|

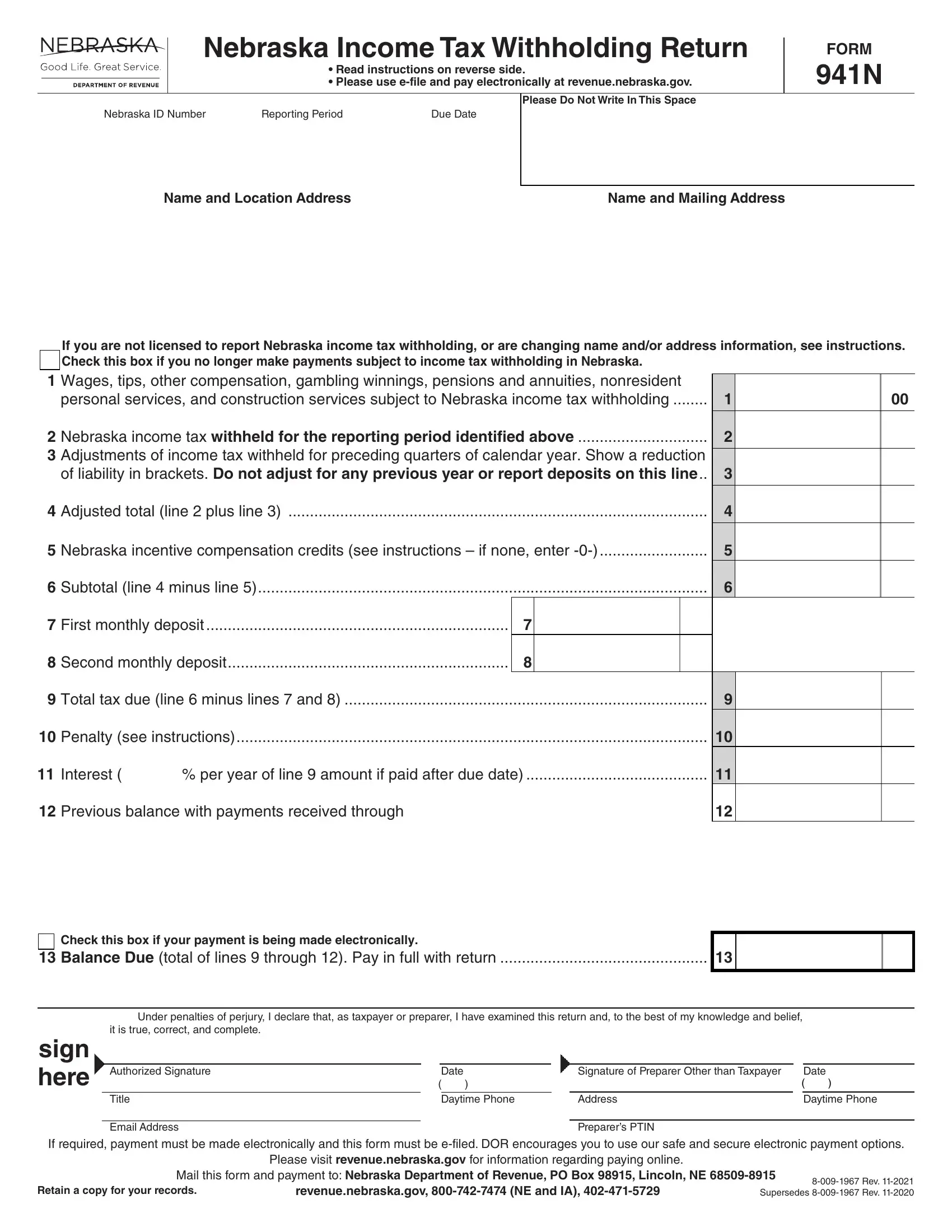

Who Must File. A taxpayer must file a Form 941N if: |

The former owner, partnership, LLC, or corporation must cancel all |

|

1. You have an office or conduct business in Nebraska, and pay |

permits, licenses, and certificates by filing Nebraska Change Request, |

|

wages, gambling winnings; or |

Form 22. |

|

2. You make payments to nonresidents performing personal |

Penalty and Interest. There are penalties and interest for failing |

|

services in Nebraska; or |

to timely remit income tax withheld. The penalty is 5% per month or |

|

3. You have an office or conduct business in Nebraska and pay |

fraction of a month the return is late, up to 25%, of the tax due amount. |

|

pensions or annuities to Nebraska residents who request that you |

A $25 penalty can also be levied for failing to timely file Form 941N. |

|

withhold Nebraska income tax from those payments; or |

Interest is calculated from the due date to the date the payment |

|

4. You are required to withhold Nebraska income tax from |

is received. Refer to Revenue Ruling 99-20-2 and Regulation 21-016 |

|

construction contractors. |

for applicable interest rates and additional information. |

|

Prior to filing any deposits or returns: |

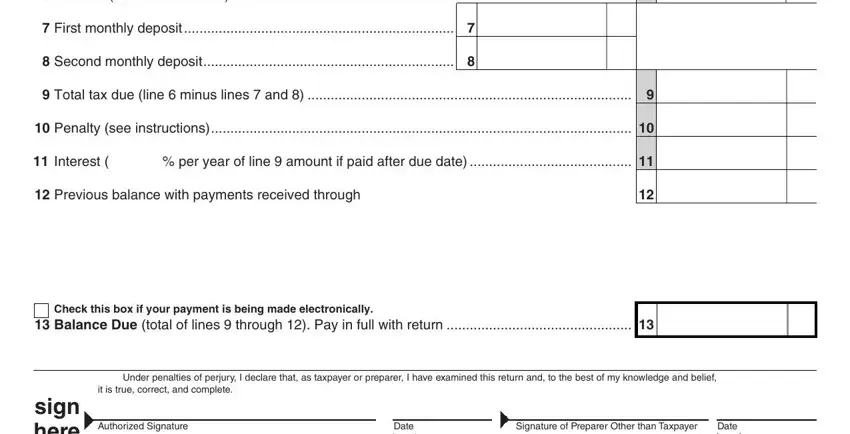

Monthly Deposits, Form 501N. If the Nebraska income tax |

|

1. You must apply for a Nebraska income tax withholding number |

|

withheld is more than $500 for the first or second month in a quarter, |

|

on a Nebraska Tax Application, Form 20; so that |

|

you must make a monthly deposit. If you make the payment |

|

2. An income tax withholding certificate will be issued by the |

|

electronically, do not file Form 501N. |

|

Nebraska Department of Revenue (DOR); and |

|

If a monthly deposit is required for the first month of a calendar |

|

3. A Form 941N must be e-filed or mailed to DOR. DOR will |

|

quarter, a deposit for the second month is also required, even if the |

|

not mail the Form 941N to anyone required to pay and file |

|

amount of income tax withheld is not more than $500. |

|

electronically or to anyone who has e-filed Form 941N for a |

|

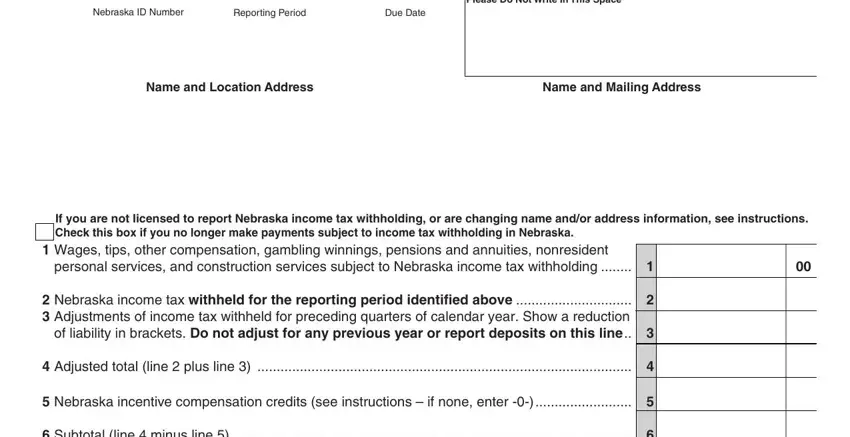

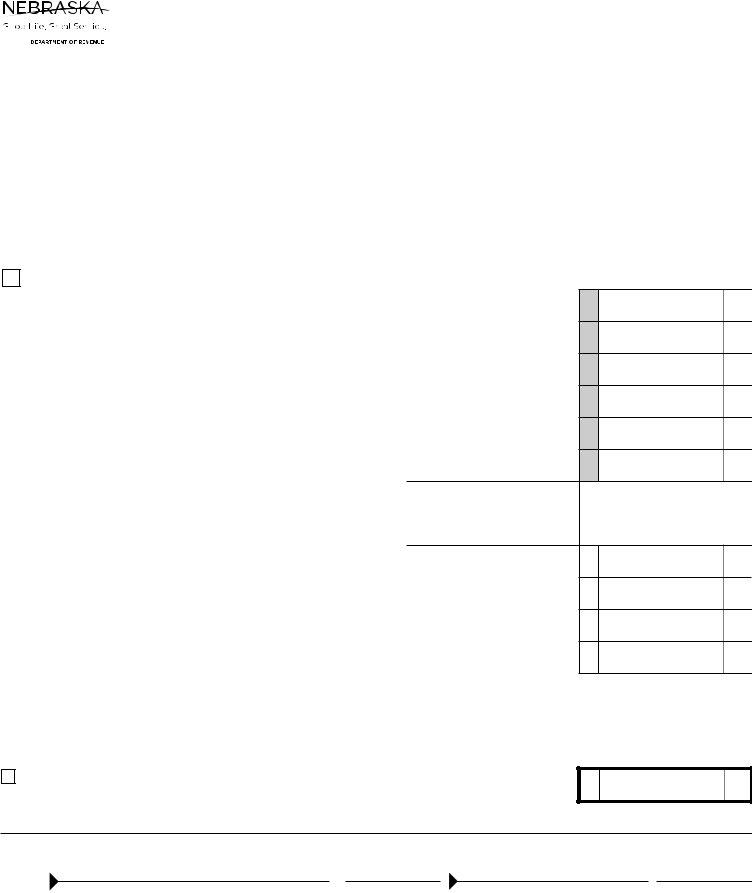

Line 1. Enter the amount of wages paid this quarter. If a prior period's |

|

prior quarter. If you have questions about electronic filing or |

|

payment options, visit revenue.nebraska.gov. |

wages were reported incorrectly, it is not necessary to file an amended |

|

Even if you temporarily do not have payments or income tax |

Form 941N. Refer to the Form W-3N instructions to report wages paid |

|

during the entire tax year. See line 3 instructions if the income tax |

|

withholding to report, Form 941N must be filed for each reporting |

|

withholding was reported incorrectly. |

|

period. See the Nebraska Circular EN for more information. |

|

Line 2. Enter the total amount of income tax withheld for Nebraska |

|

Cancelling an Account. If you are no longer making payments |

|

subject to Nebraska income tax withholding, check the box |

during the tax period. |

|

immediately below your name and location address. A final Nebraska |

Line 3. Adjustment of Income Tax Withheld (Quarterly |

|

Reconciliation of Income Tax Withheld, Form W-3N, will be mailed |

Filers). Use line 3 to correct errors in income tax withheld from |

|

to you. The Form W-3N must be filed even if you did not make any |

payments paid in earlier quarters of the same calendar year. When |

|

payments subject to Nebraska income tax withholding. |

paper filing, explain by attaching a statement that shows: |

|

Annual Filers. If the Nebraska income tax you withhold is less than |

1. What the error was; |

|

$500 a year, you may be licensed to file on an annual basis. Annual |

2. The quarter in which the error was made; |

|

filers may e-file or file the preidentified paper Form 941N. Only lines |

3. The amount of the error for each quarter; |

|

1 and 2 must be completed. |

4. The quarter when you found the error; and |

|

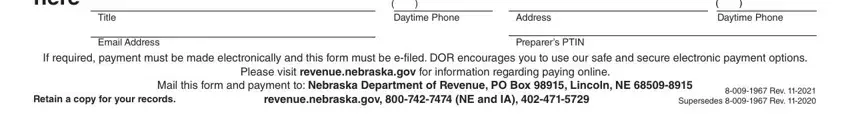

Filing and Payment Information. Start with the first calendar |

5. How you and your payees have settled any overcollection or |

|

quarter or year in which you are required to withhold state income tax. |

undercollection. If you are adjusting income tax withholding |

|

Quarterly returns are due the last day of the month following the close |

for a qualified military spouse, see revenue.nebraska.gov. Under |

|

of the quarter. |

“For Businesses,” click on “Income Tax Withholding.” From this |

|

If DOR has assigned you an annual filing status, your return is due by |

page, click on “Nebraska Income Tax for U.S. Servicemembers, |

|

Their Spouses, and Civilians Working with U.S. Forces.” |

|

January 31 of the following year. |

|

Do not use line 3 to adjust income tax withholding for earlier years. |

|

A Form 941N is required even if no payments were made that were |

|

subject to income tax withholding. Paper filers should mail this return |

If you have requested that an overpayment from a previous year’s |

|

with payment to the Nebraska Department of Revenue, PO Box 98915, |

Form W-3N be transferred to this year, do not use the resulting |

|

Lincoln, Nebraska 68509-8915. |

credit until it appears on the previous balance line of Form 941N. |

|

All taxpayers are encouraged to pay and file electronically the Nebraska |

Line 5. This credit is only available to taxpayers under the Nebraska |

|

income tax they have withheld. See revenue.nebraska.gov for these |

Advantage Act or the Invest Nebraska Act who have completed their |

|

options. Checks written to DOR may be presented for payment |

qualification audit and have earned compensation or wage benefit |

|

electronically. Taxpayers may be mandated to pay and file returns |

credits and taxpayers under the ImagiNE Nebraska Act who have |

|

electronically. You will be notified in writing if this requirement |

previously filed a an ImagiNE Nebraska Act Incentive Computation, |

|

applies to you. |

Form 1107N showing that they have achieved levels and earned |

|

Preidentified Return. This return is to be used only by the employer |

compensation credits. The amount of credits used against income |

|

or payor whose name is printed on it. If you have not received a return |

tax withholding cannot exceed the lesser of income tax withholding |

|

for the tax period, and will be filing a paper return, visit DOR’s website |

attributable to new employees at the qualified project or qualified |

|

to print a Form 941N. Complete the ID number, tax period, name, and |

location, or the amount of credit reported on the taxpayer’s income |

|

address information. DOR will not mail Form 941N to anyone required |

tax return and carried forward into the quarter. Attach the Incentive |

|

to pay and file returns electronically, or to anyone who has e-filed |

Withholding Worksheet. When e-filing, this credit is shown on line 4 |

|

Form 941N for a prior quarter. Paper filers, review line 12 to determine |

of Form 941N. DOR will not allow this credit to offset an income tax |

|

if a previous balance or credit exists when filing a paper return. When |

liability until a 0.5% administrative fee is paid on the amount of credit |

|

e-filing, check line 6 to determine if a previous balance or credit exists. |

used. The fee is computed on an ImagiNE Nebraska Act Payment |

|

Name and/or Address Changes. If the business name, location, or |

of Fees for Incentive Credit Use, Form 1107F. The Form 1107F |

|

mailing address is not correct, strike through the incorrect information |

must be filed with DOR and the fee is to be paid separately from the |

|

and plainly print the correct information. If you e-file, mailing name |

Form 941N. |

|

and address changes can be made during e-filing. Location name and |

Line 12. A balance due or credit resulting from a partial payment, |

|

address changes must be made by completing a Nebraska Change |

math or clerical errors, penalty, or interest on prior returns may be |

|

Request, Form 22. Note: If you are licensed for sales tax under this |

entered in this space by DOR. The interest shown includes interest |

|

same number, the location address must be the same one used for the |

on the unpaid income tax withholding calculated through the due date |

|

sales tax permit (cannot be a PO Box number). |

of this return. If the amount owed is paid before the due date, interest |

|

If this is a name change only, and the ownership or FEIN number has |

will be recomputed and credit will be given on your next return. If |

|

not changed, indicate “Name change only.” If this is: an ownership |

the amount entered by DOR has been satisfied by a prior payment, it |

|

transfer or change; a change in legal form; or your Federal ID number |

should be disregarded when calculating line 13. |

|

has changed – the new owner, partnership, LLC, or corporation |

Contact DOR if you have questions regarding a credit or balance due. |

|

must complete and return a Nebraska Tax Application, Form 20. |

When e-filing, a previous balance is shown on line 6 of Form 941N. |