Navigating the intricacies of corporate taxation in Arkansas requires a comprehensive understanding of pivotal documentation, such as the AR1100CT form, an essential instrument for corporates to file their income tax returns. This form caters to a variety of corporate entities, encompassing the necessities for initial, amended, and final tax returns, while also providing specific options for cooperative associations, financial institutions, and entities benefiting from automatic federal or Arkansas-specific extensions. Moreover, the form seeks detailed information about the corporation's income, deductions, taxable income adjustments, and tax computation, alongside special considerations for multistate corporations concerning apportionment of income. Essential checkboxes enable corporations to declare significant changes, for instance in their name or address since the prior year, thereby ensuring the state’s records remain updated. Accompanied by rigorous sections addressing income, deductions, and the computation of tax liabilities or refunds, the AR1100CT form embodies the structure through which Arkansas corporations navigate their fiscal responsibilities. Notably, the form mandates the attachment of the federal return and highlights penalties for late filings or payments, underscoring the importance of timeliness and accuracy in corporate tax compliance.

| Question | Answer |

|---|---|

| Form Name | Form Ar1100Ct |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | AR1100CT, preparer, ARKANSAS, MULTISTATE |

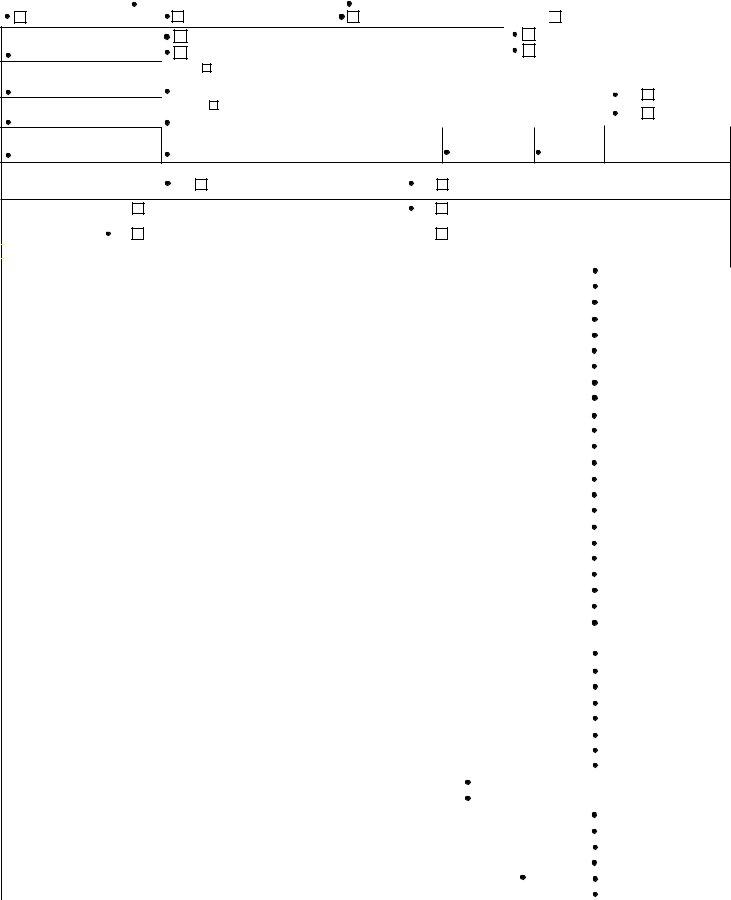

2011 AR1100CT

ARKANSAS CORPORATION

INCOME TAX RETURN

Tax Year year beginning _______/_______/________ and ending |

_______/_______/________ |

Check if INITIAL Return

Check if AMENDED Return

Check if FINAL Arkansas Return

Check if Cooperative Association

FEIN

NAICS Code

Date of Incorporation

Check this box if Automatic Federal Extension Form 7004 iled |

Check if Filing as Financial Institution |

|||

|

(SEE INSTRUCTIONS) |

Check if Single Weighting Sales Factor |

||

Check this box if Arkansas Extension Form AR1155 iled |

||||

Name |

Check this box if Name has changed from prior year |

|

Type of Corporation |

|

|

|

|

Check only one box below |

|

|

|

|

5 |

Domestic |

Address |

Check this box if Address has changed from prior year |

|

6 |

Foreign |

|

||||

|

|

|

||

|

|

|

|

|

Date Began Business in AR

City

State

Zip

Telephone Number

If you are a

the iling status boxes below: |

7 |

LIMITED LIABILITY COMPANY |

8 |

PARTNERSHIP |

See Instructions, page 4 |

|

|

|

|

FILING STATUS: 1

(CHECK ONLY

ONE BOX) |

2 |

CORPORATION OPERATING ONLY IN ARKANSAS |

3 |

MULTISTATE CORPORATION - APPORTIONMENT 4

MULTISTATE CORPORATION - DIRECT ACCOUNTING (Prior written approval required for Direct Accounting) CONSOLIDATED RETURN: # of corp.entities in AR___

|

Note: Attach completed copy of Federal Return and Sign Arkansas Return. (See Important Reminders) |

|

|

ARKANSAS |

||||||||

|

|

9. |

Gross Sales: (Less returns and allowances) |

|

9. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

10. |

Less Cost of Goods Sold: |

|

10. |

|

|

|

00 |

|||

|

INCOME |

|

|

|

|

|

||||||

|

11. |

Gross Proit: (Line 9 less Line 10) |

|

11. |

|

|

|

00 |

||||

|

|

|

|

|

|

|||||||

|

|

12. |

Dividends: (See Instructions) |

|

12. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

13. |

Taxable Interest: (Attach AR1100REC) |

|

13. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

14. |

Gross Rents/Gross Royalties: (See Instructions) |

|

14. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

15. |

Gains or Losses: |

|

15. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

16. |

Other Income: |

|

16. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

17. |

TOTAL INCOME: (Add Lines 11 through 16) |

|

17. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

18. |

.............................................................Compensation of Oficers/Other Salaries and Wages: (See Instructions) |

18. |

|

|

|

00 |

||||

|

|

19. |

Repairs: |

|

19. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

20. |

Bad Debts: |

|

20. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

DEDUCTIONS |

21. |

Rent on Business Property: |

|

21. |

|

|

|

00 |

|||

|

|

22. |

Taxes: (Attach AR1100REC) |

|

22. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

23. |

Interest: |

|

23. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

24. |

Contributions: |

|

24. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

25. |

Depreciation: (Attach AR1100REC) |

|

25. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

26. |

Depletion: |

|

26. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

27. |

Advertising: |

|

27. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

28. |

Other Deductions: (Attach schedule) |

|

28. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

29. |

TOTAL DEDUCTIONS: (Add Lines 18 through 28) |

|

29. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

30. |

Taxable Income Before Net Operating Losses: (Line 17 less Line 29) |

|

30. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

31. |

Net Operating Losses: (Adjust for |

|

31. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

32. |

Net Taxable Income: (Line 30 less Line 31 or Schedule A C4 page 2) |

(If Amended Return Box Checked, Enter |

|

|

|

|

||||

|

|

|

Amended Net Taxable Income) |

|

32. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

|

|||||

|

COMPUTATION |

33. |

Tax from Table: (Instruction Booklet, pages 17 and 18) |

|

33. |

|

|

|

00 |

|||

|

|

|

|

|

|

|||||||

|

34. |

........................................Business Incentive Credits: (Attach all original certiicates and Schedule AR1100BIC) |

34. |

|

|

|

00 |

|||||

|

|

|

|

|

||||||||

|

|

35. |

Tax Liability: (If Amended Return Box Checked, Enter Amended Tax Liability) |

35. |

|

|

|

00 |

||||

|

|

|

|

|

|

|||||||

|

|

36. |

Estimated Tax Paid: (Including estimate carryforward from prior year) |

|

36. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

||||||

|

|

37. |

Payment with Extension Request: |

|

37. |

|

|

|

00 |

|||

|

|

38. |

Amended Return Only: (Enter Net tax paid (or refunded) on previous returns(s) for this tax year) |

38. |

|

|

|

00 |

||||

|

|

39. |

Overpayment: (Line 36 plus line 37 less line 35; plus or minus Line 38, if applicable) |

39. |

|

|

|

00 |

||||

|

|

40. |

Amount Applied to 2012 Estimated Tax |

40. |

|

|

|

|

00 |

|

|

|

|

|

41. Amount Applied to Check Off Contributions: (Attach AR1100CO) |

41. |

|

|

|

|

00 |

|

|

||

|

TAX |

42. Amount to be Refunded: (Line 39 less Lines 40 and 41) |

|

42. |

|

|

|

00 |

||||

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

43. |

Tax Due: (Line 35 less Line 36 and 37; plus or minus Line 38, if applicable) |

43. |

|

|

|

00 |

||||

|

|

44. |

Interest on Tax Due: |

|

44. |

|

|

|

|

|||

|

|

45. |

Penalty for Late Filing or Payment: (See Instructions) |

|

|

45. |

|

|

|

00 |

||

|

|

46. |

Penalty for Underpayment of Estimated Tax: (Attach AR2220) Enter exception checked in Part 3 |

|

46. |

|

|

|

00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47. |

Amount Due: (Add Lines 43 through 46) |

|

47. |

|

|

|

00 |

|||

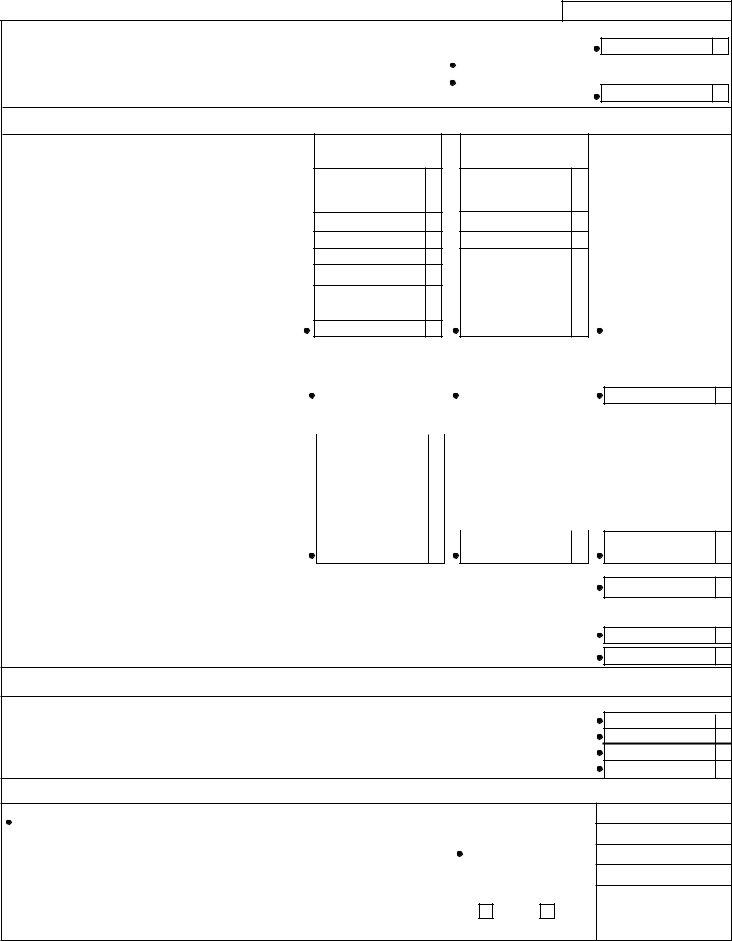

AR1100CT (R 9/8/11)

SCHEDULE A |

|

Apportionment of Income |

|

for Multistate Corporation |

FEIN: |

A.INCOME TO APPORTION:

1. |

Income per Federal Return: (Federal Form 1120, Line 28) |

................................................ |

1. |

||

2. |

Add Adjustments: (Attach schedule) |

2. |

|

|

|

|

00 |

|

|||

3. |

Deduct Adjustments: (Attach schedule) |

3. |

|

00 |

|

4. |

TOTAL APPORTIONABLE INCOME: |

................................................ |

4. |

||

00

00

NOTE: If all factors in Section B are 100%, do not complete Columns (A), (B), or (C). The return should be iled as a status 1, CORPORATION OPERATING ONLY IN ARKANSAS and complete all appropriate lines on page 1 of Form AR1100CT.

B.APPORTIONMENT FACTOR:

1.Property Used in Business:

a.Tangible Assets Used in Business and Inventories Less Construction in Progress:

1. |

Amount Beginning of Year: |

1. |

2. |

Amount End of Year: |

2. |

3. |

Total: (Add Lines a1 and a2) |

3. |

4. |

Average Tangible Assets: (Line 3 ÷ 2) |

4. |

b. Rental Property: (8 times annual rent) |

b. |

|

c. Average Value of Intangible Property: |

c. |

|

(For Financial Institutions Only - Attach schedule) |

|

|

d. TOTAL PROPERTY: (Add Lines a4, b, and c) |

d. |

|

2. Salaries, Wages, Commissions and Other Compensation

(A)

Amounts in Arkansas

(B) |

(C) |

Total Amounts |

Percentage (A) ÷ (B) |

|

|

00

(Calculate to 6 places to

00the right of the decimal.

00Fill in all spaces.)

00 |

|

|

|

|

|

|

|

00 |

|

999.999999 |

% |

|

|

|

|

|

|

(EXAMPLE) |

|

00 |

|

|

|

|

|

|

|

00 d. |

|

% |

|

Related to the Production of Business Income: |

|

|

|

|

|

|

|

|

|

a. TOTAL: |

a. |

|

|

a. |

|

|

|

||

|

00 |

|

00 |

a. |

|||||

3. Sales/Receipts: |

|

|

|

|

|

|

|

|

|

a. Destination Shipped From Within Arkansas: |

a. |

|

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|||

b. Destination Shipped From Without Arkansas: |

b. |

00 |

|

|

|

|

|

|

|

c. Origin Shipped From Within Arkansas to U.S. Govt: .. |

c. |

00 |

|

|

|

|

|

|

|

d. Origin Shipped From Within Arkansas to |

|

|

|

|

|

|

|

|

|

Other |

d. |

00 |

|

|

|

|

|

|

|

e. Other Gross Receipts: (Attach schedule) |

e. |

00 |

|

|

|

|

|

|

|

f. TOTAL SALES / RECEIPTS: |

|

|

|

|

|

|

|

|

|

(Add Lines 3a through 3e) |

f. |

00 |

|

f. |

|

00 f. |

|||

g.DOUBLE WEIGHTED: (Applies to tax years beginning on or after January 1, 1995)

(Financial Institutions must use Single Weighted Factor) (Column C, Line 3f X 2) |

g. |

4.Sum of Percentages:(Single Weighted: Add Column C, Lines 1d, 2a and 3f)

(Double Weighted: Add Column C, Lines 1d, 2a and 3g) |

4. |

||||

|

|

|

|

|

|

...................*5. Percentage Attributable to Arkansas: |

Line 4 |

|

Divided By* |

|

= 5. |

*For Part B, Line 5, Divide Line 4 by number of entries other than zero which you make on Part B, Column B, Lines (1d), (2a), and (3f). NOTE: An entry other than zero in Part B, Column B, Line (3f), counts as two (2) entries unless using Single Weighted Factor.

%

%

%

%

%

C. ARKANSAS TAXABLE INCOME:

1. |

Income Apportioned to Arkansas: (Part A, Line 4) x (Part B, Line 5,Column C) |

1. |

2. |

Add: Direct Income Allocated to Arkansas: (Attach schedule) |

2. |

3. |

Less: Apportioned NOL to Arkansas: (See NOL Instructions, page 7) |

3. |

4. |

TOTAL INCOME TAXABLE TO ARKANSAS: (Enter here and on Line 32, page 1) |

4. |

00

00

00

00

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules, statements and documents, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

SIGNATURE OF OFFICER |

DATE |

TITLE |

|

|

|

|

|

PREPARER’S SIGNATURE |

DATE |

PREPARER’S FEIN/PIN |

|

|

|

|

|

PREPARER’S PRINTED NAME |

|

May the Arkansas Revenue Agency |

|

|

|

discuss this return with the preparer |

|

|

|

shown above? |

|

AREA CODE AND TELEPHONE NUMBER OF PREPARER |

|

|

|

|

Yes |

No |

|

|

|

||

|

|

|

|

Mail completed form to: Corporation Income Tax, P O Box 919, Little Rock, AR

FOR OFFICE USE ONLY

A

B C

AR1100CT Back (R 9/7/2011)