Form Ar1100S can be completed in no time. Just open FormsPal PDF editor to do the job without delay. The tool is consistently improved by us, acquiring new functions and growing to be greater. To get the ball rolling, consider these simple steps:

Step 1: Hit the "Get Form" button in the top section of this webpage to get into our PDF tool.

Step 2: The tool provides the opportunity to customize PDF files in many different ways. Transform it with customized text, correct original content, and place in a signature - all within the reach of a couple of clicks!

It really is straightforward to finish the pdf with this practical tutorial! Here is what you should do:

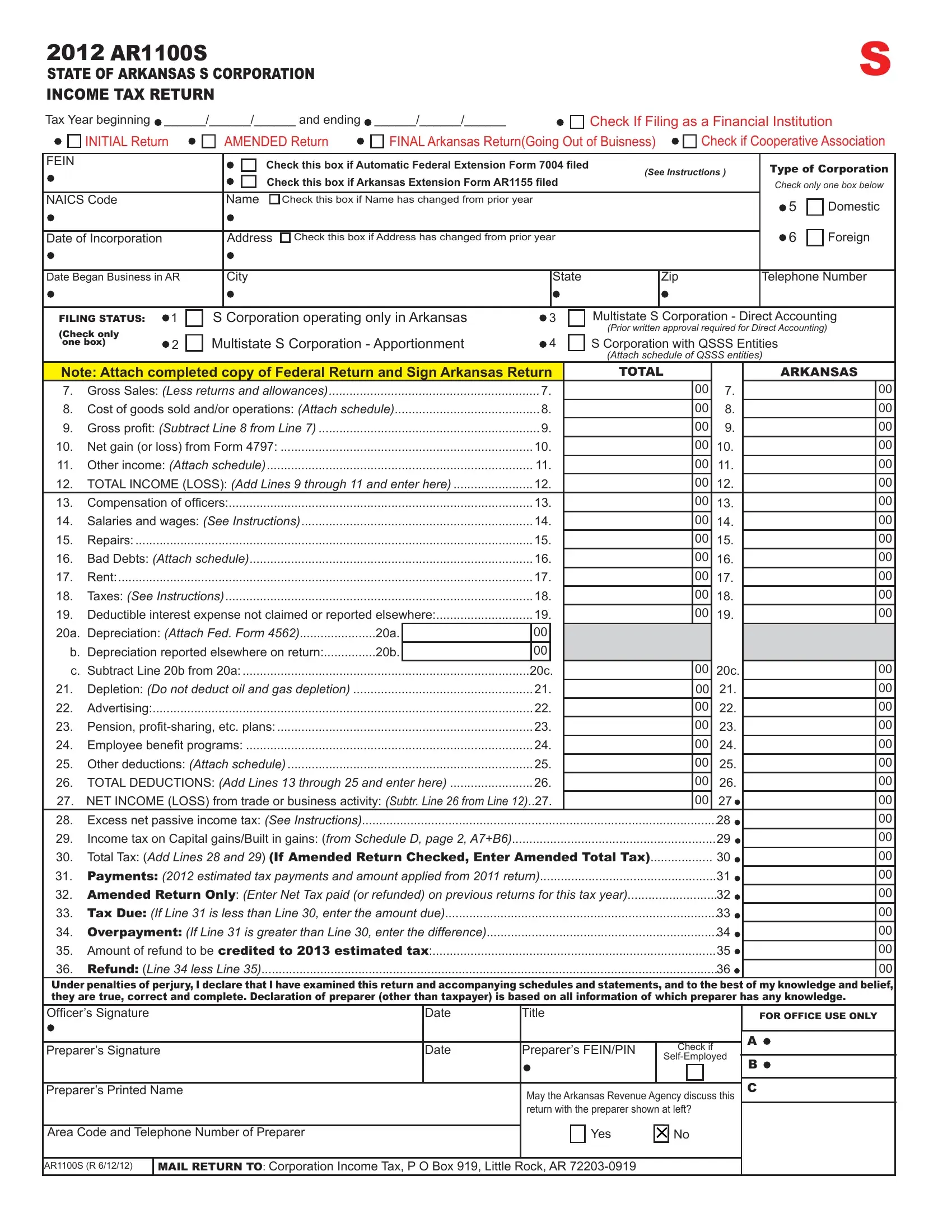

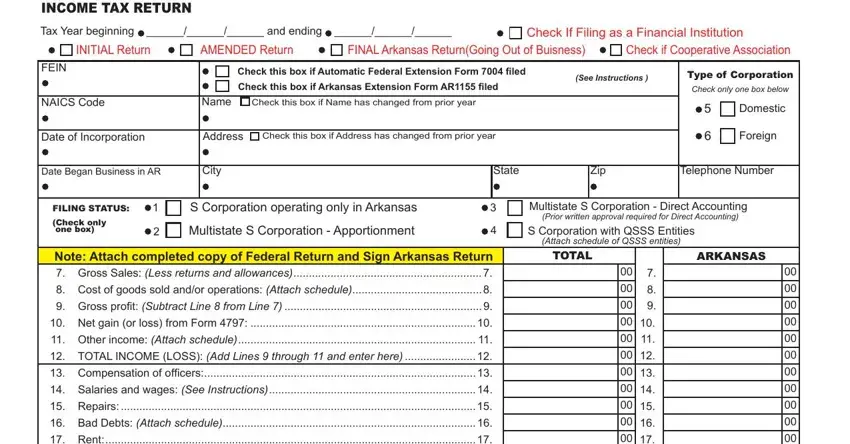

1. The Form Ar1100S involves certain details to be inserted. Make certain the next blank fields are completed:

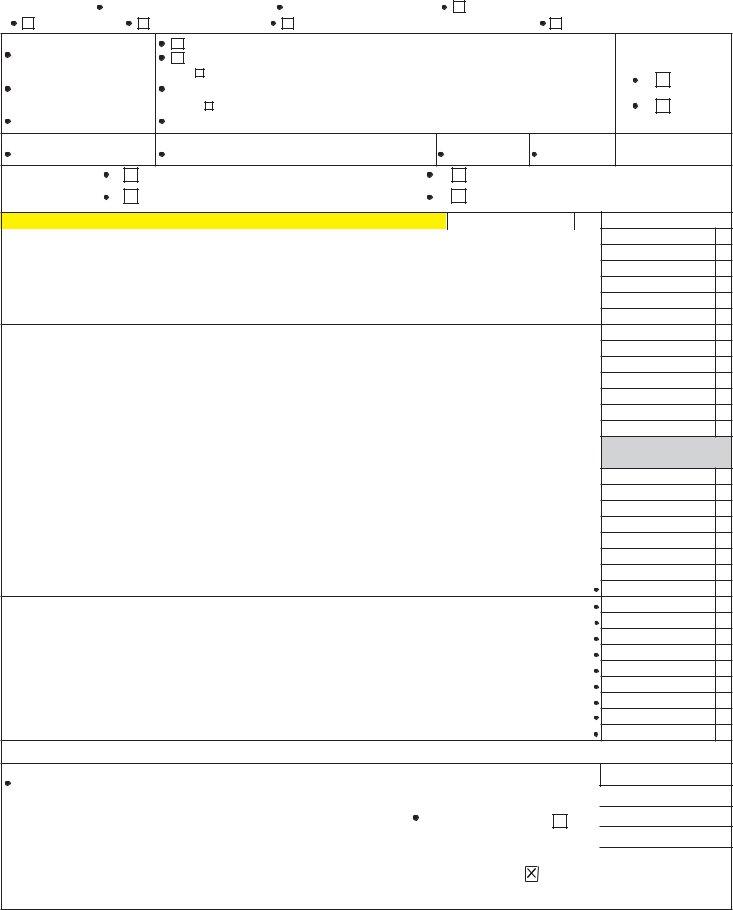

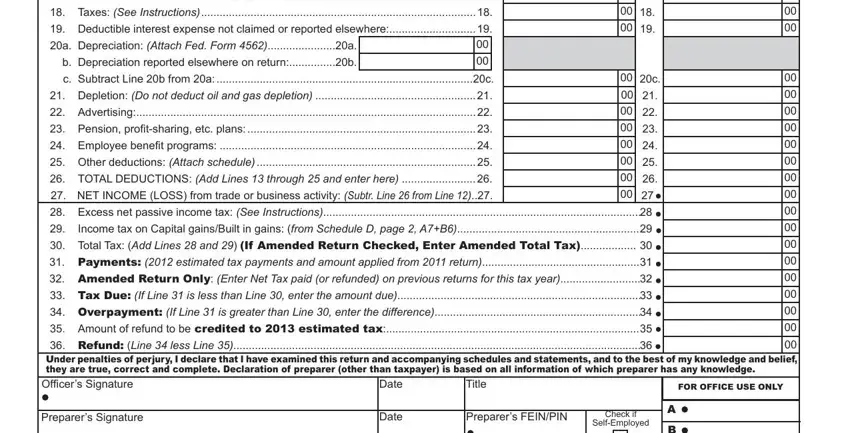

2. Your next part is usually to complete the next few blanks: Rent, Taxes See Instructions, Deductible interest expense not, a Depreciation Attach Fed Form a, b Depreciation reported elsewhere, c Subtract Line b from a c, Depletion Do not deduct oil and, Advertising, Pension profi tsharing etc plans, Employee benefi t programs, Other deductions Attach schedule, TOTAL DEDUCTIONS Add Lines, NET INCOME LOSS from trade or, Excess net passive income tax See, and Income tax on Capital gainsBuilt.

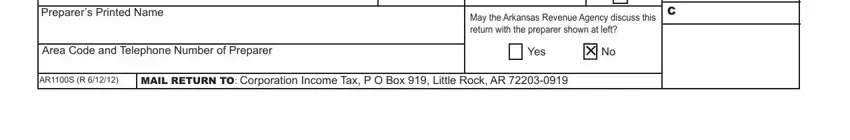

3. Your next step is generally hassle-free - complete every one of the empty fields in Preparers Printed Name, Area Code and Telephone Number of, May the Arkansas Revenue Agency, Yes, ARS R, and MAIL RETURN TO Corporation Income in order to complete this part.

Regarding Preparers Printed Name and MAIL RETURN TO Corporation Income, be certain you take another look in this current part. The two of these are viewed as the most significant fields in the file.

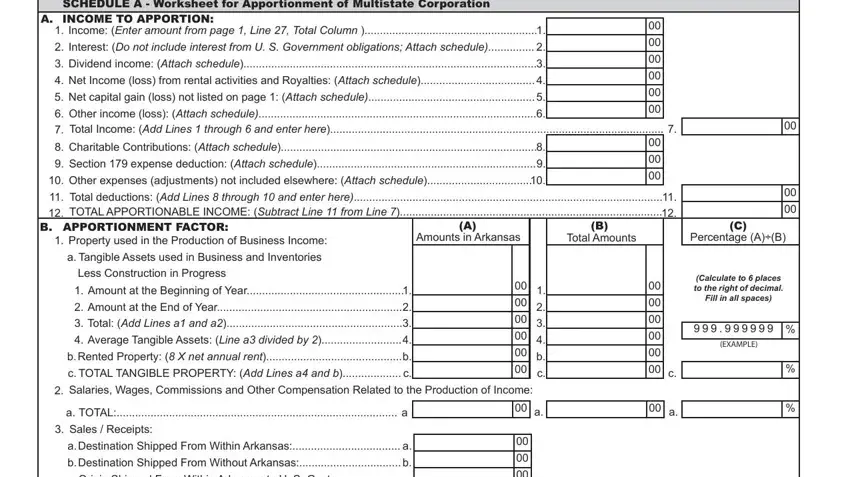

4. The following paragraph will require your attention in the following areas: SCHEDULE A Worksheet for, A INCOME TO APPORTION, Income Enter amount from page, Interest Do not include interest, Dividend income Attach schedule, Net Income loss from rental, Net capital gain loss not listed, Other income loss Attach schedule, Charitable Contributions Attach, Other expenses adjustments not, Total deductions Add Lines, Amounts in Arkansas, Total Amounts, Percentage AB, and Salaries Wages Commissions and. It is important to give all of the needed information to move onward.

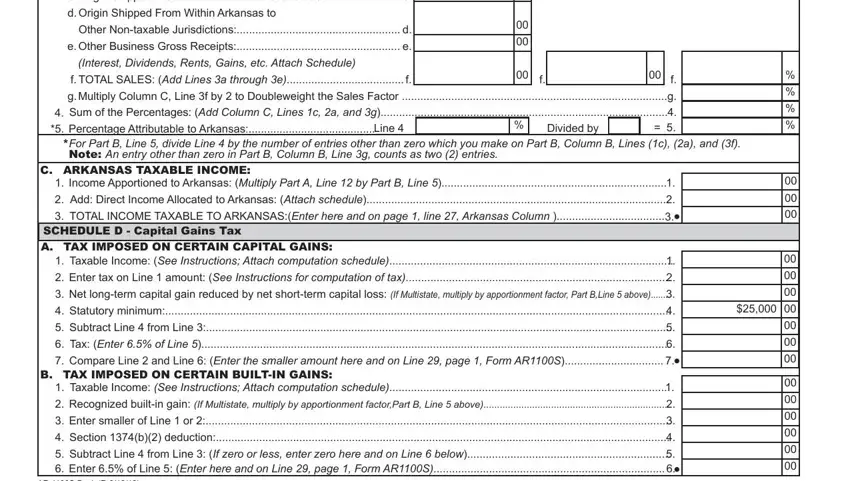

5. To wrap up your form, the last section has a number of additional blanks. Filling out Origin Shipped From Within, Other Nontaxable Jurisdictions, Other Business Gross Receipts, Interest Dividends Rents Gains etc, Multiply Column C Line f by to, Divided by, For Part B Line divide Line by, Income Apportioned to Arkansas, TOTAL INCOME TAXABLE TO, SCHEDULE D Capital Gains Tax, TAX IMPOSED ON CERTAIN CAPITAL, Taxable Income See Instructions, Enter tax on Line amount See, Net longterm capital gain reduced, and Subtract Line from Line should wrap up everything and you'll certainly be done in a flash!

Step 3: Revise the information you have typed into the form fields and press the "Done" button. Join us now and easily gain access to Form Ar1100S, prepared for download. Each and every change made is handily preserved , making it possible to change the file later on when necessary. When you work with FormsPal, you can fill out documents without having to get worried about information breaches or records getting shared. Our protected software makes sure that your private data is maintained safely.