Aac 3942 is a new medication that has been released to the public. It is used to treat depression and can be prescribed by a doctor. This medication comes in the form of a pill and should be taken once a day, with or without food. Aac 3942 is not habit-forming and has been shown to be effective in most patients. Side effects are rare but may include nausea, vomiting, and headache. If you are taking this medication, it is important to follow your doctor's instructions carefully.

| Question | Answer |

|---|---|

| Form Name | Form Aac 3942 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | mah agricredit acceptance llc reviews form |

|

|

AGRICREDIT ACCEPTANCE LLC FAX COVERSHEET |

||||||||

|

|

|

|

|

FAX |

|

|

|||

Date: |

|

|

|

|

Number of Pages: |

|

|

|||

From: |

|

|

|

|

Contact: |

|

|

|

||

|

|

|

|

|

|

Telephone # : |

|

|

|

|

|

|

|

|

|

|

Fax # : |

|

|

|

|

Attention: |

|

|

|

|

|

|

|

|

|

|

Customer Name: |

|

|

|

|

|

|

|

|

|

|

Equipment Being Financed: |

|

|

|

|

|

|

|

|

||

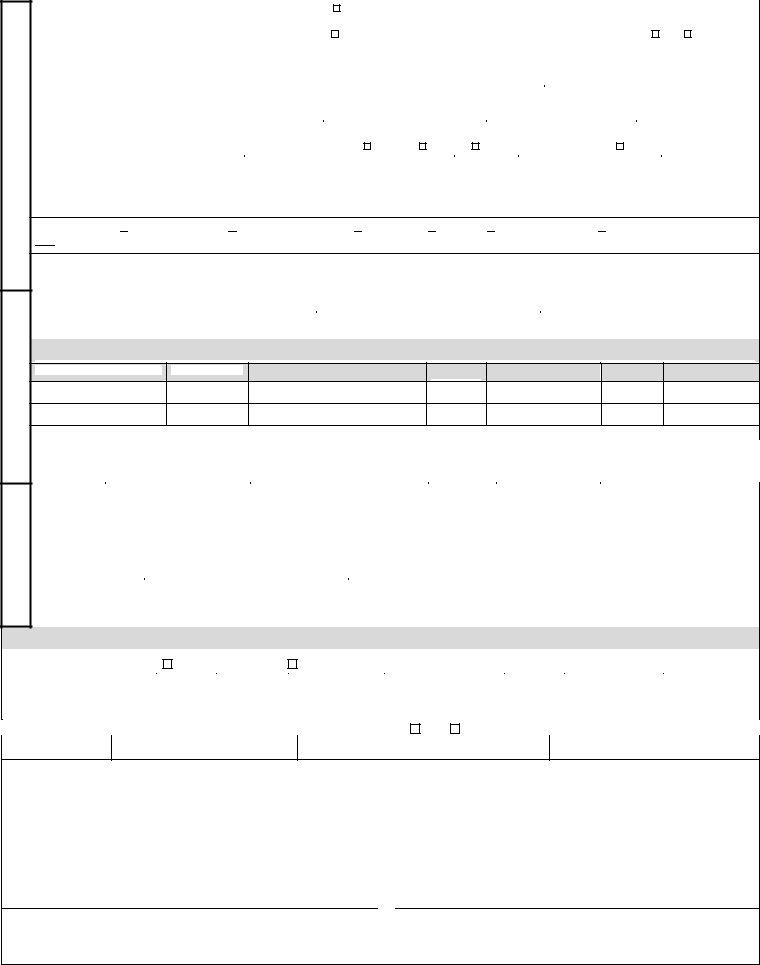

N/U Year Make |

Model |

Description Serial # |

Sales Price Cost if New |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options: FWA |

|

Duals |

|

Weights |

|

RWA (Combines) |

|

Hours |

IS THIS A REFINANCE OF EXISTING DEBT? YES

|

|

|

Year Make |

Model Description |

Serial # |

NO (ANSWER REQUIRED)

Trade |

|

Allowance Pay off |

Lien Holder |

Contract Type: |

Retail |

|

|

|

Lease – Amount of Residual: |

|||

Term (Mo.): |

|

Rate: |

|

% Indicate: Fixed ; Variable |

||||

|

|

|

|

|

|

|

||

If Manufacturer program rate, describe: |

||||||||

Cash Down Payment: |

$ |

|

|

|

||||

Sales Tax: |

|

|

|

|

% |

|

||

Filing Fees: |

|

|

$ |

|

|

|

||

Admin Fees: |

|

|

$ |

|

|

|

||

%

; Equity Advantage

Customer wishes insurance coverage through AAC? |

Yes |

No |

|||

Payment Schedule: (Check one or include schedule) |

|

|

|

||

Monthly |

Quarterly |

Annual |

|

Other |

|

(Description)

First Payment Due Date:

Additional Information:

Copy of Manufacturer’s Invoice

Customer’s signature(s) on application for credit (Authorization for release of credit information)

If total owing to Agricredit > $250,000 or total customer debt > $750,000, two year history of Financial Statements (Balance Sheet and Income Statement)

AGRICREDIT ACCEPTANCE LLC |

APPLICATION FOR CREDIT |

GENERAL

INCOME – BANK INFO BUSINESS /CO

APPLICANT’S NAME (Last, First, Middle) |

US CITIZEN YES |

|

SOCIAL SEC. NO. |

|

DATE OF BIRTH |

|

HAVE YOU EVER USED AAC BEFORE? |

|||||||||||

|

|

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|||

|

|

NO |

|

|

|

|

|

/ |

/ |

|

|

|

|

|

NO |

YES |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

CITY |

|

|

|

|

|

STATE |

|

|

|

ZIP CODE |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHYSICAL ADDRESS OF RESIDENCE (If Different Than Mailing Address) |

|

COUNTY (REQUIRED) |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

HOME TELEPHONE NUMBER |

|

|

|

MARITAL STATUS |

|

|

PARTNER STATUS |

YRSATCURRENTADDRESS |

||||||||||

WORK OR CELL TELEPHONE NUMBER |

|

|

Married Unmarried |

Separated |

|

Registered Domestic Partnership |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NAMEOFNEARESTRELATIVENOTLIVINGWITHYOU |

|

|

|

CITY |

|

|

STATE |

|

TELEPHONE NUMBER |

|

|

RELATIONSHIP |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY AND STATE IN WHICH EQUIPMENT WILL BE KEPT:

TYPE OF BUSINESS LIMITED PARTNERSHIP LIMITEDLIABILITYCOMPANY(LLC) CORPORATION INDIVIDUAL GENERAL PARTNERSHIP OTHER (Please specify)

|

EQUIPMENTUSE: FARM |

|

|

% CUSTOM WORK _% FORESTRY % CONSTRUCTION/COMMERCIAL |

% INDUSTRIAL % RENTALYARD % PERSONAL/FAMILY/HOUSEHOLD % OTHER |

|||||||||||||||

|

% (Please describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGAL NAME UNDER WHICH YOU OPERATE IF PARTNERSHIP, LLC OR CORPORATIONS: |

|

|

|

|

|

|

|

YEARS IN BUSINESS: |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

FED TAX ID # |

|

|

|

|

|

|

|

ORGANIZATION ID |

|

|

|

|

STATE OF ORGANIZATION: |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF BUSINESS TYPE IS PARTNERSHIP, LLC OR CORPORATION, PLEASE PROVIDE INFORMATION FOR ALL PARTNERS, MANAGERS OR OFFICERS, EACH OF WHOM MUST SIGN AND DATE APPLICATION OR

PARTNER/OFFICER/MANAGER |

SOCIAL SEC NO. |

ADDRESS |

DATE OF |

TELEPHONE |

% OWNED |

TITLE |

|

|

|

BIRTH |

|

|

|

|

LOCATION OF CHIEF EXECUTIVE OFFICE: CITY: |

|

|

STATE: |

|

|

|

|

|

|

|

|

|||||||

|

IF YOU INTEND TO APPLY FOR JOINT CREDIT, APPLICANT AND |

|

|

|

|

|

|

||||||||||||

___________________________________ |

____________________________________________________ |

|

|

|

|

|

|

|

|||||||||||

|

Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

APPLICANT AND |

|

|

|

|

|

|

||||||||||||

|

|

PRIMARY LENDER NAME |

|

CITY, STATE |

|

YEAR |

|

TELEPHONE |

|

|

|

CONTACT |

|

||||||

|

OPERATING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MACHINERY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER: |

|

|

|

|

|

CITY, STATE: |

|

|

|

YEARS: |

||||||||

|

ANNUAL GROSS |

|

OCCUPATION/POSITION: |

|

|

OTHER INCOME (Alimony, Child Support, or Maintenance Need Not Be Revealed if You Do Not Wish it |

|||||||||||||

|

INCOME: |

|

|

|

|

|

|

To Be Considered In Determining Your Credit Worthiness), Source of other income: |

|||||||||||

$ |

|

|

|

|

|

|

AMOUNT $ |

|

|

|

FREQUENCY |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE THE SECTION BELOW IF YOU HAVE INCOME FROM AGRICULTURE

A |

DO YOU FARM? |

FULL TIME |

|

PART TIME |

# OF ACRES OWNED |

|

|

|

# OF ACRES RENTED |

|

|

YEARS IN FARMING: |

|

|

|||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

KIND OF CROP/LIVESTOCK |

NO OF |

INCOME DATE |

ESTIMATED AMOUNT |

KIND OF CROP/LIVESTOCK |

NO OF |

|

INCOME DATE |

ESTIMATED AMOUNT |

||||||||

|

|

|

ACRES |

|

|

|

|

|

|

|

ACRES |

|

|

|

|

|

|

G |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Are there any bankruptcies filed in the past 10 years or any outstanding liens or judgments? |

Yes |

No Please attach an explanation for any yes answer. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF LOAN IS > $100,000 AND < $250,000

TOTAL ASSETS |

$ |

TOTAL LIABILITIES |

$ |

STATEMENT AS OF (MM/DD/YY)

By signing below, I, whether signing individually as an Applicant,

APPLICANT |

Signature |

(Individual) |

Date |

|

|

|

Signature |

Title/Capacity |

Date |

|

(Indicate Partner/Officer/Manager/Guarantor) |

|

Signature |

(Individual) |

Date |

|

|

|

Signature |

Title/Capacity |

Date |

|

(Indicate Partner/Officer/Manager/Guarantor) |

|

(Please go on to next page if this application amount PLUS all existing debt payable to Agricredit Acceptance LLC,

its agents, servicers, affiliates and assigns is $250,000 or more.)

AAC 3942 (09/09) |

Page 2 of 4 |

AGRICREDIT ACCEPTANCE LLC |

APPLICATION FOR CREDIT |

|

ALSO IF |

This application amount PLUS all existing debt payable to Agricredit Acceptance LLC, its agents, servicers,

affiliates and assigns is $250,000 or more or upon request of AAC, then please provide the additional

information requested and complete below as applicable.

•TWO YEARS OF FINANCIAL STATEMENTS (BALANCE SHEET AND INCOME STATEMENT)

•ACCOUNTANT INFORMATION:

COMPANY:

ADDRESS:

NAME:

PHONE:

I/We authorize AAC to contact my accountant and authorize my accountant to release any Financial

Information.

Signature (Applicant) |

Date |

|

Signature (Applicant) |

Date |

|

|

|

|

|

Signature |

|

Signature |

Date |

|

|

Date |

|

|

|

If the above requested information is not available, AAC would consider substituting two years history of the most recent Tax Returns, and the following financial information. If the requested credit is granted,

COMPLETE THE FOLLOWING SECTION IF ACCOUNTANT INFORMATION IS NOT AVAILABLE

F |

CASH |

|

ACCOUNTS PAYABLE |

|

|

|

|

|

|

I |

RECEIVABLE |

|

OPERATING LOANS |

|

|

|

|

|

|

|

|

|

|

|

N |

STOCKS,BONDS,CERTIFICATESOFDEPOSIT,ETC. |

|

MACHINERY LOANS |

|

|

|

|

|

|

A |

MACHINES AND EQUIPMENT |

|

AUTO & TRUCK LOANS |

|

|

|

|

|

|

N |

AUTOS AND TRUCKS |

|

REAL ESTATE LOANS |

|

|

|

|

|

|

C |

LIVESTOCK |

|

UNSECURED&CREDITCARDS |

|

|

|

|

|

|

I |

CROPS FOR SALE: HARVESTED YES NO |

|

TAXES PAYABLE |

|

|

|

|

|

|

|

|

|

|

|

A |

BUILDINGS AND LAND NO. OF ACRES |

|

MONEY OWED TO OTHERS |

|

|

|

|

|

|

L |

OTHER ASSETS |

|

OTHER LIABILITIES |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

TOTAL LIABILITIES |

|

|

|

|

|

|

A |

|

|

CONTINGENT |

|

|

|

|

LIABILITIES/GUARANTIES |

|

COMPLETE THE FOLLOWING SECTION IF EQUIPMENT WILL BE USED FOR CUSTOM,

COMMERCIAL, FORESTRY, OR OTHER

C

O

M

M

E

R

C

I

A

L

WILLEQUIPMENTBEUSED: |

FULL TIME |

PART TIME % |

|

SLACK MONTHS: |

|||

|

|

|

|

|

|

|

|

SPECIFIC LINE OF BUSINESS |

|

PRIMARY CONTRACTOR |

IF SUBCONTRACTOR, NAME ADDRESS OF PRIME CONTRACTOR |

||||

|

|

SUB CONTRACTOR |

|

|

|||

|

|

|

|

|

|

|

|

ESTIMATEDMONTHLYGROSS $

IF FORESTRY, PLEASE LIST THE MILLS CURRENTLY BUYING YOUR LOGS OR SERVICES:

NAME |

ADDRESS |

CONTACT NAME |

TELEPHONENUMBER |

VOLUMEPERWEEK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AAC 3942 (09/09) |

Page 3 of 4 |

AGRICREDIT ACCEPTANCE LLC |

APPLICATION FOR CREDIT |

ADDITIONAL DISCLOSURES

NOTICE TO CALIFORNIA RESIDENTS: If married, you may apply for a separate account.

NOTICE TO MAINE RESIDENTS: You have the right of free choice in selecting the agent and insurer through or by which the insurance you obtain in connection with the credit you are applying for is placed. Your right of free choice is subject only to our right to approve the insurer you select on a reasonably

A consumer report may be requested in connection with this application. If you ask us, we will tell you whether or not a consumer report was requested, and, if it was, we will tell you the name and address of the consumer reporting agency that furnished the report.

NOTICE TO OHIO RESIDENTS: The Ohio laws against discrimination require that all creditors make credit equally available to all credit worthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio civil rights commission administers compliance with this law.

NOTICE TO MARRIED APPLICANTS RESIDING IN WISCONSIN: No provision of any marital property agreement, unilateral statement under section 766.59 WIS. STATS. or court decree under section 766.70 WIS. STATS. adversely affects the interests of the creditor unless the creditor prior to the time the credit is granted, is furnished a copy of the agreement, statement or decree, or has actual knowledge of the adverse provision when the obligation to the creditor is incurred.

NOTICE TO ALL CUSTOMERS: USA PATRIOT Act – Customer Identification Program – Enacted to help the government fight the funding of terrorism and money laundering activities. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who applies for a loan. When you apply for a loan we will ask you for your name, address, date of birth and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

AAC 3942 (09/09) |

Page 4 of 4 |