The Amh 0493 R form, a vital document within the healthcare sector, specifically addresses the financial aspect of medical services provided to non-Medicaid patients under the Pre-Admission Screening and Resident Review (PASRR). This form is essential for care facilities focusing on Addictions and Mental Health (AMH), facilitating the request for payment for services delivered. It incorporates various fields such as provider and client information, details of the service provided including the date, procedure code, and the amount due. What sets this form apart is its adherence to billing regulations that mandate charges to be based on the cost of services as per a cost allocation plan and not to exceed the usual and customary charges to the general public. The inclusion of specific procedure codes like T2010 for PASRR Level I identification and screening, T2011 for comprehensive evaluations, and T1013 for sign language or oral interpreter services (conditional upon their provision alongside another service) reflects the form's comprehensive nature. Instructions for billing, alongside contact details for additional support, notably the Addictions and Mental Health Division, underscore the form's role in streamlining financial processes for service providers. This framework not only ensures transparency in billing practices but also supports the provision of essential healthcare services to those in need.

| Question | Answer |

|---|---|

| Form Name | Form Amh 0493 R |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | DHS, pasrr oregon, Alondra, AMH |

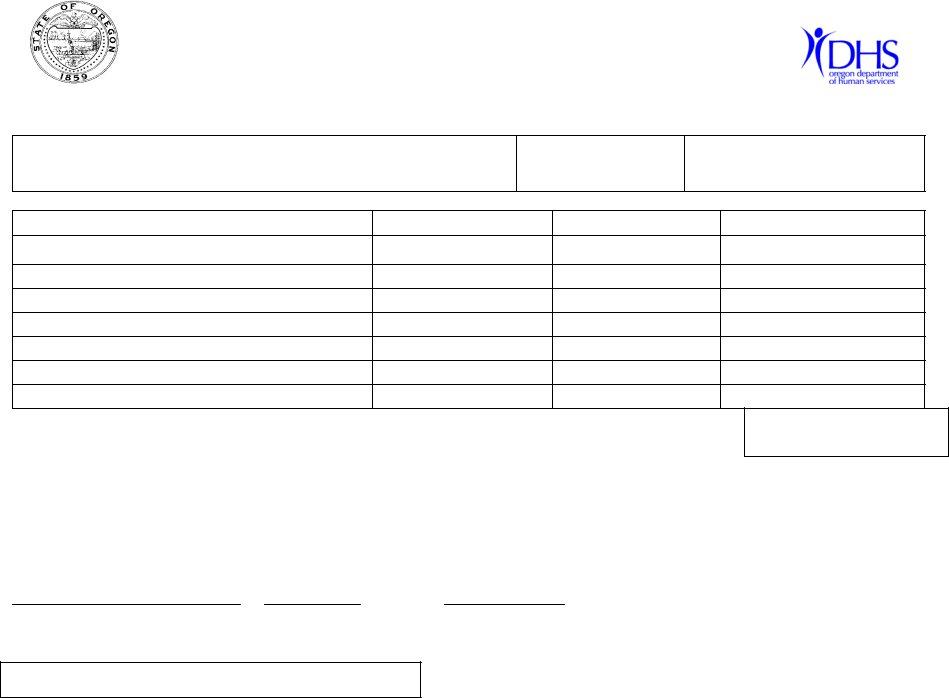

Request for Payment

Addictions and Mental Health Division (AMH)

Provider Name

Address

Federal Tax ID

Provider Number

Client Name

Date of Service

Procedure Code

Amount Due

Total Due ______________

Providers must bill at rates based on the cost of services determined through a cost allocation plan, not in excess of their usual and customary charge to the general public (OAR

T2010 PASRR Level I Identification and Screening, for the purpose of billing, means the Resident Review/Brief Consultation & Screening. T 2011 PASRR Level II MH Evaluation – Comprehensive Evaluation

T1013 Sign Language/Oral interpreter services are allowed only when provided in conjunction with another service such as an assessment for the duration of the service.

For current rates, see most recent publication of “MH Procedural Codes and Reimbursement Rates and Table (most recent date)” at www.oregon.gov/DHS/mental health/publications/main.shtml. For additional billing forms contact Addictions and Mental Health at

SignatureDate

For AMH Use Only

Telephone Number

AMH 0493 R (12/07)

Mail To: Alondra Rogers

DHS/AMH/PASRR

500 Summer St NE E 86

Salem, OR