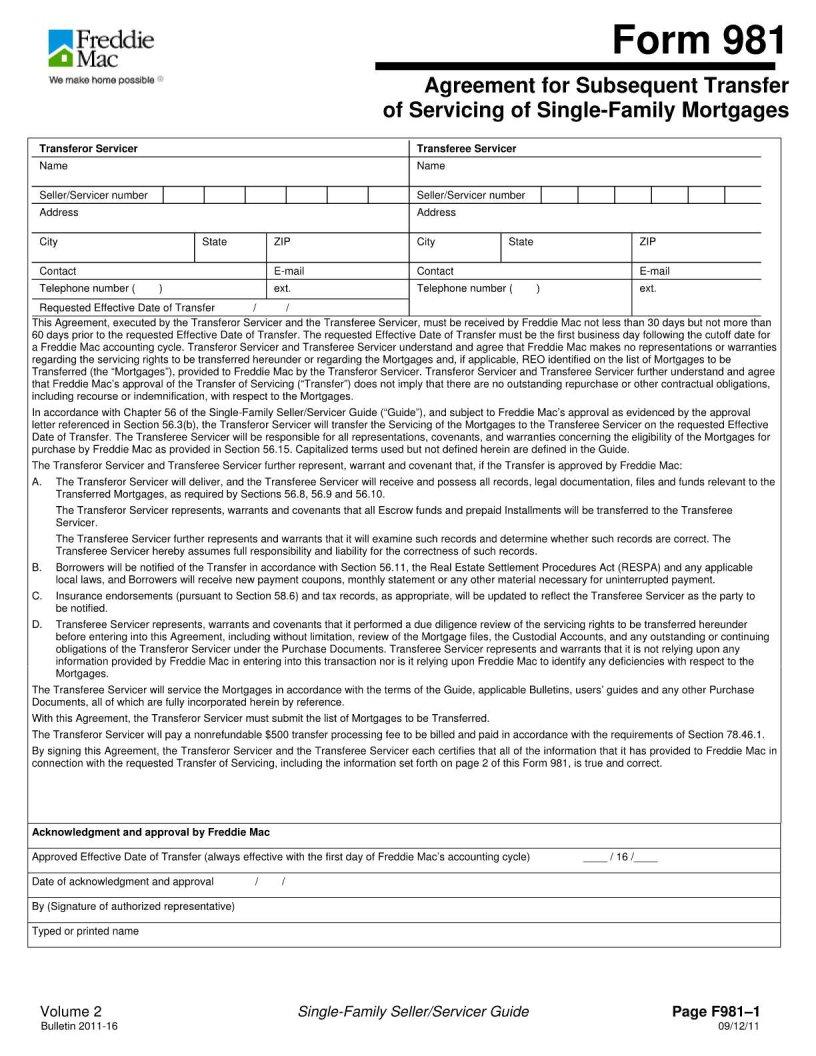

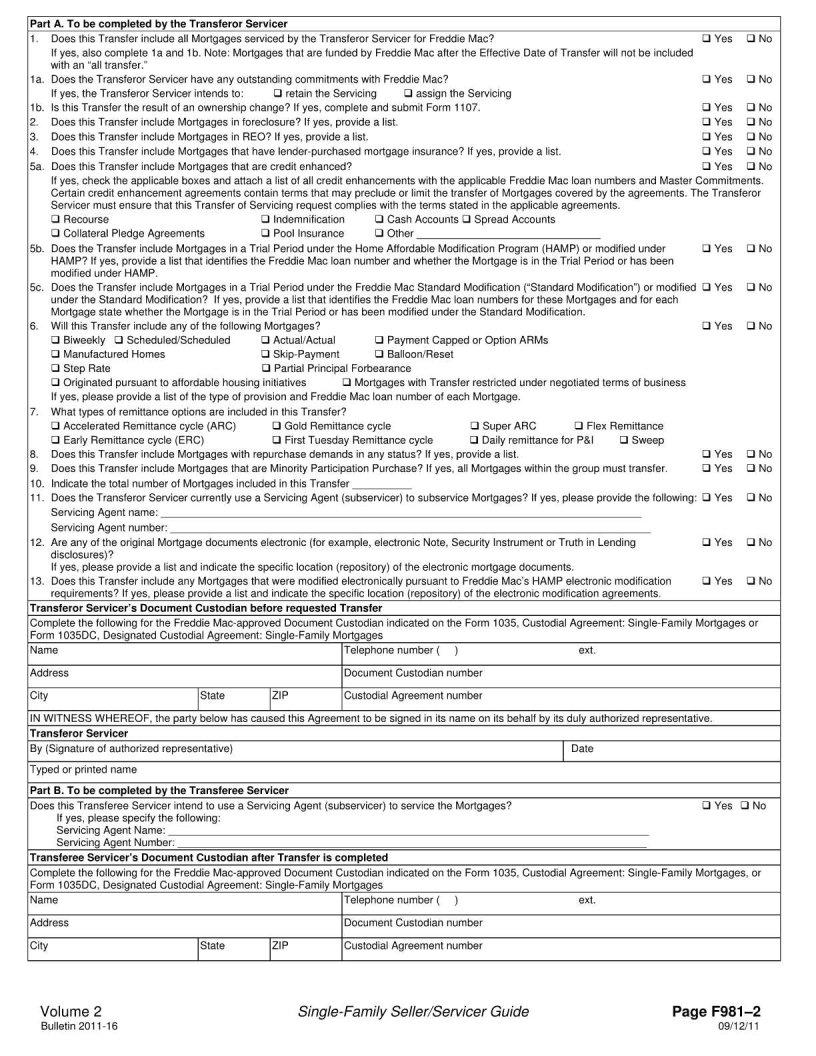

In navigating the complexities of tax compliance, individuals and businesses alike encounter various forms, each serving a pivotal role in the financial reporting landscape. Among these, the 981 form emerges as a critical document, designed to streamline processes and ensure accuracy in reporting specific transactions. This form, while not universally applicable, plays a significant role for those it impacts, serving as a bridge between straightforward tax reporting and the nuanced requirements set forth by tax authorities. The significance of the 981 form lies not just in its function but also in its ability to provide clarity and structure in areas of tax reporting that might otherwise be prone to oversight or error. By meticulously capturing data pertaining to certain transactions, it aids in the preservation of financial integrity while simultaneously offering a clear pathway for compliance. Thus, understanding the major aspects of the 981 form is not just about navigating tax obligations; it's about embracing an essential tool in the broader quest for fiscal responsibility and transparency.

| Question | Answer |

|---|---|

| Form Name | Form 981 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | ERC, irs form 981, Servicer, 1035DC |