You may fill out wi review request form easily using our PDF editor online. To have our tool on the cutting edge of convenience, we strive to put into operation user-oriented features and enhancements on a regular basis. We are routinely glad to receive suggestions - join us in revolutionizing PDF editing. All it takes is several simple steps:

Step 1: Just click on the "Get Form Button" at the top of this site to open our pdf form editor. Here you will find everything that is needed to fill out your file.

Step 2: The tool will allow you to work with PDF files in various ways. Transform it with your own text, adjust what's originally in the file, and put in a signature - all within a couple of clicks!

Completing this PDF will require attention to detail. Make certain each blank is filled out accurately.

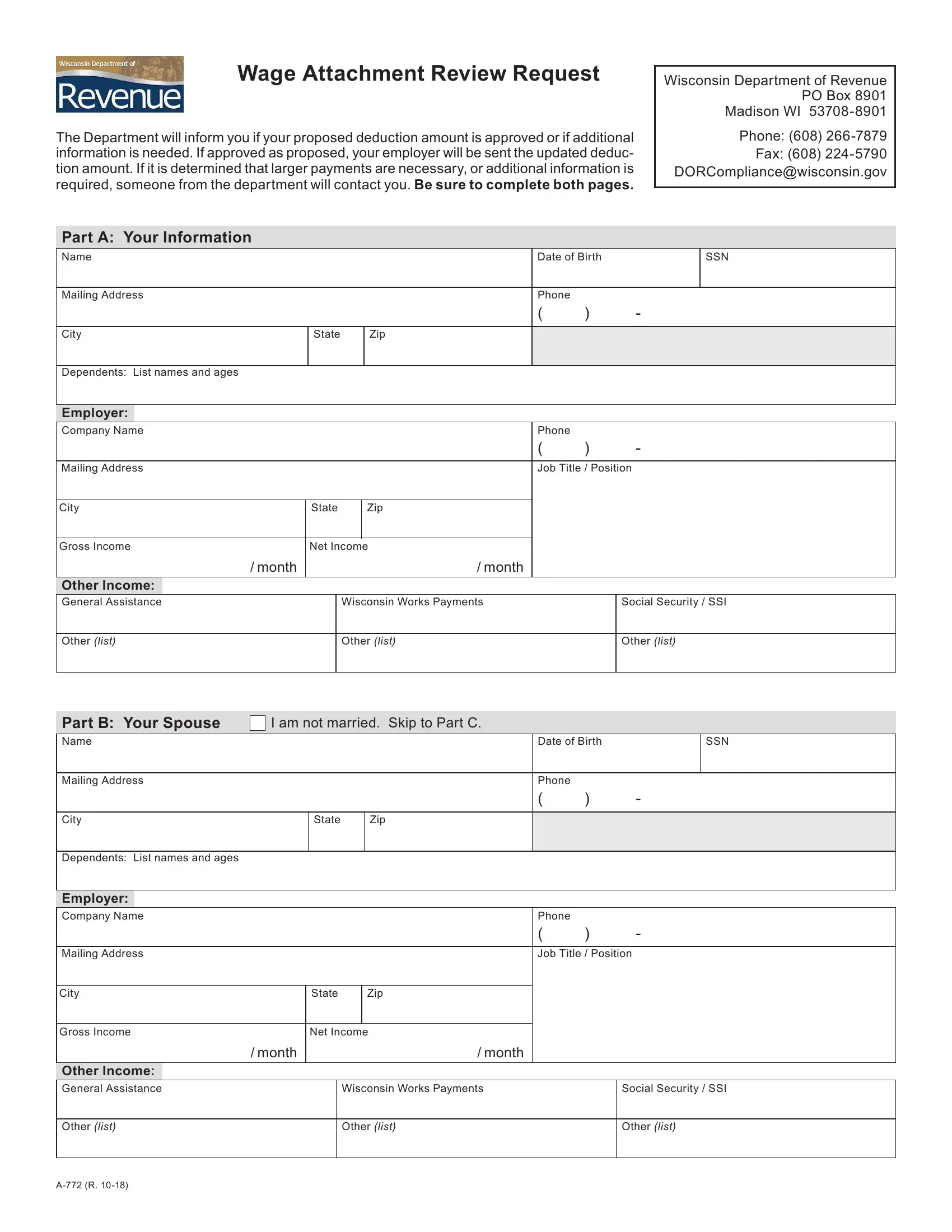

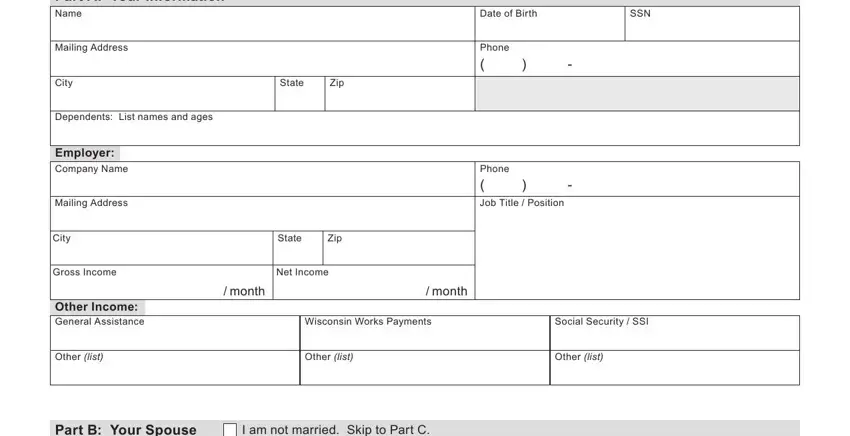

1. For starters, when filling out the wi review request form, begin with the page containing subsequent fields:

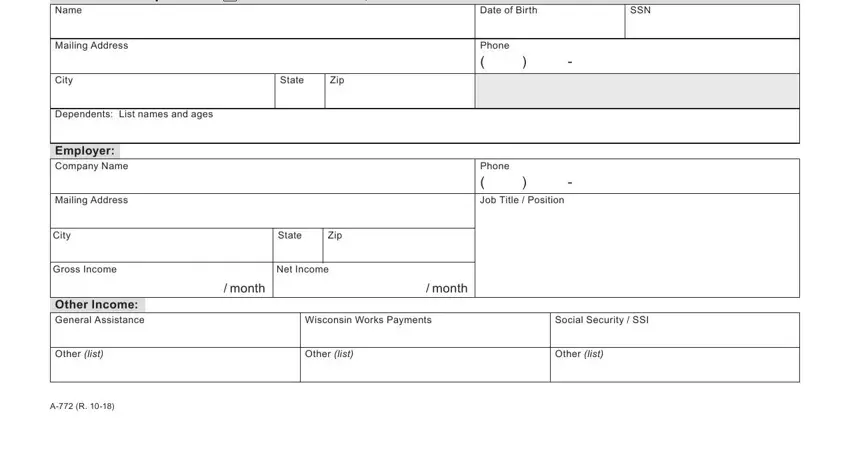

2. After this segment is finished, you'll want to include the essential details in Part B Your Spouse Name, I am not married Skip to Part C, Date of Birth, SSN, Mailing Address, City, State, Zip, Dependents List names and ages, Phone, Employer Company Name, Mailing Address, Phone Job Title Position, City, and State in order to go further.

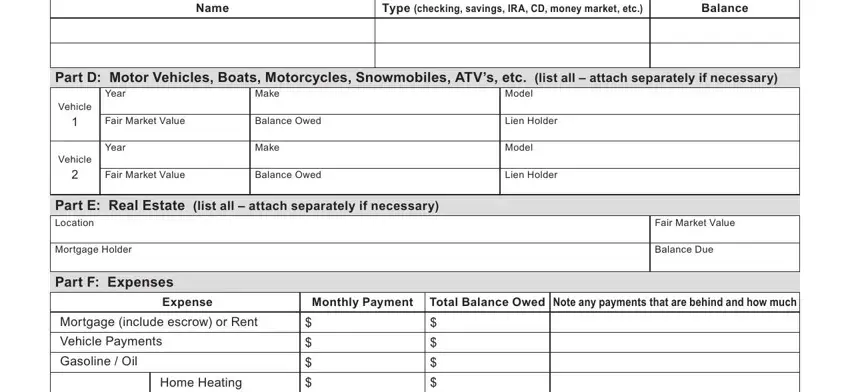

3. Within this step, look at Name, Type checking savings IRA CD money, Balance, Part D Motor Vehicles Boats, Vehicle, Vehicle, Year, Make, Fair Market Value, Balance Owed, Year, Make, Fair Market Value, Balance Owed, and Model. All of these are required to be taken care of with greatest attention to detail.

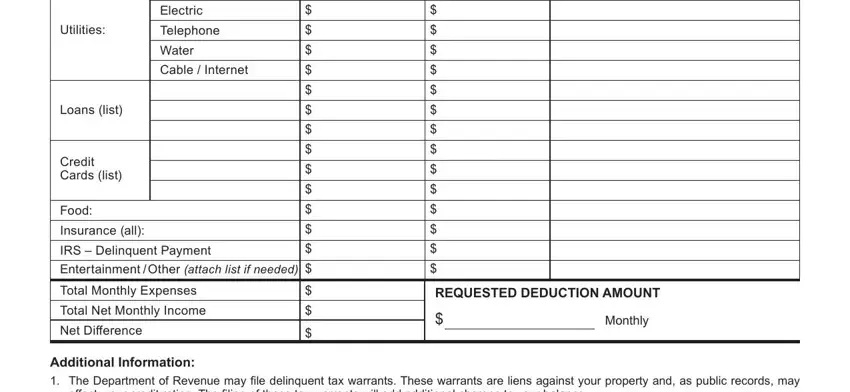

4. This next section requires some additional information. Ensure you complete all the necessary fields - Electric, Telephone, Water, Cable Internet, Utilities, Loans list, Credit Cards list, Food, Insurance all, IRS Delinquent Payment, Entertainment Other attach list, Total Monthly Expenses, Total Net Monthly Income Net, REQUESTED DEDUCTION AMOUNT, and Monthly - to proceed further in your process!

It's easy to make an error while filling in the Insurance all, hence be sure you look again prior to deciding to send it in.

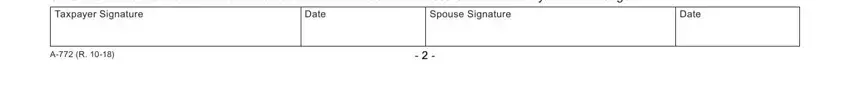

5. As you near the last parts of your form, you'll notice just a few extra requirements that should be satisfied. Particularly, I We attest that the information, Taxpayer Signature, Date, Spouse Signature, Date, and A R should be filled out.

Step 3: Ensure the details are accurate and click on "Done" to finish the task. Join us right now and immediately gain access to wi review request form, ready for download. All alterations made by you are saved , meaning you can change the file at a later point as needed. FormsPal is committed to the privacy of all our users; we make sure that all personal information going through our tool is protected.