Whenever you need to fill out va r 1 form, you won't need to download any kind of software - simply use our PDF tool. To keep our editor on the leading edge of efficiency, we work to put into practice user-oriented features and enhancements on a regular basis. We are always glad to receive suggestions - join us in revolutionizing PDF editing. To get the process started, go through these basic steps:

Step 1: Click on the "Get Form" button above on this webpage to get into our PDF editor.

Step 2: With our advanced PDF file editor, it is possible to do more than just fill out forms. Edit away and make your documents appear professional with customized text incorporated, or optimize the file's original content to perfection - all that comes with an ability to add any type of images and sign the document off.

Be attentive while filling in this pdf. Ensure every field is done properly.

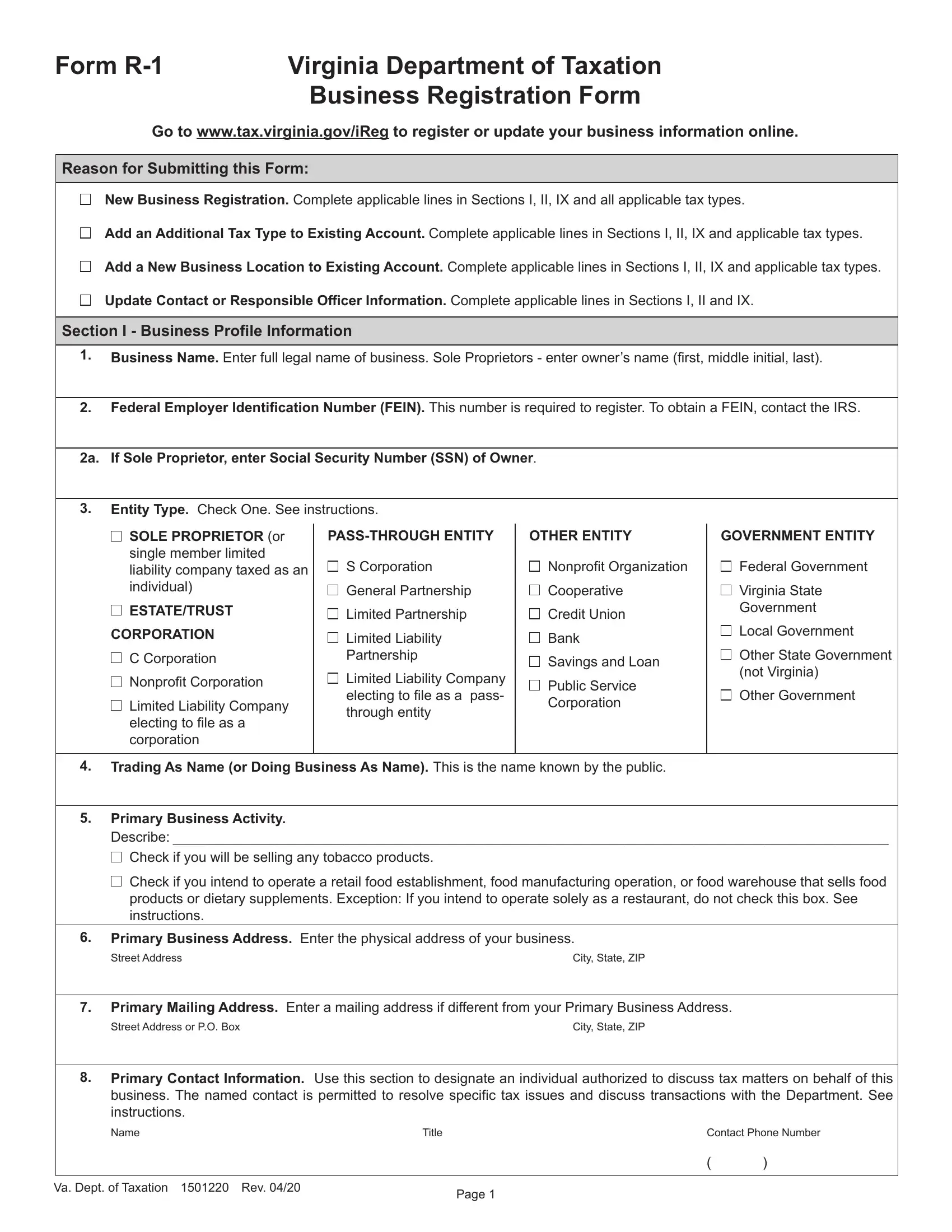

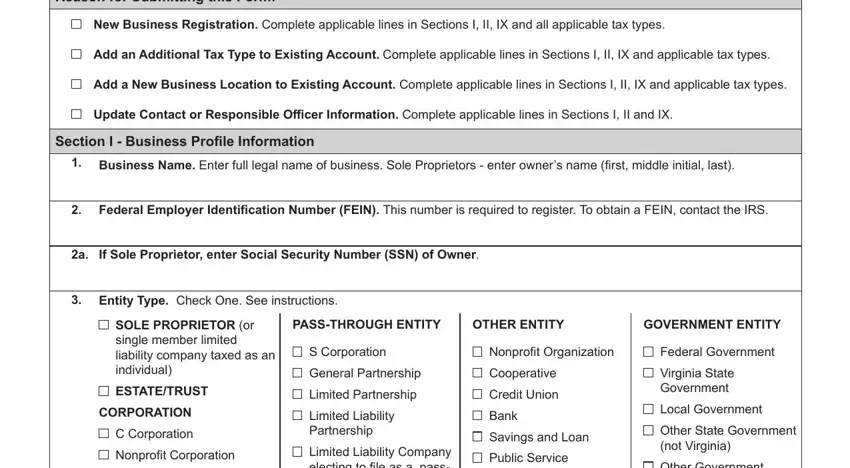

1. The va r 1 form requires specific information to be entered. Make certain the next fields are complete:

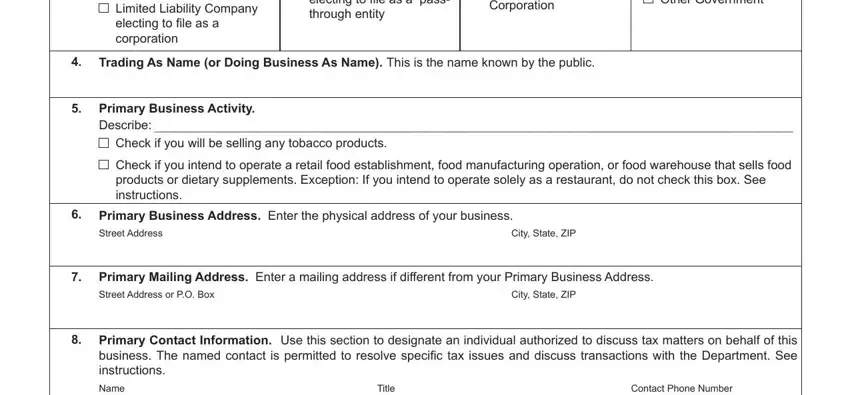

2. After performing the last section, go on to the subsequent stage and enter the essential particulars in these fields - CORPORATION C Corporation, electing to file as a, corporation, Limited Liability Company electing, through entity, Corporation, Other State Government not, Trading As Name or Doing Business, Primary Business Activity Describe, Check if you will be selling any, Check if you intend to operate a, products or dietary supplements, Primary Business Address Enter the, City State ZIP, and Primary Mailing Address Enter a.

3. This next section will be focused on Name, Title, Va Dept of Taxation Rev, Page, and Contact Phone Number - complete all of these blanks.

Always be very careful when filling out Va Dept of Taxation Rev and Name, since this is the section in which a lot of people make some mistakes.

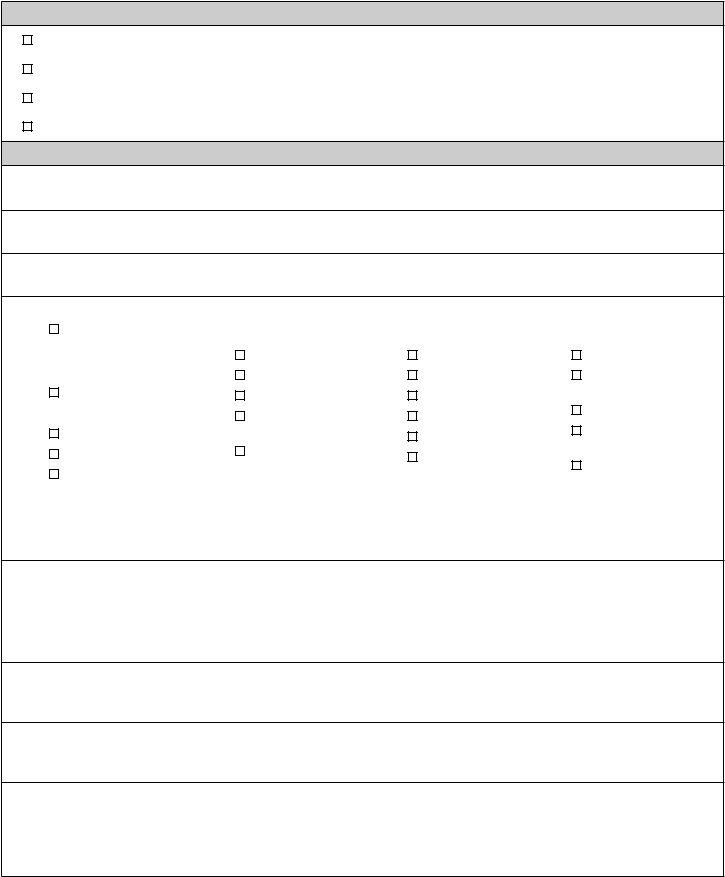

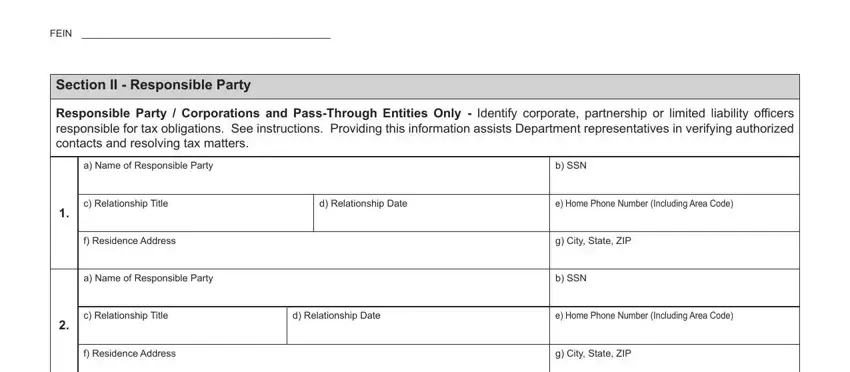

4. This next section requires some additional information. Ensure you complete all the necessary fields - FEIN, Section II Responsible Party, a Name of Responsible Party, b SSN, c Relationship Title, d Relationship Date, e Home Phone Number Including Area, f Residence Address, a Name of Responsible Party, g City State ZIP, b SSN, c Relationship Title, d Relationship Date, e Home Phone Number Including Area, and f Residence Address - to proceed further in your process!

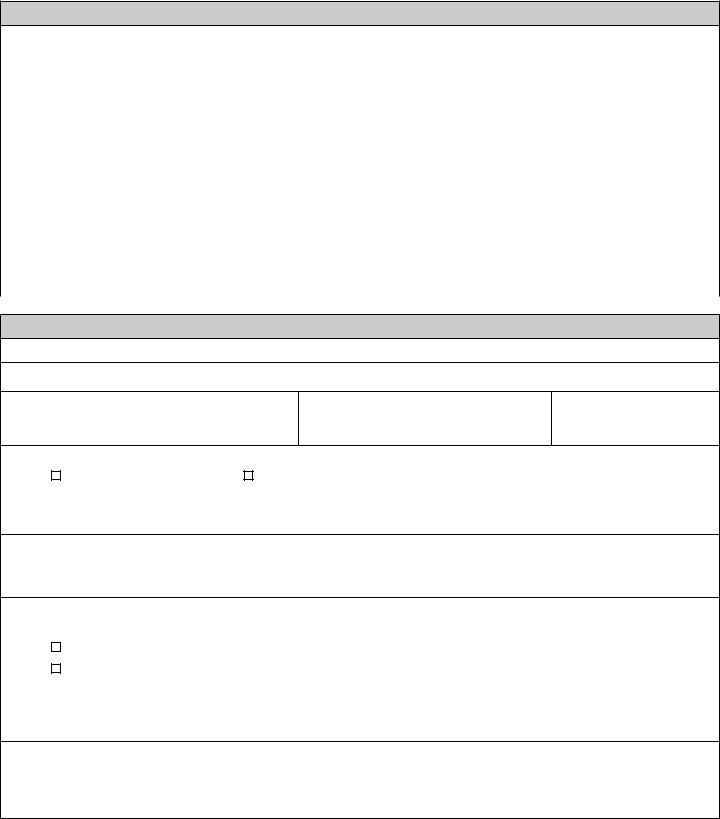

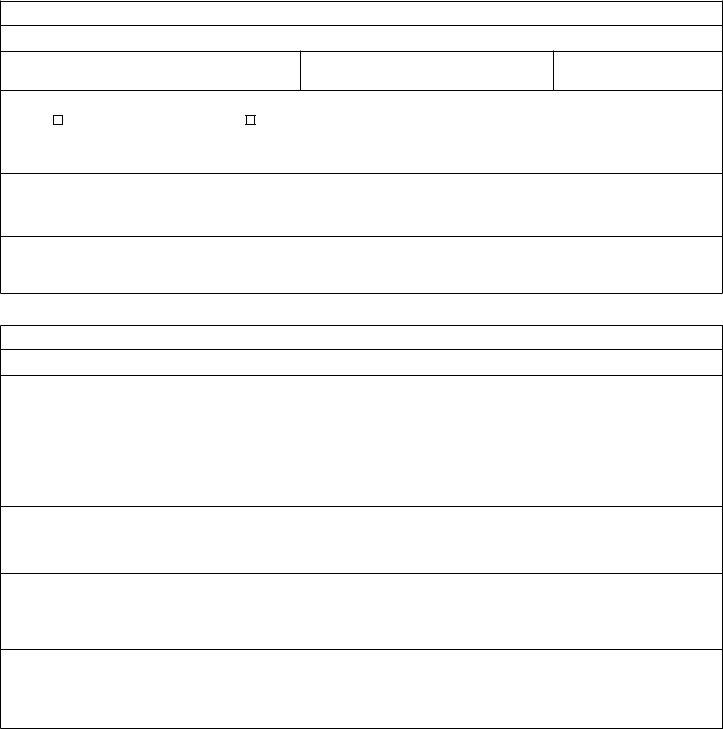

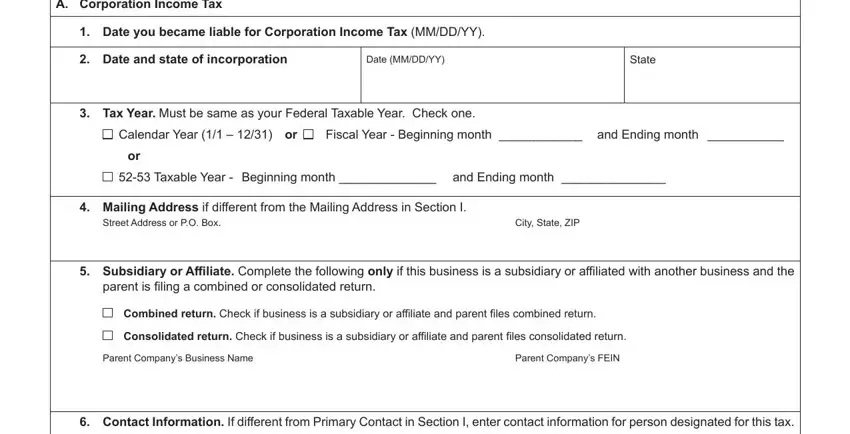

5. To finish your document, this final segment involves several extra blanks. Filling out Section III Annual Tax A, Date you became liable for, Date and state of incorporation, Date MMDDYY, State, Tax Year Must be same as your, Calendar Year or, Fiscal Year Beginning month and, Taxable Year Beginning month, Mailing Address if different from, Street Address or PO Box, City State ZIP, Subsidiary or Affiliate Complete, parent is filing a combined or, and Combined return Check if business will wrap up everything and you're going to be done before you know it!

Step 3: Once you have reread the information in the fields, click "Done" to complete your form at FormsPal. Right after getting afree trial account at FormsPal, you'll be able to download va r 1 form or send it via email directly. The PDF file will also be readily available in your personal account page with all of your edits. FormsPal guarantees risk-free form completion with no personal information recording or sharing. Be assured that your details are secure with us!