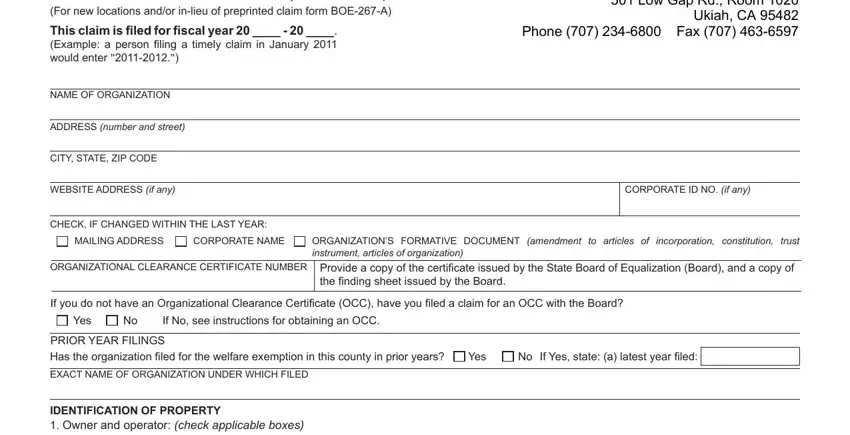

BOE-267 (P1) REV. 13 (05-12)

|

CLAIM FOR WELFARE EXEMPTION (FIRST FILING) |

SUSAN M. RANOCHAK, Mendocino County Assessor |

|

501 Low Gap Rd., Room 1020 |

|

(For new locations and/or in-lieu of preprinted claim form BOE-267-A) |

|

Ukiah, CA 95482 |

|

This claim is iled for iscal year 20 ____ - 20 ____. |

|

Phone (707) 234-6800 Fax (707) 463-6597 |

|

(Example: a person iling a timely claim in January 2011 |

|

|

would enter "2011-2012.") |

|

|

|

|

|

NAME OF ORGANIZATION |

|

|

|

|

|

ADDRESS (number and street) |

|

|

|

|

|

CITY, STATE, ZIP CODE |

|

CORPORATE ID NO. (if any)

CHECK, IF CHANGED WITHIN THE LAST YEAR:

MAILING ADDRESS CORPORATE NAME

ORGANIZATION’S FORMATIVE DOCUMENT (amendment to articles of incorporation, constitution, trust instrument, articles of organization)

ORGANIZATIONAL CLEARANCE CERTIFICATE NUMBER

Provide a copy of the certiicate issued by the State Board of Equalization (Board), and a copy of the inding sheet issued by the Board.

If you do not have an Organizational Clearance Certiicate (OCC), have you iled a claim for an OCC with the Board?

No If No, see instructions for obtaining an OCC.

PRIOR YEAR FILINGS

Has the organization iled for the welfare exemption in this county in prior years?

No If Yes, state: (a) latest year iled:

EXACT NAME OF ORGANIZATION UNDER WHICH FILED

IDENTIFICATION OF PROPERTY

1.Owner and operator: (check applicable boxes)

|

|

|

|

|

|

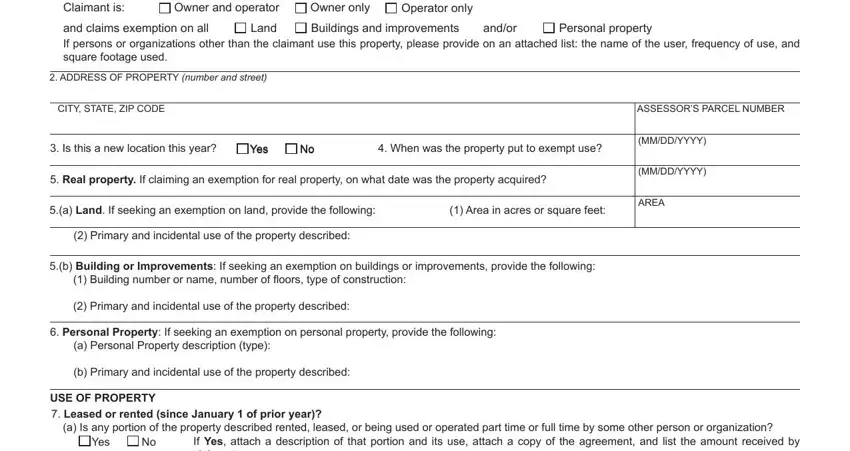

Claimant is: |

Owner and operator |

Owner only |

Operator only |

|

and claims exemption on all |

Land |

Buildings and improvements |

and/or |

If persons or organizations other than the claimant use this property, please provide on an attached list: the name of the user, frequency of use, and square footage used.

2. ADDRESS OF PROPERTY (number and street)

CITY, STATE, ZIP CODE |

|

|

|

ASSESSOR’S PARCEL NUMBER |

|

|

|

|

|

|

3. |

Is this a new location this year? |

Yes |

No |

4. When was the property put to exempt use? |

(MM/DD/YYYY) |

|

|

|

|

|

|

|

5. |

Real property. If claiming an exemption for real property, on what date was the property acquired? |

(MM/DD/YYYY) |

|

|

|

|

|

|

|

5.(a) Land. If seeking an exemption on land, provide the following: |

(1) Area in acres or square feet: |

AREA |

|

|

|

|

|

|

|

(2) Primary and incidental use of the property described:

5.(b) Building or Improvements: If seeking an exemption on buildings or improvements, provide the following:

(1)Building number or name, number of loors, type of construction:

(2)Primary and incidental use of the property described:

6.Personal Property: If seeking an exemption on personal property, provide the following:

(a)Personal Property description (type):

(b)Primary and incidental use of the property described:

USE OF PROPERTY

7.Leased or rented (since January 1 of prior year)?

(a)Is any portion of the property described rented, leased, or being used or operated part time or full time by some other person or organization?

Yes |

No |

If Yes, attach a description of that portion and its use, attach a copy of the agreement, and list the amount received by |

|

|

claimant. |

(b) Is any equipment or other property at this location being leased, rented, or consigned from someone else? |

Yes |

No |

If Yes, attach a list of equipment and other property at this location that is being leased, rented, or consigned to the claimant. |

|

|

Please list the name and address of lessor or consignor and the quantity and description of the property, and attach to the |

|

|

claim. Property so listed is not subject to the exemption, and will be assessed by the Assessor if owned by a taxable entity. |

|

|

|

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

BOE-267 (P2) REV. 13 (05-12)

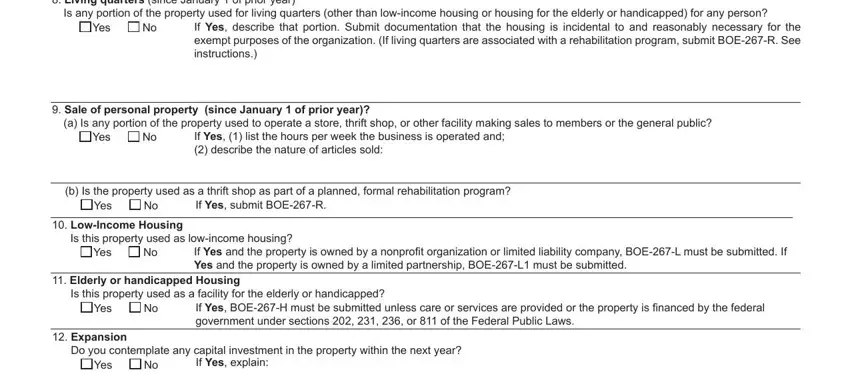

8.Living quarters (since January 1 of prior year)

Is any portion of the property used for living quarters (other than low-income housing or housing for the elderly or handicapped) for any person?

Yes |

No |

If Yes, describe that portion. Submit documentation that the housing is incidental to and reasonably necessary for the |

|

|

exempt purposes of the organization. (If living quarters are associated with a rehabilitation program, submit BOE-267-R. See |

|

|

instructions.) |

9.Sale of personal property (since January 1 of prior year)?

(a)Is any portion of the property used to operate a store, thrift shop, or other facility making sales to members or the general public?

Yes |

No |

If Yes, (1) list the hours per week the business is operated and; |

(2)describe the nature of articles sold:

(b)Is the property used as a thrift shop as part of a planned, formal rehabilitation program?

Yes |

No |

If Yes, submit BOE-267-R. |

10.Low-Income Housing

Is this property used as low-income housing?

Yes |

No |

If Yes and the property is owned by a nonproit organization or limited liability company, BOE-267-L must be submitted. If |

|

|

Yes and the property is owned by a limited partnership, BOE-267-L1 must be submitted. |

11.Elderly or handicapped Housing

Is this property used as a facility for the elderly or handicapped?

Yes |

No |

If Yes, BOE-267-H must be submitted unless care or services are provided or the property is inanced by the federal |

|

|

government under sections 202, 231, 236, or 811 of the Federal Public Laws. |

12.Expansion

Do you contemplate any capital investment in the property within the next year?

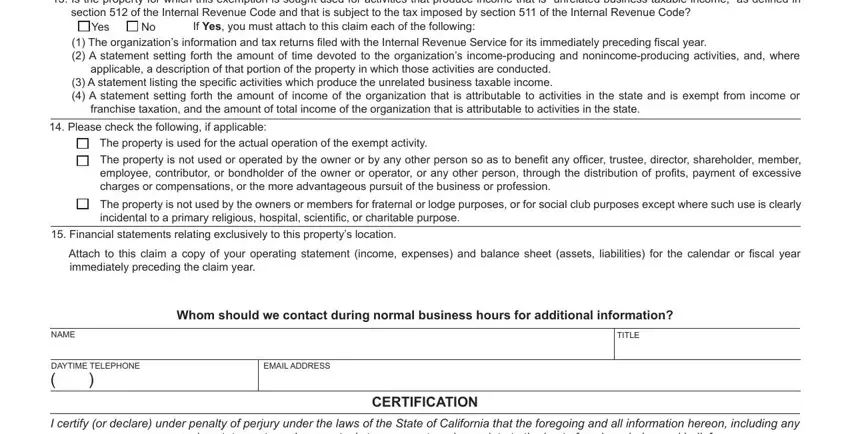

13.Is the property for which this exemption is sought used for activities that produce income that is “unrelated business taxable income,” as deined in section 512 of the Internal Revenue Code and that is subject to the tax imposed by section 511 of the Internal Revenue Code?

Yes |

No |

If Yes, you must attach to this claim each of the following: |

(1)The organization’s information and tax returns iled with the Internal Revenue Service for its immediately preceding iscal year.

(2)A statement setting forth the amount of time devoted to the organization’s income-producing and nonincome-producing activities, and, where applicable, a description of that portion of the property in which those activities are conducted.

(3)A statement listing the speciic activities which produce the unrelated business taxable income.

(4)A statement setting forth the amount of income of the organization that is attributable to activities in the state and is exempt from income or franchise taxation, and the amount of total income of the organization that is attributable to activities in the state.

14.Please check the following, if applicable:

The property is used for the actual operation of the exempt activity.

The property is not used or operated by the owner or by any other person so as to beneit any oficer, trustee, director, shareholder, member, employee, contributor, or bondholder of the owner or operator, or any other person, through the distribution of proits, payment of excessive charges or compensations, or the more advantageous pursuit of the business or profession.

The property is not used by the owners or members for fraternal or lodge purposes, or for social club purposes except where such use is clearly incidental to a primary religious, hospital, scientiic, or charitable purpose.

15.Financial statements relating exclusively to this property’s location.

Attach to this claim a copy of your operating statement (income, expenses) and balance sheet (assets, liabilities) for the calendar or iscal year immediately preceding the claim year.

Whom should we contact during normal business hours for additional information?

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM

t

NAME OF PERSON MAKING CLAIM

BOE-267 (P3) REV. 13 (05-12)

INSTRUCTIONS FOR FILING A CLAIM FOR

WELFARE EXEMPTION FROM PROPERTY TAX

EXEMPTION FROM PROPERTY TAXES UNDER SECTIONS 4(b) AND 5 OF ARTICLE XIII OF THE CONSTITUTION OF THE

STATE OF CALIFORNIA AND SECTIONS 214, 254.5 AND 259.5 OF THE REVENUE AND TAXATION CODE

(See also sections 213.7, 214.01-214.1, 215.2, 221-222.5, 225.5, 231, 236, 254-254.6, 259.5, 261, and 270-272 of the Revenue and Taxation Code)

GENERAL INFORMATION

FILING OF CLAIM

Claims for the Welfare Exemption must be signed and iled with the Assessor. Each claim must contain supporting documents including inancial statements.

An oficer or duly authorized representative of the organization owning the property must sign the claim. An oficer or duly authorized representative of the organization operating the property must sign and ile a separate claim. If an organization both owns and operates the property, only one claim need be signed and iled with the Assessor for each property location. A separate claim form must be completed and iled for each property for which exemption is sought.

The Assessor will supply claim forms and supporting documents upon request. A copy of the claim should be retained by the organization. It is recommended that the retained copy be submitted to the Assessor for acknowledgment of iling by entry of the date and the Assessor’s or the designee’s signature. This copy will serve as a record of iling should there be any later question relative thereto.

ORGANIZATIONAL CLEARANCE CERTIFICATE

An organization that is seeking the Welfare Exemption shall ile with the State Board of Equalization (Board) a claim for an Organizational Clearance Certiicate. The Board shall review each claim to determine whether the organization meets the requirements of section 214 and shall issue a certiicate to a claimant that meets these requirements. The Assessor may not approve a property tax exemption claim until the claimant has been issued a valid Organizational Clearance Certiicate. If the claim is iled timely with the Assessor, the claim will be considered timely iled even if the claimant has not yet received the Organizational Clearance Certiicate from the Board.

Claim form BOE-277, Claim for Organizational Clearance Certiicate - Welfare Exemption, is available on the Board’s website (www.boe. ca.gov) or you may request a form by contacting the Exemptions Section at 916-274-3430.

PRIOR YEAR FILINGS

Year iled is the year in which the claim was submitted to the Assessor. State the exact name under which the organization iled for the

year indicated.

RECORDATION REQUIREMENT

Revenue and Taxation Code section 261 requires that an organization claiming the Welfare Exemption for its real property must have recorded its ownership interest as of the lien date (12:01 a.m., January 1) in the recorder’s ofice of the county in which the property is

located.

A claimant which on the lien date has a possessory interest in publicly owned land, owns water rights, or owns improvements on land owned by another may in lieu of recordation ile a copy of the document giving rise to that possessory interest or water rights or ile a written statement attesting to the separate ownership of those improvements with the Assessor. Failure to establish the fact of such recordation to the Assessor constitutes a waiver of the exemption.

TIME FOR FILING

To receive the full exemption, the claimant must ile a claim each year on or before February 15. Only 90 percent of any tax or penalty or interest thereon may be canceled or refunded when a claim is iled between February 16 of the current year and January 1 of the following calendar year; if the application is iled thereafter, only 85 percent of any tax or penalty or interest thereon may be canceled or refunded. In no case, however, is the tax, penalty, and interest for a given year to exceed $250.

ADDITIONAL INFORMATION

The owner and the operator must furnish additional information to the Assessor, if requested. The Assessor may institute an audit or veriication of the operations of the owner and of the operator and may request additional information from the claimant.

BOE-267 (P4) REV. 13 (05-12)

PREPARATION OF CLAIM

The term property as used here means any operating unit of property consisting of one parcel or several contiguous parcels for which exemption is sought even though there may be several improvements and separate buildings thereon. All personal property for which exemption is sought should also be listed.

If the owner and operator of the property are not the same, each must execute a separate claim and give the information requested. All questions must be answered. Failure to answer all questions may result in denial of your claim. Leave no blanks; use “no,” “none,” or “not applicable” where needed. The following information is provided to assist you in answering speciic questions on your claim.

The iscal year for which exemption is sought must be entered correctly. The proper iscal year follows the lien date (12:01 a.m., January

1)as of which the taxable or exempt status of the property is determined. For example, a person iling a timely claim in February 2011 would enter “2011-2012”; a “2010-2011” entry on a claim iled in February 2011 would signify that a late claim was being iled for the preceding iscal year.

Line 1. If the owner and operator of any portion of the property are not the same, both must ile a claim, and each must meet all of the requirements to obtain the exemption.

Line 2. Enter the property address, city, state, zip code, and Assessor’s Parcel Number.

Line 5. If the exemption is being claimed for real property, enter the date on which the property was acquired. (a)(1) Indicate the area and the unit of measurement used (acres or square feet.)

(2)List the primary use which should qualify the property for exemption and the incidental use or uses of the property since January 1 of the prior year.

(b)(1) List all buildings and improvements on the land. Use additional sheets if necessary. Describe as stucco, concrete and steel, brick, wood, etc.

(2)List the primary use and the incidental use or uses of the property since January 1 of the prior year.

Line 6. (a) List the type of personal property;

(b)List the primary use and the incidental use or uses since January 1 of the prior year.

Line 7. (a) Copies of leases or agreements must be submitted if the answer is yes. If the leases or other agreements have been iled in prior years, it is only necessary to attach copies of subsequent extensions, modiications, and changes.

(b)If the answer is yes, provide the names and addresses of the lessors and consignors and list the quantity and description of the property.

Line 8. If the answer is yes, describe the portion of the property used for living quarters. Submit documentation, including tenets, canons, or written policy, that indicates the organization requires housing be provided to employees and/or volunteers. Include statement why such housing is incidental to and reasonably necessary for the exempt purpose of the organization and the occupant’s role or position in the organization. (This question is not applicable where the exempt activity is providing housing, for example, homes for aged, youth, mentally or physically disabled.)

Line 9. If the answer is yes, describe in suficient detail to determine the volume of business and the hours open for business since

January 1 of the prior year. If a business operation located on the listed parcel has been deliberately omitted, because you do not desire the exemption on the business, so state.

Line 12. If the answer is yes, describe the type of investment contemplated and the reasons that make such expansion necessary. Line 13. If the answer is yes, provide the documents and other information requested.

Line 15. In submitting the inancial statements, the operating statement should be restricted to the inancial transactions relating to the operation of the subject property. The income should include only those receipts that result from the operation of the property and should not include receipts from invested funds, gifts, or other items that do not result directly from the operation of the

property.

The expenditures should be limited to those resulting from the operation of the property. Any expenses of the organization or expenses extraneous to the operating unit should not be included. If compensation of personnel or other administrative expenses are pro-rated to the property, such pro-rata should be indicated. If the nature of an item of income or disbursement is not clear from the account name, further explanation indicating the nature of the account should be appended. Your claim will not be processed until the inancial statements are received by the Assessor.