form 910 can be completed in no time. Just make use of FormsPal PDF editor to complete the job quickly. To make our tool better and more convenient to work with, we consistently work on new features, with our users' suggestions in mind. It merely requires a couple of simple steps:

Step 1: First, access the editor by pressing the "Get Form Button" in the top section of this site.

Step 2: Once you access the PDF editor, you'll see the form all set to be filled out. Aside from filling in different blank fields, you could also do other sorts of actions with the form, namely adding your own words, editing the original text, inserting illustrations or photos, affixing your signature to the form, and a lot more.

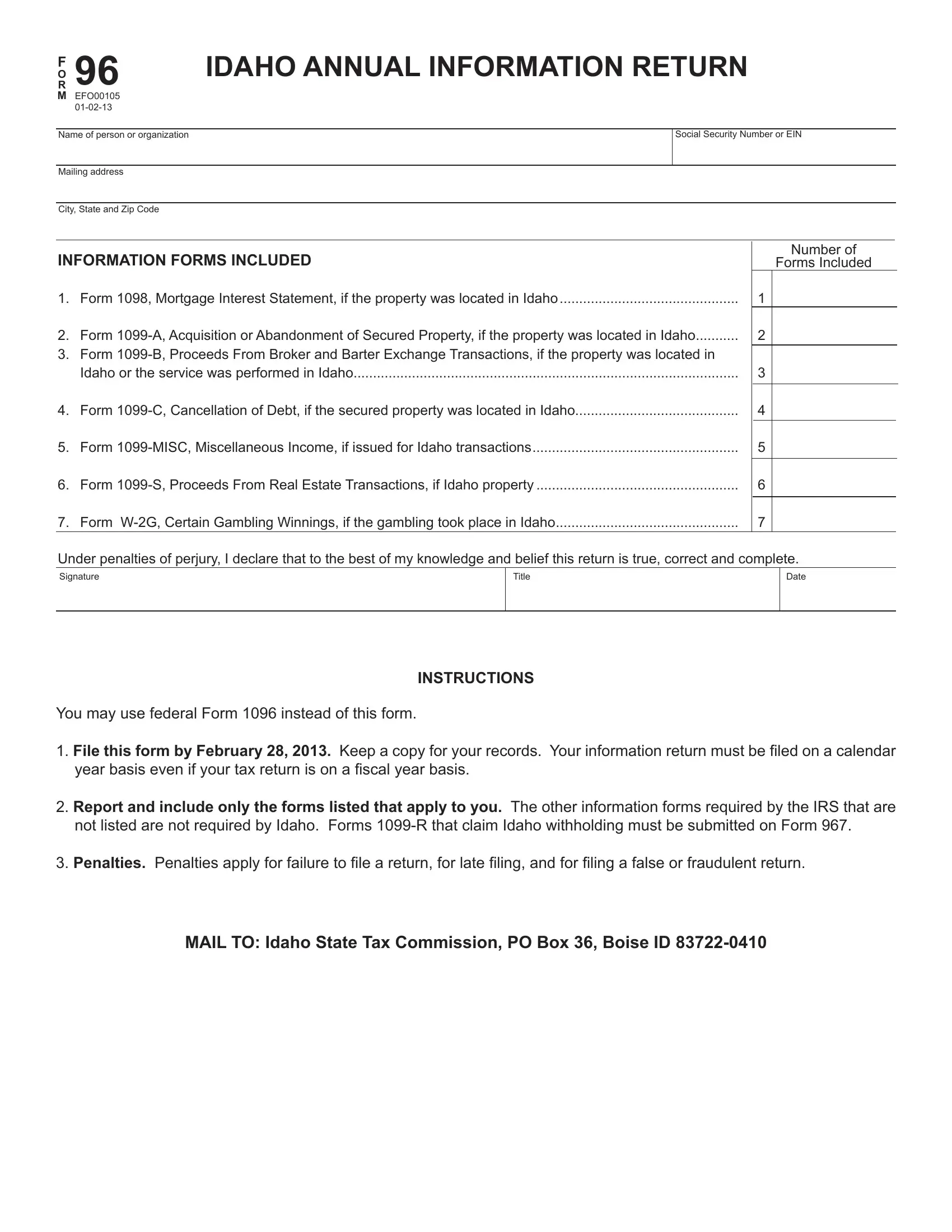

This document will involve some specific details; to ensure consistency, please make sure to heed the following tips:

1. When completing the form 910, be certain to incorporate all essential fields in the relevant form section. It will help to facilitate the work, making it possible for your information to be handled without delay and appropriately.

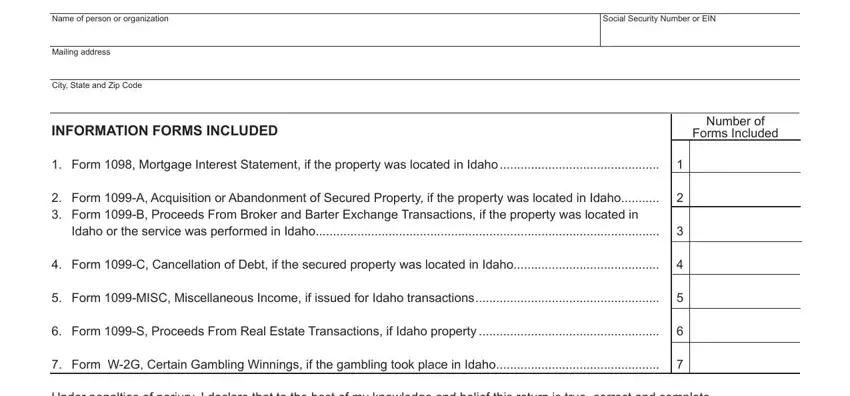

2. Right after finishing the previous step, go on to the next step and fill in all required particulars in these blanks - Under penalties of perjury I, Signature, Title, You may use federal Form instead, INSTRUCTIONS, File this form by February Keep, year basis even if your tax return, Report and include only the forms, not listed are not required by, Penalties Penalties apply for, and MAIL TO Idaho State Tax Commission.

A lot of people frequently make some mistakes when filling in MAIL TO Idaho State Tax Commission in this part. Remember to reread everything you enter here.

Step 3: Proofread the details you've inserted in the blank fields and click the "Done" button. Sign up with FormsPal right now and instantly access form 910, all set for downloading. All modifications you make are saved , allowing you to modify the form later on anytime. FormsPal guarantees your information confidentiality by using a secure method that in no way saves or shares any kind of personal information involved in the process. You can relax knowing your paperwork are kept protected each time you use our services!