Working with PDF documents online is definitely quite easy using our PDF editor. Anyone can fill in creditworthiness here and try out various other functions we offer. Our tool is constantly developing to present the best user experience attainable, and that's thanks to our commitment to constant enhancement and listening closely to testimonials. All it takes is a couple of simple steps:

Step 1: Click the "Get Form" button in the top area of this page to access our editor.

Step 2: After you start the online editor, you will see the form prepared to be filled in. In addition to filling in different blanks, you may as well perform several other actions with the form, particularly putting on your own text, changing the initial text, inserting illustrations or photos, putting your signature on the PDF, and much more.

This PDF form requires some specific details; in order to ensure accuracy, please make sure to bear in mind the guidelines further down:

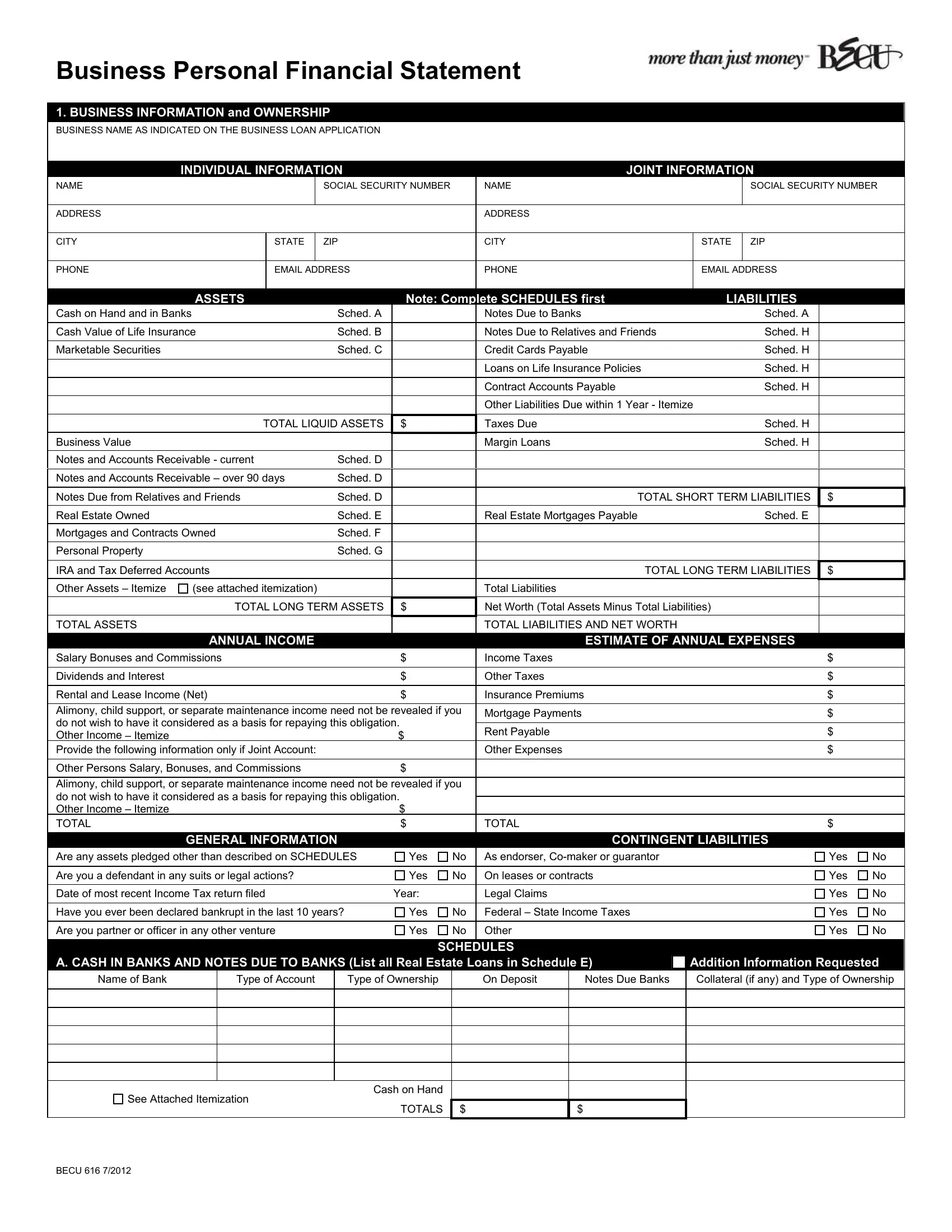

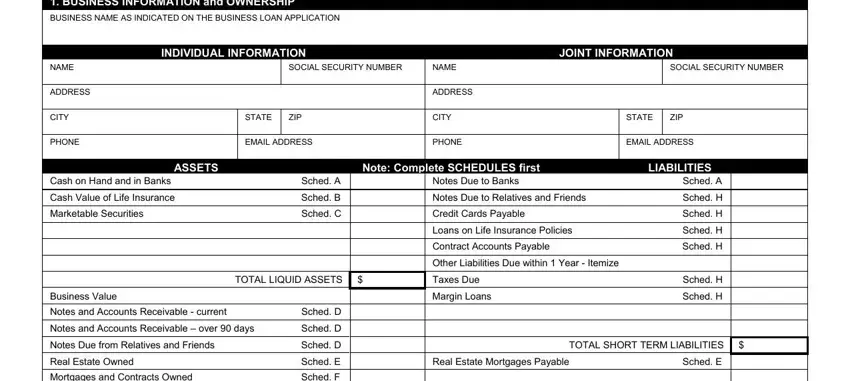

1. The creditworthiness involves certain details to be entered. Ensure that the following blank fields are filled out:

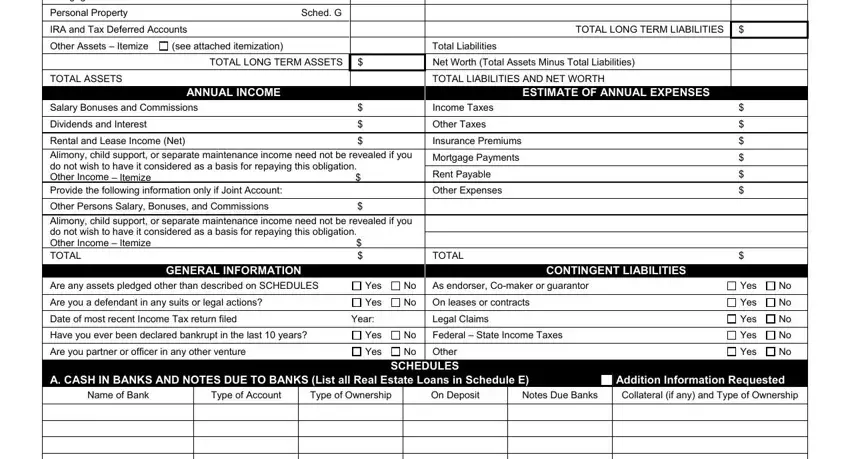

2. The next stage would be to complete these blank fields: Mortgages and Contracts Owned, Personal Property, IRA and Tax Deferred Accounts, Other Assets Itemize, see attached itemization, Sched F, Sched G, Total Liabilities, TOTAL LONG TERM LIABILITIES, TOTAL ASSETS, TOTAL LIABILITIES AND NET WORTH, TOTAL LONG TERM ASSETS, Net Worth Total Assets Minus Total, ANNUAL INCOME, and ESTIMATE OF ANNUAL EXPENSES.

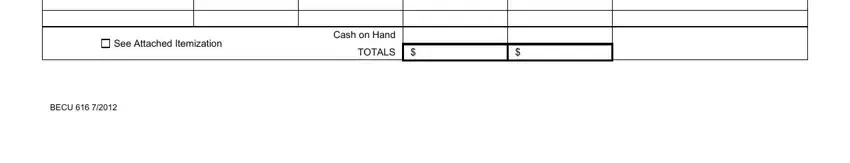

3. This third segment is considered relatively easy, See Attached Itemization, Cash on Hand, TOTALS, and BECU - all of these fields will have to be filled in here.

Be extremely attentive when completing Cash on Hand and BECU, as this is the section in which many people make mistakes.

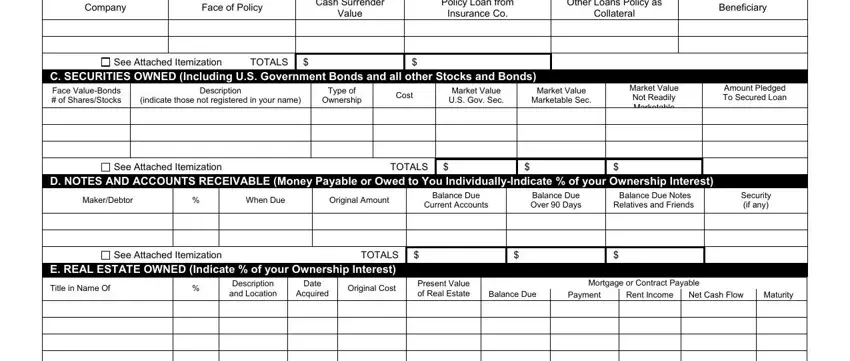

4. Your next part requires your attention in the subsequent places: Company, Face of Policy, Cash Surrender, Value, Policy Loan from, Insurance Co, Other Loans Policy as, Collateral, Beneficiary, See Attached Itemization, C SECURITIES OWNED Including US, indicate those not registered in, Market Value US Gov Sec, TOTALS, and Description. Make certain you type in all of the requested info to move further.

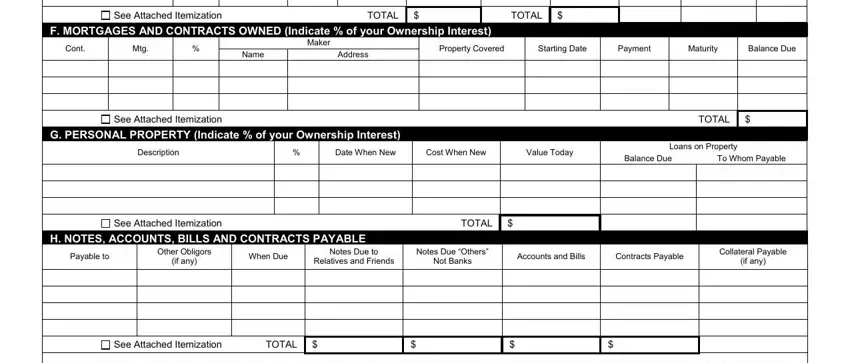

5. To finish your document, the particular subsection requires some additional fields. Filling out See Attached Itemization, TOTAL, TOTAL, F MORTGAGES AND CONTRACTS OWNED, Cont, Mtg, Maker, Name, Address, See Attached Itemization, G PERSONAL PROPERTY Indicate of, Property Covered, Starting Date, Payment, and Maturity is going to finalize everything and you will be done in a short time!

Step 3: Ensure that the details are accurate and then click "Done" to finish the process. Go for a free trial account with us and acquire immediate access to creditworthiness - downloadable, emailable, and editable from your FormsPal account. We don't share the information you type in when dealing with forms at FormsPal.