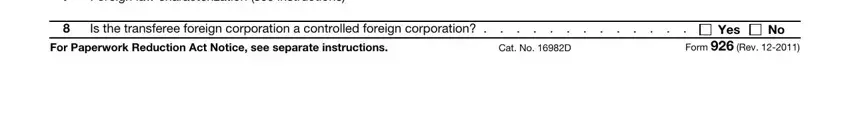

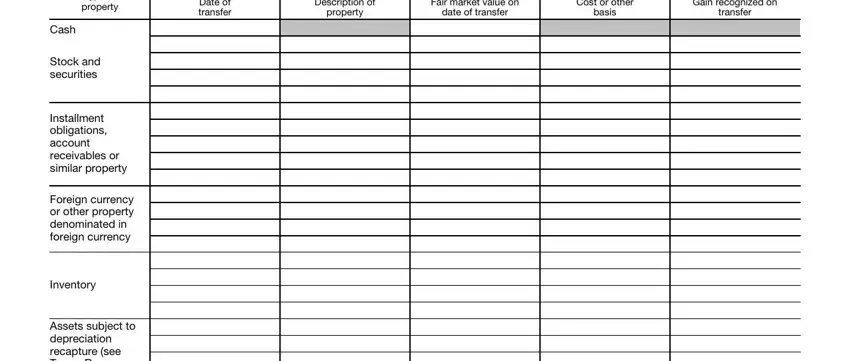

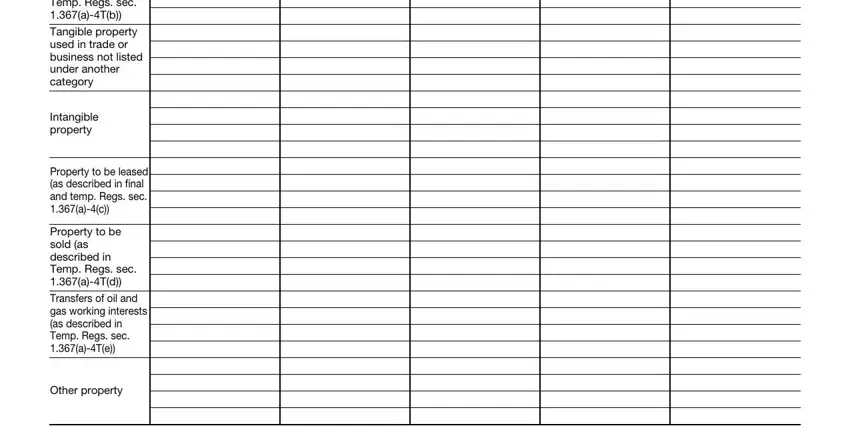

4. The following paragraph needs your information in the following places: Date of transfer, Description of, property, Fair market value on, date of transfer, Cost or other, basis, Gain recognized on, transfer, Type of property, Cash, Stock and securities, Installment obligations account, Foreign currency or other property, and Inventory. It is important to enter all of the needed details to go onward.

5. The document needs to be completed by filling in this section. Further you'll see a detailed listing of blanks that require correct details for your document submission to be faultless: Assets subject to depreciation, Intangible property, Property to be leased as described, Property to be sold as described, and Other property.

Step 3: Make certain the details are correct and then click on "Done" to continue further. After creating a7-day free trial account here, it will be possible to download OMB or send it via email directly. The document will also be readily accessible from your personal account menu with all of your changes. When you work with FormsPal, you'll be able to fill out documents without stressing about personal data incidents or data entries getting shared. Our protected software ensures that your private data is kept safe.