WHO MUST FILE

Businesses are required to obtain a Certificate/Statement from the NH Department of Revenue Administration (NH DRA) prior to filing with the NH Secretary of State Corporate Division. This requirement is mandated by law pursuant to RSA 293-A, the NH Business Corporation Act, and RSA 304-C, Limited Liability Companies.

If not required to file taxes in NH, attach a copy of the first four pages of the federal return actually filed with the Internal Revenue Service (IRS) for the period that includes the last date of business in NH.

WHAT TO FILE

Statement of Good Standing: Attach all returns that are due, but have not yet been filed with the NH DRA, including copies of all federal pages as fi led with the IRS. See Rev 309.02 and Rev 2409.02.

Certificate of Dissolution: If not already filed with NH DRA, attach a final NH Business Enterprise and/or Business Profits Tax return with copies of all federal pages, including forms 4797 and 6252, as filed with the IRS for the period that includes the last date of business in NH. Also, attach copies of: 1) the minutes of the board of directors’ meeting authorizing the dissolution; 2) a plan of liquidation; 3) a schedule detailing the distribution of all NH assets; and if a corporation, 4) Federal Form 966. See Rev 309.03 and Rev 2409.03.

Statement for Withdrawal: If required to file taxes in NH and not already filed with NH DRA, attach a final NH Business Enterprise and/or Business Profits Tax return with copies of all federal pages as filed with the IRS for the period that includes the last date of business in NH. Also attach a statement addressing the disposition of all NH assets. If a plan of liquidation has been adopted, attach a copy of Federal Form 966. See Rev 309.04 and 2409.04.

WHEN TO FILE

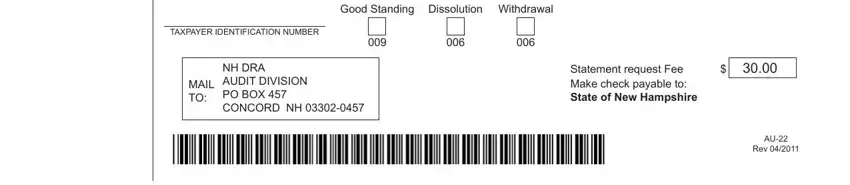

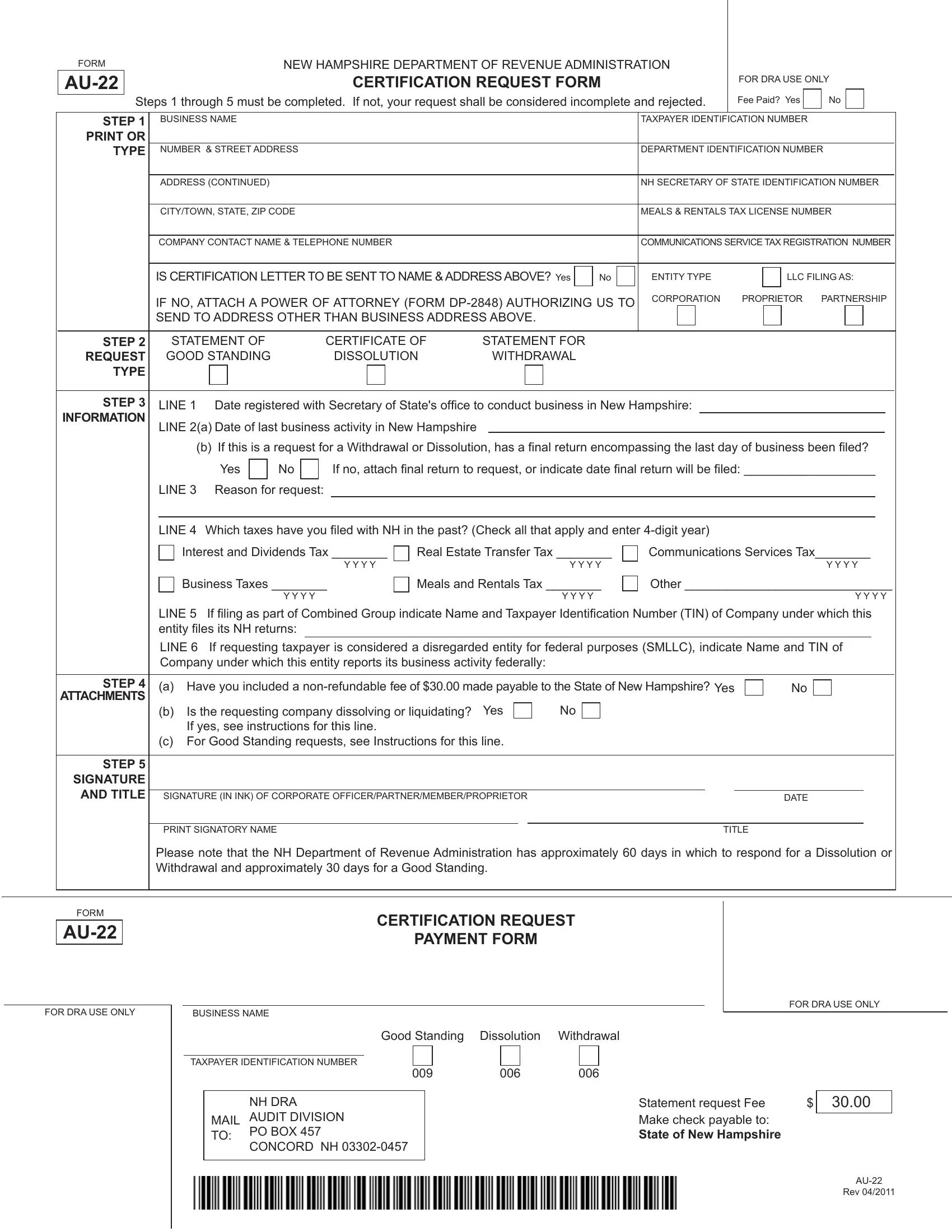

A completed Form AU-22 and the $30.00 fee should be filed at least 60 days prior to application with the NH Secretary of State Corporate Division to allow for tax account reconciliation and processing. It is recommended that this request not be submitted before a final return is filed, as a Certificate/ Statement cannot be issued until a return encompassing the last business day in NH is filed.

WHERE TO FILE

Send your completed Form AU-22 and $30.00 fee to: NH DRA, Audit Division, 109 Pleasant Street, PO Box 457, Concord, NH 03302-0457.

NEED HELP?

Call Central Taxpayer Services at (603) 271-2191, Monday through Friday, 8:00 am - 4:30 pm. For assistance with the Secretary of State Corporate Division requirements, call (603) 271-3246 or visit their website at www. sos.nh.gov/corporate.

NEED FORMS?

To obtain additional forms you may access our web site at www.nh.gov/revenue or call the forms line at (603) 271-2192.

ADA COMPLIANCE

Individuals who need auxiliary aids for effective communications in programs and services of the New Hampshire Department of Revenue Administration are invited to make their needs and preferences known. Individuals with hearing or speech impairments may call TDD Access: Relay NH 1-800- 735-2964.

LINE BY LINE INSTRUCTIONS

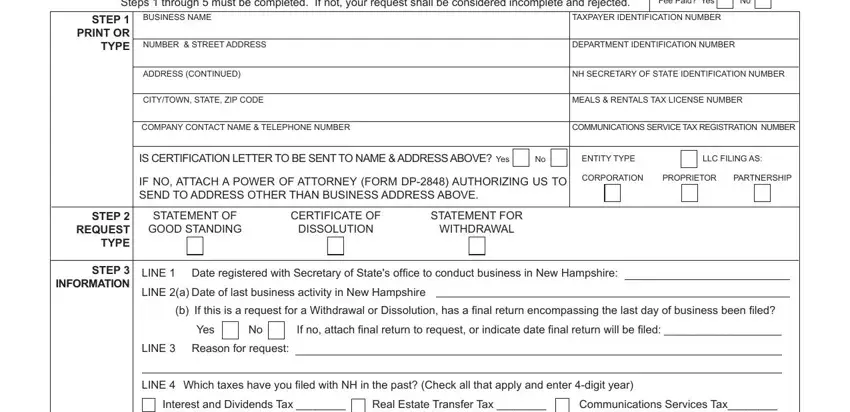

STEP 1: BUSINESS INFORMATION

Enter the business name, address, company contact name and telephone number. Enter the Tax Identification Number (TIN) assigned to the business by the IRS. Enter the NH Department Identification Number (DIN) if one has been assigned. Enter the NH Secretary of State Identification Number. Enter the Meals & Rentals Tax Operator License Number, if applicable. Enter Communications Service Tax Registration Number, if applicable.

Check the applicable entity type, and if the business is a Limited Liability Company, check box. Check "Yes" or "No" as to whether the Certificate/ Statement is to be sent to address in Step 1. If no, then Form DP-2848, Power ofAttorney, must accompany this form. Form DP-2848 is also required if company contact is not an employee or officer.

STEP 2: REQUEST TYPE

Check the box indicating the type of Certificate/Statement you are requesting. If requesting more than one original Certificate/Statement, a separate Form AU-22 and fee must be submitted for each additional request.

Dissolution vs. Withdrawal: If the requesting company is a domestic corporation or limited liability company, check the “Certificate of Dissolution” box. If the requesting company is a foreign corporation or limited liability company, check the “Statement For Withdrawal” box.

STEP 3: INFORMATION

Line 1 Enter the date the business registered with the Secretary of State's offi ce to do business in New Hampshire.

Line 2(a) Enter the last or most recent day of business activity in New Hampshire.

2(b) A fi nal return encompassing the date of withdrawal or dissolution must be fi led. Check the appropriate box to indicate if the fi nal return has been fi led. If not, submit your completed fi nal return with this request, or indicate the date the fi nal return will be fi led. If a fi nal return has not already been fi led or does not accompany this form, your request will be delayed or denied until such time the fi nal return is filed.

Line 3 Provide a complete explanation of the reason(s) for the request.

Line 4 Check the box(es) to indicate all New Hampshire taxes you have fi led with the NH DRA. Enter the 4-digit year of the last return that was fi led with the NH DRA.

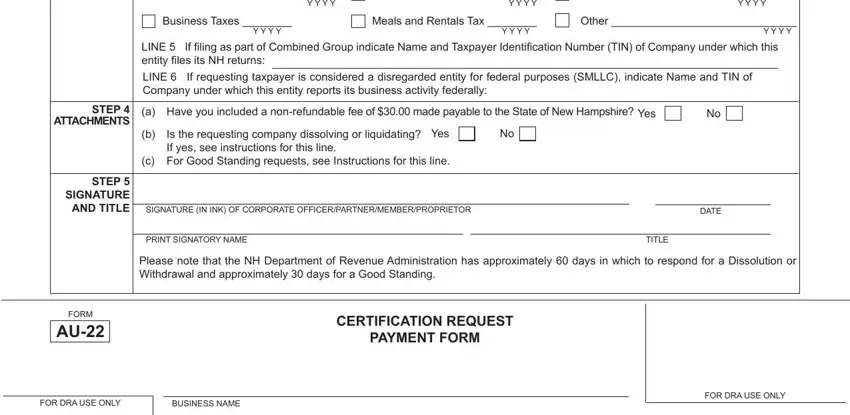

Line 5 Enter the name and TIN of the parent company, if applicable. If not, specify "No Parent" or specify principal NH fi ler if entity

files as a member of a combined group. Line 6 Enter the name and TIN

of the federal reporting entity if taxpayer is a Single Member Limited Liability Company (SMLLC).

STEP 4: ATTACHMENTS

(a)Select "Yes" or "No" to indicate whether you have enclosed the $30 non-refundable fee, made payable to the State of New Hampshire. If your request is submitted without the appropriate fee, your request shall be denied.

(b)Dissolution or liquidation requests require that you submit a copy of your Federal Form 966 and a copy of the minutes of the meeting held when the decision to dissolve or liquidate was made. Check the appropriate box to indicate that you have included these documents, if applicable.

(c)For Good Standing requests: If your business does not meet the minimum fi ling requirements for NH Business Profits or Business Enterprise Taxes, include copies of pages 1 through 4 of your three most recent federal returns. See RSA 77-A:6 and RSA 77-E:5 for filing requirements.

STEP 5: SIGNATURE AND TITLE

Signature, in ink, of a corporate officer, member, partner or proprietor, the title of that individual and the date the request was signed. If other than the corporate officer, member, partner or proprietor, attach a completed Form DP-2848, Power of Attorney.

NOTE:

The Commissioner's determination is not the result of an audit and issuance of a Statement of Good Standing, Statement for Withdrawal, or Certificate for Dissolution does not preclude audit of the business organization and its returns for any period within the statutory provisions of RSA 21-J:29.