This PDF editor makes it easy to create forms. It's not necessary to undertake much to modify ma form ap 1 files. Just simply try out these actions.

Step 1: The initial step should be to click the orange "Get Form Now" button.

Step 2: You can find each of the options that you may use on your template when you have accessed the ma form unclaimed editing page.

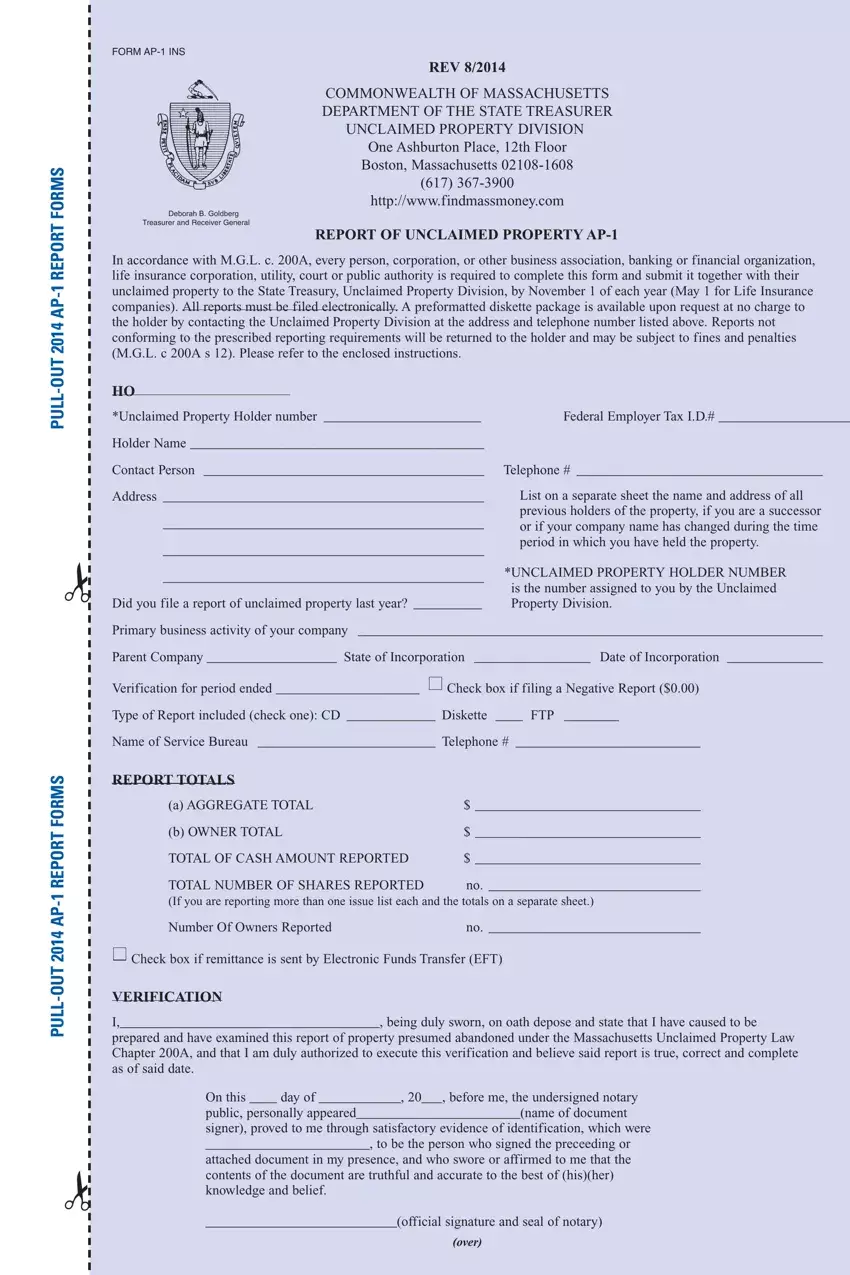

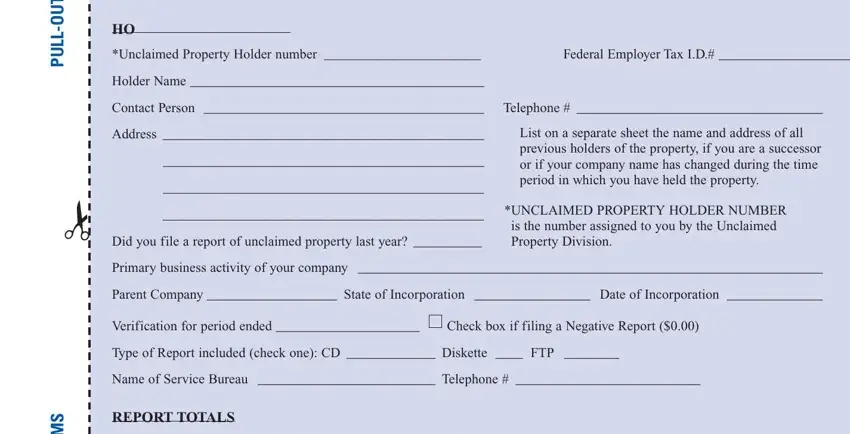

Prepare all of the following segments to create the form:

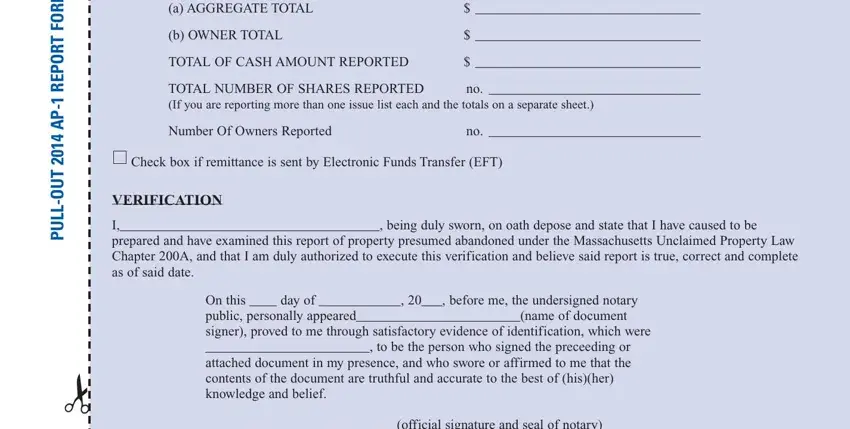

Write down the necessary information in the segment a AGGREGATE TOTAL, b OWNER TOTAL, TOTAL OF CASH AMOUNT REPORTED, TOTAL NUMBER OF SHARES REPORTED If, Number Of Owners Reported, Check box if remittance is sent by, VERIFICATION, I being duly sworn on oath depose, On this day of before me the, official signature and seal of, and S M R O F T R O P E R P A T.

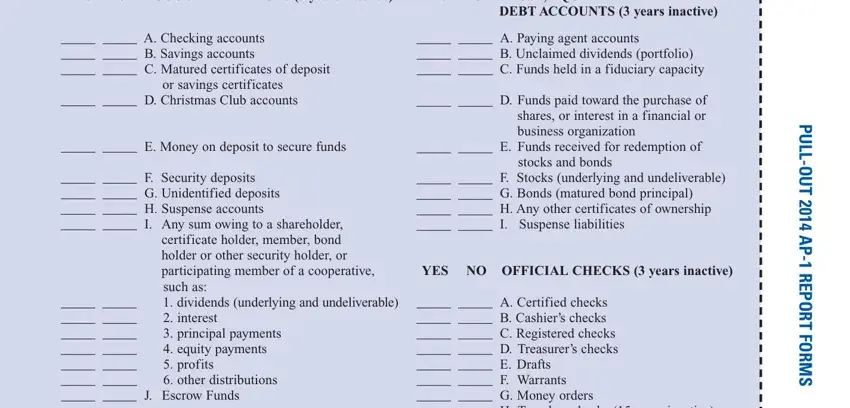

Identify the relevant data in the YES NO ACCOUNT BALANCES years, YES NO TRUST EQUITY AND, A Checking accounts B Savings, or savings certificates, DEBT ACCOUNTS years inactive, A Paying agent accounts B, D Christmas Club accounts, D Funds paid toward the purchase, E Money on deposit to secure, E Funds received for redemption of, F Security deposits G, dividends underlying and, stocks and bonds, F Stocks underlying and, and YES NO OFFICIAL CHECKS years segment.

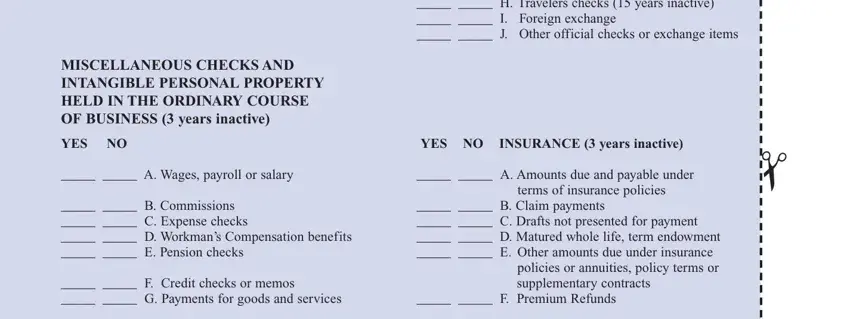

Indicate the rights and obligations of the sides in the part A Certified checks B Cashiers, MISCELLANEOUS CHECKS AND, YES NO, YES NO INSURANCE years inactive, A Wages payroll or salary, B Commissions C Expense checks, F Credit checks or memos G, A Amounts due and payable under, B Claim payments C Drafts not, policies or annuities policy terms, and F Premium Refunds.

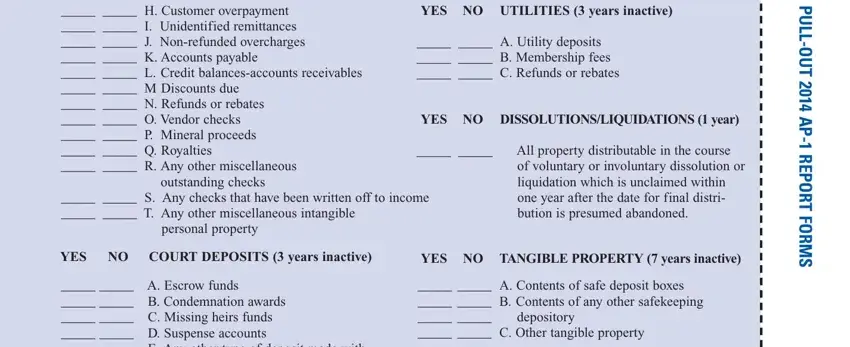

Look at the fields H Customer overpayment I, outstanding checks, S Any checks that have been, YES NO UTILITIES years inactive, A Utility deposits B Membership, YES NO DISSOLUTIONSLIQUIDATIONS, All property distributable in the, YES NO COURT DEPOSITS years, YES NO TANGIBLE PROPERTY years, A Escrow funds B Condemnation, A Contents of safe deposit boxes, depository, and P U L L O U T A P R E P O R and next fill them in.

Step 3: Select "Done". Now you may upload the PDF form.

Step 4: To stay away from possible upcoming challenges, take the time to possess at least two or more duplicates of every document.