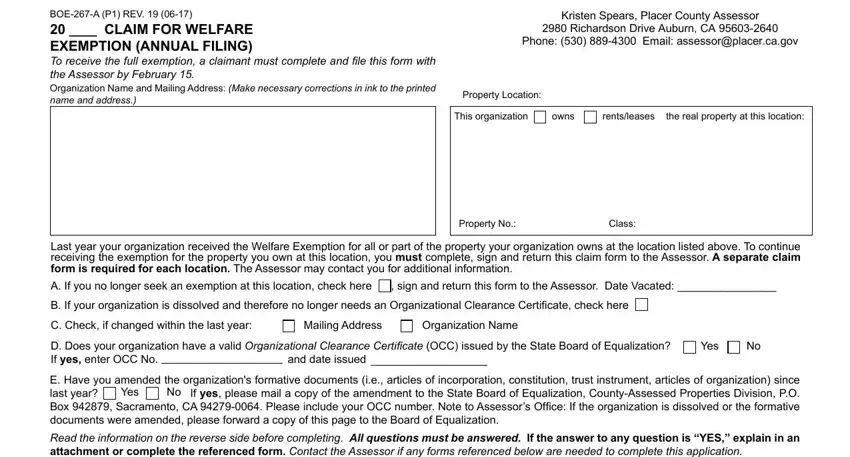

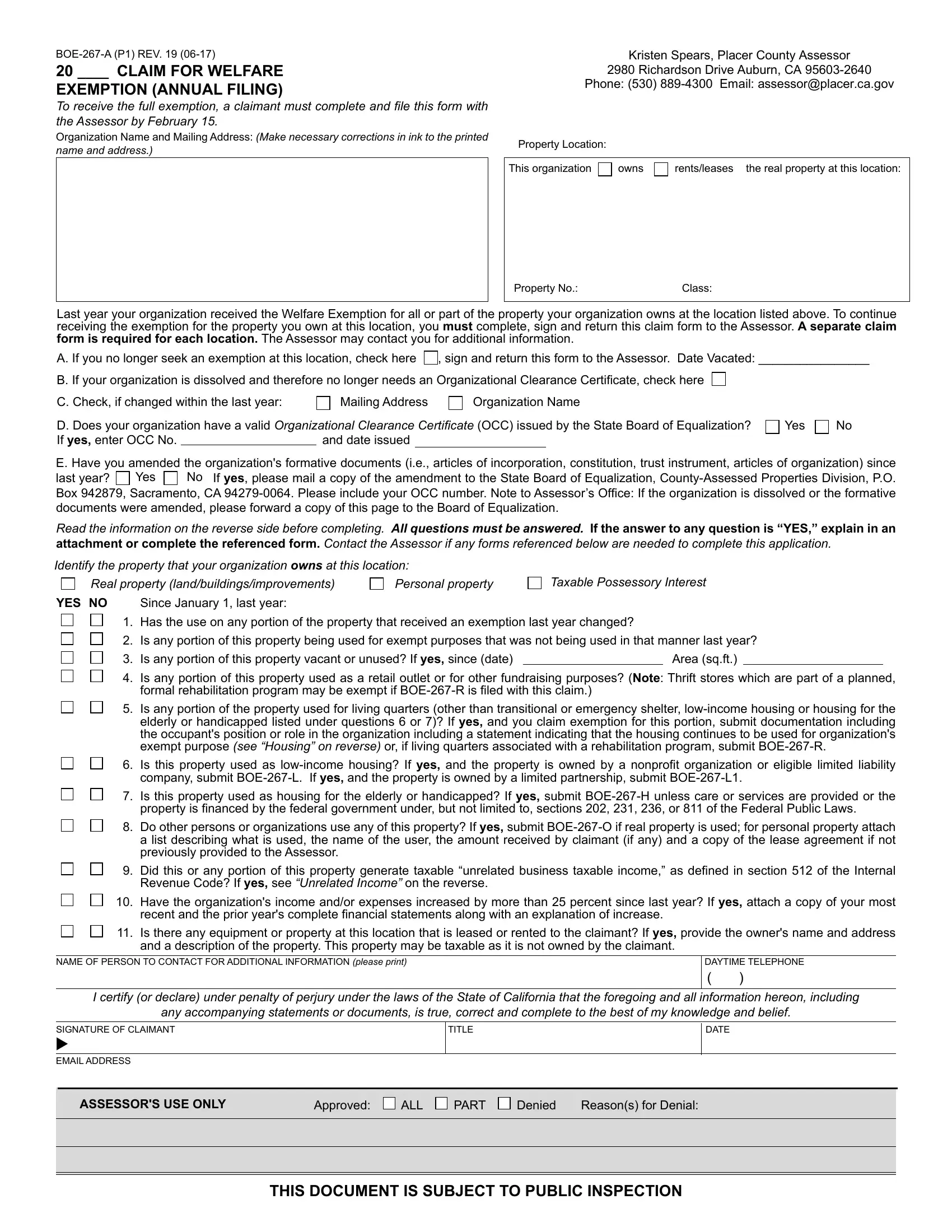

BOE-267-A (P1) REV. 19 (06-17)

20 ____ CLAIM FOR WELFARE

EXEMPTION (ANNUAL FILING)

To receive the full exemption, a claimant must complete and file this form with

the Assessor by February 15.

Organization Name and Mailing Address: (Make necessary corrections in ink to the printed name and address.)

Kristen Spears, Placer County Assessor

2980 Richardson Drive Auburn, CA 95603-2640

Phone: (530) 889-4300 Email: assessor@placer.ca.gov

Property Location:

This organization |

|

owns |

|

rents/leases the real property at this location: |

Last year your organization received the Welfare Exemption for all or part of the property your organization owns at the location listed above. To continue receiving the exemption for the property you own at this location, you must complete, sign and return this claim form to the Assessor. A separate claim form is required for each location. The Assessor may contact you for additional information.

A. If you no longer seek an exemption at this location, check here

, sign and return this form to the Assessor. Date Vacated: ________________

B. If your organization is dissolved and therefore no longer needs an Organizational Clearance Certificate, check here

C. Check, if changed within the last year:

D. Does your organization have a valid Organizational Clearance Certificate (OCC) issued by the State Board of Equalization? |

Yes |

No |

If yes, enter OCC No. |

|

and date issued |

|

|

|

|

|

|

|

|

|

E. Have you amended the organization's formative documents (i.e., articles of incorporation, constitution, trust instrument, articles of organization) since

last year? |

Yes |

No If yes, please mail a copy of the amendment to the State Board of Equalization, County-Assessed Properties Division, P.O. |

Box 942879, Sacramento, CA 94279-0064. Please include your OCC number. Note to Assessor’s Office: If the organization is dissolved or the formative |

documents were amended, please forward a copy of this page to the Board of Equalization. |

Read the information on the reverse side before completing. All questions must be answered. If the answer to any question is “YES,” explain in an attachment or complete the referenced form. Contact the Assessor if any forms referenced below are needed to complete this application.

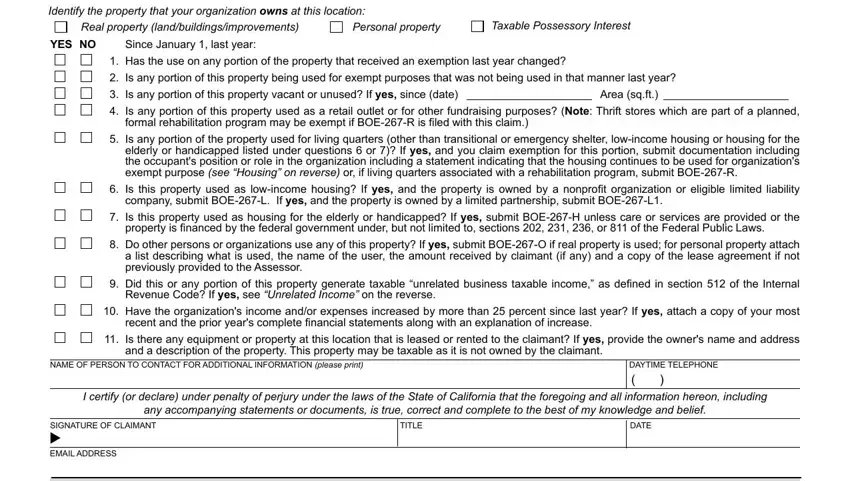

Identify the property that your organization owns at this location:

Real property (land/buildings/improvements) |

Personal property |

Taxable Possessory Interest

YES NO Since January 1, last year:

1. Has the use on any portion of the property that received an exemption last year changed?

2. Is any portion of this property being used for exempt purposes that was not being used in that manner last year?

3. Is any portion of this property vacant or unused? If yes, since (date) |

|

Area (sq.ft.) |

4. Is any portion of this property used as a retail outlet or for other fundraising purposes? (Note: Thrift stores which are part of a planned, formal rehabilitation program may be exempt if BOE-267-R is filed with this claim.)

5. Is any portion of the property used for living quarters (other than transitional or emergency shelter, low-income housing or housing for the elderly or handicapped listed under questions 6 or 7)? If yes, and you claim exemption for this portion, submit documentation including the occupant's position or role in the organization including a statement indicating that the housing continues to be used for organization's exempt purpose (see “Housing” on reverse) or, if living quarters associated with a rehabilitation program, submit BOE-267-R.

6. Is this property used as low-income housing? If yes, and the property is owned by a nonprofit organization or eligible limited liability company, submit BOE-267-L. If yes, and the property is owned by a limited partnership, submit BOE-267-L1.

7. Is this property used as housing for the elderly or handicapped? If yes, submit BOE-267-H unless care or services are provided or the property is financed by the federal government under, but not limited to, sections 202, 231, 236, or 811 of the Federal Public Laws.

8. Do other persons or organizations use any of this property? If yes, submit BOE-267-O if real property is used; for personal property attach a list describing what is used, the name of the user, the amount received by claimant (if any) and a copy of the lease agreement if not previously provided to the Assessor.

9. Did this or any portion of this property generate taxable “unrelated business taxable income,” as defined in section 512 of the Internal Revenue Code? If yes, see “Unrelated Income” on the reverse.

10. Have the organization's income and/or expenses increased by more than 25 percent since last year? If yes, attach a copy of your most recent and the prior year's complete financial statements along with an explanation of increase.

11. Is there any equipment or property at this location that is leased or rented to the claimant? If yes, provide the owner's name and address and a description of the property. This property may be taxable as it is not owned by the claimant.

NAME OF PERSON TO CONTACT FOR ADDITIONAL INFORMATION (please print) |

DAYTIME TELEPHONE |

|

( |

) |

|

|

|

|

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including |

|

|

any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief. |

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF CLAIMANT |

|

|

|

|

TITLE |

|

|

|

DATE |

|

u |

|

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSESSOR'S USE ONLY |

Approved: |

|

ALL |

|

PART |

|

Denied |

Reason(s) for Denial: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

BOE-267-A (P2) REV. 19 (06-17)

GENERAL INFORMATION

The Welfare Exemption is available only to property, real or personal, owned by a religious, charitable, hospital, or scientific organization and used exclusively for religious, charitable, hospital, or scientific purposes. It is also available on a taxable possessory interest in publically owned real property used for exempt purposes by an organization that qualifies for the welfare exemption. A public owner is a local, state or

federal agency.

To be eligible for the full exemption, the claimant must file a claim each year on or before February 15. Only 90 percent of any tax, penalty, or interest may be canceled or refunded when a claim is filed between February 16 and December 31 of the current year. If the application is filed on or after January 1 of the next year, only 85 percent of any tax, penalty, or interest may be canceled or refunded. The tax, penalty, and interest for a given year may not exceed $250. A separate claim must be completed and filed for each property for which exemption is sought.

In accordance with Revenue and Taxation Code section 254.5(b)(2), the assessor may institute an audit or verification of the property’s use to

determine whether both the owner and user of the property meet the requirements of Revenue and Taxation Code section 214.

ORGANIZATIONAL CLEARANCE CERTIFICATE

The Assessor may not approve a property tax exemption claim until the claimant has been issued a valid Organizational Clearance Certificate (OCC) by the State Board of Equalization. If you are seeking exemption on this property, you must provide the organization's OCC No. and date issued. A listing of organizations with valid OCCs is available on the Board's website (www.boe.ca.gov) and can be accessed at www.boe. ca.gov/proptaxes/welfareorgeligible.htm. You may also contact the Board at 1-916-274-3430.

HOUSING

If question 5 is answered yes, describe the portion of the property used for living quarters (since January 1 of the prior year). Submit (1) documentation, including tenets, canons, or written policy, that indicates the organization requires housing be provided to employees and/or volunteers, or (2) include statement why such housing is incidental to and reasonably necessary for the exempt purpose of the organization. If the documentation described in items (1) or (2) has been submitted in a previous year for this location, please submit documentation including the occupant's position or role in the organization with a statement indicating that the housing continues to be used for organization's exempt purpose. (This question is not applicable where the exempt activity is providing housing.)

USE OF THE PROPERTY BY OTHER ORGANIZATIONS

If question 8 is answered yes, and your organization’s real property is used by another party submit BOE-267-O. If another party only uses your personal property, then submit an attachment providing the requested information for such personal property and confirm that no real property is

used by other parties. The lease does not need to be provided if furnished in a prior year.

UNRELATED BUSINESS TAXABLE INCOME

If question 9 is answered yes, you must attach the following to the claim:

•the organization's information and tax returns, including Form 990-T, filed with the Internal Revenue Service for its immediately preceding year;

•a statement setting forth the amount of time devoted to the organization's income-producing and to its non income-producing activities and, where applicable, a description of that portion of the property on which those activities are conducted;

•a statement listing the specific activities and locations which produce unrelated business taxable income; and

•a statement setting forth the amount of income of the organization that is attributable to activities in this state and is exempt from income or franchise taxation and the amount of total income of the organization that is attributable to activities in this state.

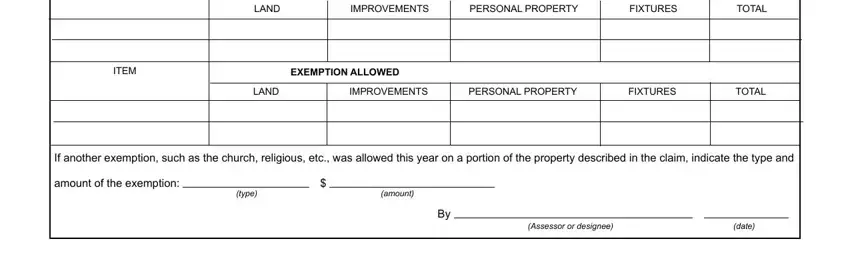

ASSESSOR'S USE ONLY

ASSESSED VALUES

|

|

ITEM |

|

TOTAL ASSESSED VALUE OF: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAND |

|

IMPROVEMENTS |

PERSONAL PROPERTY |

FIXTURES |

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITEM |

|

EXEMPTION ALLOWED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAND |

|

IMPROVEMENTS |

PERSONAL PROPERTY |

FIXTURES |

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If another exemption, such as the church, religious, etc., was allowed this year on a portion of the property described in the claim, indicate the type and

amount of the exemption: |

|

$ |

|

|

|

|

|

|

(type) |

|

(amount) |

|

|

|

|

|

By |

|

|

|

|

|

|

|

|

(Assessor or designee) |

|

(date) |