Form 981 is an important form that must be filed in order to report a Cancellation of Debt (COD) transaction. A COD transaction can occur when a business or individual repays a loan, forgiveness of the debt, or a foreclosure on property. Filing Form 981 is necessary to determine if the transaction is taxable. There are specific instructions for filing Form 981, and it is important to ensure all information is included so that the IRS can make an accurate determination. The deadline for filing this form is generally 60 days after the COD event occurred.

| Question | Answer |

|---|---|

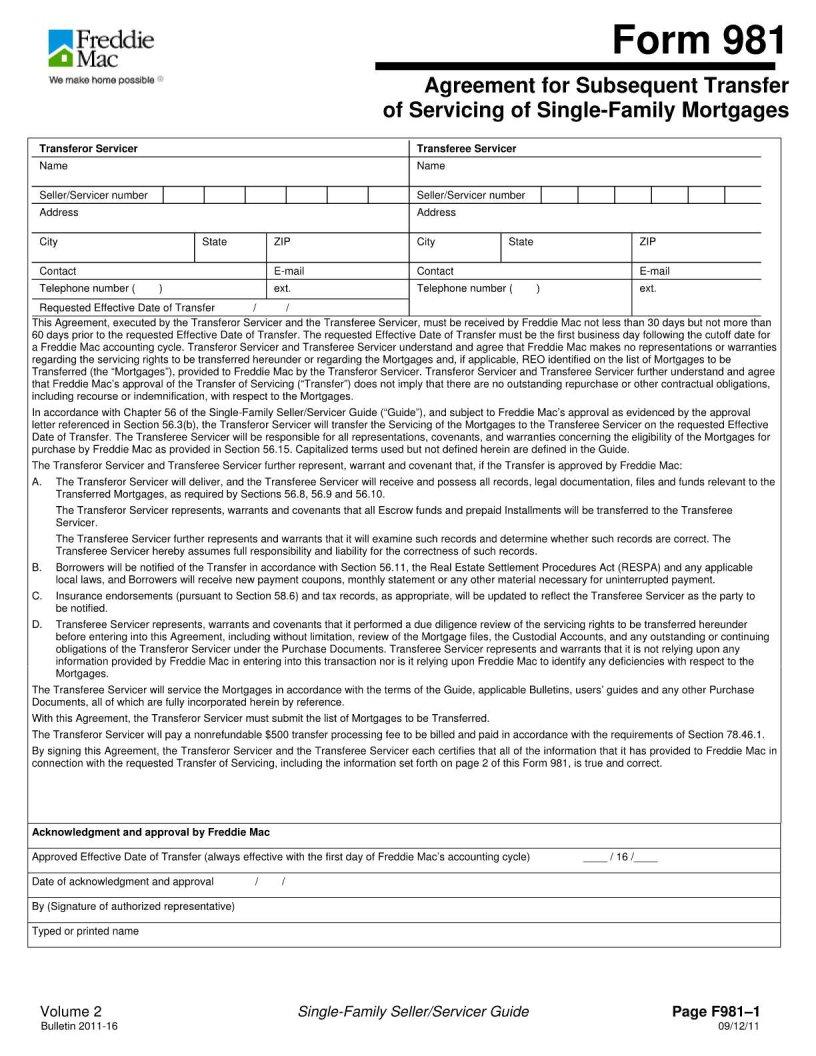

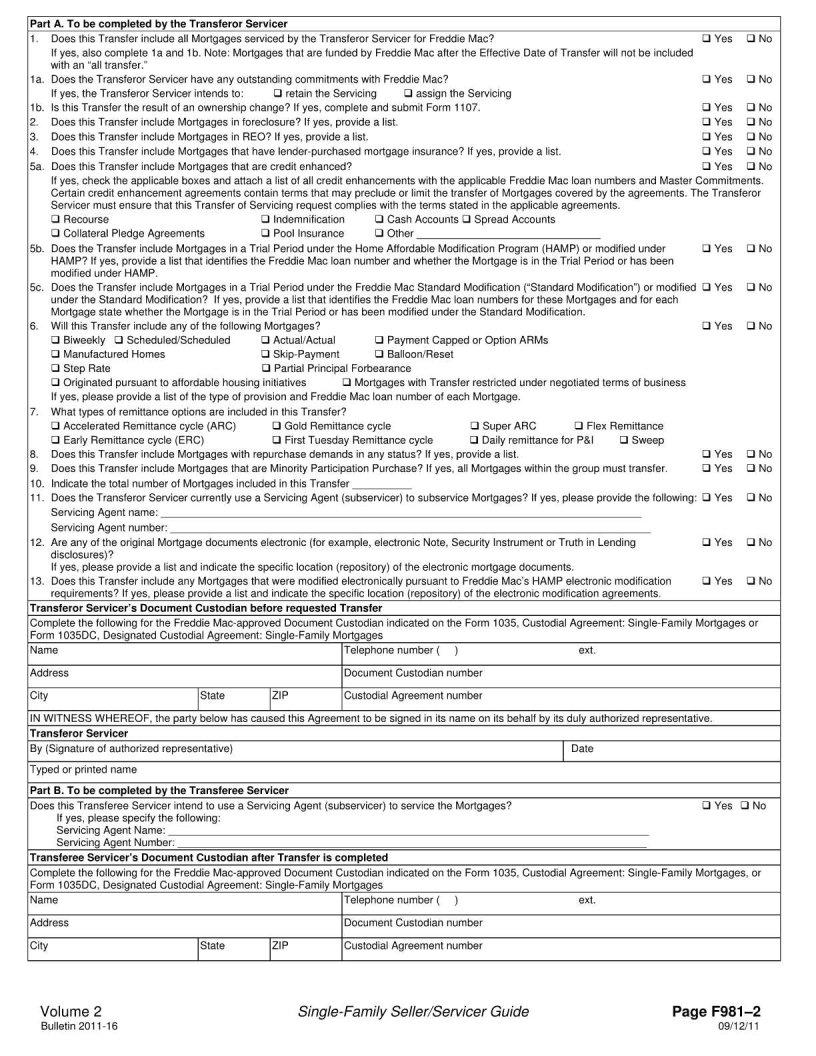

| Form Name | Form 981 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | ERC, irs form 981, Servicer, 1035DC |