The form 982.5(15), a critical document within the legal and financial landscape for individuals facing state tax liabilities, serves multiple purposes, primarily focusing on claiming exemptions and providing a thorough financial declaration in the face of wage garnishment. This form becomes a crucial tool for taxpayers or respondents who find themselves navigating the complexities of managing their earnings amidst state tax obligations. It begins with necessary identification details including the attorney or party’s name, contact information, and case specifics, ensuring clear communication paths within the judicial system. The form then delves into the heart of financial matters, asking the individual to delineate their earnings and how much of these they need to support themselves or their family, an inquiry that underscores the form’s objective in safeguarding the taxpayer’s financial stability while complying with tax liabilities. Moreover, it requires detailed disclosures about income, dependents, expenses, assets, and existing wage assignments or garnishment orders, painting a comprehensive picture of the respondent's financial health. This nuanced approach not only facilitates the court’s understanding of the taxpayer's situation but also plays a pivotal role in the adjudication process regarding wage garnishment for state tax liabilities. Ultimately, the form 982.5(15) embodies a critical intersection of legal and financial considerations, guiding individuals through the process of claiming exemptions and declaring their financial status in detail, all while navigating the broader implications of state tax obligations.

| Question | Answer |

|---|---|

| Form Name | Form 982 5 15 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ca000234 declaration of mailing do u staple with ud 105 form |

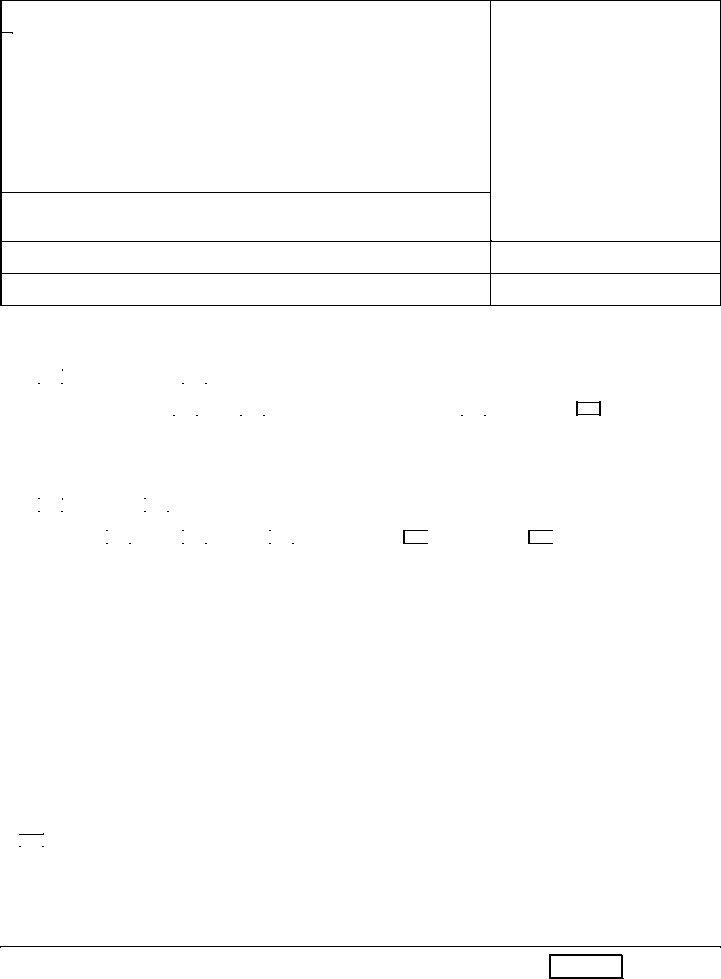

982.5(15)

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, state bar number, and address): |

FOR COURT USE ONLY |

TELEPHONE NO.: |

FAX NO.: |

ATTORNEY FOR STATE TAXPAYER/RESPONDENT |

|

|

|

NAME OF COURT: |

|

STREET ADDRESS: |

|

MAILING ADDRESS: |

|

CITY AND ZIP CODE: |

|

BRANCH NAME: |

|

APPLICATION OF (Name):

TAXPAYER/RESPONDENT

CASE NUMBER:

CLAIM OF EXEMPTION AND FINANCIAL DECLARATION

NAME OF STATE TAX AGENCY: |

TAX AGENCY NUMBER: |

(Copy the information required above from the Application for Earnings Withholding Order for Taxes (form 982.5(11)). The top left space is for your or your attorney's name and address.)

1. |

I need the following earnings to support myself or my family (check and complete item a or b): |

||||||||||||

|

a. |

|

All earnings. |

b. |

|

|

$ |

|

each pay period. |

|

|

||

|

|

|

|

|

|

|

|||||||

2. |

Please send all papers to |

|

|

|

me |

|

my attorney |

at the address |

|

shown above |

|||

|

|

|

|

|

|||||||||

following (specify):

3.In addition to the 25 percent minimum withholding, I am willing for the following amount to be withheld from my earnings during the withholding period:

a. |

|

None |

b. |

|

Withhold: $ |

each pay period. |

4. a. |

I am paid |

|

daily |

|

weekly |

|

every two weeks |

b. |

My gross pay is: $ |

|

per pay period. |

||||

c. |

My |

|

|

per pay period. |

|||

d. My payroll deductions are (item and amount):

twice a month

monthly.

5. The following persons depend, in whole or in part, on me for support: |

|

||

Name |

Age |

Relationship to me |

Monthly income and its source |

a. |

|

Myself |

|

b.

c.

d.

e.

6. The earnings of others listed in item 5 are now subject to wage assignments and Earnings Withholding Orders as follows (specify):

(Continued on reverse)

Form Adopted for Mandatory Use

Judicial Council of California 982.5(15) [Rev. July 1, 2000]

CLAIM OF EXEMPTION AND FINANCIAL DECLARATION

(Wage

WEST GROUP

Official Publisher

Code of Civil Procedure, §§ 706.051, 706.076

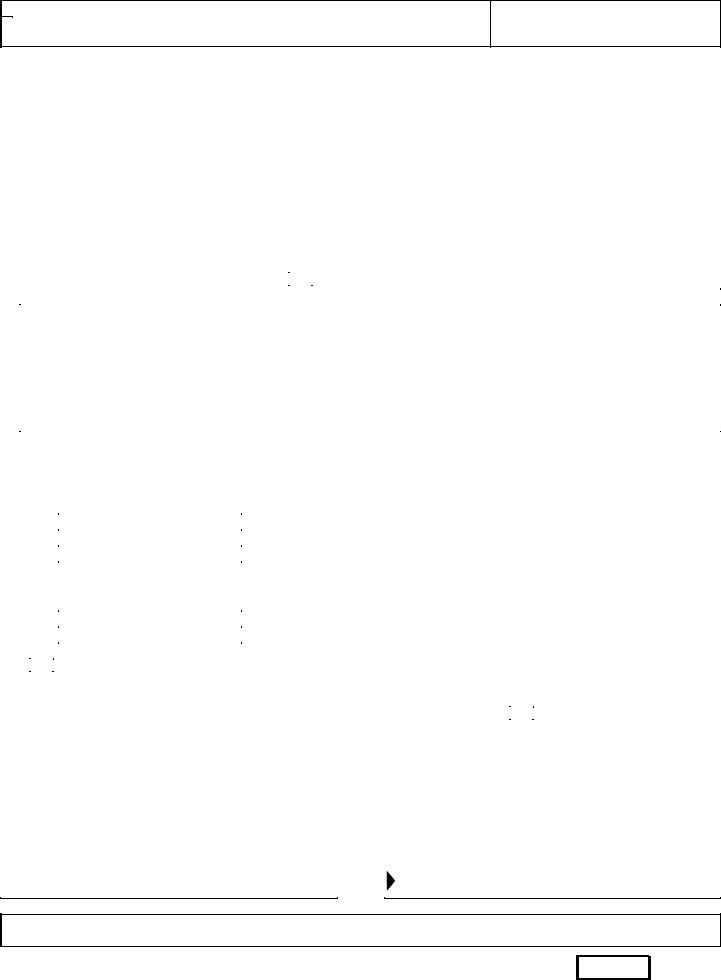

APPLICATION OF (Name):

TAXPAYER/RESPONDENT

CASE NUMBER:

7. My monthly expenses are as follows: |

|

|

|

|

|

||

|

a. |

Rent or house payment and |

|

|

j. |

Entertainment and incidentals |

$ |

|

|

maintenance |

$ |

|

k. Transportation and auto expenses |

|

|

|

b. |

Food and household supplies |

$ |

|

|

(insurance, gas, repair) |

$ |

|

c. |

Utilities and telephone |

$ |

|

l. |

Installment payments (insert |

|

|

d. |

Clothing |

$ |

|

|

total and list below in item 8) |

$ |

|

e. |

Laundry and cleaning |

$ |

|

m. Other (specify): |

$ |

|

|

f. |

Medical and dental payments |

$ |

|

|

|

|

|

g. |

Insurance (life, health, |

|

|

|

|

|

|

|

accident, etc.) |

$ |

|

|

|

|

|

h. |

School, child care |

$ |

|

|

|

|

|

i. |

Child, spousal support |

|

|

TOTAL MONTHLY EXPENSES |

|

|

|

|

(prior marriage) |

$ |

|

(add a through m) |

$ |

|

8. List payments on installment and other debts. |

|

Continued on Attachment 8. |

|

||||

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Creditor's name |

|

For |

Monthly payment |

Balance |

|

|

|

|

|

|

|

|

|

9.What do you own? (State value.)

a.Cash . . . . . . . . . . . . . . . . . . . . . . . . $

b.Checking, savings and credit union accounts, etc. (list institutions):

(1) |

|

$ |

(2) |

|

$ |

(3) |

|

$ |

(4) |

|

$ |

c.Cars, other vehicles, and boat equity (list make, year of each):

(1) |

|

$ |

(2) |

|

$ |

(3) |

|

$ |

d.Real estate equity (addresses): . . . $

e.Other personal property (jewelry, furniture, furs, stocks and bonds, etc. List separately):

Total for item e: . . . . $

10. |

|

An Order Assigning Salary and Wages (for support) is now in effect as to my earnings. The amount payable under that order |

|

|

|

is: $ |

monthly. |

11.Other facts that support this Claim of Exemption are (describe unusual medical needs, school tuition, expenses for recent family

emergencies, or other unusual expenses to help the judge understand your budget): |

|

Continued on Attachment 11. |

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME) |

(SIGNATURE OF TAXPAYER) |

File this form with the clerk of the court and mail a copy to the tax agency as soon as possible. Keep a copy and take it with you to the court hearing. If you wish to obtain the advice of an attorney, you should do so at once.

982.5(15) [Rev. July 1, 2000]

CLAIM OF EXEMPTION AND FINANCIAL DECLARATION

(Wage

WEST GROUP

Official Publisher

Page two