The Form AS 2745-A plays a crucial role in how taxpayers in Puerto Rico manage their representation before the Department of the Treasury, aligning with Section 6072.01 of the Puerto Rico Internal Revenue Code of 2011. This comprehensive form not only facilitates the appointment of a representative to act on behalf of a taxpayer but also outlines the process for such an appointment meticulously. It requires the inclusion of a valid photo identification of the taxpayer to ensure authenticity and legality of the representation. The form spans several vital aspects, from basic taxpayer and representative information, specifying the types of tax matters the representative is authorized to handle, to detailing the acts the representative is permitted to undertake on behalf of the taxpayer. This includes receiving confidential information, signing documents, and making appearances before the Department and its officials, among others. Importantly, it also covers the receipt of reimbursement or refund checks, setting clear boundaries regarding the representative’s authority in financial matters. Additionally, it specifies how notices and communications should be directed, ensuring both the taxpayer and their representative(s) stay informed. The form further mentions the revocation of prior powers of representation, making it a critical document for updating the taxpayer’s representation status. Lastly, it details the effective period and signature requirements for both taxpayers and representatives, alongside the declaration that must be signed by the representative, affirming their eligibility and compliance with the regulation. Through Form AS 2745-A, taxpayers can securely delegate their representation, providing a structured method to navigate tax matters efficiently while ensuring legal compliance and representation integrity.

| Question | Answer |

|---|---|

| Form Name | Form As 2745 A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | puerto form declaration pdf, puerto rico declaration form, puerto rico travel declaratin form, puerto department declaration |

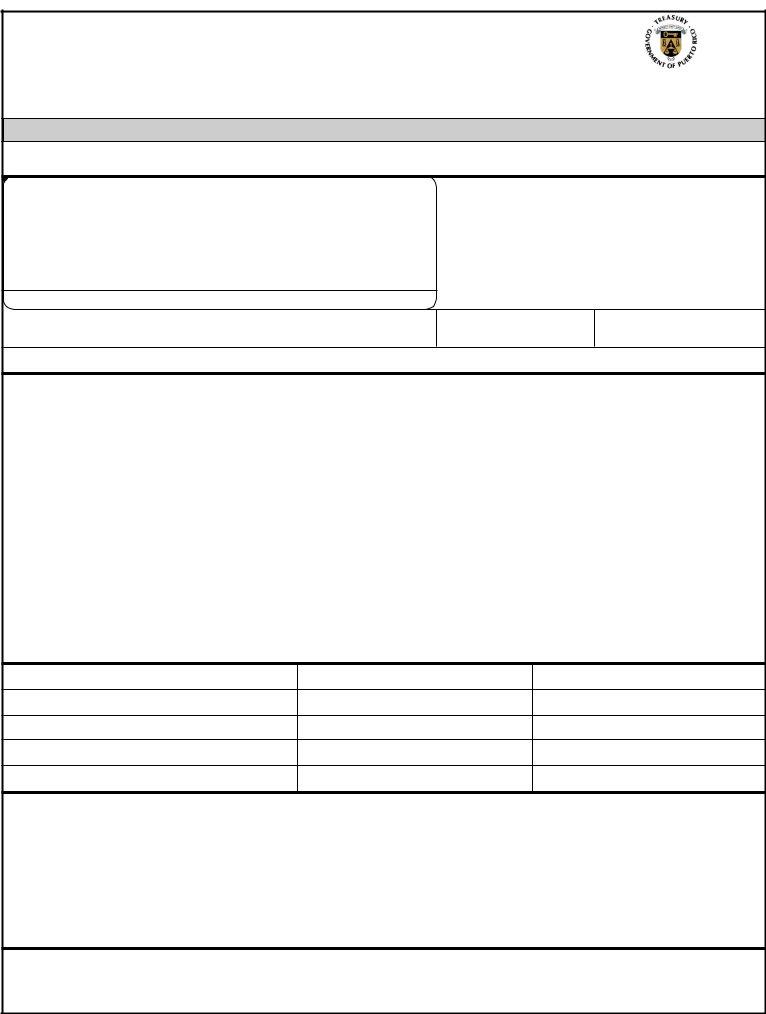

Form AS |

Government of Puerto Rico |

Rev. Oct 26 16 |

Department of the Treasury |

Rep. Feb 1 17 |

|

|

Power and Declaration of Representation |

Section 6072.01 of the Puerto Rico Internal Revenue Code of 2011, as amended, authorizes the Secretary of the Treasury to regulate the practice of the persons representing the taxpayers before the Department of the Treasury. To enforce the provisions of this section, the taxpayer who wants to appoint a person to act in his/her representation must complete this form. The taxpayer must include with this form a copy of a valid photo identification, showing the name in a legible way and signed by the taxpayer.

AUTHORIZATION FOR REPRESENTATION

1.Taxpayer's information (In case of individuals, include name, initial, last name and second last name. If you are married and filing jointly, you must complete the spouse's information)

Taxpayer's name |

Taxpayer's social security number |

|

|

Postal address |

Employer's identification number |

|

|

|

Spouse's social security number |

Zip code

Spouse's first name and initial |

Last name |

Second last name |

Telephone (Home)

Telephone (Office)

I appoint the following representative(s) as attorney(s) in fact:

2. Representative(s) information

Representative's name and address |

Telephone number |

Fax number |

|

|

|

|

|

|

|

|

Registration number |

Check (W) if changed: |

||

|

|

Address Q |

Telephone Q |

|

|

|

|

|

|

|

|

|

|

|

Representative's name and address |

Telephone number |

Fax number |

|

|

|

|

|

|

|

|

Registration number |

Check (W) if changed: |

||

|

|

Address Q |

Telephone Q |

|

|

|

|

|

|

|

|

|

|

|

To represent the taxpayer(s) before the Department of the Treasury for the following tax matters: |

|

|

|

|

|

|

|

|

|

3. Tax matter |

|

|

|

|

Type of tax (Income, Excise, Employment, etc.)

Forms (Return, Statement, etc.)

Year(s) or Period(s)

4.Acts authorized - The representative(s) is (are) authorized to receive and inspect confidential information and to perform any and all acts that I (we) can perform with respect to tax matters described on line 3, including the authority to present taxpayer's information and documents; sign any agreement, consent or document; make appearances before the Department of the Treasury and its functionaries; attend to every administrative hearing; accept or agree according with the law and regulations, any matter related with my (our) tax responsibility and accept or negotiate on my (our) behalf any resolution or administrative decision, or to make the decisions that in his/her/their judgement are correct.

List any specific additions or limitations to the acts authorized in this power of representation: _______________________________.

Note: A Returns or Declarations Specialist, who is not named as representative, cannot sign any document for the taxpayer.

5.Receipt of reimbursement or refund checks - Include your initials here if you authorize a representative named on line 2 to receive a refund or reimbursement check. Initials: ______. This authorization does not permit the representative to sign or cash the refund or reimbursement check.

Name of the representative authorized to receive reimbursement or refund check(s): ________________________________________.

Retention Period: Six (6) years

Form AS

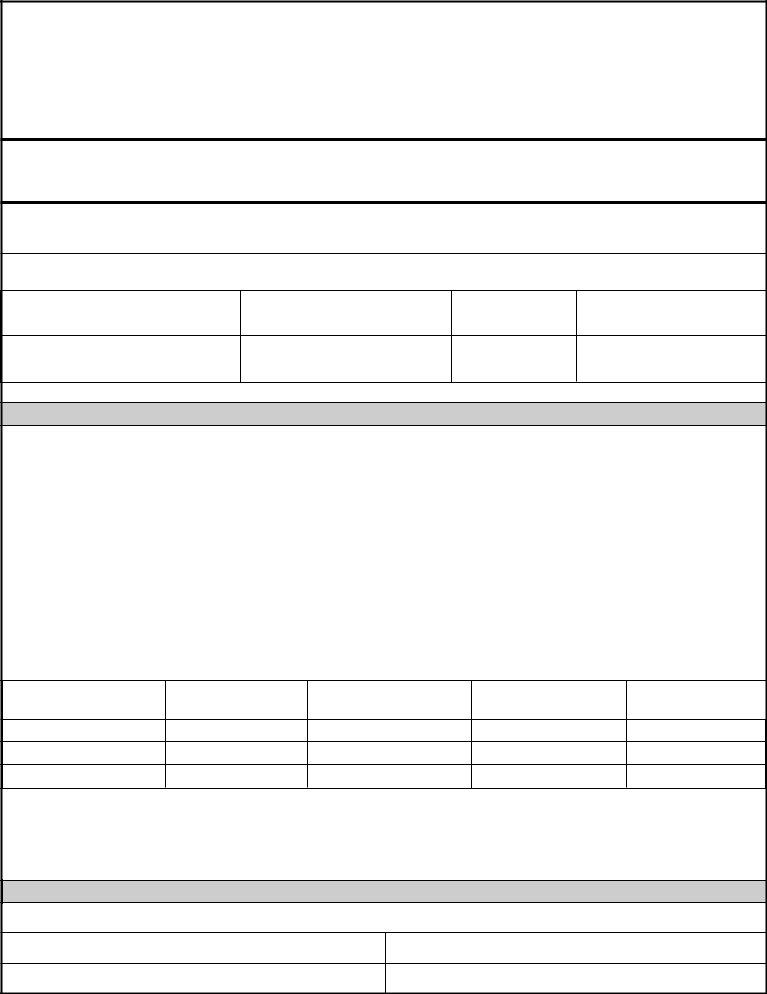

6.Notices and communications - Original notices and other written communications will be sent to the first representative and a copy to the taxpayer, unless you check one or more of the boxes below.

a. If you want to receive the original and the first representantive named on line 2 to receive copy of such notices or communications,

check (W) this box .............................................................................................................................................................................................. ;

b. If you also want the second representative listed to receive a copy of such notices and communications, check (W) this box ;

c. If you do not want any notices or communications sent to your representative(s), check (W) this box |

; |

7.Revocation of prior power(s) of representation - The filing of this authorization of representation revokes all earlier authorizations on file with the Department of the Treasury for the same tax matter and years or periods covered by this document. If you do not want to revoke

a prior authorization check (W) here |

; |

(You must attach a copy of any authorization of representation you want to remain in effect).

8.Effective Period and Signature of taxpayer - In case of tax matter concerning an individual income tax return filed jointly, both, the taxpayer and the spouse, must sign if joint representation is requested. On the other hand, if it is signed by a corporate officer, partner, guardian, executor, administrator or trustee on behalf of the taxpayer, such representative certifies that he/she have the authority to sign this form on behalf of the taxpayer.

I authorize this Power and Declaration of Representation for a period of _____ months from the date of its signing. (The effective period

cannot exceed one (1) year).

Name (print letter) |

Signature |

Date |

Title (if applicable) |

Name (print letter)

Signature

Date

Title (if applicable)

If the Authorization of Representation is not signed and dated, it will not be valid and will be returned.

DECLARATION OF REPRESENTATIVE (Current identification with photo and signature must be presented)

.I declare under penalty of perjury that:

I am not currently under suspension or disbarment from practice as a representative before the Department of the Treasury as a Returns,

.Declarations and Refund Claims Specialist;

I have knowledge of the provisions of Section 6072.01 of the Puerto Rico Internal Revenue Code of 2011, as amended (Code) and the

. regulations of such section;

. I am authorized to represent the taxpayer(s) identified on line 1 for the tax matter(s) specified in this document; and I am one of the following:

a. Lawyer - a member in good standing of the bar of the highest court of the jurisdiction shown below.

b. Certified Public Accountant - and individual duly qualified to practice as a certified public accountant in the jurisdiction shown below.

c. Returns and Declarations Specialist - an individual duly registered in the Department of the Treasury as a Returns, Declarations and Refund Claims Specialist as established in Section 6072.01 of the Code.

d. Officer - a bona fide officer of the taxpayer's organization. e. Full time employee - a

f. Family Member - a member of the taxpayer's immediate family (i.e. spouse, parent, child, brother). g. Other (Specify):____________________________________

Designation - Include the

corresponding letter from above

(a - g)

Jurisdiction or

Registration Number

Name

Signature

Date

Note: Requirements to be a representative:

The representative must show that: (A) has observed proper conduct at all times; (B) has the necessary qualifications to provide valuable services to the persons; and (C) is competent in tax matters, in a way that allows him/her to advise and assist the persons in the presentation of their cases.

TO BE COMPLETED BY THE DEPARTMENT OF THE TREASURY

I certify that I reviewed the information included in this form, including signatures, that I verified the effective period and that I validated the photo identifications presented.

Name |

Office |

Signature

Date

Retention Period: Six (6) years