In the complex landscape of agricultural regulation and compliance, the AD-1026C form plays a crucial role, especially for landlords and landowners engaged in the sphere of the United States Department of Agriculture (USDA) programs. This electronically available form, sanctioned under the OMB No. 0560-0185, serves as a request for exemption concerning the cultivation of highly erodible land or the conversion of wetlands under USDA initiatives. The form's significance stretches beyond a mere procedural document; it embodies the rigorous standards and legal requisites set forth by the Commodity Credit Corporation Charter Act, the Food, Conservation, and Energy Act of 2008, and regulations found in 7 CFR Part 12. By facilitating a pathway for landlords or landowners to assert that they have not conspired with tenants or sharecroppers to infringe upon the soil conservation provisions of the Food Security Act of 1985 and its later amendments, the AD-1026C form acts as a safeguard, ensuring that agricultural practices comply with federal conservation standards. Moreover, the form is a testament to the USDA's commitment to privacy and the responsible handling of personal information, aligning with the guidelines of the Privacy Act of 1974, thereby reinforcing the ethical stewardship of data collected in the course of ensuring agricultural compliance. With implications that extend to eligibility for USDA benefits and the potential for sanctions in cases of non-compliance, the comprehensive data collected, including landlord certifications and determinations by the County Committees (COC), underscores the form's pivotal role in the broader goal of sustainable agriculture and conservation.

| Question | Answer |

|---|---|

| Form Name | Form Ad 1026C |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | OMB, 12B, form 1026, fsa forms 1026 |

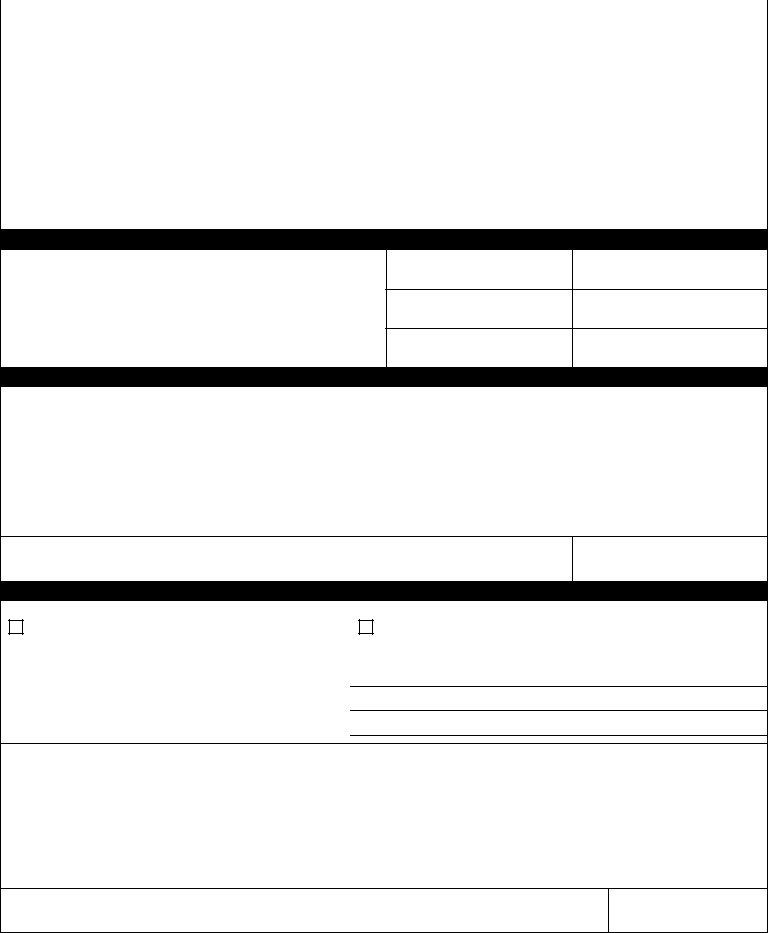

This form is available electronically. |

|

Form Approved – OMB No. |

||

U.S. DEPARTMENT OF AGRICULTURE |

1A. |

STATE NAME |

||

|

Farm Service Agency |

|

|

|

|

|

LANDLORD OR LANDOWNER EXEMPTION REQUEST |

|

|

|

|

1B. |

COUNTY NAME |

|

|

|

|

||

NOTE: |

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this |

|||

|

form is 7 CFR Part 12, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Food, Conservation, and Energy Act of 2008 (Pub. L. |

|||

The information will be used to process a landlord or landowner request to receive an exemption for highly erodible land and/or wetland conservation provisions under USDA programs. The information collected on the form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

PART A – PRODUCER’S INFORMATION

2.NAME AND ADDRESS OF LANDLORD OR LANDOWNER (Including Zip Code)

3. TELEPHONE NO. (Area Code)

4.IDENTIFICATION NUMBER (Last 4 Digits)

5A. FARM NUMBER

5B. TRACT NUMBER

6. CROP YEAR

7. CROPLAND ACRES

PART B - LANDLORD OR LANDOWNER CERTIFICATION

8.I hereby certify that the following information is correct for the farm and tract(s) listed in items 5A and 5B for the crop year entered in item 6:

(a)Production of an agricultural commodity on highly erodible land or on converted wetland in violation of the highly erodible land and wetland conservation provisions of the Food Security Act of 1985 as amended is NOT required under the terms of an agreement between myself and the tenant or sharecropper.

(b)I did not consent to any activities by the tenant or sharecropper to violate the highly erodible land and wetland conservation provisions of the Food Security Act of 1985 as amended.

9A. SIGNATURE OF LANDLORD

9B. DATE

PART C – TO BE COMPLETED BY COC

10. Based on the producer certification and available information, the COC determined that:

A. The landlord exemption shall NOT apply.

B. The landlord exemption shall apply. (List all land on which the producer will be ineligible for benefits. Determine according to the table in Part D.)

11. Describe the reasons for the COC determination. (Attach another sheet, if necessary.)

12A. SIGNATURE OF COC

12B. DATE

|

Page 2 of 2 |

|

|

PART D – RULES FOR APPLYING LANDLORD INELIGIBILITY |

|

|

|

|

|

13. If item 10B is checked, use this table to determine land on which the landlord will be ineligible for benefits. |

|

IF the producer's status |

AND if the crop |

THEN the landlord or landowner shall be ... |

||

on the violating farm is ... |

planted on the land |

|

|

|

|

with the violation ... |

|

|

|

|

|

|

||

landlord, who is not the |

is cash rented, and not |

ineligible for USDA benefits on lands and warehouses where the landlord |

||

operator |

shared by the landlord |

and violating operator, tenant or sharecropper, or the affiliates are involved. |

||

|

|

NOTE: |

The landlord could be eligible for USDA benefits on the |

|

|

|

|

farm where the violation occurred, if the landlord is share |

|

|

|

|

renting a part of the farm with another tenant or |

|

|

|

|

sharecropper. |

|

|

|

|

||

|

is shared by the landlord |

ineligible for USDA benefits on any land and warehouses where the landlord |

||

|

|

and violating operator, tenant or sharecropper, or their affiliates are involved. |

||

|

|

eligible for USDA benefits on other land or warehouses where the violating |

||

|

|

operator, tenant or sharecropper, or their affiliates are not involved. |

||

|

|

|

|

|

landlord and also |

is shared by the landlord |

ineligible for all USDA benefits. |

||

operator |

and operator |

|||

|

|

|||

|

|

|

||

|

is cash rented, and not |

ineligible for USDA benefits on: |

||

|

shared by the landlord and |

|

|

|

|

operator |

the farm where the violation occurred |

||

|

|

any other land and warehouses where the landlord |

||

|

|

involved with: |

||

|

|

|

|

|

|

|

the violating tenant or sharecropper |

||

|

|

|

|

|

|

|

affiliates of the violating tenant or sharecropper. |

||

|

|

|

|

|

The U.S. Department of Agriculture (USDA) prohibits discrimination in all of its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, political beliefs, genetic information, reprisal, or because all or part of an individual’s income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202)