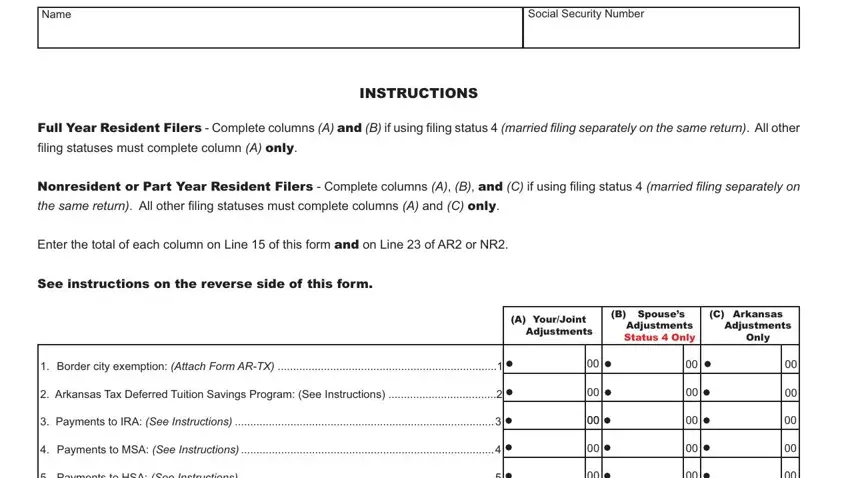

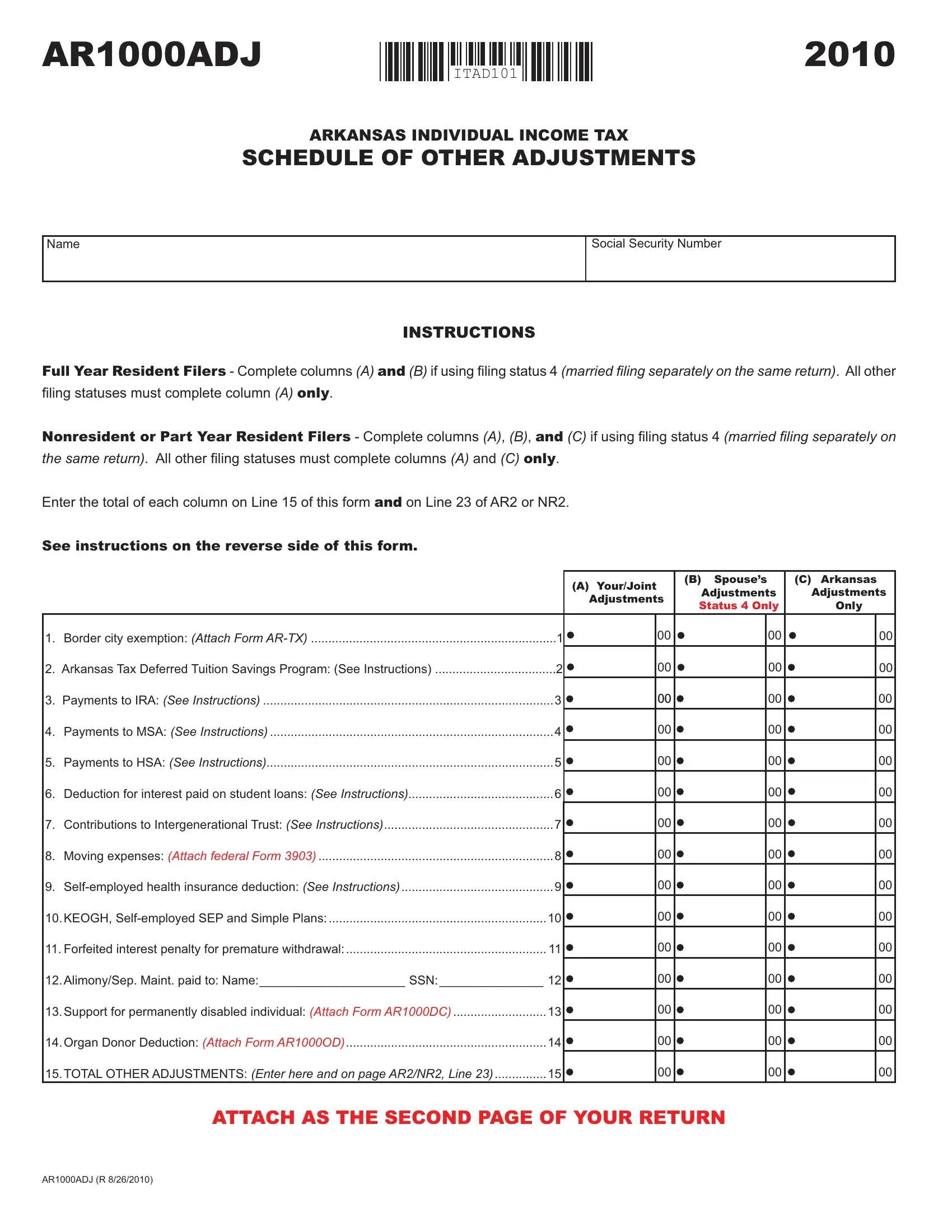

INSTRUCTIONS FOR

AR1000ADJ

LINE 1. To claim the Texarkana exemption, you must file a return and report allArkansas income you received during the year.AttachAR-TX Form.

AR-TX Form is supplied by your employer.

TheAR-TXFormisnotrequiredfornonwageincome such as interest, dividends, Schedule C (sole propri- etor),ScheduleF(farm),ScheduleE(rents,royalties, partnerships,etc.)orretirement.Additionalinformation may be required for verification if an adjustment for these types of income is allowed.

NOTE: Taxpayerswhoclaimthisexemptionmust file using their street address inTexarkana,Arkansas or Texarkana, Texas. If you use a Post Office Box, this exemption will not be allowed.

If you lived within the city limits of Texarkana, Arkan- sas, you are allowed a full exemption fromArkansas incometaxation. PartyearTexarkanaresidentsclaim theexemptiononlyonincomeearnedwhilearesident of Texarkana,Arkansas.

If you lived within the city limits of Texarkana, Texas, you are allowed to deduct the income you earned in the city limits of Texarkana, Arkansas. All other Arkansas income is taxable to you.

LINE 2. If you made contributions to a tuition sav- ings account established under the Arkansas Tax Deferred Tuition Savings Program enter the amount here. Contributions to plans established in states other thanArkansas are not deductible. The deduct- ible contribution cannot exceed $5,000 per taxpayer per tax year. Qualified withdrawals from a tuition savings account established under theArkansasTax Deferred Tuition Savings Program or a tax-deferred tuition savings program established by another state willbeexemptfromArkansasincometaxwithrespect to the designated beneficiary’s income.

LINE 3. This line is used to report your allowable contributiontoanIndividualRetirementAccount(IRA). If you contributed to your own IRA, certain limitations may apply to the amount you may use as an adjust- ment to income. If neither you nor your spouse was coveredbyanemployerprovidedretirementplan,the entire contribution is deductible up to $5,000 each for all filing statuses. If either you or your spouse was covered by such a plan, the amount of the deduction depends on the amount of your Adjusted Gross In- come(AGI)beforetheIRAdeduction,asshowninthe table on page 21 of the booklet. Use this table along with your Arkansas AGI to determine your allowable deduction. Catch up Contributions - Individuals who turned50beforethecloseofthetaxyearmayincrease the maximum permitted annual contribution by up to $1,000.

LINE 4. This line is used to report your allowable contribution to an Archer Medical Savings account (MSA).An MSAis a trust or custodial account that is created or organized exclusively for the purpose of payingthequalifiedmedicalexpensesofthetaxpayer (accountholder)aswellasthetaxpayer’sspouseand/ ordependents. Inordertobeeligible,ataxpayermust

havehadinsurancecoverageunderahighdeductible healthplan(HDHP)only. AHDHPwillhavethefollow- ing deductions and limitations: (1) for self-only cover- age, the minimum deductible is $2,000, maximum deductible is $3,000 and the maximum out of pocket expense is $4,050, and (2) for family coverage, the minimum deductible is $4,050, maximum deductible is $6,050 and the maximum out of pocket expense is $7,400.Thecontributionlimitationforanymonthisthe amountequalto1/12of65%oftheannualdeductible for an individual with self-only coverage and 1/12 of 75%oftheannualdeductibleforfamilycoverage.New Archer MSAs may not be established after 2007 but contributions can be made to existing accounts.

LINE 5. This line is used to report your allowable contributiontoaHealthSavingsAccount(HSA).Inor- dertobeeligible,ataxpayermusthavehadinsurance coverage under a HDHP only. AHDHP will have the following deductions and limitations: (1) for self-only coverage, the minimum deductible is $1,200 and the maximum out of pocket expense is $5,950, and (2) forfamilycoverage,theminimumdeductibleis$2,400 and the maximum out of pocket expense is $11,900. You can make pre-tax contributions of up to $3,050 each year ($6,150 for families) to cover health care costs. Individuals who reached age 55 by the end of the tax year can increase their annual contribution by $1,000 for 2010. Maximum contributions allowed to anHSAarereducedbyanycontributionsmadetoan Archer MSA.

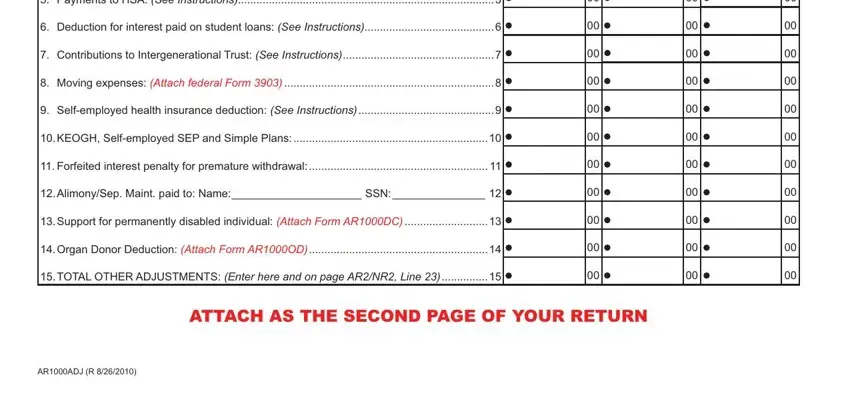

LINE 6. You may take an adjustment for interest paid on student loans if all of the following apply:

1.You paid interest in 2010 on a qualified student loan.

2.Your filing status is any status other than married filing separately on different returns (Status 5). 3.YourAGIislessthan:$75,000iffilingStatus1,3,or 6;$150,000iffilingStatus2or4.Status4filers,please note that this is a combined income amount.

4.You are not claimed as a dependent on another taxpayer’s 2010 tax return.

Figure your allowable deduction using the worksheet on page 21 of the booklet.

LINE 7. You may take an adjustment from income forcontributionsmadetoalong-termintergenerational trust. Thisisatrustestablishedforanindividualunder the age of 18 in order to provide funds for the minor’s retirement. The trustee must be a resident of Arkan- sas and cannot distribute any of the trust funds to the beneficiaryuntilthebeneficiaryreachestheageof55. Contributions are limited to $4,000 per year.

LINE 8. Employees and self-employed persons (including partners) can deduct certain moving ex- penses. Expenses incurred in 2010 are deducted on this line as an adjustment to income.

You can only take this deduction if you moved in con- nection with your job or business and your change in job location has added at least fifty (50) miles to the distance from your old home to your workplace. If you had no former workplace, your new workplace must be at least fifty (50) miles from your old home. You must attach a completed copy of federal Form 3903.

If you were reimbursed for any part of your moving expenses and the amount was included on your W-2, report this amount as income on Form AR1/ NR1, Line 8. If the amount was not included on your W-2,includetheamountonFormAR1/NR1,Line20, Other Income.

LINE 9. If you were self-employed and had a net profit for the year, you may be able to deduct part of the amount paid for health insurance on behalf of yourself, your spouse, and/or dependents. Complete theworksheetonpage22ofthebooklettodetermine your deduction.

LINE 10. Ifyouwereself-employedandcontribut- edtoa“Keogh”,H.R.10retirementplan,oraSIMPLE plan, enter the total amount of your contributions in the space provided. The amount of the deduction depends upon the type of plan.

LINE 11. Enter the total interest penalties paid for premature or early withdrawal of certificates of deposit.

LINE 12. If you paid alimony or separate mainte- nance as the result of a court order, enter the total amount in the space provided. You must enter the name and Social Security Number of the person you paid.

LINE 13. If you have a permanently disabled indi- vidualwhoqualifiesforthedeductionyoucantakean adjustmentfromincomeof$500foreachpermanently disabled individual.Attach FormAR1000DC.

LINE 14. If you paid unreimbursed expenses for yourself or one of your dependents related to the donationofanorgan(partofaliver,pancreas,kidney, intestine, lung or bone marrow) you may take an income tax deduction of up to $10,000. The deduc- tion must be claimed for the taxable year in which the transplantation of the organ occurs. Allowable expenses include travel, lodging, medical expenses andlostwagesthatarerelatedtotheorgandonation. An individual may claim the deduction only once in his or her lifetime. This deduction does not apply to organs harvested from a deceased donor. Attach FormAR1000-OD.

LINE 15. Total Other Adjustments. Add Lines 1 through 14 and enter on this line and on FormsAR2 or NR2, Line 23.