At its core, the AP-224 form serves as a comprehensive business questionnaire for a variety of business entities such as partnerships, associations, trusts, joint ventures, joint stock companies, and railroad companies in Texas. This critical document, revised as of May 2012, plays a pivotal role in ensuring that businesses provide essential information including but not limited to the entity's name, federal employer identification number (FEIN), contact details, and the type of entity. It delves deeper by requesting specifics on the entity's formation, registration with the Texas Secretary of State, and its classification under the North American Industry Classification System (NAICS). Furthermore, the AP-224 form requires details on any permits or licenses issued by the Texas Comptroller, along with information on all members or partners holding a significant interest in the entity. This form is not just a bureaucratic requirement; it underscores the participant's rights under Chapters 552 and 559 of the Government Code, highlighting the importance of accuracy and transparency in the submission process. Beyond serving the immediate needs of compliance, it aids in the broader goal of maintaining a transparent, regulated, and fair business environment in Texas. Entities are reminded of their potential eligibility for exemption from filing franchise tax reports, a crucial consideration for any business aiming to navigate the intricacies of Texas tax regulations efficiently.

| Question | Answer |

|---|---|

| Form Name | Form Ap 224 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ap 224 texas business questionnaire form |

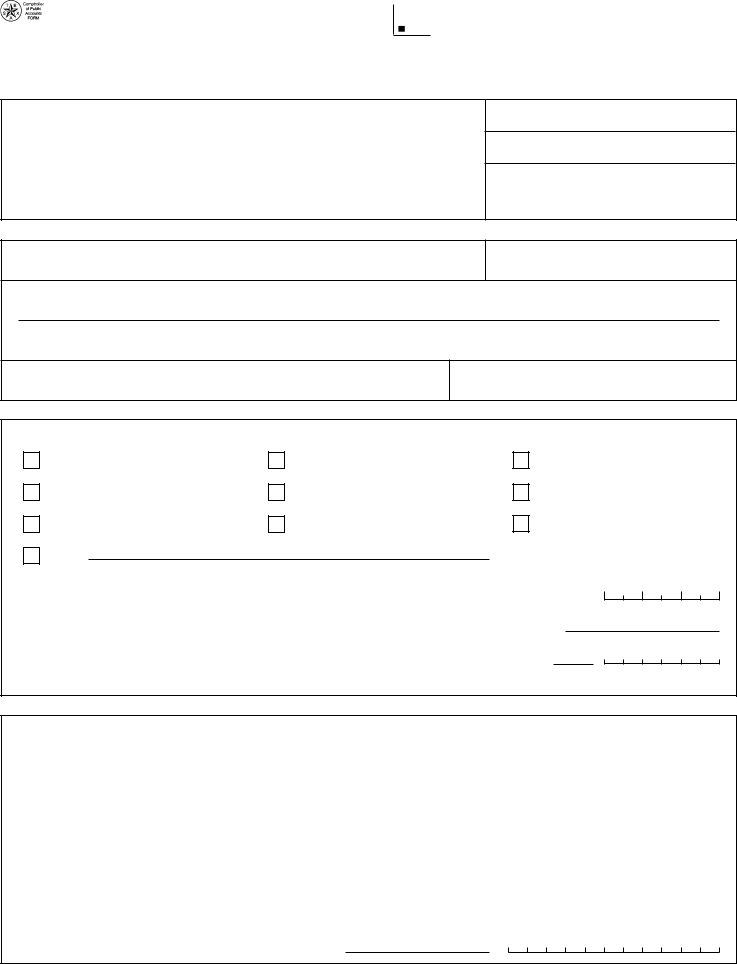

Texas Business Questionnaire

for partnerships, associations, trusts, joint ventures, joint stock companies and railroad companies

Texas taxpayer number

File number

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the address or phone number listed on this form.

1.Entity name

2.Federal employer identification number (FEIN)

3.Mailing address (if different than above address)

City |

State |

ZIP code |

4.Contact person

5.Contact phone (Area code and number)

6.Entity type

Limited partnership (PL) General partnership (PB, PI) Business association (AB) Other

Other association (AR)

Trust (TR)

Real estate investment trust (TH)

Joint venture (PV)

Joint stock company (ST) Railroad company (CW)

month day year

7. In what state or country was this entity formed? |

|

Formation date |

8.If this entity is registered with the Texas Secretary of State, please provide the file number.

9. Please provide the entity's North American Industry Classification System (NAICS) code.

(NAICS c o d e s are av ailab le at w w w .c e ns us .g o v /e p c d /w w w /naic s .htm l.)

10.Please list any tax permits or licenses issued to this entity by the Texas Comptroller.

Type of permit or license |

Taxpayer number for permit or license |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If included in a combined group Texas Franchise Tax Report, provide the reporting entity's Texas taxpayer number.

(continued on back)

Form

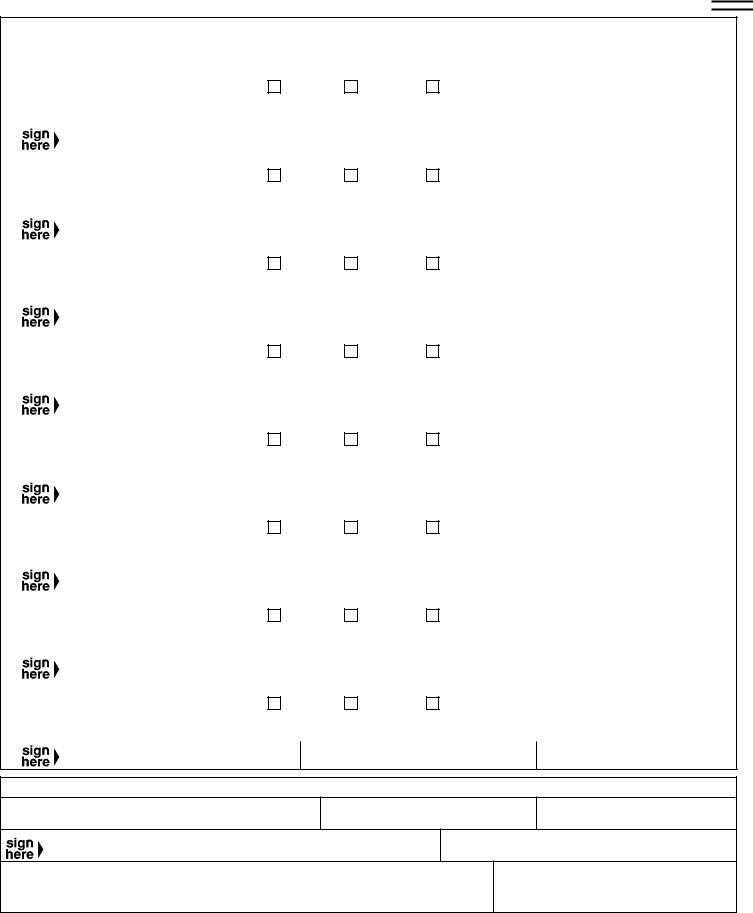

11.Please complete this information for all members, all general partners and each limited partner with a 10% or more

interest in the partnership. (For limited partnerships, general partnerships, joint ventures and joint stock companies.)

(Attach additional sheets if necessary.)

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed name |

|

|

|

|

Title |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name |

|

Type of owner |

General |

Limited |

FEIN |

|

Percentage of ownership |

|||

|

|

Member |

|

|

|

% |

|

|||

|

|

Partner |

Partner |

|

|

|

|

|||

Mailing address |

City |

|

State |

ZIP code |

|

Begin date in Partnership |

||||

|

|

|

|

|

|

|

|

|

|

|

Printed name

Title

I declare that the information in this document and any attachment is true and correct to the best of my knowledge and belief.

Print preparer's name

Title

Phone (Area code and number)

Date

Information about franchise tax is available online at www.window.state.tx.us/taxinfo/franchise/. For taxpayer assistance, call

Please return this completed questionnaire to: Texas Comptroller of Public Accounts P.O. Box 149348

Austin, TX

Exemptions: An entity may qualify for exemption from filing franchise tax reports. Please see Guidelines to Texas Tax Exemptions on our website at www.window.state.tx.us/taxinfo/exempt.