ar1000anr can be completed without difficulty. Just open FormsPal PDF editing tool to get the job done quickly. FormsPal is dedicated to making sure you have the absolute best experience with our tool by continuously releasing new functions and improvements. Our editor has become even more useful thanks to the newest updates! At this point, editing PDF forms is a lot easier and faster than ever before. Starting is easy! Everything you need to do is take the next basic steps below:

Step 1: Open the PDF file in our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: With this state-of-the-art PDF tool, you may do more than merely fill out blank form fields. Edit away and make your forms appear professional with customized text put in, or adjust the file's original input to perfection - all that supported by an ability to insert stunning photos and sign the PDF off.

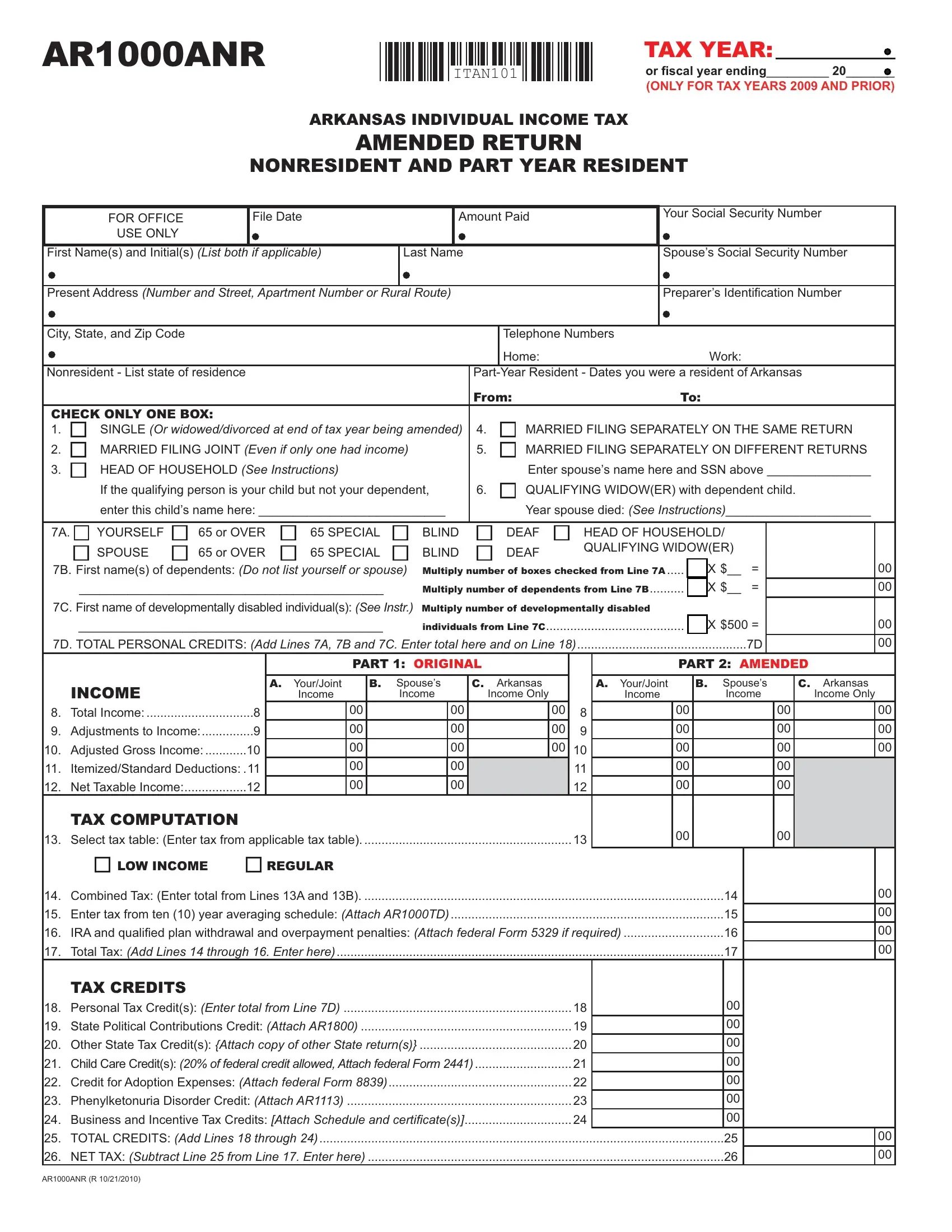

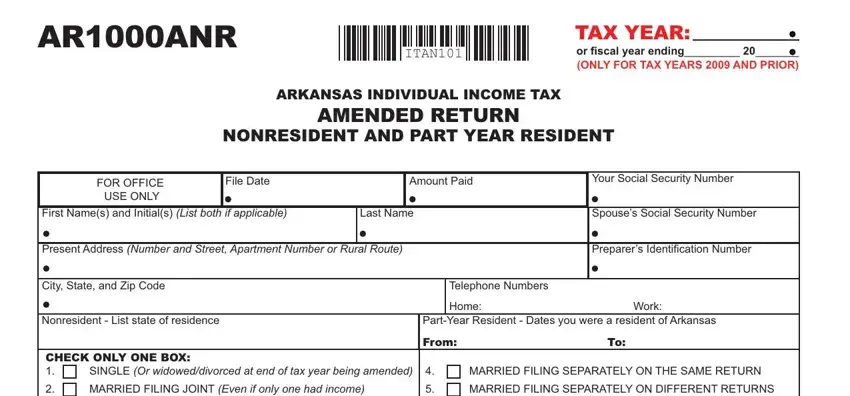

With regards to the fields of this particular document, here is what you should consider:

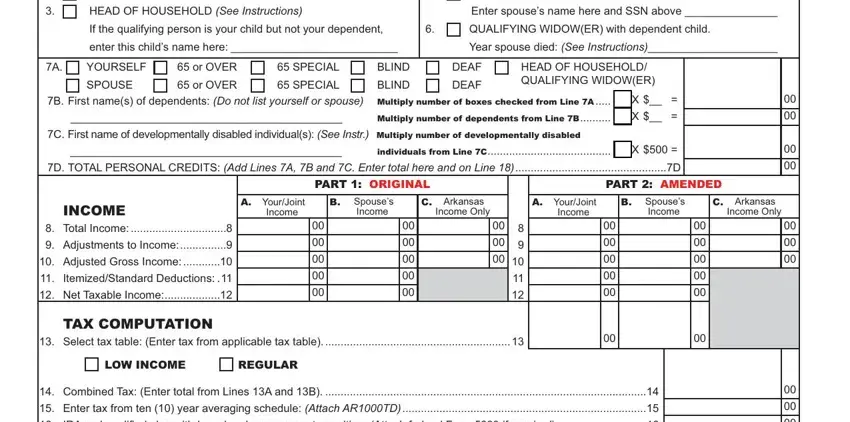

1. Begin completing the ar1000anr with a group of necessary blanks. Get all of the required information and ensure not a single thing left out!

2. Immediately after the prior part is done, go to type in the relevant details in all these - HEAD OF HOUSEHOLD See Instructions, If the qualifying person is your, enter this childs name here, Enter spouses name here and SSN, QUALIFYING WIDOWER with dependent, Year spouse died See Instructions, YOURSELF, or OVER, SPECIAL, BLIND, DEAF, SPOUSE, BLIND, DEAF, and HEAD OF HOUSEHOLD QUALIFYING.

It is possible to make an error when completing the YOURSELF, thus make sure that you reread it prior to when you submit it.

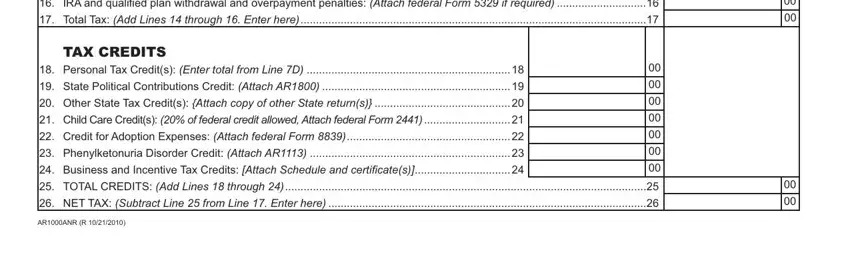

3. Your next part is usually simple - fill out all of the fields in IRA and qualified plan withdrawal, Total Tax Add Lines through, TAX CREDITS, Personal Tax Credits Enter total, State Political Contributions, Other State Tax Credits Attach, Child Care Credits of federal, Credit for Adoption Expenses, Phenylketonuria Disorder Credit, Business and Incentive Tax, TOTAL CREDITS Add Lines through, NET TAX Subtract Line from Line, and ARANR R to complete this part.

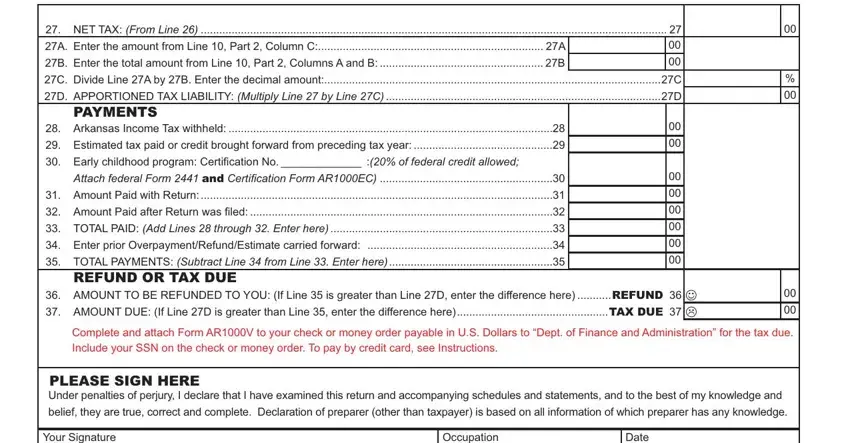

4. To move forward, the next step will require completing several empty form fields. Examples of these are NET TAX From Line, A Enter the amount from Line Part, B Enter the total amount from Line, C Divide Line A by B Enter the, D APPORTIONED TAX LIABILITY, PAYMENTS, Estimated tax paid or credit, Early childhood program, Attach federal Form and, Amount Paid with Return, Amount Paid after Return was filed, TOTAL PAYMENTS Subtract Line, REFUND OR TAX DUE, AMOUNT DUE If Line D is greater, and cid, which you'll find vital to moving forward with this document.

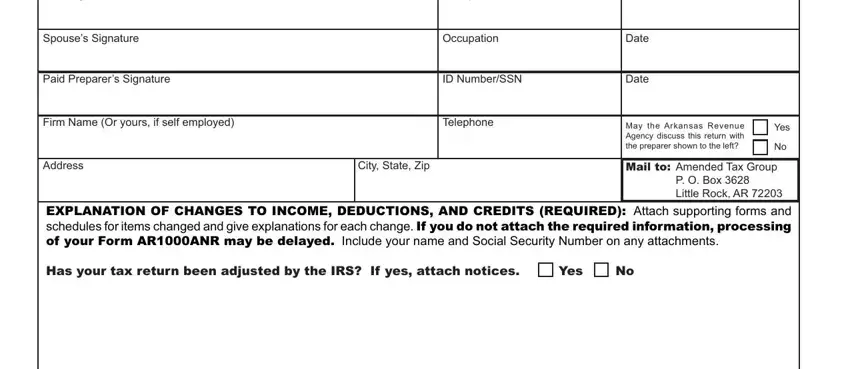

5. While you draw near to the conclusion of this form, there are a couple more requirements that have to be met. In particular, Your Signature, Spouses Signature, Occupation, Occupation, Paid Preparers Signature, ID NumberSSN, Date, Date, Date, Firm Name Or yours if self employed, Telephone, Address, City State Zip, May the Arkansas Revenue Agency, and Yes should be filled out.

Step 3: As soon as you have looked over the information you given, click on "Done" to complete your FormsPal process. Find your ar1000anr once you join for a 7-day free trial. Easily view the pdf form inside your personal cabinet, along with any edits and adjustments being automatically kept! When using FormsPal, you can complete forms without needing to worry about personal information incidents or records getting distributed. Our protected system helps to ensure that your personal details are maintained safe.