Working with PDF forms online is definitely a piece of cake with our PDF editor. You can fill out mo form 948 here and try out various other functions available. Our team is focused on providing you the ideal experience with our editor by continuously introducing new features and enhancements. Our tool has become a lot more useful thanks to the newest updates! Currently, editing PDF documents is easier and faster than ever. Starting is effortless! All that you should do is follow these basic steps down below:

Step 1: First of all, access the pdf editor by clicking the "Get Form Button" above on this webpage.

Step 2: When you start the tool, you will notice the document made ready to be completed. Besides filling out different fields, it's also possible to do other sorts of actions with the file, such as writing your own words, changing the initial textual content, inserting illustrations or photos, putting your signature on the form, and much more.

Be attentive when filling in this document. Ensure that each blank field is filled in properly.

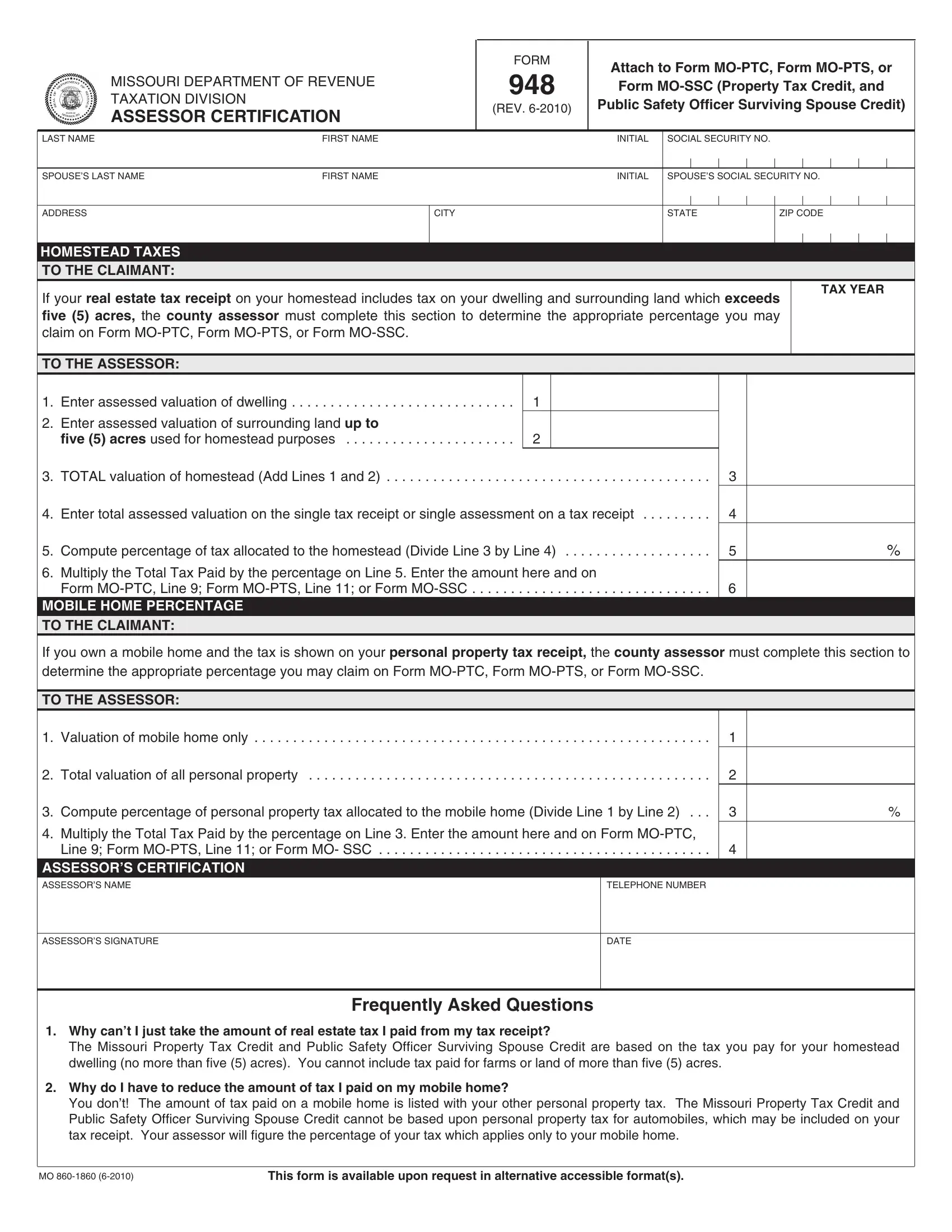

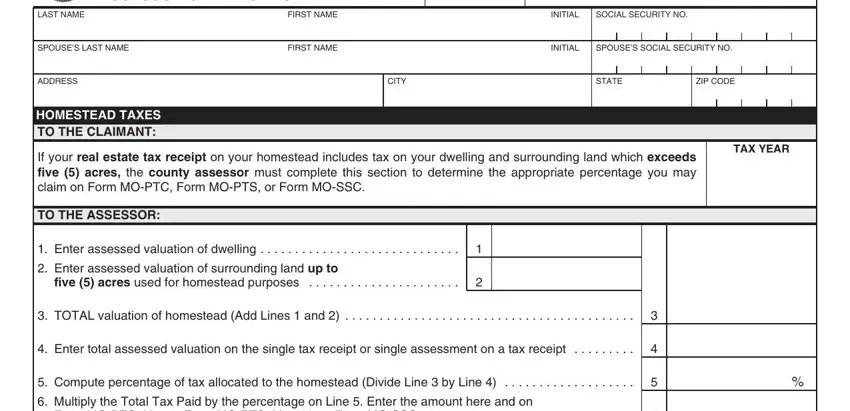

1. To begin with, when filling in the mo form 948, start out with the part that features the next fields:

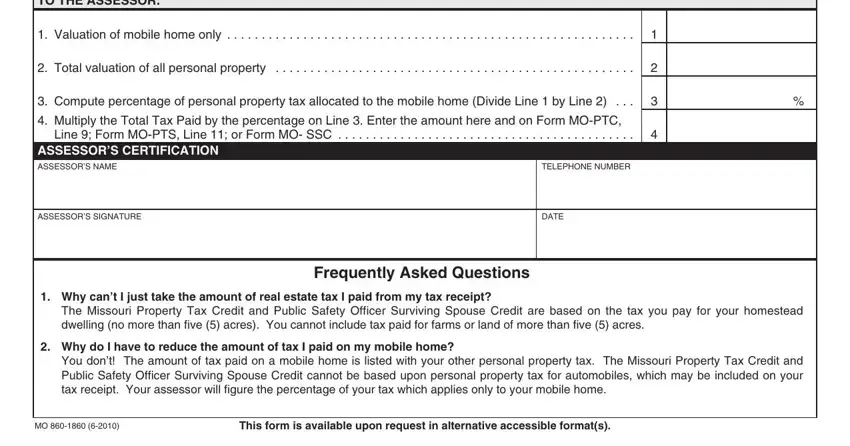

2. Just after completing the previous part, head on to the subsequent part and enter all required details in all these blank fields - TO THE ASSESSOR, Valuation of mobile home only, Total valuation of all personal, Compute percentage of personal, Multiply the Total Tax Paid by, Line Form MOPTS Line or Form MO, ASSESSORS CERTIFICATION ASSESSORS, ASSESSORS SIGNATURE, TELEPHONE NUMBER, DATE, Frequently Asked Questions, Why cant I just take the amount, The Missouri Property Tax Credit, Why do I have to reduce the, and You dont The amount of tax paid on.

Many people frequently get some points wrong when completing ASSESSORS CERTIFICATION ASSESSORS in this area. You need to review what you enter right here.

Step 3: Always make sure that your information is accurate and simply click "Done" to continue further. Right after creating afree trial account at FormsPal, it will be possible to download mo form 948 or send it via email right off. The PDF will also be accessible via your personal cabinet with all of your adjustments. FormsPal is focused on the privacy of our users; we make sure all information entered into our system remains confidential.